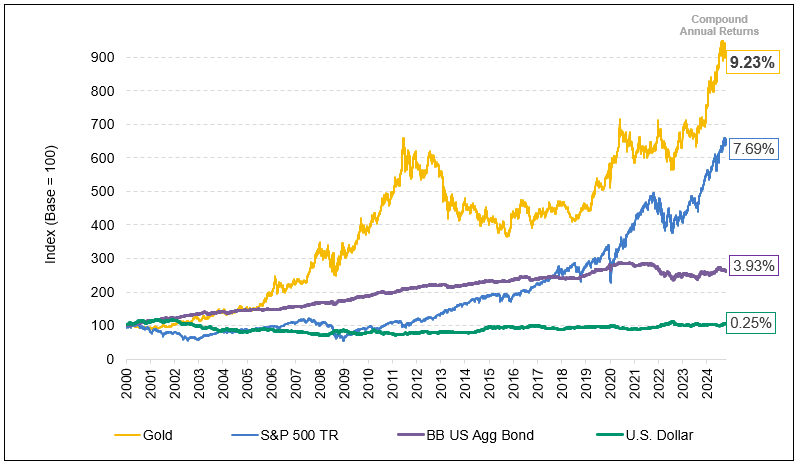

Gold bullion appreciated over 27% in 2024, the most in 14 years, and outperformed most major asset classes, ending the year at $2,624.50. Since the start of this century, gold has outperformed stocks, bonds and the U.S. dollar (see Figure 1).

Figure 1. Gold Leads the Pack vs. Stocks, Bonds and USD (2000-2024)

Source: Bloomberg. Period from 12/31/1999 to 12/31/2024. Gold is measured by GOLDS Comdty Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Curncy. Past performance is no guarantee of future results.

But that is now history. What lies ahead for 2025 is the big question.

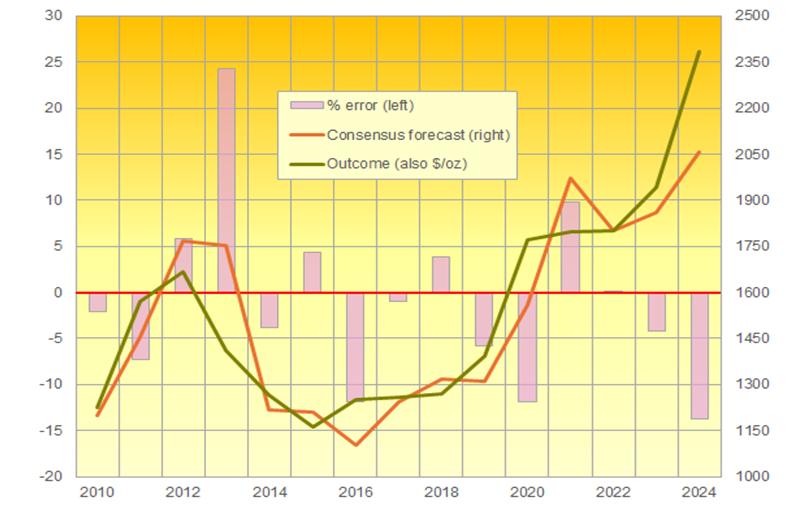

Figure 2 shows that London Bullion Market Association (LBMA) consensus expectations have often missed the mark by a wide margin, but useful in that they portray crowd thinking and positioning. LBMA respondents typically “include analysts from major banks and commodity trading firms” (LMBA website).

Figure 2. Gold Analysts’ Average Annual Price Forecasts (2010-2024)

Source: BullionVault via LBMA Survey.

