Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

Special Report

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump's tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Special Report

Top 10 Themes for 2025

What forces will shape the markets in critical materials and precious metals in 2025 and beyond? We identify 10 key macro and market themes investors should watch in the coming year.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Sprott Uranium Report

Uranium Case Strengthens

The uranium spot price has remained range-bound between $85 and $95 per pound, and ended the first half at $85.34 (June 30, 2024). Uranium miners fell in June, but bounced back in early July, outperforming the commodity YTD.

Sprott Uranium Report

Uranium Miners Lead Market Higher

YTD the uranium spot price has stabilized between $85-$95 per pound after an 88.54% rise in 2023, indicating a healthy correction in a bullish cycle. Uranium miners' performance improved, matching spot price gains.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global nuclear energy commitments make uranium a compelling investment. Despite a slight dip in spot prices, there's potential for growth.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

In March, the uranium market saw mixed results: spot prices fell, but miners' stocks rose due to a positive long-term outlook. We believe the uranium bull market has more room to grow.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. News from Kazatomprom and Cameco reinforce uranium markets' structural supply deficit.

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was lackluster for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment surged to an unprecedented $1.77 trillion.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January, fueled in part by Kazatomprom's cut in guidance for 2024 production. Junior uranium miners were top performers , climbing 18.78%.

White Paper

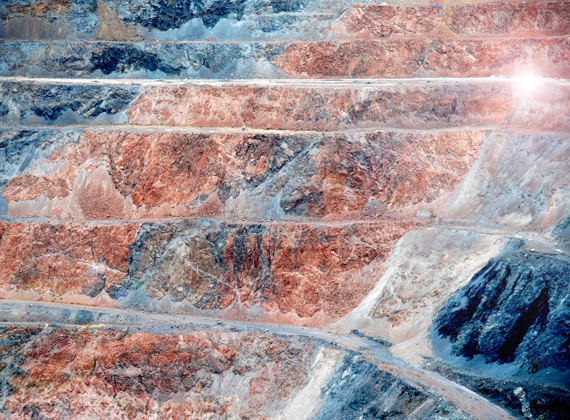

Unearthing Opportunity: Uranium Miners and the Global Clean Energy Transition

Energy infrastructure and commodity markets are coming into high focus. A new wave of technological changes geared towards higher energy efficiency is underway. We believe that nuclear energy and uranium miners are poised to benefit from this shift.

White Paper

A New Era: How Critical Minerals Are Driving the Global Energy Transition

Critical minerals are essential for the global energy transition as we gradually phase out CO2-intensive energy sources with cleaner sources, including nuclear, solar, wind, hydro and geothermal energy and greater use of electric vehicles (EVs).

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Sprott Uranium Report

Higher Uranium Prices Allow Miners to Resume Production

The uranium price increased in October, reaching a 12-year high at $74.48 per pound. A growing supply deficit is helping to support higher price levels as the West focuses on reshoring supply chains.

Sprott Critical Materials Monthly

Silver Demand Grows as Solar Leads Renewables

Uranium's performance helped the energy transition complex close higher in September. From a macro outlook, solar panels are emerging as a critical player in the global energy transition.

Sprott Uranium Report

Uranium Rally Gains Power in September

Uranium and uranium mining stocks posted their best month in two years, as the price of U3O8 reached a 12-year high. YTD as of 9/30/23, physical uranium has risen 51.88% and uranium mining equities have gained 23.93%.

Special Report

Pro-Nuclear Sentiment Ignites Uranium Opportunities

The global nuclear power industry is experiencing a revival. Geopolitical events and a surge in energy demand have shifted sentiment positively, with countries investing in new nuclear reactor builds, restarts and extensions.

Sprott Uranium Report

Strong Fundamentals Anchor Uranium's Rise

Uranium and uranium mining stocks had a strong month in August. YTD as of 8/31/2023, spot uranium and uranium mining stocks have climbed 25.49% and 21.52%, respectively, outperforming the frothy S&P 500.

