Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Interview

Metals & Mining: Year in Review, Future in Focus

Host Ed Coyne speaks to Sprott CEO Whitney George and Senior Portfolio Manager Justin Tolman about the firm's strong performance in 2025, highlighting significant gains across gold, silver, copper and related strategies, driven by resource nationalization and supply disruptions. Looking ahead to 2026, they anticipate continued opportunities, increased investor interest and ongoing M&A activity as the mining and metals space gains broader recognition.

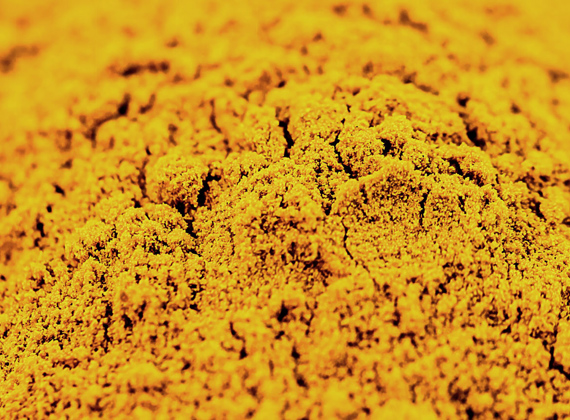

Sprott Uranium Report

Uranium’s Tale of Two Markets

The uranium market's short-term volatility has masked strengthening fundamentals, as long-term prices rise, supply tightens and policy commitments translate into greater demand for nuclear power. With capital flowing into miners, upstream fundamentals improving and policy alignment accelerating, we believe the uranium market is well positioned for a stronger setup in 2026.

Webcast Replay

Navigating Gold’s Next Chapter: A Conversation with John Hathaway and Justin Tolman

Sprott Portfolio Managers John Hathaway and Justin Tolman break down the powerful forces driving this year's gold and precious metals rally. They provide insights on market catalysts, mining equity valuations and explore how today’s environment compares to prior positive cycles. Learn more about how Sprott's deep technical expertise and on-the-ground diligence enhance its investment approach in the metals and mining space.

Sprott Precious Metals Report

Gold Holds Gains as Liquidity Stress Emerges

Gold reached its highest monthly close in November 2025, driven by fiscal dominance, rising global debt and the Fed’s pivot to “QE-lite.” We believe gold’s strategic role as a safe haven asset is strengthening amid mounting liquidity stress and shifting global financial dynamics. Silver closed November at an all-time high.

Special Report

Lithium Gains Momentum in 2025

Lithium has entered a renewed bull phase as tightening supply, rising global demand from EVs to data centers, and major strategic investments shift the market from surplus toward potential deficit. Governments, oil majors and tech giants are racing to secure supply, solidifying lithium's essential role in long-term energy security.

Infographic

The Uranium Opportunity

Global uranium mine supply continues to fall short of reactor demand, creating a persistent and widening deficit. With uranium demand expected to double by 2040, these tightening fundamentals underpin a powerful long-term investment case.

Sprott Precious Metals Report

The Debasement Trade Broadens Across Precious Metals

In October, gold closed above $4,000 and silver hit record highs amid growing strategic demand, signaling a sustained shift away from fiat-based assets. Major developed economies are increasingly operating under fiscal dominance, driving investors toward hard assets like gold and silver.

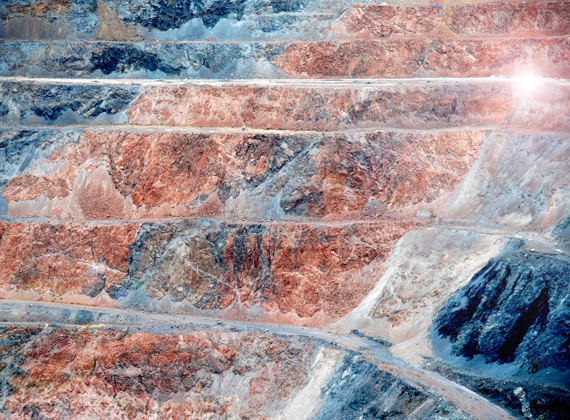

Sprott Copper Report

Catalyzing Copper: Supply Shocks and Betting Billions

Copper markets rallied in September, buoyed by tightening supply and renewed investor confidence. Copper’s supply squeeze is intensifying as mine shutdowns and years of underinvestment drive inventories to historic lows. New U.S. policy tailwinds are providing support, as the world races to secure critical materials.

Interview

Platinum and Palladium Are on the Move

Platinum and palladium prices have surged due to persistent supply deficits. Demand from catalytic converters and industrial uses outstrips the limited supply, with platinum facing the most acute shortage. Slower EV and hybrid growth have reinforced auto-sector reliance on PGMs, fueling 2025's price rallies.

Sprott Gold Report

Dips: The Rx for Acrophobia

With gold and silver reaching new all-time highs, we believe there is still opportunity in both the physical and miners markets. We see structural drivers (central bank demand, inflation resilience and declining trust in fiat currencies) that continue to support long-term allocations to gold and silver.

Sprott Precious Metals Report

Gold Leads as Faith in Fiat Falters

Gold surged to record highs as fading confidence in fiscal and monetary policy drove investors toward hard assets. With long-term yields rising and central banks turning increasingly accommodative, markets are signaling a loss of faith in fiat currencies, fueling gold’s breakout and silver’s potential squeeze.

Sprott Uranium Report

Investors Act with Conviction

Uranium prices and miners surged in September, fueled by tight supply and strong utility demand. The rally drew renewed investor interest, with capital flows into uranium equities and ETFs reinforcing confidence in the sector’s momentum.

Interview

Overview of Uranium Spot and Term Markets

Per Jander of WMC joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Jander reflects on his 20 years at the World Nuclear Symposium, noting the industry’s growing optimism and Microsoft’s entry as a paradigm shift. Jander highlights uranium market dynamics and sees limited downside for the sector, given rising utility contracting and strong fundamentals.

Interview

Where Is Spot Uranium Going?

John Ciampaglia, CEO of Sprott Asset Management, joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Ciampaglia highlights strong global investor interest in uranium, with both specialist and generalist funds viewing nuclear as a long-term growth story. He notes stabilizing uranium prices, lingering supply challenges and growing demand from utilities, AI and data centers.

Interview

Uranium: At the Fulcrum of AI, National Security and Global Energy Demand

John Ciampaglia, CEO of Sprott Asset Management, shares takeaways from the September 2025 World Nuclear Symposium. He highlights surging uranium demand from rising electricity needs, AI data centers and energy security concerns, plus growing tech ties such as Microsoft joining the World Nuclear Association. With supply still tight, Ciampaglia sees higher prices and new mining investment creating a strong backdrop for investors.

Special Report

Steel Meets Rising Global Electricity Demand

Steel is emerging as a strategic material in meeting global electricity demands, underpinning everything from power generation and transmission to electric vehicles and grid modernization. Demand for green steel is accelerating with market forecasts projecting rapid growth relative to traditional steel.

Sprott Copper Report

Copper Fundamentals Prevail After Tariff Turmoil

Copper rallied in August, with junior copper miners taking top performance honors. Policy momentum is accelerating as copper gains critical minerals status and attracts major investment. Copper miners are enjoying strong margins as copper demand rises to support electrification, AI and defense.

Sprott Precious Metals Report

Challenges to Fed Autonomy Strengthen Case for Gold

Gold has topped another all-time high above $3,600 per ounce, while silver has reached $41, its highest level since 2011. Both metals may be among the strongest-performing asset classes for the year. We explore how erosion of Fed independence heightens policy risk, reinforcing the strategic role of gold and silver.

Interview

What's Next for Gold?

