Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Infographic

The Uranium Opportunity

Global uranium mine supply continues to fall short of reactor demand, creating a persistent and widening deficit. With uranium demand expected to double by 2040, these tightening fundamentals underpin a powerful long-term investment case.

Sprott Uranium Report

Investors Act with Conviction

Uranium prices and miners surged in September, fueled by tight supply and strong utility demand. The rally drew renewed investor interest, with capital flows into uranium equities and ETFs reinforcing confidence in the sector’s momentum.

Interview

Overview of Uranium Spot and Term Markets

Per Jander of WMC joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Jander reflects on his 20 years at the World Nuclear Symposium, noting the industry’s growing optimism and Microsoft’s entry as a paradigm shift. Jander highlights uranium market dynamics and sees limited downside for the sector, given rising utility contracting and strong fundamentals.

Interview

Where Is Spot Uranium Going?

John Ciampaglia, CEO of Sprott Asset Management, joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Ciampaglia highlights strong global investor interest in uranium, with both specialist and generalist funds viewing nuclear as a long-term growth story. He notes stabilizing uranium prices, lingering supply challenges and growing demand from utilities, AI and data centers.

Interview

Uranium: At the Fulcrum of AI, National Security and Global Energy Demand

John Ciampaglia, CEO of Sprott Asset Management, shares takeaways from the September 2025 World Nuclear Symposium. He highlights surging uranium demand from rising electricity needs, AI data centers and energy security concerns, plus growing tech ties such as Microsoft joining the World Nuclear Association. With supply still tight, Ciampaglia sees higher prices and new mining investment creating a strong backdrop for investors.

Interview

Asset TV Masterclass: Real Assets

Ed Coyne, Senior Managing Partner at Sprott, discusses the outlook for gold, silver, copper and other real assets amid economic uncertainty, geopolitical conflict and the potential for persistent inflation. He joins Jodie Gunzberg, CFA®, Managing Partner at InFi Strategies and Don Marleau, CFA®, Metals & Mining Managing Director at S&P Global Ratings.

Interview

Sprott: Physical Commodities as Core Allocation

Gold and silver can serve as core physical allocations, with gold standing out as a proven portfolio diversifier. For investors seeking potential upside, mining equities offer opportunistic potential beyond the stability of the physical markets.

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

Interview

Uranium Outlook Mid-Year 2025

John Ciampaglia, CEO of Sprott Asset Management, joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the current state of the uranium market. Ciampaglia highlights the market's V-shaped recovery since April and the improved investor sentiment following the absence of tariffs on uranium.

Interview

Uranium Spot Market Update

Per Jander of WMC provides a nuanced look at the uranium spot market's opportunities and challenges. He discusses tariffs, the cautious dance of utilities and explores what may support higher uranium prices.

Special Report

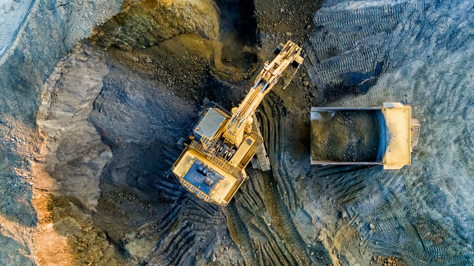

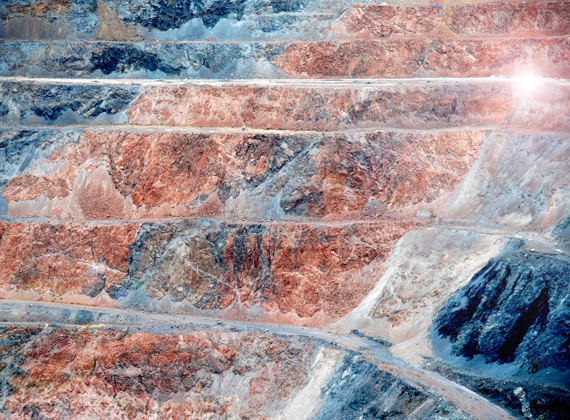

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Shifting Energy

The White House’s Nuclear Push: What It Means for Uranium Opportunities

In this episode of Shifting Energy (Season 2), John Ciampaglia discusses the major policy shift under President Trump’s new executive orders, which aim to fast-track advanced nuclear technologies and revitalize the entire U.S. nuclear fuel cycle.