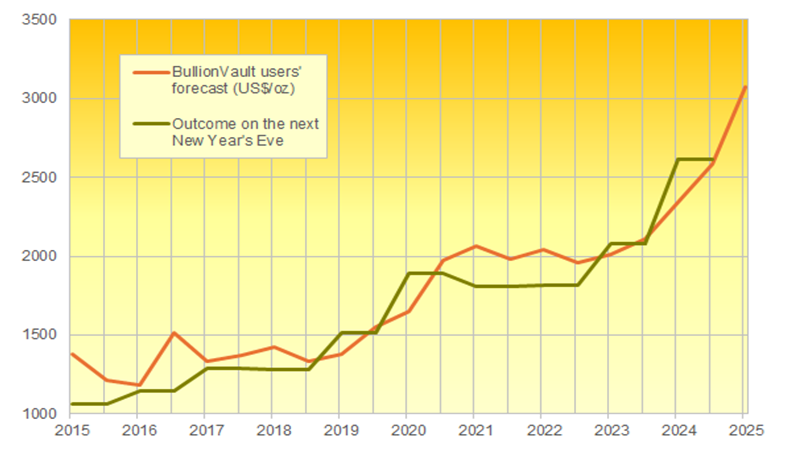

BullionVault’s survey of 1,400 respondents (not LBMA) have been historically more accurate than LBMA, and for 2025, BullionVault projects gold prices topping $3,000 (see Figure 3). While the LMBA survey has yet to be published, LBMA member Goldman Sachs predicts $3,000 for 2025, while Deutsche Bank is on record with $2,600, and JPMorgan is calling for $2,400.

Figure 3. Where Will Gold Be Trading Next Year? (2015-2025)

Source: BullionVault user survey as of 12/31/2024.

Investor Indifference Persists

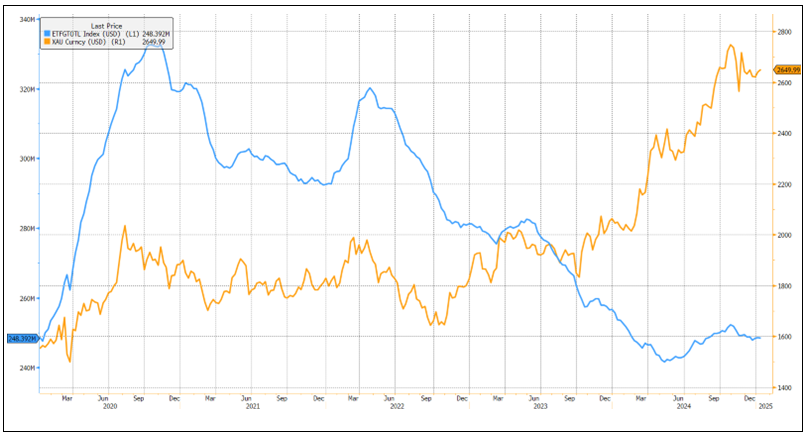

Bullish prognostications by assorted experts have gone unheard by institutional and retail investors in the U.S. and Europe. Look no further than the shrinkage in gold-backed global ETFs (see Figure 4; in 2024 ounces declined 3.2%) or gold miner ETFs (the share count of GDX declined 10.36% in 2024). The gold market prognosticators' vision is not shared by financial advisors or their clients.

In our opinion, there is substantial potential buying power that could shift into gold and related mining equities if the consensus forecasts turn out to be on the money. From a contrarian perspective, a nearly universal bullish consensus would be something to worry about. What is intriguing is the discrepancy between bullish opinion and bearish positioning almost across the board in mainstream investment portfolios.

Figure 4. Gold-Backed ETFs Have Decoupled from the Gold Price

Known Gold ETF Holdings vs. Gold Price (2020-2025)

Source: Bloomberg. Data as of 12/31/2024.

What Catalyst May Close the Gap?

In this note, we suggest potential catalysts that could trigger investment inflows into gold. We will also discuss gold's illiquidity relative to a potential shift in positioning and the outsized price impact of that illiquidity that could drive the metal price beyond even the most bullish forecast.

The surprising (to most) performance of gold in 2024 was driven by geopolitical concerns, central bank buying, and the poor performance of government bonds as a safe haven and portfolio diversifier. It is hard to see much of this backdrop reversing, but it may also be priced in to some extent. It would not be surprising for gold to consolidate within a frustrating trading range for several months.

What is needed to take gold significantly higher are outcomes yet unimagined by consensus thinking. In our opinion, four candidates with sufficient shock value are an equity bear market, a cryptocurrency bear market, a continuation of the bond bear market and a U.S. dollar overvaluation/currency reset.