John Hathaway of Sprott highlights gold’s resilience, citing U.S. fiscal imbalances, Federal Reserve pressures, geopolitical risks and central bank de-dollarization as key drivers of support. He warns that extreme equity market concentration and leverage could spark a downturn, triggering stronger flows into gold and gold miners, which remain under-owned despite strong earnings.

Sprott Critical Materials Report

Critical Materials Breakout into a New Bullish Phase

The convergence of national security imperatives, energy transition policies and evolving trade dynamics is fundamentally redefining the role of critical minerals. The breakout in the Nasdaq Sprott Critical Materials Index™ is an early signal of this shift, reflecting technical strength and deep structural drivers.

Sprott Gold Report

A Cure for Financial Dementia

In our view, market euphoria and collective amnesia have left gold miners overlooked despite record profits, soaring margins and aggressive shareholder returns. Gold mining equities are still stuck at bargain basement valuations, and we unabashedly continue to pound the table for precious metals equities and bullion alike.

Sprott Precious Metals Report

Gold Miners Shine in 2025

Gold and silver are up over 25% in 2025, with mining stocks surging more than 50%, yet still undervalued. We see continued upside amid inflation, geopolitical risks and strong fundamentals.

Interview

Asset TV Masterclass: Real Assets

Ed Coyne, Senior Managing Partner at Sprott, discusses the outlook for gold, silver, copper and other real assets amid economic uncertainty, geopolitical conflict and the potential for persistent inflation. He joins Jodie Gunzberg, CFA®, Managing Partner at InFi Strategies and Don Marleau, CFA®, Metals & Mining Managing Director at S&P Global Ratings.

Interview

Sprott: Global Leader in Precious Metals & Critical Materials

Sprott is a global leader in precious metals and critical materials investments, with over $40 billion AUM and more than four decades of expertise. We offer investors diverse solutions across physical trusts, ETFs, mining equities and private lending.

Interview

Sprott: Physical Commodities as Core Allocation

Gold and silver can serve as core physical allocations, with gold standing out as a proven portfolio diversifier. For investors seeking potential upside, mining equities offer opportunistic potential beyond the stability of the physical markets.

Sprott Copper Report

The Emerging Copper Premium: Policy Risk Meets Physical Scarcity

Copper is being redefined as a national security asset, not just an industrial metal. U.S. tariffs and geopolitical shifts have fractured global pricing and exposed deep supply vulnerabilities.

Silver Report

Silver Investment Outlook Mid-Year 2025

Silver gained nearly 25% through mid-year, and continues to rise in July, as supply remains tight and demand accelerates. With silver crucial to new technologies, the metal is benefiting from powerful structural tailwinds and renewed interest from investors.

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

Sprott Precious Metals Report

Gold and Silver Bull Run Continues

Gold and silver have been strong performers in 2025, with both metals up over 25% YTD as global instability drives demand for safe haven assets. Central banks are shifting away from the U.S. dollar, while silver’s breakout suggests a potential supply squeeze ahead.

Interview

Uranium Outlook Mid-Year 2025

John Ciampaglia, CEO of Sprott Asset Management, joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the current state of the uranium market. Ciampaglia highlights the market's V-shaped recovery since April and the improved investor sentiment following the absence of tariffs on uranium.

Interview

Uranium Spot Market Update

Per Jander of WMC provides a nuanced look at the uranium spot market's opportunities and challenges. He discusses tariffs, the cautious dance of utilities and explores what may support higher uranium prices.

Sprott Copper Report

Copper’s Bullish Setup Strengthens

Copper is surging toward $10,000 per ton as plunging inventories and unexpected supply disruptions expose the market’s tightness. Easing tariff tensions and rising electrification demand are driving bullish sentiment. We believe copper may be heading toward a structural repricing.

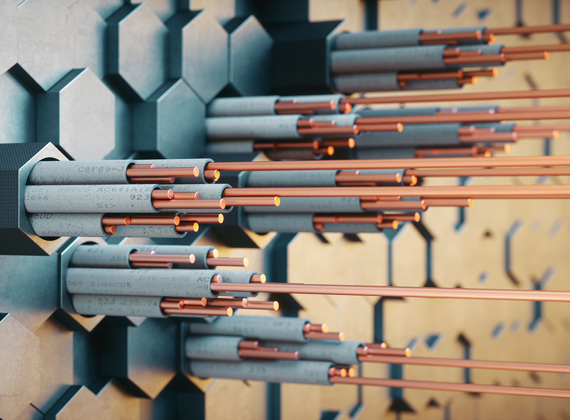

Special Report

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Sprott Precious Metals Report

Gold Gains Ground as Faith in the Dollar Erodes

Gold continues its rally as fading confidence in U.S. fiscal policy and the U.S. dollar drives demand for real assets. As we publish, silver is breaking out above $35, supported by structural supply deficits, renewed investor interest and mounting macroeconomic pressures.

Shifting Energy

The White House’s Nuclear Push: What It Means for Uranium Opportunities

In this episode of Shifting Energy (Season 2), John Ciampaglia discusses the major policy shift under President Trump’s new executive orders, which aim to fast-track advanced nuclear technologies and revitalize the entire U.S. nuclear fuel cycle.

Special Report

Platinum Is on Track for a Status Upgrade

Platinum demand is rising across autos, industry, jewelry and investment, while supply remains tight and above-ground stocks fall. With no major new mines ahead, this rare metal is gaining attention—and the investment case is growing stronger.

Video

Trump’s Executive Orders Set Stage for U.S. Nuclear Expansion

With President Trump's executive orders aimed at jumpstarting the U.S. nuclear energy industry and boosting domestic uranium production, uranium is in the spotlight. This move, driven by concerns over foreign fuel reliance and increasing global support for nuclear power, has investors paying close attention.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Sprott Precious Metals Report

A Shaky U.S. Dollar Boosts Gold’s Role as an Alternative Reserve Asset

Gold is gaining prominence as a reserve asset due to a weak U.S. dollar and declining U.S. financials, reaching record highs while equities and bonds fell. We believe this positions gold as a potential anchor for a multi-asset reserve system. Given silver’s correlation to gold, we believe its monetary value will reassert itself in time.

Interview

Sprott CIO on Gold/Silver Miner Selection and Silver Outlook

James Connor of Bloor Street Capital speaks with Maria Smirnova, Sprott CIO, about the firm’s approach to gold and silver miner selection. Smirnova remains bullish on silver, citing a deep supply deficit and its essential role in electrification, despite prices lagging gold due to weak central bank demand and stagnant supply.

Interview

A Closer Look at Silver’s Strategic Value

Silver remains significantly undervalued despite strong fundamentals, including rising industrial demand and consistent annual supply deficits. Although gold has surged to new highs, silver’s price has lagged, influenced by its hybrid role as both a monetary and industrial metal amid global economic uncertainty.

Shifting Energy

Safe Havens: The Enduring Stability of Precious Metals in Turbulent Times

In this episode of Shifting Energy (Season 2), Steve Schoffstall, Director, ETF Product Management and John Kinnane, Director, Key Accounts at Sprott Asset Management, chat about how investors are navigating bumpy markets and global trade wars with assets like gold and silver.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Sprott Gold Report

The Return of Exter’s Inverted Pyramid

Gold has been rising on strong official sector demand, fueled by concerns over the U.S. dollar and global instability. While Western investors have focused on potentially overvalued stocks, gold and mining equities offer potential upside as other assets struggle.

Sprott Copper Report

Copper’s Record-Setting Rally and Reversal on U.S. Tariffs

Copper prices reached record highs in March, driven by tariff fears and U.S. demand. Despite recent market volatility, copper remains a strategic asset with strong long-term fundamentals, supported by rising global energy demands and U.S. policy shifts.

