Key Takeaways

- Market Uncertainty: The uranium market is currently experiencing significant uncertainty due to frequent changes in Trump's U.S. tariff policies and rising geopolitical tensions.

- Tariff Impact: The Trump administration's tariffs on imports from Canada, Mexico and China have created a complex and unpredictable environment for utilities and investors.

- Investment Opportunity: At ~$65 per pound, uranium’s current spot price weakness presents a potentially attractive entry opportunity for investors who can weather near-term turbulence.

- U.S.-Russia Relations: The warming relations between the U.S. and Russia and potential changes to the Prohibiting Russian Uranium Imports Act have added to the market's ambiguity.

- Long-Term Fundamentals: Despite short-term volatility, the uranium market's long-term fundamentals remain strong, with a persistent supply deficit and increasing global reliance on nuclear power.

Performance as of February 28, 2025

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

-8.67% | -15.97% | -11.49% | -31.53% | 10.16% | 20.97% |

|

Uranium Mining Equities |

-14.66% | -24.87% | -13.43% | -25.37% | 0.81% | 30.93% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 |

-19.57% | -29.29% | -14.75% | -32.43% | -7.63% | 32.32% |

|

Broad Commodities (BCOM Index) 4 |

0.45% | 4.70% | 4.04% | 6.26% | -3.56% | 7.67% |

|

U.S. Equities (S&P 500 TR Index) 5 |

-1.30% | -0.97% | 1.44% | 18.41% | 12.54% | 16.84% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 2/28/2025. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Markets in “Wait and See” Mode

The uranium spot price and uranium miners have experienced a notable decline following the start of President Trump’s second term. While this performance has been frustrating, it is important to separate the intense market noise from the longer-term fundamental picture, which remains clear.

An unprecedented level of policy uncertainty created by the new U.S. administration has paralyzed utilities and investors, forcing them to the sidelines. Market participants are in a “wait and see” mode after being hit with a barrage of uncertainty related to tariffs, geopolitical trade tensions, potential changes to the Inflation Reduction Act (IRA) and Loan Program Office (LPO) and thawing relations between President Trump and Putin.

U.S. Tariff Policies Create Uncertainty

The central source of uncertainty has been the frequent changes and delays in the Trump administration’s tariff policies, which has distracted utilities from normal procurement activities.

- February 1: President Trump issued new executive orders imposing tariffs on imports from Canada, Mexico and China. Initially, all imports from Canada and Mexico faced a 25% tariff,6 but “energy or energy resources”, including uranium, were granted a lower 10% rate.7

- February 3: Just before implementation, the United States temporarily paused these tariffs on Canada and Mexico for 30 days to allow for further negotiations. However, the additional 10% tariff on all imports from China took effect as planned on February 4, effectively raising the Chinese enriched uranium tariff to 17.5%.

- March 4: Another 10% tariff on all imports from China was imposed, increasing the overall tariff rate on Chinese goods to 20%.8

- March 5-6: Although the Canadian and Mexican tariffs were scheduled to begin on March 4, President Trump announced a delay for auto imports on March 5.9 On March 6, he then extended the delay to goods under the United States-Canada-Mexico Agreement (USCMA), including uranium.10

- April 2: These tariffs are now rescheduled to take effect. On this date, President Trump is also expected to introduce a system of “reciprocal tariffs” that he states will adapt to other countries’ retaliatory measures, as well as any non-monetary trade barriers. This may include an increase in the potential tariffs to Canada/Mexico to account for any retaliatory tariffs. Mexico has yet to respond with retaliatory tariffs, but Canada has imposed a 25% retaliatory tariff on $30 billion in U.S. goods with another round of tariffs on a wider list of American products, valued at $125 billion, pushed back to April 2.11 In retaliation, the Province of Ontario has announced a 25% export tax on electricity exports to the U.S., while the Province of Quebec is considering similar action.

Seesawing on U.S. tariff policies has caused uncertainty and disrupted uranium procurement by utilities.

The constant shifting of deadlines and specifics has kept utilities in a holding pattern, awaiting clarity. Although the direct financial impact of a tariff or export tax may be minimized in some cases, thanks to swaps or book transfers, nuclear fuel supply chains will undoubtedly be disturbed, creating further distraction and higher costs for utilities and end customers.

