Sprott Uranium Report

Uranium & Nuclear Get Boost from COP28

Key Takeaways

- The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November and is up 67.10% YTD; uranium stocks followed suit.

- Uranium continues to outperform other commodities and demonstrate its strong fundamentals.

- Both Western and Eastern nations made important geopolitical maneuvers in November to secure uranium supplies.

- Competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap.

- COP28 was dubbed the "nuclear COP" as nuclear energy took center stage.

Performance as of November 30, 2023: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

8.39% | 33.16% | 67.10% | 63.32% | 39.69% | 22.87% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

6.31% | 26.90% | 54.22% | 46.74% | 54.38% | 27.87% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 7.47% | 28.70% | 42.66% | 30.94% | 54.22% | N/A |

|

Broad Commodities (BCOM Index) 4 |

-2.69% | -3.98% | -9.75% | -12.28% | 11.04% | 4.28% |

|

U.S. Equities (S&P 500 TR Index) 5 |

9.13% | 1.74% | 20.80% | 13.84% | 9.76% | 12.51% |

*Performance for periods under one year not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 11/30/2023. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium's Resurgence to a 16-Year High

The U3O8 uranium spot price gained 8.39% in November, increasing from US$74.48 to $80.73 per pound as of November 30, 2023.1 Uranium has posted a stellar 67.10% year-to-date return as of November 30, 2023, and continued to show strength and diversification relative to other commodities, which declined 9.75% (as measured by the BCOM Index).

Breaking through the $80 per pound level represents a high price for the current uranium bull market and a price level not seen in almost 16 years. Uranium’s all time high of $136 was reached in 2007 at the end of the last commodity supercycle which ended due to the 2008 Global Financial Crisis. Following the GFC, the uranium price was in a state of decline through 2016, when it reached a month-end low of $17.75 on November 30, 2016. Although November was characterized by lower inflation and favorable 2024 interest rate change expectations, which provided many asset classes with a boost, energy and metals commodity markets were largely negative, with the notable exception of uranium. This trend continues to showcase the uranium market's economic insensitivity and diversification to major asset classes.

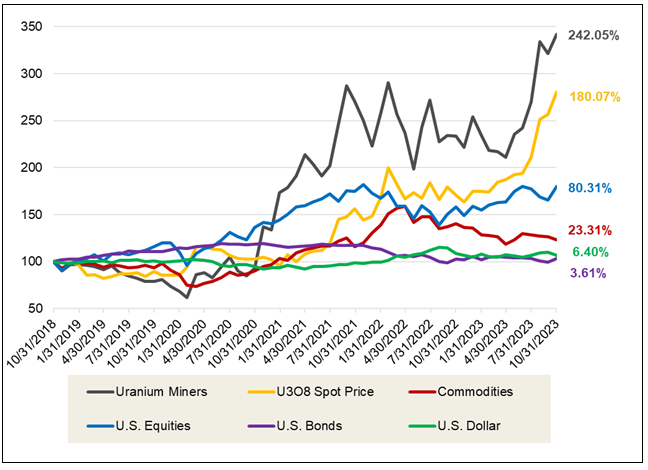

Over the longer term, physical uranium and uranium equities have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended November 30, 2023, the U3O8 spot price has risen a cumulative 180.07% compared to 23.31% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (11/30/2018-11/30/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 09/30/2023. Uranium miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 spot price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Urgency of the Uranium Supply Race

Geopolitical uncertainty and concerns about the security of uranium supply continue to be the driving forces behind the ongoing uranium rally. Notably, French President Emmanuel Macron's November visit to Kazakhstan marked a pivotal event. During this visit, a significant joint declaration was made to enhance trade and cooperation in the fields of nuclear energy and strategic minerals. Additionally, a crucial agreement was signed, focusing on collaboration in the nuclear fuel cycle.6 These strengthened ties between France and Kazakhstan come at a critical juncture for France, especially in light of deteriorating relations with Niger following the July coup. Niger's military junta has publicly accused France of attempting to destabilize the country, leading to the closure of borders and heightened uncertainty surrounding France's uranium supply from Niger. It's worth noting that France shares a deep historical connection with Niger, having maintained control until Niger gained independence in 1960. Over the past decade, France has relied heavily on Niger for almost 20% of its uranium imports, a substantial proportion considering that Niger's contribution to global production stands at just 4%.7,8