Sprott Q1 Precious Metals Report

Gold's Strength Amid a Crisis of Confidence

Gold's record-breaking rally in Q1 2025 reflects mounting investor anxiety over stagflation, policy volatility and a fraying global economic order. U.S. tariffs and policy unpredictability have elevated the risk of stagflation, fueling demand for gold as the lone liquid safe-haven asset. We also believe silver is potentially poised to break out.

Interview

Outlook on Gold and Gold Miners, Ryan McIntyre on CNBC

Sprott's Ryan McIntyre is interviewed on CNBC's Fast Money about rising gold prices. McIntyre also addresses the surging demand for physical gold, the undervaluation of gold miners and whether Bitcoin poses a real threat to gold’s dominance.

Video

Introducing Sprott Active Gold & Silver Miners ETF (GBUG)

Sprott’s Steve Schoffstall introduces GBUG, an actively managed ETF focused on gold and silver miners, using a team with deep industry expertise to identify investments. With a long-term, value-driven approach, it aims to provide exposure to precious metals while navigating market shifts.

Interview

Trump Tariffs: Disruption or Opportunity?

Are tariffs set to disrupt gold, silver and uranium markets? Find out how potential trade barriers could impact prices and create arbitrage opportunities. Kitco’s Senior Mining Editor and Anchor Paul Harris interviews John Ciampaglia, CEO of Sprott Asset Management, at the 2025 BMO Global Metals, Mining & Critical Minerals Conference.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump's tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Sprott Critical Materials Monthly

Critical Materials Markets Shake Off DeepSeek Disruption and U.S. Policy Rollbacks

Critical materials showed resilience in January amid global volatility. We take a deep dive into China's growing leadership in clean technology investments, the disruptive impact of DeepSeek's AI model and the implications of U.S. policy changes on the energy transition and critical materials supply chains.

Video

Introducing Sprott Silver Miners & Physical Silver ETF (Nasdaq: SLVR)

Discover the unique advantages of Sprott Silver Miners & Physical Silver ETF (SLVR), a new ETF offering exposure to both silver miners and physical silver. With rising industrial demand and a tightening supply, SLVR provides investors with a strategic opportunity to benefit from silver’s dual role as a precious and industrial metal.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Interview

Gold & Silver Forecast 2025

Sprott CIO Maria Smirnova and Rick Rule discuss key drivers for gold and silver in 2025. They emphasize central bank buying, Eastern demand and the erosion of purchasing power as major factors for gold. For silver, industrial demand, particularly from solar and EVs, is crucial.

Interview

Uranium Outlook for 2025

Sprott CEO John Ciampaglia remains bullish on the uranium markets, citing rising term prices, increased utility interest and the global nuclear renaissance fueled by clean energy needs and AI-driven power demands. Ciampaglia expects uranium prices to strengthen as pent-up demand grows, driven by reactor life extensions, new builds and geopolitical supply disruptions.

Interview

Gold Flows into Sprott Physical Gold Trust (PHYS)

John Ciampaglia, CEO of Sprott Asset Management, joins James Connor of Bloor Street Capital to discuss his 2025 outlook for gold. Ciampaglia discusses Sprott's flagship Physical Gold Trust and dives into why gold is a crucial financial asset and portfolio diversifier.

Special Report

Top 10 Themes for 2025

What forces will shape the markets in critical materials and precious metals in 2025 and beyond? We identify 10 key macro and market themes investors should watch in the coming year.

Sprott Gold Report

Recalibrating Our Crystal Ball

Gold was a strong performer in 2024, gaining 27.22% to end the year at $2,624.50, fueled by geopolitical tensions, central bank purchases and bond market struggles. These strong gains occurred with negligible participation or interest from investors in North America or Europe. Key catalysts for a gold rally could include stock or cryptocurrency downturns, bond market disruptions or a U.S. dollar reset.

Shifting Energy

Uranium Unleashed: How Mining Stocks Fuel the Nuclear Comeback

Sprott's John Kinnane and Steve Schoffstall explore the growing opportunities in the uranium and nuclear energy markets. They discuss how pure-play uranium miners, supply-demand dynamics and shifting geopolitical policies are positioning this sector as a promising investment frontier for 2025 and beyond.

Silver Report

Silver's Impressive Strength in 2024

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Interview

Nuclear Power and Critical Materials: A Post-Election Outlook

What’s the potential impact of the incoming Trump administration on nuclear power, clean energy and critical materials? Thalia Hayden of @etfguide talks with John Ciampaglia about what potential changes may be on the horizon for U.S. energy policies and some strategies for investment portfolios.

Special Report

Gold’s Post-Election Correction Comes as No Surprise

We see gold's post-election pullback as a healthy consolidation, affirming our bullish outlook. Post-election market dislocations, historically tied to political outcomes, may present a strategic buying opportunity in precious metals and mining equities.

Interview

Real Assets in Focus: Gold, Silver, Copper and Uranium

Unlock the power of real assets investing with Sprott’s Masterclass video. Dive into gold, silver, copper and uranium with industry experts Ed Coyne, Ryan McIntyre and Steve Schoffstall as they reveal strategies to navigate global uncertainties and identify opportunities.

Sprott Critical Materials Monthly

Batteries and Minerals Driving Global Electrification

Batteries and energy storage continue to underpin electrification trends, solidifying their role as a cornerstone in the global shift toward sustainable energy. Support is being strengthened by strategic investments from governments and corporations, and resilient demand for critical minerals like lithium, copper and nickel.

Interview

Why Tech & Big Investors Are Turning to Uranium & Gold

John Ciampaglia, CEO of Sprott, joins James Connor to discuss why gold is increasingly viewed as a safeguard against economic uncertainty and why uranium has become essential to powering big tech's ambitious AI expansion.

Shifting Energy

The New Power Play: How Tech Giants Are Embracing Nuclear Energy for Data Centers

Nuclear power is creating a buzz in media circles. Thalia Hayden of @etfguide talks with John Ciampaglia about the powerful comeback of nuclear energy and how tech giants are embracing nuclear energy for data centers.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Q3 Precious Metals Report

Gold and Silver Enjoy Continued Rally

Gold and silver prices surged in Q3 2024, driven by central bank buying and macroeconomic factors. While gold experienced a historic price increase, silver's price was influenced by both its precious metal value and industrial demand. YTD through September 30, gold is up 27.71% and silver has gained 30.95%.

Sprott Critical Materials Monthly

U.S. Electricity Grid Remakes Itself to Meet Surging AI-Led Power Demand

Demand for electricity over the next decade will put pressure on the U.S. power grid to keep pace. New investment in power-hungry industrial facilities is driving demand, especially the data centers that support artificial intelligence (AI), U.S. reshoring initiatives and the steady electrification of the transport sector.

Sprott Webcast Replay

Investing in Critical Materials: A Diversified Approach to a Long-Term Opportunity

In our webcast with Nasdaq, John Ciampaglia discusses the rapid emergence of technologies like AI, the race to upgrade power grids, continuing global decarbonization goals and growing middle classes. He gives an overview of how the critical materials behind energy—such as uranium, copper, nickel, lithium and more—are likely to remain growth-oriented investment opportunities for the long term, and how to invest in them in a single allocation.

Sprott Webcast Replay

Investing in Critical Materials: A Diversified Approach to a Long-Term Opportunity

In our webcast with Nasdaq, John Ciampaglia discusses the rapid emergence of technologies like AI, the race to upgrade power grids, continuing global decarbonization goals and growing middle classes. He gives an overview of how the critical materials behind energy—such as uranium, copper, nickel, lithium and more—are likely to remain growth-oriented investment opportunities for the long term, and how to invest in them in a single allocation.