Canada is the largest foreign supplier of uranium to the United States, accounting for roughly 27% of total deliveries, and plays a critical role in conversion.12 In response to a previous 25% tariff placed on Canadian steel in 2018, Cameco Corp., the world’s largest publicly traded uranium company and a Canadian-based company inserted clauses in its contracts stipulating that if U.S. tariffs are imposed, the cost burden will fall on utilities rather than Cameco itself.

Notably, there is also the possibility of a Canadian export tax on uranium. If enacted, this will also be passed along to U.S. utilities, further increasing their potential cost burden for imported uranium fuel. This scenario may provide a competitive edge to U.S. uranium producers as U.S. utilities seek ways to avoid unpredictable and mounting fees on foreign-sourced material.

Thawing U.S.-Russia Relations

The Trump administration’s international relations mark a stark change to historical U.S. foreign policy. Trump is directly engaging with Putin and fostering a warmer relationship with Russia, and utilities are weighing the possibility of relaxing sanctions/allowing waivers to resume, giving them the ability to resume importing Russian-enriched uranium.

Potential U.S. policy shifts on Russian uranium imports create uncertainty for utilities.

Russia has roughly 44% of the world’s uranium enrichment capacity and, before the following recent developments, was a significant supplier of U.S. nuclear fuel.13 However, there is currently legislation (the Prohibiting Russian Uranium Imports Act) in the U.S. that limits and phases out the total amount of Russian-enriched uranium imports per year, with zero enriched uranium allowed starting on January 1, 2028. Further, in a “tit-for-tat” response, Russia placed an export ban on enriched uranium to the U.S. in November 2024.14

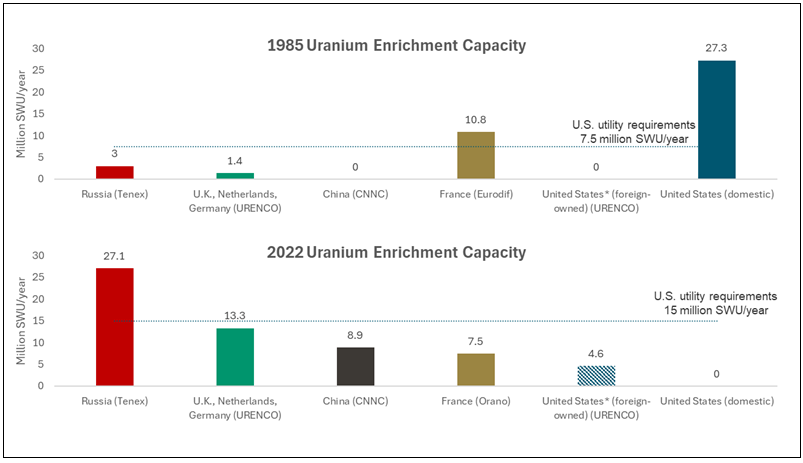

The possibility of reversing the export ban and/or the Prohibiting Russian Uranium Imports Act has created further ambiguity for the nuclear fuel market and contributed to reducing uranium purchases. The likelihood of these reversals may be dubious, especially for the Prohibiting Uranium Imports Act, considering that this Act has passed into law (though laws may be changed) and that this may be contrary to national security and the need to reshore the supply chain on uranium enrichment. The U.S. has gone from the world’s dominant uranium enricher to having zero domestically owned enrichment capacity (Figure 1), and if the pivot back to Russia was allowed, additional investments in U.S. capacity, like Orano’s new facility in Tennessee, could be in jeopardy.

Figure 1. The Loss of U.S. Nuclear Fuel Leadership

Source: 2022 data from World Nuclear Association Nuclear Fuel Report 2023. 1985 data from the Congressional Budget Office. Centrus Energy Corp.

* The only remaining enrichment plant physically located in the U.S. is controlled by URENCO, a European-owned corporation.

