With powerful magnetic and conductive properties, nickel has rapidly graduated from an industrial metal in stainless steel to a critical mineral essential to electric vehicle (EV) batteries. As nations incentivize EV adoption and manufacturers increase production, nickel's changing supply and demand dynamics—and pricing—may shift away from broader industrial trends to align more closely with the EV market. We see this as a long-term trend that is likely to experience short-term ebbs and flows.

The Evolving Nickel Market

For electric vehicles to go fully mainstream, they need longer battery ranges and faster charging times – both of which nickel can provide. Nickel lends a greater energy density to batteries, allowing for "more battery" at a lighter weight. As a result, battery designers have been increasing the percentage of nickel by weight in battery cathodes over time. As battery technology advances, industry players expect these higher-nickel battery designs to gain market share and dominate.

In addition to EV batteries, nickel-dominant batteries are increasingly used in energy storage systems that employ thousands of NMC (Lithium Nickel Manganese Cobalt Oxide) batteries to power both small-scale and large-scale battery storage systems. These systems have the potential to provide power for EV charging stations, commercial, industrial and residential buildings, and large utility electrical grids.

Global EV Sales Climbed 35% in 2023

In the U.S., EV sales broke through the one million mark in 2023, an increase of 52% from the previous year.1 Globally, 14 million new electric cars hit the road, making the new total 40 million.2 EV car sales were 3.5 million higher in 2023 than in 2022, representing a 35% year-over-year increase. While current sales are mostly concentrated in Europe, China and the U.S., emerging market sales are increasing, led by Southeast Asia and Brazil. Half of all cars sold globally are expected to be electric by 2035.3

Benefits of Nickel-Dominant Batteries

- Nickel-intensive batteries have a much higher energy density than other battery chemistries

- Batteries that use nickel help increase the driving range of EVs

- Nickel weighs less and has a smaller footprint

New Demand Requires Changes in Supply

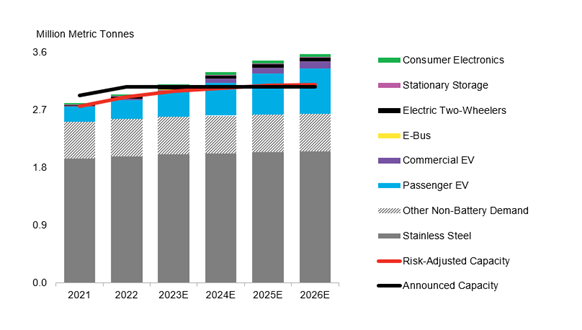

While nickel is still predominantly used for stainless steel, the demand has rapidly shifted toward batteries. With EV sales climbing (see Figure 4) and nickel earning a higher share of cathode weight over time, EV batteries are projected to be the largest end-user of nickel by 2040 (see Figure 2).

Figure 1. Nickel Uses by First Use

Source: The Nickel Institute. Data as of 12/31/2023

But demand isn’t just expanding. It’s also shifting in its mix because stainless steel and EV batteries do not use the same grade of nickel. Stainless steel can be manufactured from Class 2 nickel, a lower-purity product that is cheaper to mine (and more expensive to refine). However, EV batteries use Class 1 nickel, which has higher purity and is expensive to mine (but cheaper to refine).

Currently, approximately one-third of the demand for Class-1 nickel comes from batteries, but forecasts predict it will increase to over 50 percent by 2027.4

Figure 2. Primary Nickel Demand Forecast (2018 – 2030E)

Source: Bloomberg NEF. Data as of 12/31/2023.

Nickel Demand for the Energy Transition

In addition to EV batteries, other energy transition efforts could also drive new demand for nickel.

• Energy Storage

Nickel’s longer battery life and faster charging time also make it advantageous to use in battery storage systems. These systems help to balance power supply and demand, provide backup power, and stabilize an electrical grid. They can also store excess energy produced from renewable energy sources like wind and solar. The global battery energy storage systems market is expected to reach up to $150 billion by 2030,5 which will likely affect nickel demand.

• Hydrogen Production

Nickel can be used as a catalyst for producing hydrogen, which is seen as a clean energy carrier with potential applications in transportation and industry. Nickel-hydrogen batteries are also emerging as an option in the space.