Video

Trump’s Executive Orders Set Stage for U.S. Nuclear Expansion

With President Trump's executive orders aimed at jumpstarting the U.S. nuclear energy industry and boosting domestic uranium production, uranium is in the spotlight. This move, driven by concerns over foreign fuel reliance and increasing global support for nuclear power, has investors paying close attention.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Shifting Energy

Safe Havens: The Enduring Stability of Precious Metals in Turbulent Times

In this episode of Shifting Energy (Season 2), Steve Schoffstall, Director, ETF Product Management and John Kinnane, Director, Key Accounts at Sprott Asset Management, chat about how investors are navigating bumpy markets and global trade wars with assets like gold and silver.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Interview

Trump Tariffs: Disruption or Opportunity?

Are tariffs set to disrupt gold, silver and uranium markets? Find out how potential trade barriers could impact prices and create arbitrage opportunities. Kitco’s Senior Mining Editor and Anchor Paul Harris interviews John Ciampaglia, CEO of Sprott Asset Management, at the 2025 BMO Global Metals, Mining & Critical Minerals Conference.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump's tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Interview

Uranium Outlook for 2025

Sprott CEO John Ciampaglia remains bullish on the uranium markets, citing rising term prices, increased utility interest and the global nuclear renaissance fueled by clean energy needs and AI-driven power demands. Ciampaglia expects uranium prices to strengthen as pent-up demand grows, driven by reactor life extensions, new builds and geopolitical supply disruptions.

Special Report

Top 10 Themes for 2025

What forces will shape the markets in critical materials and precious metals in 2025 and beyond? We identify 10 key macro and market themes investors should watch in the coming year.

Shifting Energy

Uranium Unleashed: How Mining Stocks Fuel the Nuclear Comeback

Sprott's John Kinnane and Steve Schoffstall explore the growing opportunities in the uranium and nuclear energy markets. They discuss how pure-play uranium miners, supply-demand dynamics and shifting geopolitical policies are positioning this sector as a promising investment frontier for 2025 and beyond.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Interview

Nuclear Power and Critical Materials: A Post-Election Outlook

What’s the potential impact of the incoming Trump administration on nuclear power, clean energy and critical materials? Thalia Hayden of @etfguide talks with John Ciampaglia about what potential changes may be on the horizon for U.S. energy policies and some strategies for investment portfolios.

Interview

Real Assets in Focus: Gold, Silver, Copper and Uranium

Unlock the power of real assets investing with Sprott’s Masterclass video. Dive into gold, silver, copper and uranium with industry experts Ed Coyne, Ryan McIntyre and Steve Schoffstall as they reveal strategies to navigate global uncertainties and identify opportunities.

Interview

Why Tech & Big Investors Are Turning to Uranium & Gold

John Ciampaglia, CEO of Sprott, joins James Connor to discuss why gold is increasingly viewed as a safeguard against economic uncertainty and why uranium has become essential to powering big tech's ambitious AI expansion.

Shifting Energy

The New Power Play: How Tech Giants Are Embracing Nuclear Energy for Data Centers

Nuclear power is creating a buzz in media circles. Thalia Hayden of @etfguide talks with John Ciampaglia about the powerful comeback of nuclear energy and how tech giants are embracing nuclear energy for data centers.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Webcast Replay

Investing in Critical Materials: A Diversified Approach to a Long-Term Opportunity

In our webcast with Nasdaq, John Ciampaglia discusses the rapid emergence of technologies like AI, the race to upgrade power grids, continuing global decarbonization goals and growing middle classes. He gives an overview of how the critical materials behind energy—such as uranium, copper, nickel, lithium and more—are likely to remain growth-oriented investment opportunities for the long term, and how to invest in them in a single allocation.