Sprott Gold Report

The Stage Is Set

We believe gold mining equities are poised for growth, as they remain undervalued despite rising gold prices. Western investors have largely ignored gold, but any shift has the potential to push gold prices higher, which will likely benefit miners. In our view, the current market displays the signs of an early-stage bull market.

Sprott Webcast Replay

An Investor's Guide to Precious Metals and Critical Materials

2024 has been an exciting year thus far for precious metals and critical materials. This webcast takes a technical perspective on the key drivers for gold, silver, uranium and copper, as all four metals enjoy positive markets. We also provide strategic portfolio allocation ideas for precious metals and critical materials.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Interview

John Hathaway's Macro View on Gold

In this exclusive interview with Metals and Miners, John Hathaway offers a comprehensive analysis of the current economic landscape. From the deteriorating economic metrics to the growing threat of de-dollarization, Hathaway provides expert insights on the most pressing issues facing investors today.

Interview

Sprott CEO John Ciampaglia on Underpriced Silver Catching Up to Gold

Silver prices should spike higher with gold hitting a new all-time high above $2,500 an ounce, said John Ciampaglia, CEO of Sprott Asset Management, when speaking with Kitco Mining. “It's mind-boggling to us that silver is still below $30. It is obviously way off its 2010 highs, and we would love to see it get back to the $50 level,” said Ciampaglia. “We think it has the ability to do that over time.”

Shifting Energy

An Inside Look at the Global War for Lithium, Copper and Critical Minerals with Author Ernest Scheyder

Author and acclaimed Reuters journalist Ernest Scheyder discusses his book, The War Below: Lithium, Copper, and the Global Battle to Power Our Lives, with Sprott's Steve Schoffstall in this exclusive interview.

Special Report

Gold Tops $2,500: A Technical View

Gold has surged above the psychological $2,500 level, driven by factors not easily explained by traditional market variables, suggesting possible central bank or sovereign activity rather than usual market dynamics.

Sprott Critical Materials Monthly

The Unstoppable Rise of Renewable Energy

Renewable energy is rapidly replacing fossil fuels as costs decrease and efficiencies improve with increased deployment, making it much cheaper than traditional energy sources. This shift, driven by the exponential growth of renewables, electrification, and efficiency, is expected to significantly alter global power dynamics as fossil fuels are phased out.

Interview

Core Conversations on Silver Featuring Maria Smirnova

Chief Investment Officer Maria Smirnova talks silver with Mark Bunting of Red Cloud Financial Services, RCTV LIVE. Maria takes a deep dive into what is providing support for silver in 2024, which is up 21.90% as of July 31, 2024.

Special Report

The AI Revolution and Data Centers: A New Frontier in Energy Demand

Significant investments in AI-related tech stocks have helped push the S&P 500 Index to record highs this year. The rapid growth of AI is significantly increasing the energy demands of data centers, which is likely to lead to a surge in demand for critical materials.

Special Report

Lithium: Short-Term Opportunities for a Long-Term Trend

This might be an ideal moment to re-evaluate lithium miners given their potential to benefit as the global energy transition continues. The current dip in the price of lithium miners presents a potential short-term opportunity, given the strong future demand and supply imbalance.

Sprott Uranium Report

Uranium Case Strengthens

The uranium spot price has remained range-bound between $85 and $95 per pound, and ended the first half at $85.34 (June 30, 2024). Uranium miners fell in June, but bounced back in early July, outperforming the commodity YTD.

Sprott Gold Report

U.S. Dollar: Decline and Fall

Gold’s breakout may signify more than one might infer from the continuing lack of interest. Inflows into the precious metals mining space have the potential to generate compelling outcomes.

Sprott Q2 Precious Metals Report

Gold’s Record-Setting Quarter and Silver’s Resurgence

Gold gained 12.79% YTD by June 30, supported by central bank buying. Silver closed Q2 at $29.14, boosted by gold's breakout and global monetary expansion.

Sprott Critical Materials Monthly

Fourth Industrial Revolution Fuels Global Competition for Critical Minerals

The fourth industrial revolution (4IR) is driving unprecedented change. Its dominated by AI, robotics, IoT, genetic engineering and quantum computing. 4IR technologies need critical minerals, fueling a new commodity supercycle.

Shifting Energy

Copper and AI: Understanding the Opportunity for ETF Investors

In this episode of Shifting Energy (Season 1), Thalia Hayden of @etfguide talks with John Ciampaglia about the growing energy requirements of AI and how uranium, copper, silver and other metals may benefit.

Shifting Energy

Uncovering Big Opportunities and Demand in Nickel for Investors

In this episode of Shifting Energy (Season 1), Thalia Hayden of etfguide talks with Steve Schoffstall about the nickel growth story, what's driving it and the investment opportunities now and ahead.

Interview

Gold Outlook with John Hathaway

What will take the gold price higher? John Hathaway, Senior Portfolio Manager, provides his thoughts on why gold isn't moving and what will take it higher.

Sprott Uranium Report

Uranium Miners Lead Market Higher

YTD the uranium spot price has stabilized between $85-$95 per pound after an 88.54% rise in 2023, indicating a healthy correction in a bullish cycle. Uranium miners' performance improved, matching spot price gains.

Sprott Critical Materials Monthly

A New Copper Supercycle Is Emerging

The copper market is entering a new supercycle. Demand is surging as countries invest in clean energy and protect their access to copper, while supply is constrained by a lack of new mine development.

Sprott Silver Report

Silver’s Critical Role in the Clean Energy Transition

Silver is crucial in the shift to cleaner energy, vital for solar panels and EVs, which reduce greenhouse gases. New technologies like AI have increased demand, while overall silver supply has declined.

Sprott Webcast Replay

Gold and Silver: Precious Metals On the Move

Replay our webcast on gold and silver with John Hathaway and Maria Smirnova. Gold is supported by central bank buyers like China, while silver benefits from increased demand for PV solar panels.

Sprott Critical Materials Monthly

AI's Critical Impact on Electricity and Energy Demand

The rise of AI and data centers will boost global electricity demand, challenging power grids but benefiting clean energy sources like nuclear. This trend will also increase demand for copper.

Special Report

The Case for Investing in Nickel Miners

Nickel's future is bright due to its role in net-zero goals. Stricter regulations and government support for EVs are driving demand, benefiting nickel mining companies in the long run.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global nuclear energy commitments make uranium a compelling investment. Despite a slight dip in spot prices, there's potential for growth.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

In March, the uranium market saw mixed results: spot prices fell, but miners' stocks rose due to a positive long-term outlook. We believe the uranium bull market has more room to grow.

Sprott Critical Materials Monthly

Battery Storage Is the Technological Cornerstone for a Sustainable Energy Future

The energy sector has experienced a remarkable transformation, primarily driven by the rapid growth and integration of renewable energy sources. Central to this transition is the advancement of battery storage technology.

Interview

Sprott CEO Says He’s Bullish on Gold in the Near-Term Thanks to China Buying

John Ciampaglia, CEO of Sprott Asset Management, joins CNBC's Fast Money to talk about the gold market and explain how central banks and overseas buyers are driving current demand.

Sprott Gold Report

What Does the Gold Price Breakout Mean?

The breakout in gold prices since February has been largely ignored by mainstream investors. Gold bullion’s breakout is significant in that it represents the positive resolution of a three-year consolidation.

Sprott Q1 Precious Metals Report

Gold Is on the Rise and Reaches All-Time High

Gold reached an all-time closing high and is up 8.09% YTD (as of 3/31/2024) after rising 13.10% in 2023. We believe several factors are in place for gold to move higher, such as strong central bank buying.

Shifting Energy

The Copper Growth Story

In this episode of Shifting Energy (Season 1), Thalia Hayden @etfguide talks with Ed Coyne and Steve Schoffstall at Sprott Asset Management about what's driving the copper growth story.