1. Bear Market Risk

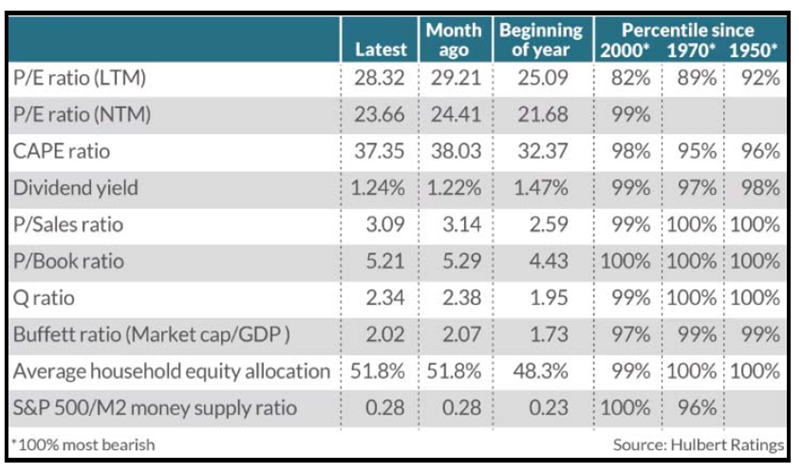

The stock market is historically overvalued, with most metrics in the 97-99% of historical extremes (see Figure 5). While equities could stay overvalued or become even more overvalued over the near term, probabilities of poor returns over the next three to five years seem inescapable.

In addition to overvaluation, sentiment is excessive. According to market strategist Michael Belkin, “It appears that everyone is up to their eyeballs in bubble stocks. That positioning is a big reason for the market to reverse. Buyers are all in, and there is not much firepower left.” (12/30/2024 Belkin report).

Figure 5. Equity Market Valuation Ratios Are at Their Most Overvalued in Decades

Source: Hulbert Ratings. Data as of 12/31/2024.

The highly concentrated market structure is another red flag. According to Fred Hickey, “Seven (grossly overpriced) Mag 7 stocks1 account for nearly 20% of the entire world’s stock market value.” Over-concentration equates to a risk of illiquidity. Fred observes that "market illiquidity is difficult to measure.” Fred unearthed a quote from my former partner and colleague Ray DeVoe (at Spencer Trask), who said, “Liquidity is a coward — it runs away at the first sign of trouble.”

A fourth cause for concern is poor market breadth. Most stocks have not participated in the 2024 market advance. According to savvy market analyst Carter Worth:

“The Russell 3000 Index,2 representing approximately 98% of the investible U.S. Equity Market, was +22.15% in 2024, yet the median performance of the Index’s constituents was +3.82%. That’s sobering. Fully 1,331 stocks in the Russell 3000 (45.7% of the Index) were DOWN on the year, while 1,581 stocks (54.3% of the Index) were UP on the year. That’s even more sobering.” (Worth Charting 1/2/2025)

The litany of bell-ringing insanity is too long to recount. A few from “View from the crazy train” (Grant’s 11/22/2024):

- There are more than 1,200 startups valued at $1 billion or more afloat, according to CB Insights. Just 1,931 publicly traded U.S. companies are so valued.

- Destiny Tech100, Inc., a closed-end fund invested in private tech companies including SpaceX, OpenAI and Klarna, trades at a 780% premium to NAV.

- Peanut the Squirrel Coin, a cryptocurrency named after the eponymous pet that NY environmental authorities seized and euthanized on October 30, 2024, commands a market cap of $1.7 billion.

- A November 4, 2024, Barron’s headline: “The Market Is Extremely Expensive. Don’t Sell Your Stocks.”

2. Cryptocurrency Risk

From a precious metals perspective, there is one thing to like about the rise of cryptocurrencies. The original attraction of crypto was distrust of government-issued paper currency: a notion shared by gold investors. Crypto surfaced as a creative response to the prospective secular meltdown in the value of fiat paper, a vision that we wholeheartedly endorse.

However, it is concerning that crypto’s spectacular investment performance appears to have been driven by the speculative lust afoot in equities, private equity and junk credit, to name a few recipients of manic capital inflows. While gold is unloved, the pursuit of all things crypto is white hot. Perhaps the discrepancy is generational. Perhaps it is due to the bright future foreseen for decentralized finance in which gold is thought to have little role to play (although we will see about that when digital gold becomes a reality — timing admittedly uncertain).

Although cryptocurrencies are creative and revolutionary in the world of monetary instruments, we question their viability as safe assets. The market capitalization of all cryptocurrencies is $3.7 trillion, equal to the market cap of the Russell 2000 Index.3 The market cap of the physical gold “float” is slightly more than $4 trillion.