Sprott Webcast Replay

Investing in Critical Materials: A Diversified Approach to a Long-Term Opportunity

In our webcast with Nasdaq, John Ciampaglia discusses the rapid emergence of technologies like AI, the race to upgrade power grids, continuing global decarbonization goals and growing middle classes. He gives an overview of how the critical materials behind energy—such as uranium, copper, nickel, lithium and more—are likely to remain growth-oriented investment opportunities for the long term, and how to invest in them in a single allocation.

Sprott Webcast Replay

An Investor's Guide to Precious Metals and Critical Materials

2024 has been an exciting year thus far for precious metals and critical materials. This webcast takes a technical perspective on the key drivers for gold, silver, uranium and copper, as all four metals enjoy positive markets. We also provide strategic portfolio allocation ideas for precious metals and critical materials.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Sprott Uranium Report

Uranium Case Strengthens

The uranium spot price has remained range-bound between $85 and $95 per pound, and ended the first half at $85.34 (June 30, 2024). Uranium miners fell in June, but bounced back in early July, outperforming the commodity YTD.

Sprott Uranium Report

Uranium Miners Lead Market Higher

YTD the uranium spot price has stabilized between $85-$95 per pound after an 88.54% rise in 2023, indicating a healthy correction in a bullish cycle. Uranium miners' performance improved, matching spot price gains.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global nuclear energy commitments make uranium a compelling investment. Despite a slight dip in spot prices, there's potential for growth.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

In March, the uranium market saw mixed results: spot prices fell, but miners' stocks rose due to a positive long-term outlook. We believe the uranium bull market has more room to grow.

Interview

The Elements of Energy: Uranium and Copper

Learn how renewed interest in nuclear power, rising global energy demands, and the transition to clean energy are driving investment opportunities in uranium, copper and their miners in this Asset TV video featuring Ed Coyne and Steve Schoffstall.

Sprott Webcast Replay

Uranium and Copper: The Elements of Energy

Electricity demand is expected to grow 86% by 2050. At the center of this growth are uranium and copper – two critical materials that are in high demand and limited supply.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. News from Kazatomprom and Cameco reinforce uranium markets' structural supply deficit.

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was lackluster for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment surged to an unprecedented $1.77 trillion.

Shifting Energy

The Nuclear Energy Comeback and Uranium Powering It

John Ciampaglia joins Thalia Hayden on Sprott’s new video series, Shifting Energy. They discuss surging uranium prices, the latest nuclear renaissance and potential investment opportunities.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January, fueled in part by Kazatomprom's cut in guidance for 2024 production. Junior uranium miners were top performers , climbing 18.78%.

Grant's Interest Rate Observer

Radioactive-Asset Manager

Whitney George, CEO of Sprott, joined Evan Lorenz to discuss Sprott's growth and the increasing demand for critical materials, including uranium.

White Paper

Unearthing Opportunity: Uranium Miners and the Global Clean Energy Transition

Energy infrastructure and commodity markets are coming into high focus. A new wave of technological changes geared towards higher energy efficiency is underway. We believe that nuclear energy and uranium miners are poised to benefit from this shift.

White Paper

A New Era: How Critical Minerals Are Driving the Global Energy Transition

Critical minerals are essential for the global energy transition as we gradually phase out CO2-intensive energy sources with cleaner sources, including nuclear, solar, wind, hydro and geothermal energy and greater use of electric vehicles (EVs).

Interview

Sprott Uranium Update 2024

John Ciampaglia joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the growing interest in the uranium market, and Sprott’s movement in the space.

Interview

Sprott is Bullish on Uranium as Governments Shift to the Energy Source

John Ciampaglia sits down with BNN Bloomberg to discuss the uranium market. "We’ve been very active in educating the market and investors about the uranium thesis since we acquired the Uranium Participation Corporation in July 2021."

Educational Video

Nuclear Waste: Dispelling Fears and Myths

Nuclear waste is not something to be feared. In this video, we dispel the many fears and concerns about spent nuclear fuel.