Interview

The Elements of Energy: Uranium and Copper

Learn how renewed interest in nuclear power, rising global energy demands, and the transition to clean energy are driving investment opportunities in uranium, copper and their miners in this Asset TV video featuring Ed Coyne and Steve Schoffstall.

Sprott Webcast Replay

Uranium and Copper: The Elements of Energy

Electricity demand is expected to grow 86% by 2050. At the center of this growth are uranium and copper – two critical materials that are in high demand and limited supply.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. News from Kazatomprom and Cameco reinforce uranium markets' structural supply deficit.

Interview

Nasdaq TradeTalks: How the Demand for Copper Could be Impacted by the Transition to Cleaner Energy

Steve Schoffstall visits Nasdaq TradeTalks to talk about Sprott’s continued expansion in the critical minerals sector, including the launch of COPP.

Interview

Nasdaq Investment News: Copper and its Role in the Transition to Cleaner Energy

Ed Coyne discusses copper’s role in the energy transition, its current status in the market and how Sprott is capturing the potential opportunity with COPP and COPJ.

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was lackluster for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment surged to an unprecedented $1.77 trillion.

Shifting Energy

The Nuclear Energy Comeback and Uranium Powering It

John Ciampaglia joins Thalia Hayden on Sprott’s new video series, Shifting Energy. They discuss surging uranium prices, the latest nuclear renaissance and potential investment opportunities.

Special Report

Copper: Wired for the Future

The demand for copper in energy grids, electric vehicles and clean energy technologies, combined with diminishing ore grades and limited inventories, underscores copper's growing importance.

White Paper

Copper: The Red Metal's Central Role in Powering Our Net-Zero Carbon Future

In the U.S. alone, copper is a crucial element in nearly 7 million miles of electrical wires. This white paper introduces the trends that are driving copper markets and copper miners, and explains our positive outlook.

Interview

John Hathaway: Gold Stocks "Ridiculously Cheap," What Will Make Them Move?

John Hathaway shares his thoughts on the disconnect between the gold price and gold stocks, explaining why it's happening, whether he's seen it before and what could make gold stocks finally start moving.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January, fueled in part by Kazatomprom's cut in guidance for 2024 production. Junior uranium miners were top performers , climbing 18.78%.

Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this is a fundamental transformation powered by the fall in renewable energy costs.

Grant's Interest Rate Observer

Radioactive-Asset Manager

Whitney George, CEO of Sprott, joined Evan Lorenz to discuss Sprott's growth and the increasing demand for critical materials, including uranium.

White Paper

Unearthing Opportunity: Uranium Miners and the Global Clean Energy Transition

Energy infrastructure and commodity markets are coming into high focus. A new wave of technological changes geared towards higher energy efficiency is underway. We believe that nuclear energy and uranium miners are poised to benefit from this shift.

White Paper

A New Era: How Critical Minerals Are Driving the Global Energy Transition

Critical minerals are essential for the global energy transition as we gradually phase out CO2-intensive energy sources with cleaner sources, including nuclear, solar, wind, hydro and geothermal energy and greater use of electric vehicles (EVs).

Interview

Sprott Uranium Update 2024

John Ciampaglia joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the growing interest in the uranium market, and Sprott’s movement in the space.

Interview

Sprott is Bullish on Uranium as Governments Shift to the Energy Source

John Ciampaglia sits down with BNN Bloomberg to discuss the uranium market. "We’ve been very active in educating the market and investors about the uranium thesis since we acquired the Uranium Participation Corporation in July 2021."

Special Report

Top 10 Themes for 2024

What forces are likely to drive energy transition materials and precious metals markets in 2024 and over the next decade? We discuss 10 critical macroeconomic and market-specific themes.

Educational Video

Nuclear Waste: Dispelling Fears and Myths

Nuclear waste is not something to be feared. In this video, we dispel the many fears and concerns about spent nuclear fuel.

Sprott Gold Report

Gold Mining Stocks, A Clear and Compelling Investment Case

Gold mining equities offer a compelling value case. Patience is key as investors recognize their long-term attraction.

Interview

Sergio Lujan Talks Sprott’s Expertise and the Gold Markets with RIA Channel

At the 2023 Schwab Impact conference, Sergio Lujan joined Keith Black of RIA Channel to discuss Sprott’s specialization in precious metals, the current state of the gold market, along with our outlook.

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Sprott Uranium Report

Uranium & Nuclear Get Boost from COP28

The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November. COP28 was dubbed the "nuclear COP" in recognition of nuclear power's increasing importance.

Sprott Webcast Replay

Future Facing Metals, Both Precious and Critical

Watch our webcast. Miners are shifting focus from a China-led commodity supercycle focused on industrialization and urbanization to a new cycle driven by clean energy and renewable energy technologies.

Sprott Critical Materials Monthly

Lithium-Ion Technology Solidifies Lead in EV Battery Stakes

The long-term trajectory for EVs is positive despite the recent slowdown. Lithium-ion batteries (LIBs) are the preferred battery technology for EVs, thanks to their superior technical properties.

Sprott Special Report

Gold’s Bold Move to New Closing High

On Friday, December 1, 2023, spot gold bullion registered an all-time high closing price of $2,072.22, surpassing the prior closing high of $2,063.54 reached on August 6, 2023.

Infographic

The Global Uranium Market in 3 Charts

The uranium market is experiencing increased demand, driven by its integral role in clean energy generation through its use in nuclear power.

Interview

Uranium Market Outlook 2024

Per Jander expresses optimism for the uranium market, emphasizing strong demand, ongoing long-term contracting discussions and potential supply disruptions as factors that could contribute to further price increases in 2024.

Sprott Uranium Report

Higher Uranium Prices Allow Miners to Resume Production

The uranium price increased in October, reaching a 12-year high at $74.48 per pound. A growing supply deficit is helping to support higher price levels as the West focuses on reshoring supply chains.

Interview

Battery Metals with Bloor Street Capital

Bloor Street Capital's Battery Metals Conference featured John Ciampaglia, CEO of Sprott Asset Management, interviewed by Margot Rubin.

Sprott Critical Materials Monthly

Energy Security and the Shifting Focus from Oil to Critical Minerals

As the U.S. advances in its pursuit of clean energy, it is strategically redirecting its energy security emphasis from oil to critical minerals, and diminish the influence of oil geopolitics and petrostates such as Russia.

Interview

Uranium Rally in Early Innings, Sprott Asset Management CEO Suggests

John Ciampaglia, CEO of Sprott Asset Management joins CNBC's Fast Money to talk about the uranium market and share Sprott's views on the benefits of nuclear energy and the need for energy security.

Interview

The Energy Transition to Uranium and Battery Metals

Ed Coyne sits down with Asset TV to discuss the energy transition, including uranium and battery metals, and what investors should take into consideration in this space.

Sprott Q3 Precious Metals Report

Central Banks Support Gold & Solar PV Demand Buoys Silver

Gold demand from sovereigns and central banks remains unwavering. Over the past decade, China has been committed to bolstering its gold reserves to enhance its economic and geopolitical standings.

Sprott Gold Report

Gold and the Debt Bubble

The Fed's "higher for longer" stance on interest rates is unsustainable and could lead to a general credit deflation and a recession. Trouble is brewing in the banking system and the labor market, which could further support a rise in gold prices.

Sprott Critical Materials Monthly

Silver Demand Grows as Solar Leads Renewables

Uranium's performance helped the energy transition complex close higher in September. From a macro outlook, solar panels are emerging as a critical player in the global energy transition.

Interview

Uranium Update with Bloor Street Capital

"Uranium has been one of the shining lights among commodities, given that it has had strong performance year to date. I think many investors are interested and are trying to understand the key drivers."

