Sprott Uranium Report

Strong Fundamentals Anchor Uranium's Rise

Key Takeaways

- Uranium and uranium mining stocks had a strong month in August while most other energy transition metals declined on China's weakening economy.

- An unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds are likely to boost uranium demand.

- Global primary mine supply is consistently falling short of the world's nuclear reactor needs as geopolitical tensions constrict supply.

- Utilities are refocusing on rebuilding their uranium inventories as we believe secondary supply has reached its peak.

- The uranium bull market is intact and favorable supply-demand dynamics will likely continue to provide support.

Performance as of August 31, 2023: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

7.85% | 11.06% | 25.49% | 14.77% | 25.48% | 18.37% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

11.48% | 27.70% | 21.51% | -0.61% | 37.01% | 21.22% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 13.00% | 32.46% | 10.88% | -12.17% | 36.32% | N/A |

|

Broad Commodities (BCOM Index) 4 |

-1.22% | 8.23% | -6.01% | -12.83% | 13.09% | 4.83% |

|

U.S. Equities (S&P 500 TR Index) 5 |

-1.59% | 8.28% | 18.73% | 15.94% | 10.52% | 11.12% |

Sources: Bloomberg and Sprott Asset Management LP. Data as of August 31, 2023.

*Performance for periods under one year not annualized.

August Overview

The U3O8 uranium spot price surged 7.85% in August, rising from US$56.21 to $60.63 per pound. Uranium's impressive uptick in August set it apart from many other commodities, which faced declines due to the strengthening USD and China's softening economy (see Figure 1). Decade-high uranium contracting levels by utilities, coupled with supply disruptions and risks, are helping to create a robust demand market.

Uranium mining equities also posted notable gains in August: the broad sector of uranium miners rose by 11.48%2, while junior uranium miners surged 13.00%.3 This upward trend in uranium stocks underscores the sector's strengthening fundamentals. It also signals a growing reality that the future of uranium supply will hinge on the revival of dormant mines and the inception of new mining projects.

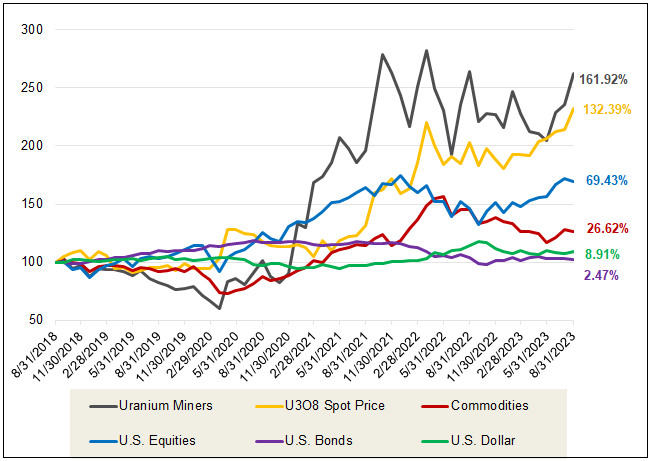

Uranium fundamentals are the least exposed to China's economic cycle and secular and cyclical challenges. Year to date as of August 31, 2023, spot uranium and uranium mining stocks have gained 25.49%1 and 21.52%,2 respectively, and have outperformed the frothy S&P 500 TR Index's YTD gain of 18.73%.5 Over the longer term, uranium has demonstrated even greater outperformance among various commodities. For the five years ended August 31, 2023, U3O8 spot price appreciated a cumulative 132.39% compared to 26.62% for the BCOM (see Figure 2).