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Sprott Uranium Report

Uranium & Nuclear Get Boost from COP28

The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November. COP28 was dubbed the "nuclear COP" in recognition of nuclear power's increasing importance.

Sprott Webcast Replay

Future Facing Metals, Both Precious and Critical

Watch our webcast. Miners are shifting focus from a China-led commodity supercycle focused on industrialization and urbanization to a new cycle driven by clean energy and renewable energy technologies.

Infographic

The Global Uranium Market in 3 Charts

The uranium market is experiencing increased demand, driven by its integral role in clean energy generation through its use in nuclear power.

Interview

Uranium Market Outlook 2024

Per Jander expresses optimism for the uranium market, emphasizing strong demand, ongoing long-term contracting discussions and potential supply disruptions as factors that could contribute to further price increases in 2024.

Sprott Uranium Report

Higher Uranium Prices Allow Miners to Resume Production

The uranium price increased in October, reaching a 12-year high at $74.48 per pound. A growing supply deficit is helping to support higher price levels as the West focuses on reshoring supply chains.

Interview

Battery Metals with Bloor Street Capital

Bloor Street Capital's Battery Metals Conference featured John Ciampaglia, CEO of Sprott Asset Management, interviewed by Margot Rubin.

Interview

Uranium Rally in Early Innings, Sprott Asset Management CEO Suggests

John Ciampaglia, CEO of Sprott Asset Management joins CNBC's Fast Money to talk about the uranium market and share Sprott's views on the benefits of nuclear energy and the need for energy security.

Interview

The Energy Transition to Uranium and Battery Metals

Ed Coyne sits down with Asset TV to discuss the energy transition, including uranium and battery metals, and what investors should take into consideration in this space.

Sprott Critical Materials Monthly

Silver Demand Grows as Solar Leads Renewables

Uranium's performance helped the energy transition complex close higher in September. From a macro outlook, solar panels are emerging as a critical player in the global energy transition.

Interview

Uranium Update with Bloor Street Capital

"Uranium has been one of the shining lights among commodities, given that it has had strong performance year to date. I think many investors are interested and are trying to understand the key drivers."

Sprott Uranium Report

Uranium Rally Gains Power in September

Uranium and uranium mining stocks posted their best month in two years, as the price of U3O8 reached a 12-year high. YTD as of 9/30/23, physical uranium has risen 51.88% and uranium mining equities have gained 23.93%.

Interview

How the Uranium Market Works

Per Jander, WMC Technical Advisor to Sprott Physical Uranium Trust, draws upon his years of experience as a uranium trader to reveal how the market works.

Special Report

Pro-Nuclear Sentiment Ignites Uranium Opportunities

The global nuclear power industry is experiencing a revival. Geopolitical events and a surge in energy demand have shifted sentiment positively, with countries investing in new nuclear reactor builds, restarts and extensions.

Sprott Webcast Replay

The Great Power Shift: Uranium, Battery Metals and the Energy Transition

The clean energy transition and worldwide energy security goals are fueling a global power shift. This shift has reignited interest in nuclear power, accelerated electric vehicle (EV) adoption and spurred renewable energy deployment.

Sprott Uranium Report

Strong Fundamentals Anchor Uranium's Rise

Uranium and uranium mining stocks had a strong month in August. YTD as of 8/31/2023, spot uranium and uranium mining stocks have climbed 25.49% and 21.52%, respectively, outperforming the frothy S&P 500.

Sprott Critical Materials Monthly

U.S. Taking Center Stage in Cleantech Investment

Uranium had a strong August, contrasting with the decline of most energy transition metals due to China's economic troubles. The investment capital spurred by the U.S. Inflation Reduction Act (IRA) is turning the U.S. into a cleantech powerhouse.

Interview

Uranium, Lithium, Copper, Gold and Silver and Changing Attitudes Toward Commodities

John Ciampaglia discusses why a higher uranium price will help incentivize much needed production for the world's growing nuclear fleet. John also discusses his outlook on gold, silver, copper, lithium and more.