Sprott Uranium Report

Uranium Rally Gains Power in September

Uranium and uranium mining stocks posted their best month in two years, as the price of U3O8 reached a 12-year high. YTD as of 9/30/23, physical uranium has risen 51.88% and uranium mining equities have gained 23.93%.

Interview

How the Uranium Market Works

Per Jander, WMC Technical Advisor to Sprott Physical Uranium Trust, draws upon his years of experience as a uranium trader to reveal how the market works.

Special Report

Pro-Nuclear Sentiment Ignites Uranium Opportunities

The global nuclear power industry is experiencing a revival. Geopolitical events and a surge in energy demand have shifted sentiment positively, with countries investing in new nuclear reactor builds, restarts and extensions.

Sprott Webcast Replay

The Great Power Shift: Uranium, Battery Metals and the Energy Transition

The clean energy transition and worldwide energy security goals are fueling a global power shift. This shift has reignited interest in nuclear power, accelerated electric vehicle (EV) adoption and spurred renewable energy deployment.

Sprott Uranium Report

Strong Fundamentals Anchor Uranium's Rise

Uranium and uranium mining stocks had a strong month in August. YTD as of 8/31/2023, spot uranium and uranium mining stocks have climbed 25.49% and 21.52%, respectively, outperforming the frothy S&P 500.

Sprott Critical Materials Monthly

U.S. Taking Center Stage in Cleantech Investment

Uranium had a strong August, contrasting with the decline of most energy transition metals due to China's economic troubles. The investment capital spurred by the U.S. Inflation Reduction Act (IRA) is turning the U.S. into a cleantech powerhouse.

Special Report

Electric Vehicles and the Growing Opportunity for Lithium Miners

Electric vehicle (EV) adoption has surged in recent years, creating unprecedented demand for lithium, a critical component of EV batteries.

Interview

Uranium, Lithium, Copper, Gold and Silver and Changing Attitudes Toward Commodities

John Ciampaglia discusses why a higher uranium price will help incentivize much needed production for the world's growing nuclear fleet. John also discusses his outlook on gold, silver, copper, lithium and more.

Sprott Uranium Report

Stars are Aligning for Uranium and Nuclear Energy

Uranium continued to outshine other commodities, with U3O8 surging 16.35% and uranium mining stocks up 9.11% YTD as of July 31, 2023. The growing embrace of nuclear energy is driving demand and sparking a resurgence in uranium mine operations.

Sprott Critical Materials Monthly

Growing Urgency to Modernize U.S. Power Grid

The U.S. power grid desperately needs modernization. This is driving the development of energy storage systems and V2G (vehicle-to-grid) technology and is a major copper demand driver.

Interview

Sprott Update on Gold, Uranium and Battery Metals

John Ciampaglia discusses the current state of the gold market, the resilience of uranium, the growth of the battery metals sector and Sprott’s focus on providing investors with access to energy transition investments.

Sprott Q2 Precious Metals Report

Central Banks Flex Gold Market Muscle

Central banks and investment funds were the main players shaping the gold market in the first half of the year. Gold is reverting to its historical role as a significant reserve asset as central banks seek to diversify amid geopolitical uncertainties.

Sprott Uranium Report

Supply-Demand Gap Ignites Uranium Rally

U3O8 has climbed a healthy 15.95% YTD, while most other commodities have lost ground. Greater focus on the uranium supply-demand gap helped boost uranium mining stocks as well.

Sprott Gold Report

Gold vs. Gold Stocks, An Unresolved Incongruity

Gold mining stocks are inextricably connected to the price behavior of gold bullion. Yet their recent response to the gold bull market has been disappointing. If gold should rise above the psychological $2,000 threshold, this may provide a strong catalyst for gold mining stocks.

Sprott Critical Materials Monthly

EV Battery Independence and the New U.S. Manufacturing Supercycle

Energy transition metals miners posted strong results in June, with uranium mining equities leading the group. The U.S. is entering the early stages of a manufacturing supercycle driven by massive energy transition investment.

Special Uranium Report

Key Facts about Spent Nuclear Fuel

Chemical reactions of fossil-fuel plants release more radiation into the environment than the operation of nuclear energy plants — 10 times more. Most nuclear-industry waste is relatively low in radioactivity, and only a small amount is produced. Estimates put the total waste from a nuclear reactor supplying one person's electricity needs for a year at the size of a standard brick.

Sprott Uranium Report

Uranium Remains Resilient, While Threats of Nationalism Rattle Equities

The U3O8 uranium spot price has posted a healthy 12.99% year-to-date return as of May 31, and continued to show strength and diversification relative to other commodities.

Sprott Precious Metals Report

Geopolitical Risks Enhance Gold’s Role as a Reserve Asset

Gold attempted to breakout above $2,050 in early May before drifting lower as the U.S. debt-ceiling drama deepened and the U.S. dollar strengthened. At the same time, global central banks have been accumulating gold at a record pace.

Sprott Critical Materials Monthly

The West Moves to Weaken China's Hold

Lithium and lithium miners staged a sharp rebound rally in May and were the positive exception among critical minerals. The sector was weighed down by China's faltering recovery, ongoing global growth concerns and the U.S. debt ceiling drama.

Sprott Webcast Replay

Gold: A Safe Haven without Parallel?

Replay our webcast featuring John Hathaway and Doug Groh, discussing the current outlook for gold and gold mining equities. Gold has proven to be an effective safe haven asset during this challenging period.

Interview

Unearthing Investment Opportunities in Precious Metals and Critical Minerals

Sprott CEO Whitney George discusses the growing interest in critical minerals investing. George explains how Sprott has expanded beyond "all things gold" to offer physical uranium and is now a recognized asset manager in the energy transition space.

Sprott Precious Metals Report

Gold Rides Higher on Recession Fears

The gold market continues to be bullish as the probability of a recession rises, regional banking stress resurfaces and the Fed seems determined " get inflation down to 2%, over time".

Interview

Bloor Street Capital Virtual Copper Conference

Shree Kargutkar discusses the supply/demand scenario for the metal and how it may change with the growth of electric vehicles, geopolitical factors impacting global copper mining and recent M&A activity in the sector.

Sprott Critical Materials Monthly

Nationalization and Surging M&A Highlight Secular Strength

The long-term secular growth outlook for energy transition materials got several boosts in April. Chile's decision to nationalize its lithium reserves reinforces the metal's role as a global strategic economic asset.

Sprott Uranium Report

Uranium’s April Breakthrough

The U3O8 uranium spot price climbed 6.01% in April, reacting positively to China's ambitious plans to expand its nuclear energy capacity. Global acceptance of nuclear energy has increased and positive momentum is building within the uranium industry.

Sprott Critical Materials Monthly

How Deglobalization is Changing the Dynamics of Securing Critical Minerals

As deglobalization accelerates, unfettered access to critical minerals is not likely to last. The old system of free and fair access to commodities, including critical minerals, is moving toward one marked by interregional competition, and unstable availability and pricing.

Special Report

A Bullion "Moat" for Your Portfolio

In Q1 2023, precious metals bullion and equities showed strong YTD momentum, with gold closing above the psychologically important $2,000 per ounce mark and silver reaching $25. Gold/silver mining equities also posted notable gains.

Sprott Uranium Report

Uranium Proves Resilient in March

The U3O8 uranium spot price fell slightly in March. YTD through 3/31/2023, uranium has gained 4.93%, demonstrating resilience relative to other commodities.

Sprott Precious Metals Report

Gold Bulls Run Faster as Fed Tackles Banking Crisis

Gold posted a solid Q1 2023 gain of 7.96%, and is now up 21.38% from last autumn's low (9/26/22) following the most aggressive central bank purchases in decades and gold investment flows catalyzed by the U.S. banking crisis.