France & the West Move to Secure Supply…

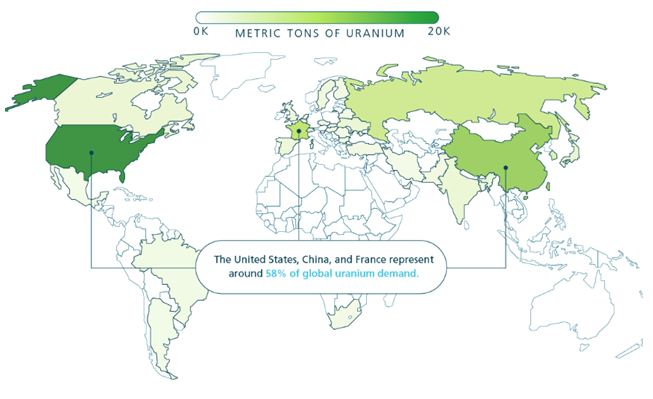

Kazakhstan and France play pivotal roles in the uranium markets, each contributing substantially to the industry. Kazakhstan, as the world's leading uranium producer, accounts for an impressive 43% of the global mine production in 2022. On the other hand, France stands out not only as the world's third-largest consumer of uranium, as illustrated in Figure 2, but also boasts a significant reliance on nuclear energy, which accounts for 63% of its total electricity generation. Given these vital positions, the evolving situation in Niger, coupled with an inherent supply-demand gap in the broader uranium market, has heightened the imperative for ensuring the security of supply, not just for France but for all nations reliant on uranium resources.

Western nations are particularly vulnerable due to their shift away from Russia for nuclear fuel supply services. While Russia contributed only 5% to the global uranium mine supply in 2022, it plays a more substantial role in uranium conversion and enrichment services. Consequently, Western utilities are still accepting deliveries of Russian-enriched uranium, but they are implementing self-sanctions by refraining from entering into new contracts. Moreover, legislative efforts are gaining momentum, aiming to restrict uranium imports into the United States. The Prohibiting Russian Uranium Imports Act has recently garnered approval in the U.S. House and now awaits consideration in the Senate (was passed on 12/11/2023 by U.S. House of Representatives). Time is limited for its passage within the current year. If the act is ratified, it will lead to a ban on Russian uranium imports 90 days after its enactment, while allowing for temporary waivers until 2028.9

...Along with Russia and China

Eastern nations are also actively pursuing the assurance of a stable uranium supply. While Russia does engage in uranium mining, its domestic production falls short of meeting its extensive demands to fuel both domestic and Russian-built reactors in various countries. Consequently, Russia also uses its southern neighbor, Kazakhstan, for access to uranium resources. In a reciprocal effort, following French President Emmanuel Macron's visit to Kazakhstan, Russian President Vladimir Putin embarked on a visit to further strengthen Russian-Kazakh relations just one week later.10 These diplomatic overtures align with China's President Xi Jinping's visit to Kazakhstan in October, where he emphasized the need for increased cooperation.11

China stands out with the second-largest uranium reactor requirements globally and ambitious nuclear expansion plans, currently overseeing the construction and planning of 68 reactors, compared to the 55 already operational. Given the scale of both current and anticipated future demand, China is deeply committed to securing its uranium supply for the long term. Leveraging its historical capability to invest significantly in commodity supply chains well in advance of actual requirements, it is likely that a substantial portion of Kazakh supply, including the announced capacity increases to 100% by 2025, will primarily flow into China. As a notable illustration, the China National Uranium Corporation is presently expanding its storage capacity at its warehouse along the Kazakhstan-China border, increasing it from 3,000 tU to 20,000 tU—almost double China's anticipated annual reactor requirements for 2023.12

The competition for uranium supply is rapidly intensifying, driven by the increasing importance of nuclear energy and the growing awareness of an impending supply-demand gap. This situation has been exacerbated by the fact that mine supply has consistently lagged behind reactor requirements for more than a decade. To bridge this gap, the industry has been compelled to depend on secondary sources, mainly utility inventories through either direct sales or, more notably, inventory drawdowns. We firmly believe that the era of destocking has come to an end, and the supply-demand deficit appears poised to endure. This scenario is likely to provide ample room for the uranium bull market to flourish.