Sprott Uranium Report

Stars are Aligning for Uranium and Nuclear Energy

Uranium continued to outshine other commodities, with U3O8 surging 16.35% and uranium mining stocks up 9.11% YTD as of July 31, 2023. The growing embrace of nuclear energy is driving demand and sparking a resurgence in uranium mine operations.

Interview

Sprott Update on Gold, Uranium and Battery Metals

John Ciampaglia discusses the current state of the gold market, the resilience of uranium, the growth of the battery metals sector and Sprott’s focus on providing investors with access to energy transition investments.

Sprott Uranium Report

Supply-Demand Gap Ignites Uranium Rally

U3O8 has climbed a healthy 15.95% YTD, while most other commodities have lost ground. Greater focus on the uranium supply-demand gap helped boost uranium mining stocks as well.

Special Uranium Report

Key Facts about Spent Nuclear Fuel

Chemical reactions of fossil-fuel plants release more radiation into the environment than the operation of nuclear energy plants — 10 times more. Most nuclear-industry waste is relatively low in radioactivity, and only a small amount is produced. Estimates put the total waste from a nuclear reactor supplying one person's electricity needs for a year at the size of a standard brick.

Sprott Uranium Report

Uranium Remains Resilient, While Threats of Nationalism Rattle Equities

The U3O8 uranium spot price has posted a healthy 12.99% year-to-date return as of May 31, and continued to show strength and diversification relative to other commodities.

Sprott Uranium Report

Uranium’s April Breakthrough

The U3O8 uranium spot price climbed 6.01% in April, reacting positively to China's ambitious plans to expand its nuclear energy capacity. Global acceptance of nuclear energy has increased and positive momentum is building within the uranium industry.

Sprott Uranium Report

Uranium Proves Resilient in March

The U3O8 uranium spot price fell slightly in March. YTD through 3/31/2023, uranium has gained 4.93%, demonstrating resilience relative to other commodities.

Sprott Uranium Report

Uranium‘s Mixed February

Uranium miners made headlines with significantly sized uranium contracts that reflect higher demand for long-term supply commitments. Uranium market fundamentals are the most positive in over a decade and are likely to continue to be the primary performance driver.

Interview

Bloor Street Capital Nuclear and Uranium Conference

“I think it's an interesting time to be investing in uranium — from a fundamental perspective, from an energy policy perspective, from a geopolitical risk perspective…we've experienced a sea change in the level of interest related to uranium, energy transition materials and mining investments.”

Sprott Webcast Replay

The Energy Transition Is Here. Is Your Portfolio Ready?

Due to years of underinvestment, we believe demand is likely to outstrip supply for many energy transition materials, including uranium, lithium, copper, nickel and others. The investment opportunities may be powerful.

Sprott Uranium Report

Uranium‘s January Jump

Looking ahead, we believe the uranium bull market still has a long way to run. Over the long term, increased demand in the face of an uncertain uranium supply is likely to support a sustained bull market.

Sprott Uranium Report

Key Trends for 2023 and December Recap

Three key themes for uranium markets in 2023: 1) increased emphasis on energy security worldwide; 2) higher conversion/enrichment prices may boost spot uranium prices; and 3) the global energy transition supports the case for nuclear power.

Sprott Uranium Report

The Optimistic News Continues

While the price of U3O8 uranium has lagged since May 2022, conversion and enriched uranium prices have significantly appreciated. We believe that current demand, coupled with a shift away from Russian suppliers, is likely to support a higher U3O8 uranium spot price.

Sprott Webcast Replay

Looking Ahead to Metals and Miners

2022 has been a difficult year for many asset classes. Markets were historically volatile, with higher-than-expected inflation, quickly rising interest rates, the Russia-Ukraine war and the threat of a global economic recession.

Sprott Uranium Report

Uranium's October Optimism

The U3O8 uranium spot price climbed 8.32% in October. Our positive outlook is supported by the unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are all creating demand for uranium.