Figure 1. Physical Uranium Leads Commodities Year-to-Date in 2023

Source: Bloomberg and Sprott Asset Management. Data as of 8/31/2023. Uranium is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. All other commodities are sourced from Bloomberg. Gold is measured by GOLDS Comdty; Silver is measured by SILV Comdty; Copper is measured by LMCADY Comdty; Lead is measured by LMPBDY Comdty; Aluminum is measured by LMAHDY Comdty; Platinum is measured by PLAT Comdty; Zinc is measured by LMZSDY Comdty; Palladium is measured by PALL Comdty; Nickel is measured by LMNIDY Comdty; Cobalt is measured by LMCODY Comdty; * Neodymium is used as a proxy for Rare Earths and is measured by NDCNDLXH Index; Lithium is measured by L4CNMJGO Index; Crude Oil is measured by CL1 Comdty; Nat Gas is measured by NG1 Comdty; and Agriculture is measured by BCOMAG Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 2. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (8/31/2018-8/31/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 08/31/2023. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Fundamentals are Powering its Third Bull Market

In our view, uranium's price momentum is approaching a pivotal juncture as it edges close to its $63.77 peak in 2022, posted shortly after Russia's February 24, 2022, invasion of Ukraine. Our analysis suggests that uranium is in its third bull market phase since 1968 (see Figure 6). With the global primary mine supply consistently falling short of the world's reactor uranium needs, we anticipate even more growth potential for the commodity.

We believe the uranium bull market is intact and favorable supply-demand dynamics are likely to continue providing support.

On the demand side, an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds are likely to create incremental demand for uranium. Consequently, utilities are accelerating their purchases under long-term agreements, which are on track to exceed last year's 10-year high at 107MM lbs. of U3O8e YTD (Figure 3). Notably, increasing contracting from utilities, as opposed to financial entities, has been the primary driver for the rise in the uranium price year to date.

Primary uranium mine supply is significantly trailing demand, with a cumulative forecasted supply shortfall of approximately 1.5 billion pounds by 2040 (see Figure 4). The industry is recognizing the need for more uranium mining. Even traditionally anti-nuclear Sweden has revealed intentions to revoke its uranium mining ban and substantially amplify its nuclear output. Yet, despite such announcements, the sector continues to grapple with pronounced supply challenges.6

Figure 3. Utility Long-Term Uranium Contracting Volumes (1990-2023)

Source: UxC LLC, Q2 2023 Uranium Market Outlook. Eval/Pot. refers to the evaluation potential of the contract. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Mine Restarts Help "Mine the Gap"

Uranium mines, previously shut down mines and maintained due to prolonged periods of low uranium prices, are the obvious starting points to increase supply and "mine the gap". A notable mine restart example is Cameco's McArthur River mine, which resumed operations in late 2022. Initially, the mine aimed to produce 15 million pounds of uranium in 2023, but this has been revised to 14 million pounds.7 Further challenges arose at Cameco's Cigar Lake mine, anticipating a production dip of 1.7 million pounds from previous estimates. Supply disruptions are becoming a trend, not an exception. Peninsula Energy Ltd. faced setbacks when Uranium Energy Corp. (UEC) ended a processing contract, leading to a "significant" postponement in restarting the Lance project.8

Geopolitical tensions have been significantly constricting the uranium supply. A case in point is the recent coup in Niger, which led to international sanctions against the ruling military junta, disrupting logistics and compelling Orano SA (Orano) to suspend uranium processing.9 In addition, Global Atomic Corp. disclosed that these circumstances might postpone the inauguration of its Dasa Project by six to 12 months. According to the World Nuclear Association, Niger accounts for 4% of the world’s uranium production.

The fragile stability of Niger's uranium supply intensifies the existing vulnerabilities in the uranium supply chain, primarily due to its high geographical concentration. Compounding the uranium supply's geopolitical risks is the question of Russian supply. Western utilities have been self-sanctioning, albeit taking deliveries of uranium under existing contracts while not signing any new contracts. Further, legislation to reshore the U.S. nuclear supply chain away from Russia has been advancing, such as the Nuclear Security Act, which helped start the current rally in uranium on July 31, 2023.