• Geothermal Energy

Geothermal plants generate electricity by capturing heat from the earth’s core. Plants use stainless steel in the pipework and process equipment, but those materials can be susceptible to corrosion. Engineers have found that alloys with a higher nickel mix are more resistant to such damage.

• Wind Turbines

High-strength nickel alloys can be used in wind turbine blades to make them lighter, more durable, larger and more efficient.

• Nuclear Power Plants

Nickel alloys are also a key component for the heat transfer and cooling systems of nuclear power plants and inside nuclear reactor vessels.

Figure 3. Energy Storage Systems are Emerging as a Critical Technology

The primary chemistries in energy storage systems are Lithium Iron Phosphate and NMC (Lithium Nickel Manganese Cobalt Oxide).

Source: Evesco.com

Worldwide Investment in Nickel Mining

While there is very little nickel mining in the U.S., there are several EV battery factories – and investment in these facilities is poised to surge in order to expand capacity. In the U.S., the Inflation Reduction Act, signed in 2022, helped accelerate bringing battery production onshore, and today, there are approximately 30 battery factories either planned, under construction or operational in the country.6

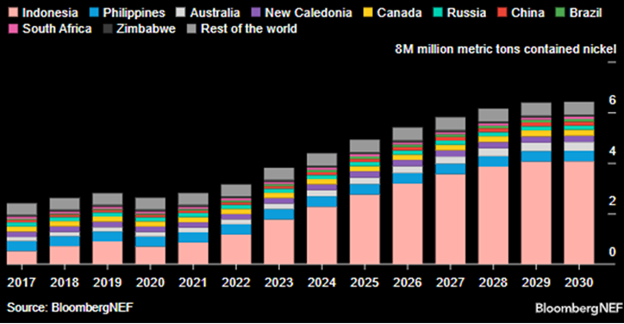

Nickel supply has increased rapidly in recent years, with Indonesia producing 1.8 million metric tons in 2023 compared to 760,000 in 2020. Indonesia now accounts for half of global supply, and some estimates predict that the country will produce more than 75% of global supply during the 2022–2029 period.7

Several European car makers are in the process of establishing EV plants in Indonesia, including Citroen, Renault and Volkswagen, following in the footsteps of Chinese automakers. Both China and Europe view Indonesia as a production base for EVs, particularly entry-level cars. China continues to dominate investment in Indonesia’s EV industry, led by companies like BYD, Wuling, Chery and Great Wall Motors.8

Figure 4. Indonesia is the World’s Largest Nickel Producer (2017-2030E)

Source: Bloomberg NEF. Data as of 12/31/2023.

What Lies Ahead for Nickel Miners?