Educational Video

Uranium: Born of the Stars

Uranium, an element born of the stars, is as complex as it is paradoxical. This heavy metal holds dormant powers both inspiring and terrifying. This video shares incredible facts about uranium’s inter-planetary origins and looks at the critical role of uranium in the burgeoning green energy economy.

Sprott Uranium Report

Uranium's September Setback

September was tough on uranium, which was negatively impacted by the month's drawdowns. We believe the uranium bull market remains intact, especially given that many countries are facing energy shortages and rocketing costs.

Sprott Uranium Report

Uranium’s August Glow

Uranium, both physical uranium and mining equities, had standout performance in August, in contrast to the weak results posted by the broader markets. We believe uranium's gains reflect the growing acceptance of nuclear power among global governments as they seek alternatives to meet ambitious energy transition and security goals.

Sprott Uranium Report

Dawn of a New Nuclear Renaissance?

The Sprott Physical Uranium Trust (“SPUT”, TSX: U.U ($US); U.UN ($CA)) was launched just over a year ago in July 2021. While we were optimistic about the prospects for uranium, we could not foresee the tectonic shifts in the uranium sector that followed the launch and SPUT’s significant impact.

UxC Weekly Article Reprint

SPUT: One Year Later

When SPUT began trading in late July 2021, there were many questions about how it would affect the uranium market. With 12 months of trading now behind us, we can confidently state that SPUT has dramatically altered the spot uranium market with far-reaching effects on much of the industry.

Sprott Webcast Replay

Uranium Miners and the Clean Energy Opportunity

A new uranium bull market is underway. Uranium miners are well positioned to take share within the energy sector as energy security and decarbonization take center stage globally.

Interview

Early Innings for Uranium Investments

Ed Coyne and Tim Rotolo, co-creator of the North Shore Global Uranium Mining Index (URNMX), explain how the Index is constructed to provide exposure to the key components of the uranium mining industry.

Interview

NYSE with CEO John Ciampaglia on URNM

Douglas Yones, NYSE Head of Exchange Traded Products, interviews John Ciampaglia, Chief Executive Officer, Sprott Asset Management, on the recent launch of Sprott Uranium Miners ETF (URNM).

Sprott Podcast

Uncovering the World of Uranium

Host Ed Coyne is joined by Tim Rotolo to discuss the current dynamics of the uranium mining sector and how the Index is constructed to provide exposure to the key components of the uranium mining industry.

Sprott Webcast Replay

Uranium and Nuclear Energy: Critical to the Clean Energy Transition

Nuclear energy’s profile as a highly efficient, reliable and zero-carbon producing energy source has helped to create a new bull market for physical uranium.

Special Uranium Report

Why Nuclear Power Plant Life Extensions & Uprates Matter (...SMRs are in Early Stages)

Research and development on small modular nuclear reactors (SMRs) are underway globally and generating tremendous buzz. But SMRs are not likely to contribute meaningful amounts of carbon-free power for another decade.

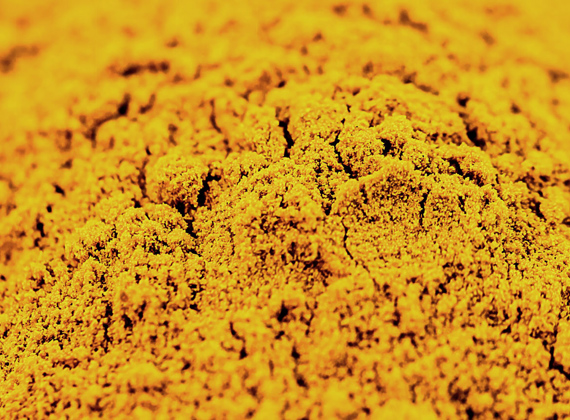

Sprott Radio

Opportunities in Uranium

Sprott's Ed Coyne and John Ciampaglia join Per Jander of WMC Energy to discuss the promising investment case for uranium and the launch of Sprott Physical Uranium Trust (TSX: U.UN). The Trust invests and holds substantially all of its assets in uranium in the form of U3O8 or "yellowcake," which is created in the first stages of its lifecycle from mined ore to spent fuel.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.