Figure 2. Uranium Demand for Nuclear Power

Source: World Nuclear Association, November 2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

The "Nuclear COP"

Nuclear energy sentiment and international collaboration were abundant in the United Nations COP28 (Conference of the Parties). COP28 took place this month, eight years after the signing of the Paris Agreement, and saw world leaders convene to discuss their collective commitments to limit global warming to below 2, preferably to 1.5 degrees, Celsius compared to pre-industrial levels.

During COP28, more than 20 nations, including the United States, France, Japan and the UK, made a significant commitment to triple global nuclear energy generation by 2050.13 COP28 was held in the United Arab Emirates, and amidst reports of geopolitical disagreements affecting discussions on fossil fuels, nuclear energy took center stage as a pivotal point of collaboration during the conference. Some even referred to this event as the "nuclear COP," underscoring its newfound prominence on the international stage. This represents a substantial acceleration in the global sentiment towards nuclear energy. In contrast, at COP27 the previous year, the most concrete nuclear-related developments were limited to altering the agreement's language to prioritize "low-emission" energy sources rather than solely "renewables." Additionally, it marked the first time nuclear energy was even considered in the conversation, a significant shift from its exclusion at COP26.

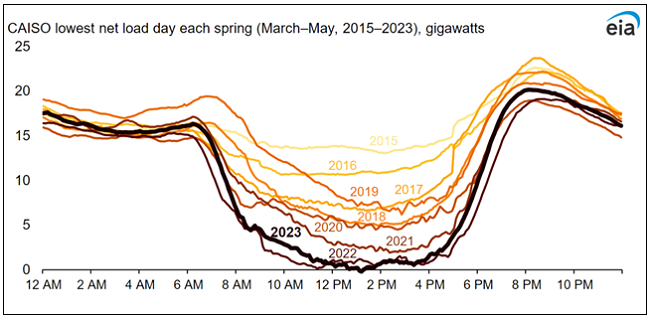

Nuclear energy has undeniably experienced a boost in favor, as governments worldwide come to recognize the imperative of dependable baseload power to counterbalance the intermittent nature of renewable energy sources. A noteworthy advantage of nuclear energy lies in its capacity factor, which stands at an impressive 93%. This metric represents the ratio of the total energy generated over a specific period to what the plant would have produced at full capacity. By comparison, renewables like solar and wind lag behind, with capacity factors of 25% and 36%, respectively.

Moreover, the growing investment in solar energy by numerous nations has underscored the critical importance of reliable power supply. This need becomes even more pronounced when considering that peak electricity demand frequently occurs after sunset when solar power becomes unavailable. This phenomenon is exemplified by California’s duck curve, a graph depicting the growing gap between electricity supply and demand as the sun sets, emphasizing the urgency of securing stable energy sources.

Figure 3. California’s Duck Curve Is Getting Deeper

Source: EIA. As solar capacity grows, duck curves are getting deeper in California. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Miners Developments

Uranium miners ascended in tandem with the U3O8 uranium spot price, with the broad sector of uranium miners rising by 6.31%2 and junior uranium miners gaining 7.47%.3

As the price of uranium has increased significantly, uranium mine projects are starting to come online. Restarts, projects that had been producing uranium and then stopped and put on care and maintenance, have been the logical start to a supply response.

In November, enCore Energy Corp. (enCore) announced the successful startup of uranium production at its Rosita plant.14 enCore also plans to restart its Alta Mesa plant in early 2024. These restarts are both located in Texas and should help to start the revival of the U.S.’s domestic uranium production.

Though restarts such as enCore’s and Boss Energy Ltd.’s Honeymoon project (see last month’s commentary) are critical to helping address the uranium market’s supply-demand deficit, new builds will also be needed for this endeavor. New builds take many years to both develop and go through the permitting process, and total lead times can take 10 to 15 years.15

NexGen Energy Ltd. (Nexgen) is a uranium developer focused on the Rook 1 Project located in the Athabasca Basin of Saskatchewan, Canada. In November, Nexgen announced it had received a major milestone with Saskatchewan’s environmental approval for its Rook 1 project.16 The 98,739 tU indicated mineral resources Rook 1 Project next step in the permitting process is for federal approval. This marks a further significant development as even though the Athabasca Basin is a large source of high-grade uranium, this Rook 1 environmental approval is the first in more than 20 years.