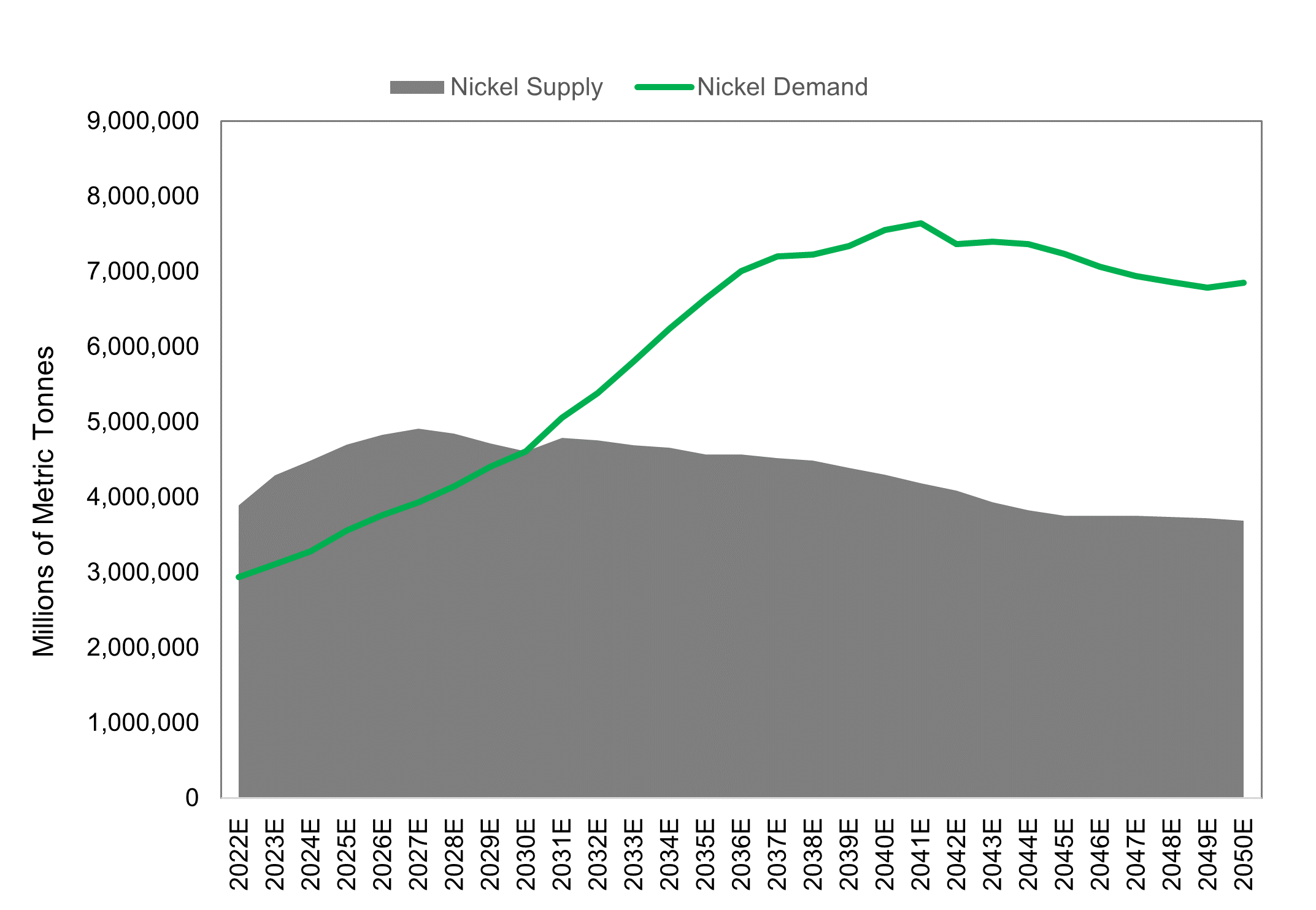

Despite the current supply glut, we believe nickel’s long-term fundamentals are strong. In future years, companies and governments will likely need large amounts of nickel to reach net-zero emissions targets. Many large economies, including Australia, have listed nickel as a critical mineral.

Stricter emission mandates are also helping to boost the nickel industry, particularly in the U.S., where the Environmental Protection Agency is imposing mandates that could require nearly two-thirds of new cars and light trucks sold to be EVs by 2032.9 As with copper and other commodities, we believe moves by global central banks to reduce interest rates will also support the nickel market, given that lower rates generally lessen the cost of carrying inventories, and thus provide support for nickel prices.

In our view, nickel miners are poised to offer investment attractive opportunities to investors. Although nickel prices declined in 2023 on the back of softer Chinese EV sales and a flood of supply from Indonesia, the metal has been rebounding thus far in 2024 and benefiting the prospects of mining companies. The rise in nickel prices seems to be a combination of investor sentiment, potential supply constraints, and the underlying long-term demand for nickel in the clean energy transition.

Figure 5. Nickel Supply and Demand Imbalance Likely to Invert

Source: Bloomberg NEF. Data as of 3/01/2024.

Footnotes

| 1 | Source: S&P Global, US EV sales grew nearly 52% in 2023. So why are automakers slowing EV investments? |

| 2 | Source: IEA, Trends in electric cars. |

| 3 | Source: CNN, The electric car revolution is on track, says IEA. |

| 4 | Source: BloombergNEF. |

| 5 | Source: McKinsey, Enabling renewable energy with battery energy storage systems. |

| 6 | Source: TechCrunch, Tracking the EV battery factory construction boom across North America. |

| 7 | Source: USGS, Nickel Statistics and Information. NikkeiAsia, “Nickel surplus seen widening in 2023 as Indonesian output soars”, June 16, 2023. |

| 8 | Source: Daily Insights, “European Carmakers Racing to Build EV Industry in Indonesia”, April 4, 2024. |

| 9 | Source: BloombergNEF, “Biden’s Tailpipe Rules a Political Target: Washington Edition”. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.