Sprott Critical Materials Monthly

U.S. Taking Center Stage in Cleantech Investment

Uranium had a strong August, contrasting with the decline of most energy transition metals due to China's economic troubles. The investment capital spurred by the U.S. Inflation Reduction Act (IRA) is turning the U.S. into a cleantech powerhouse.

Special Uranium Report

Key Facts about Spent Nuclear Fuel

Chemical reactions of fossil-fuel plants release more radiation into the environment than the operation of nuclear energy plants — 10 times more. Most nuclear-industry waste is relatively low in radioactivity, and only a small amount is produced. Estimates put the total waste from a nuclear reactor supplying one person's electricity needs for a year at the size of a standard brick.

Sprott Uranium Report

Uranium Remains Resilient, While Threats of Nationalism Rattle Equities

The U3O8 uranium spot price has posted a healthy 12.99% year-to-date return as of May 31, and continued to show strength and diversification relative to other commodities.

Sprott Uranium Report

Uranium’s April Breakthrough

The U3O8 uranium spot price climbed 6.01% in April, reacting positively to China's ambitious plans to expand its nuclear energy capacity. Global acceptance of nuclear energy has increased and positive momentum is building within the uranium industry.

Sprott Uranium Report

Uranium Proves Resilient in March

The U3O8 uranium spot price fell slightly in March. YTD through 3/31/2023, uranium has gained 4.93%, demonstrating resilience relative to other commodities.

Sprott Uranium Report

Uranium‘s Mixed February

Uranium miners made headlines with significantly sized uranium contracts that reflect higher demand for long-term supply commitments. Uranium market fundamentals are the most positive in over a decade and are likely to continue to be the primary performance driver.

Sprott Uranium Report

Uranium‘s January Jump

Looking ahead, we believe the uranium bull market still has a long way to run. Over the long term, increased demand in the face of an uncertain uranium supply is likely to support a sustained bull market.

Sprott Uranium Report

Key Trends for 2023 and December Recap

Three key themes for uranium markets in 2023: 1) increased emphasis on energy security worldwide; 2) higher conversion/enrichment prices may boost spot uranium prices; and 3) the global energy transition supports the case for nuclear power.

Sprott Uranium Report

The Optimistic News Continues

While the price of U3O8 uranium has lagged since May 2022, conversion and enriched uranium prices have significantly appreciated. We believe that current demand, coupled with a shift away from Russian suppliers, is likely to support a higher U3O8 uranium spot price.

Sprott Uranium Report

Uranium's October Optimism

The U3O8 uranium spot price climbed 8.32% in October. Our positive outlook is supported by the unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are all creating demand for uranium.

Sprott Uranium Report

Uranium's September Setback

September was tough on uranium, which was negatively impacted by the month's drawdowns. We believe the uranium bull market remains intact, especially given that many countries are facing energy shortages and rocketing costs.

Sprott Uranium Report

Uranium’s August Glow

Uranium, both physical uranium and mining equities, had standout performance in August, in contrast to the weak results posted by the broader markets. We believe uranium's gains reflect the growing acceptance of nuclear power among global governments as they seek alternatives to meet ambitious energy transition and security goals.

Sprott Uranium Report

Dawn of a New Nuclear Renaissance?

The Sprott Physical Uranium Trust (“SPUT”, TSX: U.U ($US); U.UN ($CA)) was launched just over a year ago in July 2021. While we were optimistic about the prospects for uranium, we could not foresee the tectonic shifts in the uranium sector that followed the launch and SPUT’s significant impact.

UxC Weekly Article Reprint

SPUT: One Year Later

When SPUT began trading in late July 2021, there were many questions about how it would affect the uranium market. With 12 months of trading now behind us, we can confidently state that SPUT has dramatically altered the spot uranium market with far-reaching effects on much of the industry.

Special Uranium Report

Why Nuclear Power Plant Life Extensions & Uprates Matter (...SMRs are in Early Stages)

Research and development on small modular nuclear reactors (SMRs) are underway globally and generating tremendous buzz. But SMRs are not likely to contribute meaningful amounts of carbon-free power for another decade.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.