Sprott Gold Report

Is My Money Safe?

"The yellow metal has no counterparty risk (unlike all other financial instruments including bank deposits and government bonds), is highly liquid and has an unbroken record of retaining value in absolute terms and relative to financial assets."

Sprott Critical Materials Monthly

Has the Next Commodities Supercycle Begun?

As the global energy transition "arms race" heats up, the drive to secure supply is fast becoming more important than price. All signs indicate the 40-year bond bull market has likely ended and the next great secular bull market in commodities has begun.

Sprott Uranium Report

Uranium‘s Mixed February

Uranium miners made headlines with significantly sized uranium contracts that reflect higher demand for long-term supply commitments. Uranium market fundamentals are the most positive in over a decade and are likely to continue to be the primary performance driver.

Sprott Precious Metals Report

First Gold Dip Since Central Bank Buying Spree

Gold fell in February, closing the month at $1,827 in a correction characterized by a stall in buying, but not selling. Global central banks have been buying gold at record rates; more than three times their long-term averages.

Interview

Bloor Street Capital Nuclear and Uranium Conference

“I think it's an interesting time to be investing in uranium — from a fundamental perspective, from an energy policy perspective, from a geopolitical risk perspective…we've experienced a sea change in the level of interest related to uranium, energy transition materials and mining investments.”

Sprott Webcast Replay

The Energy Transition Is Here. Is Your Portfolio Ready?

Due to years of underinvestment, we believe demand is likely to outstrip supply for many energy transition materials, including uranium, lithium, copper, nickel and others. The investment opportunities may be powerful.

Sprott Critical Materials Monthly

Critical Materials Start 2023 With a Bang

We believe we are in the early stages of an energy transition materials secular bull market and favorable supply-demand dynamics are likely going forward. The upward revision in global growth, the timing effect of the China credit impulse and the surprise ending of China's zero-COVID policy have provided a tailwind for the metals market.

Interview

Value Investor Insight: From the Ground Up

Value Investor Insight interviewed Whitney George, John Ciampaglia, John Hathaway, Matthew Haynes and Per Jander on the key global macroeconomic shifts that have prompted Sprott to broaden and deepen its focus on real assets and energy transition investing.

Sprott Uranium Report

Uranium‘s January Jump

Looking ahead, we believe the uranium bull market still has a long way to run. Over the long term, increased demand in the face of an uncertain uranium supply is likely to support a sustained bull market.

Sprott Precious Metals Report

Strong China Demand Boosts Gold Rally

January was another positive month for gold bullion. We saw strong gold buying from China, with estimated tonnes purchased at the highest level since 2017.

Special Report

Fireside Chat: Investing in the Critical Minerals Driving the Energy Transition

We believe investing in the mining companies that produce critical minerals may offer attractive investment opportunities, as discussed in this video with Ed Coyne, Senior Managing Director at Sprott, and Steven Schoffstall, Director at ETF Product Management.

Sprott Uranium Report

Key Trends for 2023 and December Recap

Three key themes for uranium markets in 2023: 1) increased emphasis on energy security worldwide; 2) higher conversion/enrichment prices may boost spot uranium prices; and 3) the global energy transition supports the case for nuclear power.

Sprott Precious Metals Report

2023 Top 10 Watch List

This year’s top 10 list offers Sprott’s thoughts on what will likely drive markets in the coming year and decade, from a macro perspective and the vantage of our asset classes: Precious Metals and Energy Transition Materials.

Sprott Gold Report

Connecting a Few Dots

Gold was an effective hedge in 2022, returning -0.28% for the bear market year. The yellow metal outperformed the S&P 500 Index, which declined 18.11%. Gold mining equities also outpaced the S&P 500.

Sprott Uranium Report

The Optimistic News Continues

While the price of U3O8 uranium has lagged since May 2022, conversion and enriched uranium prices have significantly appreciated. We believe that current demand, coupled with a shift away from Russian suppliers, is likely to support a higher U3O8 uranium spot price.

Sprott Precious Metals Report

Gold Higher After Peak Fed Hawkishness

Gold and gold mining equities posted strong results in November, up 8.26% and 16.79%, respectively. Silver gained 15.81%. Risk assets were catalyzed higher by the Fed's signal that it would slow the pace of rate hikes.

Educational Video

Silver: A History of Innovation

Silver is used in every smartphone, desktop and laptop computer, and is essential for the construction of EVs, solar panels and many other technologies needed for the green economy.

Sprott Webcast Replay

Looking Ahead to Metals and Miners

2022 has been a difficult year for many asset classes. Markets were historically volatile, with higher-than-expected inflation, quickly rising interest rates, the Russia-Ukraine war and the threat of a global economic recession.

Sprott Uranium Report

Uranium's October Optimism

The U3O8 uranium spot price climbed 8.32% in October. Our positive outlook is supported by the unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are all creating demand for uranium.

Sprott Precious Metals Report

Fed Pivot FOMO and Financial Instability

The tough year continued in October for many asset classes, including gold and other precious metals. Gold demand, however, was strong in Q3 2022 as long-term investors took advantage of lower prices to build positions.

Educational Video

Uranium: Born of the Stars

Uranium, an element born of the stars, is as complex as it is paradoxical. This heavy metal holds dormant powers both inspiring and terrifying. This video shares incredible facts about uranium’s inter-planetary origins and looks at the critical role of uranium in the burgeoning green energy economy.

Sprott Uranium Report

Uranium's September Setback

September was tough on uranium, which was negatively impacted by the month's drawdowns. We believe the uranium bull market remains intact, especially given that many countries are facing energy shortages and rocketing costs.

Sprott Gold Report

The Dollar, Safe Haven or Leaky Lifeboat?

"The parabolic rise in the dollar contains the seeds of its own demise. The façade of dollar strength foretells a comeuppance for all currencies in the form of a steep devaluation in terms of gold."

Sprott Precious Metals Report

Things are Breaking

Since Q2 2020, gold has held above $1,700 but in mid-September, a significant risk-off wave occurred, breaking nearly every risk asset lower. The primary causes were higher than expected inflation data forcing yields (especially real yields) and the USD higher, two important gold drivers.

Sprott Uranium Report

Uranium’s August Glow

Uranium, both physical uranium and mining equities, had standout performance in August, in contrast to the weak results posted by the broader markets. We believe uranium's gains reflect the growing acceptance of nuclear power among global governments as they seek alternatives to meet ambitious energy transition and security goals.

Sprott Precious Metals Report

Summer Doldrums for Gold & Silver

It’s been a summer of doldrums for many asset classes. Precious metals lost ground as a liquidity crunch took hold in response to market declines and volatility. Gold declined 3.11% and silver fell 11.62%.

Sprott Uranium Report

Dawn of a New Nuclear Renaissance?

The Sprott Physical Uranium Trust (“SPUT”, TSX: U.U ($US); U.UN ($CA)) was launched just over a year ago in July 2021. While we were optimistic about the prospects for uranium, we could not foresee the tectonic shifts in the uranium sector that followed the launch and SPUT’s significant impact.

UxC Weekly Article Reprint

SPUT: One Year Later

When SPUT began trading in late July 2021, there were many questions about how it would affect the uranium market. With 12 months of trading now behind us, we can confidently state that SPUT has dramatically altered the spot uranium market with far-reaching effects on much of the industry.

Interview

Red Cloud Summer Silver Conference 2022

Maria Smirnova is interviewed by Taylor Combaluzier, Red Cloud Financial Services. Maria joins Tavi Costa, Crescat Capital LL. and Peter Krauth, Author of "The Great Silver Bull".