Figure 4. Uranium Supply and Demand Estimates (2022E-2040E)

Source: UxC LLC. Data estimates as of Q2 2023. World Nuclear Association as of 8/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Utilities are Refocused on Uranium Inventory Management

Recent challenges experienced by some uranium miners have underscored the importance of a secure supply and elevated the role of inventory management. Utilities consistently maintain inventory stocks of uranium in various forms, whether in uranium concentrate (U3O8), natural UF6, enriched UF6 or fabricated fuel (not inserted into a reactor). Uranium's impressive energy density (see Figure 5) enables utilities to stockpile multiple years' worth of supplies. This results in a situation opposite to just-in-time inventory and ensures that the utilities can run their nuclear power plants almost continuously. Such stockpiles have been indispensable in bridging supply-demand gaps amidst disruptions.

For years, primary mine supplies have fallen short of global reactor needs. Commercial secondary stockpiles, managed by utilities and suppliers, have largely bridged this disparity. However, after a prolonged phase of inventory surplus, we contend that this secondary supply has reached its peak. The era of taking uranium stockpiles and procurement strategies for granted seems to be ending.

Other secondary sources of uranium supply used historically are also depleting. Long gone is the "Megatons for Megawatts" program between the U.S. and Russia to repurpose nuclear weapons into fuel for electricity, which concluded its 20-year run in 2013 (and ultimately supplying a total of 177,000 t U3O8, or about 2.5x annual world demand for the period).10

Another secondary source of supply has been underfeeding in the uranium enrichment process. Historically, when enrichers had surplus capacity, they introduced a reduced quantity of uranium into the enrichment centrifuges over an extended duration — a method termed "underfeeding". Essentially, the enrichers used less uranium than typically required. Notably, Russia controls 39% of this enrichment capacity, as cited by the World Nuclear Association. With potential sanctions looming on Russian enrichment services or Russia itself restricting enrichment access, there's a growing demand for Western enrichment services. This shift could reverse the trend, transitioning from underfeeding to overfeeding, wherein enrichment centrifuges receive a larger uranium input. Such a pivot in the industry would boost uranium consumption, tilting the balance from supply to demand.

Figure 5. Uranium’s High Energy Density

Source: American Nuclear Association.

Conversion and enrichment capacities of uranium have been a key bottleneck in the supply chain. The recent restart of the ConverDyn conversion facility in Illinois and increased enrichment capacity announcements, such as Urenco and Orano's recent announcements, will help to address this. As a result of these developments, we believe that conversion and enrichment services price increases have finally cascaded to the uranium spot price. However, the current uranium price remains below incentive levels to restart tier 2 production, let alone finance greenfield development. Over the long term, increased demand in the face of an uncertain uranium supply are likely to continue to support a sustained bull market (Figure 6).

Figure 6. Uranium Bull Market Continues (1968-2023)

Please click here to see an enlarged chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 08/31/2023. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/. Included for illustrative purposes only. Past performance is no guarantee of future results.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies, and reflects dividends reinvested. |

| 6 | Source: Mining Technology, 8/21/2023; Sweden to lift parliamentary ban on uranium mining. |

| 7 | Source: Mining.com, 9/5/2023; Cameco 2023 forecast down at Key Lake, Cigar Lake, McArthur River operations. |

| 8 | Source: World Nuclear News, 9/11/2023; Orano gives updates on uranium enrichment plans and Niger situation. |

| 9 | Source: Bloomberg, Orano Halts Uranium Treatment in Niger Because of Sanctions on Junta. |

| 10 | Source: Nuclear Engineering International, 4/18/2023; Ukraine, Energoatom and Cameco finalise uranium agreement. |

| 11 | Source: World Nuclear News, 12/11/2013; Megatons to Megawatts program concludes. |

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management LP (“SAM LP”) and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. SAM LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affiliates may hold a short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not residents of Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, or considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2024 Sprott Inc. All rights reserved.