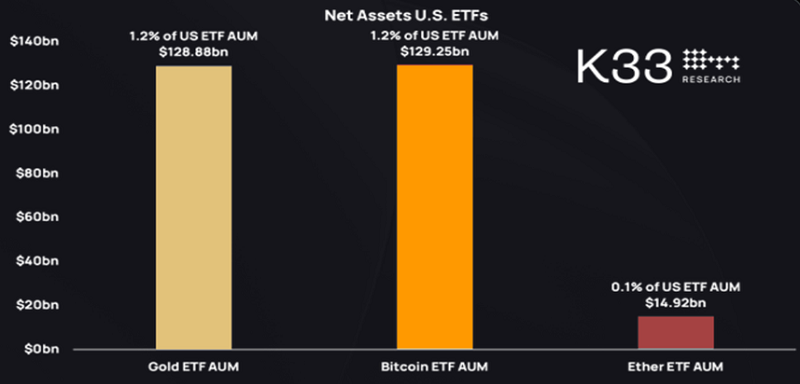

Almost overnight, the AUM of Bitcoin ETFs has surpassed the AUM of gold-backed ETFs (see Figure 6). Gold is widely accepted as a safe reserve asset, while crypto remains controversial. In our view, the price performance of crypto in 2024 is a classic demonstration of what can happen when there is a mismatch between demand and supply of a notoriously supply-constrained asset.

Figure 6. AUM of U.S. Bitcoin ETFs Surpasses U.S. Gold-Backed ETFs

Sources: ETF.com and K33 Research. Data as of 12/17/2024.

Crypto detractors raise serious concerns to consider. First, the functionality of crypto is dependent on internet connectivity, making it vulnerable to grid stability and safety issues, particularly in the event of cyberattacks. Second, crypto may be vulnerable over the long term to hacking by new quantum chips:

- Google’s Willow, a groundbreaking quantum chip, raises concerns about Bitcoin’s security.

- Quantum chips could crack Bitcoin’s encryption, sparking debate on crypto resilience.

- The community is divided on whether quantum threats are imminent or a distant possibility.

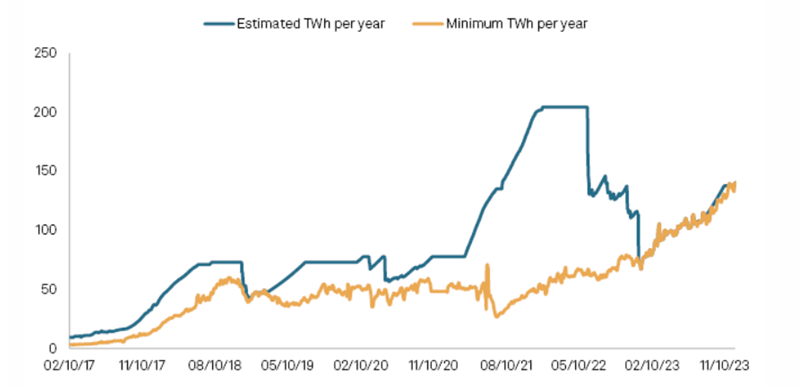

Third, crypto faces ESG headwinds due to rising energy consumption (see Figure 7).

Figure 7. Global Energy Consumption from Bitcoin Mining Doubled in 2023 (TWh/year)

Source: S&P Global. Data as of 12/31/2023.

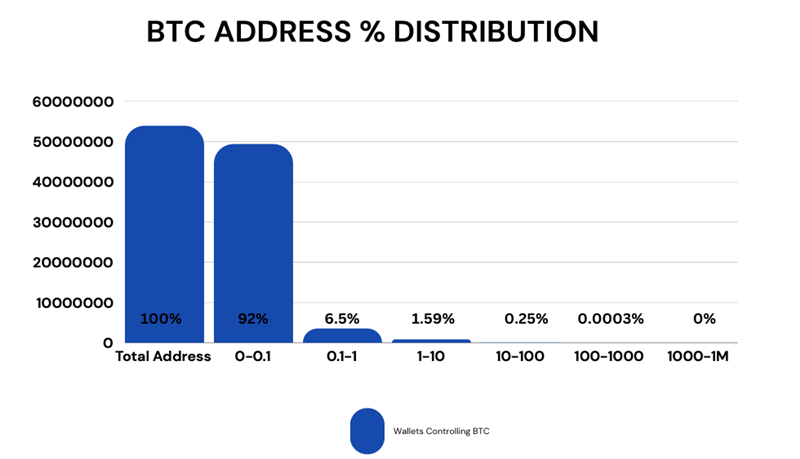

Bitcoin ownership is highly concentrated, as shown in Figure 8. The tiny float lends itself to easy manipulation.

Figure 8.

Source: CCN.com. Data as of 6/30/2024.