Sprott Precious Metals Report

Signs of Capitulation Everywhere

July was another difficult month for most asset categories and was characterized by selling capitulation into exhaustion. Much more aggressive Fed rate hike expectations relative to other global central banks were a significant cause of U.S. dollar (USD) strength and rising real yields, which adversely affected gold.

Sprott Gold Report

Inflation, No Quick Fix

If the Fed is to abandon the practice of inflating financial assets, which would represent a secular shift in direction, substantial deflation lies ahead from which the purchasing power of gold is expected increase in real terms.

Sprott Monthly Report

Gold Holds in Worst First Half in Decades

Gold continued to perform as a safe haven store of value in what has been one of the most challenging six-month periods for markets in decades. Gold has managed to stay above the $1,800 support level despite the broader market carnage.

Educational Video

Palladium: The King of Catalysts

As one of the key platinum group metals, palladium is a highly prized commodity. It commands more monetary value than gold and is 30 times as rare, with industrial demand outstripping supply for the last decade.

Interview

Gold Outlook, Inflation & Bullion vs. Miners

Ted Oakley interviews Sprott's John Hathaway on the gold bullion and equities markets. Oakley and Hathaway discuss why investors should consider adding gold to investment portfolios and how gold affects portfolio diversification.

Sprott Monthly Report

Gold, Steady in its Purpose

May saw selling across most asset classes and scant appetite for safe haven assets such as gold. However, gold bullion has outperformed many other asset classes YTD and continues to do its job.

Educational Video

Platinum: The Rarest Precious Metal

Platinum is a metal that represents power, prestige and a sense of great accomplishment. Modern day uses of platinum include catalytic converters for vehicles, as it converts car exhaust gasses into less harmful substances, as a catalyst in the chemical industry and even in the creation of life-saving anti-cancer drugs.

Sprott Silver Report

Silver Demand and Supply Trends to Watch

Silver is historically undervalued relative to gold and offers an attractive investment opportunity. Silver market fundamentals are strong, given that declining supply trends cannot keep up with rising, longer-term demand.

Sprott Webcast Replay

Uranium Miners and the Clean Energy Opportunity

A new uranium bull market is underway. Uranium miners are well positioned to take share within the energy sector as energy security and decarbonization take center stage globally.

Interview

Early Innings for Uranium Investments

Ed Coyne and Tim Rotolo, co-creator of the North Shore Global Uranium Mining Index (URNMX), explain how the Index is constructed to provide exposure to the key components of the uranium mining industry.

Interview

NYSE with CEO John Ciampaglia on URNM

Douglas Yones, NYSE Head of Exchange Traded Products, interviews John Ciampaglia, Chief Executive Officer, Sprott Asset Management, on the recent launch of Sprott Uranium Miners ETF (URNM).

Sprott Gold Report

April Pressures Risk Assets

Gold held in ETFs has increased sharply this year as the safe-haven flight continues. April was tough on many investment sectors, with the S&P 500 Index down 8.80%, the Nasdaq Composite Index declining 13.37% and U.S. Treasury bonds falling 3.10%.

Sprott Podcast

Uncovering the World of Uranium

Host Ed Coyne is joined by Tim Rotolo to discuss the current dynamics of the uranium mining sector and how the Index is constructed to provide exposure to the key components of the uranium mining industry.

Sprott Gold Report

Putin’s Gambit

The price of gold has been treading water for 10 years while the investment fundamentals have improved dramatically. That is why, in our opinion, significant upside lies ahead for gold and related equities.

Sprott Monthly Report

Gold Investment Demand Returns

Gold posted its all-time highest quarterly close on March 31, 2022, ending a volatile month that helped gold climb above $2,070 on March 8. While gold may have climbed back to its highs on safe-haven flows, other positive gold supports are definitely in play.

Industry Insight

Palladium: An introduction for Platinum and Palladium Investors

Read the latest intel on Palladium from the World Platinum Investment Council. The spectacular increase in the price of palladium since 2016, in particular during 2019, attracted widespread interest from investors, industrial users of palladium and market commentators. It also highlighted the importance of understanding the palladium market when considering an investment in palladium or platinum.

Interview

Gold Bullion Breaks Out on Safe-Haven Flight

"The Russian-Ukraine conflict is probably one of the biggest macro drivers in the marketplace... Before Russia-Ukraine, the gold market had started shaking off the hawkish Fed rhetoric. Russia-Ukraine has just amplified gold's value as a safe haven asset."

Educational Video

Gold: A True Store of Value

Throughout history, gold has played a prominent role in the advancement of human civilization. Seen as a representation of the sun, of the gods and of true value, gold is a form of real money without counterparty risks. Learn about gold’s culture, uses and history.

Sprott Webcast Replay

Uranium and Nuclear Energy: Critical to the Clean Energy Transition

Nuclear energy’s profile as a highly efficient, reliable and zero-carbon producing energy source has helped to create a new bull market for physical uranium.

Sprott Radio

Super Terrific Happy Hour Ep. 14: John Hathaway

Stephanie Pomboy and Grant Williams interview a true legend of the precious metals industry, John Hathaway. The three discuss the Fed, inflation, the financial markets and the outlook for gold bullion and gold stocks.

Interview

Gold and Silver Price Drivers, Generational Opportunity in Stocks

"I believe that we are on the cusp of a generational opportunity today. I would encourage every viewer to dust off their old notebooks and do a little research on precious metals mining companies, especially those that are well managed, with attractive balance sheets."

Sprott Monthly Report

Fed Applies Hawkish Shock Treatment

Gold reached a high of $1,848 in January, but slid following the Fed's exceptionally hawkish statements at the January FOMC meeting. Market risks are rising and we believe that gold, as it did in 2018, is likely to stage a breakout given its safe haven characteristics.

Sprott Monthly Report

2022 Top 10 Watch List

Based on historic patterns, gold's lengthy consolidation indicates that prices have the potential to rally sharply and quickly in the coming year. We explain why in our List of Top 10 things to watch for gold investors.

Sprott Gold Report

Waiting for the Pivot

With Fed policy taking a more hawkish turn, the fire hose of liquidity that has fueled market mania is being turned off. At this moment, it appears that confidence in the Fed and attraction to gold are binary.

Special Uranium Report

Why Nuclear Power Plant Life Extensions & Uprates Matter (...SMRs are in Early Stages)

Research and development on small modular nuclear reactors (SMRs) are underway globally and generating tremendous buzz. But SMRs are not likely to contribute meaningful amounts of carbon-free power for another decade.

Sprott Radio

Opportunities in Uranium

Sprott's Ed Coyne and John Ciampaglia join Per Jander of WMC Energy to discuss the promising investment case for uranium and the launch of Sprott Physical Uranium Trust (TSX: U.UN). The Trust invests and holds substantially all of its assets in uranium in the form of U3O8 or "yellowcake," which is created in the first stages of its lifecycle from mined ore to spent fuel.

Sprott Silver Report

Silver's Clean Energy Future

Silver climbed more than 47% in 2020, reaffirming its value as a safe haven portfolio asset during the COVID pandemic. But our bullish outlook for silver is based on its unique role as an industrial metal. Silver should be integral to any "green revolution" discussions, given that it is critical to the success of EVs, solar energy and 5G cellular networks. We believe that silver demand will likely explode in the next 10 years, and we don't foresee supply growth keeping pace.

Special Report

The Platinum Opportunity - Part 2

Platinum is one of the rarest of metals but often flies under the radar. In Part 2, we look at platinum supply-demand dynamics and explain why we believe that Platinum is too cheap to ignore.

Special Report

The Platinum Opportunity - Part 1

Platinum is one of the rarest of metals but often flies under the radar. In Part 1, we provide a Platinum Primer and explain why we are bullish on this essential metal, which plays a critical role in the automotive, industrial and jewelry sectors.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.