Global Atomic Corporation (Global Atomic) released an update on its Dasa project in Niger. In August, the coup d’état in Niger forced Global Atomic to announce delays of 6-12 months in the first production at Dasa to end of 2025.17 In November, their update on the situation in Niger seemed to help soothe investor concerns as the stock jumped and outperformed peers. In this update, the Global Atomic President and CEO noted, “Further to our Q2 2023 update regarding the Republic of Niger, a transition government is in place and includes a new Prime Minister and Cabinet, as well as the previous experienced staff in the Government Ministries. The Government of Niger is a 20% owner of the Dasa Project and recognizes that the Dasa Mine will benefit the Republic of Niger by generating royalty and tax revenue, creating new jobs and opportunities for local business and revitalize the northern region of the country. The Government has offered its positive support for the development of the Dasa Project.” 18

A Concerning Supply Deficit

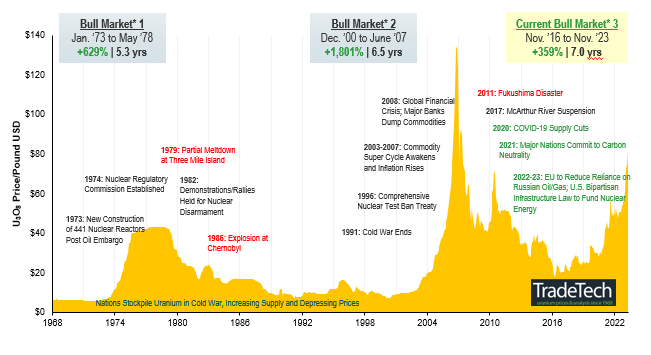

As global uranium mine production consistently falls short of the world's burgeoning uranium reactor demands, a concerning supply deficit is projected to materialize over the next decade. This deficit is further exacerbated by a decade of insufficient investment in supply infrastructure. Additionally, the prospects for future supply are hindered by extended lead times and substantial capital requirements. Consequently, we deem the reactivation of dormant mines and the development of new ones as absolutely critical. The uranium price target as an incentive for reviving existing mines and initiating greenfield projects is a moving target. Our assessment suggests that achieving higher uranium prices will be necessary to stimulate sufficient production and bridge the forecasted deficits. Looking ahead, the persistent growth in demand amid an uncertain uranium supply landscape is expected to bolster a sustained bullish market trend, as depicted in Figure 4.

Figure 4. Uranium Bull Market Continues (1968-2023)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 11/30/2023. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/. Included for illustrative purposes only. Past performance is no guarantee of future results.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. For periods before July 2021 data is from TradeTech LLC. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. The Adviser will provide certain services in connection with the Index including contributing inputs in connection with the eligibility and proce |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Source: World Nuclear News. Agreements, declarations mark Macron visits to Kazakhstan, Uzbekistan. |

| 7 | Source: Le Monde. How dependent is France on Niger's uranium? |

| 8 | Source: World Nuclear Association. World Uranium Mining Production (Updated August 2023) |

| 9 | Source: BNN Bloomberg. US House Approves Russian Uranium Import Ban. |

| 10 | Source: CNBC. As the West courts Russia’s neighbors, Putin shows he won’t give up its backyard without a fight. |

| 11 | Source: Reuters. China's Xi meets Kazakhstan president, pushes for more cooperation. |

| 12 | Source: World Nuclear Association. China's Nuclear Fuel Cycle (Updated November 2023). |

| 13 | Source: Canary Media. 20-plus countries pledge to triple the world’s nuclear energy by 2050. |

| 14 | Source: Cision. enCore Energy Commences Uranium Production at the South Texas Rosita ISR Uranium Central Processing Plant. |

| 15 | Source: IAEA. URAM-2018: Ebb and Flow — the Economics of Uranium Mining. |

| 16 | Source: WNN. Ministerial approval for NexGen uranium project. |

| 17 | Source: Bloomberg. Orano Halts Uranium Treatment in Niger Because of Sanctions on Junta. |

| 18 | Source: Global Atomic Corporation. Global Atomic Announces Q3 2023 Results, Provides Corporate Update and Re-engagement by Development Banks. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.