The questions surrounding crypto are unlikely to yield positive answers at a 100% rate. Should a significant price pullback damage investor confidence, capital flows into gold would likely benefit from disenchantment with the crypto solution to long-term paper currency depreciation.

3. Bond Market Risk

The bear market in bonds has gored investment portfolios for the past five years (see Figure 9). Bonds have not performed their function as a safe asset or portfolio risk diversifier. We are amazed that financial advisers continue to advocate “balanced portfolios” with a heavy weighting to fixed income. The low to negative correlation between equities and bonds no longer pertains. If bonds and equities continue to be positively correlated, a bear market in equities will inflict bond market damage as well, especially for junk bonds. Credit spreads on high-yield bonds fell to the lowest level since 2007 in November 2024. (Grant’s, 11/22/24)

Figure 9. Five-Year Performance of Gold vs. TLT, the iShares 20+ Year Treasury Bond ETF (2020-2024)

Source: Bloomberg. Data as of 12/31/2024. Gold is represented by the gold line; TLT Bond ETF is represented by the purple line.

Figure 10 (inverse head and shoulder pattern) suggests yields will continue to rise, unprecedented amid a Federal Reserve rate-cutting cycle. Paul Wong, Sprott’s technical and market analyst, projects an initial target of 4.9% for 10-year U.S. Treasuries. Lackluster bond auctions, sticky inflation and seemingly intractable fiscal deficits all play a part.

In December, Pimco Chief Investment Officer of Non-Traditional Strategies Marc Seidner and Portfolio Manager Pramol Dhawan said:

"At PIMCO, we are already making incremental adjustments in response to rising U.S. deficits. Specifically, we’re less inclined to lend to the U.S. government at the long end of the yield curve, favoring opportunities elsewhere." (FFTT, 12/14/2024)

Perhaps the incoming administration will change the trajectory of government spending sufficiently to restore confidence in U.S. credit. If so, we would expect significant political and market disruption along the way since 80% of government spending consists of entitlements, interest and defense, all for various reasons non-negotiable.

Figure 10. U.S. Generic Government 10-Year Yield (2023-2024)

Source: Bloomberg. Data as of 12/31/2024.

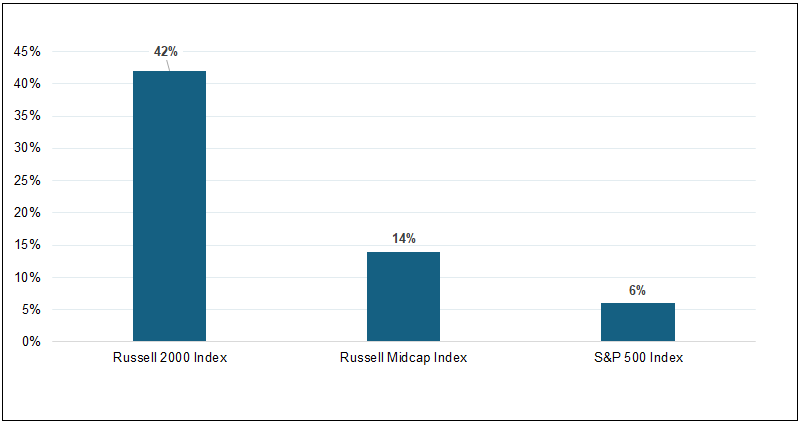

As noted by MacroMavens (12/23/2024), interest rate risk is “morphing into credit risk". Additionally, MacroMavens points out that “small/mid-sized companies, commercial real estate (CRE) and low-end consumers are all experiencing the highest delinquency/default rates since the great recession.” It is no wonder that 42% of Russell 2000 Index companies are reporting negative earnings (see Figure 11). Rising interest rates threaten economic instability.

Figure 11. Small-Cap, Mid-Cap and Large-Cap Companies: Percentage of Companies with Negative Earnings

Source: Belkin Report, 12/31/2024.

4. U.S. Dollar Devaluation Risk

As noted by Paul Wong, a strong U.S. dollar can have a “wrecking ball” impact on financial assets and the economy. The strong dollar is seen as a problem for the incoming administration. Stephen Miran, newly appointed chairman of the Council of Economic Advisers, writes in A User’s Guide to Restructuring the Global Trading System:

"The root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade, and this overvaluation is driven by inelastic demand for reserve assets. As global GDP grows, it becomes increasingly burdensome for the United States to finance the provision of reserve assets and the defense umbrella, as the manufacturing and tradeable sectors bear the brunt of the costs.”

Along with President-elect Trump, Vice President-elect JD Vance and Treasury Secretary nominee Scott Bessent, Miran joins a cohort of incoming political advisers with similar views on dollar overvaluation and its perceived negative implications for U.S. GDP growth. The strong dollar impedes U.S. economic well-being by over pricing U.S. exports in global markets. If the dollar is overvalued, what should it be devalued against? Against other currencies or gold? The U.S. dollar is trading at the high end of a five-year range (see Figure 12) relative to the euro and yen. Will the new administration act unilaterally or attempt to achieve consensus in a replay of the 1985 Plaza Accord? The prospect of dollar devaluation is intriguing, and the issues are complex.

In addition to U.S. export competitiveness, the dollar’s current strength (in terms of DXY Index4) against other currencies is problematic for financial markets, which, at the margin, causes foreign holders of U.S. financial assets to sell to service dollar-denominated debt. As stated by Luke Gromen:

“The more UST supply is left to be financed by U.S. domestic private investors, who are profit-motivated and have finite balance sheets, so U.S. debt will continue to crowd out global USD markets, sending USD and US rates up over time.” (FFTT, 12/20/2024)

Figure 12. The U.S. Dollar Has Broken Out of Its Trading Range

Source: Bloomberg. Data as of 12/31/2024.

Trend Acceleration Ahead?

The reasons for 2024’s strong gain have been widely articulated: central bank buying, geopolitical events, weaponization of the dollar, the Fed interest rate cutting cycle and bond market worries. We believe the next substantial increase will be driven by a series of surprising events for which investors are incorrectly positioned. Our best guesses are a bear market; a steep, lengthy retreat in cryptocurrencies; bond market disruption with interest rate risk morphing into credit risk; and unwanted, persistent U.S. dollar strength that threatens economic instability. When, if and how these events occur is admittedly speculative but, in our opinion, all are plausible.

We believe if any or all occur, most likely with interrelated cause and effect, inflows from Western capital markets have the potential to double or triple metal prices. The price dynamics would closely resemble those that have driven Bitcoin prices to levels unimagined only months ago — supply inelasticity coupled with a sudden, surprising and unrestrained demand surge. There has been much discussion of the challenges facing Bitcoin miners. There are daunting issues for precious metals miners as well. They include rising capital intensity, declining grades, increasingly difficult mining jurisdictions and scarcity of capital. These are different issues affecting future Bitcoin supply, but they both equate to inelastic supply responses to rising prices.

Since 1980, the supply of above-ground gold has increased from 97,564 to 216,583 metric tonnes, a compound annual growth rate of 1.79%. Gold's approximate 3.3x price gain since the 1980 top tick seems paltry compared to the 8.3% and 8.6% CAGR for the monetary base and federal debt outstanding, respectively, since then. The gold “float,” or gold in readily marketable form, at $2,650 per ounce equates to approximately $4 trillion. What price impact could a shift of 0.5% from global equities (roughly $500 billion) into gold have in the space of a few years? Would an increase in gold mined at even twice the historical rate (highly unlikely) be enough to snuff out a big move in the gold price? Clearly not, in our opinion. The 45-year compounding of assets denominated in dollars at a rate differential 4x that of the physical supply of gold suggests to us that analysts calling for a price increase of 10% in the metal simply do not appreciate the magnitude of potential buying that could be triggered by unanticipated events.

Since 2000 (see Figure 1), the dollar gold price has increased at a CAGR (compound annual growth rate) of 9.23%, outperforming the S&P 500 Index5 (7.69%) and the U.S. dollar (0.25%), while significantly outdistancing the Bloomberg U.S. Aggregate Bond Index6 (3.93%). The potential change in the value of the dollar vs. gold over the next four years may well be measured on a geometric rather than linear scale. While the possible causes for a bull market trend acceleration will forever be matters of educated speculation, the dollar-denominated quantity of financial assets that could be shifted into gold will always and everywhere be a matter of black-and-white objectivity.

| 1 | The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. |

| 2 | The Russell 3000 is a broad equity index composed of the 3,000 largest U.S. listed stocks, representing more than 95% of the investable American stock market. |

| 3 | The Russell 2000 is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. |

| 4 | The U.S. Dollar Index (DXY) is a measure of the value of the dollar against a basket of six foreign currencies. |

| 5 | The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. |

| 6 | The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.