Renewed U.S.-Russia Denuclearization Talks Weigh on Sentiment

In February, President Trump stated that he wanted to restart denuclearization talks with Russia and China, aimed at cutting defense spending, which introduced another layer of uncertainty into the uranium market. The prospect of a renewed “Megatons to Megawatts” program sparked speculation that new downblending of weapons-grade uranium into reactor fuel might materialize. Although the idea of a second iteration of this arrangement is highly improbable under current geopolitical conditions, even the notion of such talks is enough to distract market participants. In the original Megatons to Megawatts program, highly enriched uranium from dismantled Russian nuclear warheads was converted into low-enriched uranium for use in civilian nuclear reactors, significantly affecting global uranium supply at the time.

In practical terms, we believe this is extremely unrealistic, given the current geopolitical climate and lower stockpiles of highly enriched uranium. Nevertheless, the mere possibility has been a distraction, adding to the myriad factors already weighing on investor sentiment.

Potential Withdrawal of IRA and LPO Funding Support

While the Inflation Reduction Act of 2022 (IRA) and the Loan Program Office (LPO) have provided meaningful support for U.S. nuclear energy, recent speculation suggests the Trump administration might consider cutting or repurposing these funding sources. However, we believe a revocation of these programs for nuclear energy is unlikely given Trump’s consistently pro-nuclear stance and action to “Unleash Commercial Nuclear Power in the U.S.”.15 Nonetheless, the tariff and foreign relations policy uncertainty, along with the mere possibility of losing key financial support, has been enough to provide a distraction to market participants in the near term.

Long-Term Fundamentals Remain Strong

Despite the near-term policy noise and tariff-related uncertainties, the underlying fundamentals of the uranium market continue to support a strong long-term outlook.

The uranium market's strong long-term outlook is driven by growing demand and supply shortfalls.

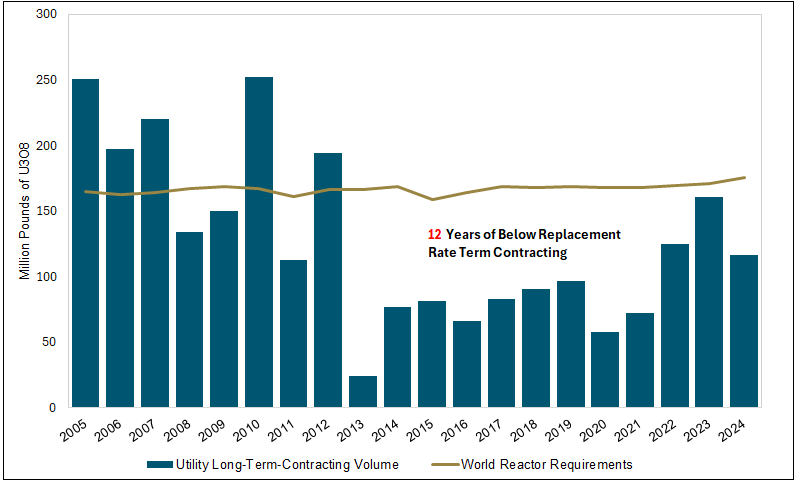

The uranium market has grappled with underinvestment in new production for years, leaving a structural deficit as global nuclear power demand continues to expand. Another key indicator is the level of term contracting by utilities; in 2024, total term contracting concluded at 116 million pounds, representing a notable 29% decline, from the 161 million pounds contracted in 2023.16 However, these figures can be somewhat misleading due to the influence of individual, large-scale agreements. In 2023, a major contract with Ukraine bolstered the overall volume, while in 2024, a single contract with China accounted for nearly 40% of the total. This concentration demonstrates that Western utilities have lagged behind in securing future supply.

A more pressing concern for the uranium market is that these volumes fall well below the annual global reactor demand for uranium, estimated at approximately 175 million pounds—highlighting a clear trend of under-replacement contracting (Figure 2). U.S. utilities alone fell short by 17 million pounds, securing barely two-thirds of the uranium needed to meet their forward requirements. This shortfall is further intensified by already tight inventory levels in many Western markets, where available-for-sale supplies have been largely depleted.

While some utilities may choose to delay or defer new term contracts due to policy uncertainties, such caution can only last for so long. Eventually, utilities will need to secure sufficient fuel to meet operational demands, creating upward pressure on uranium prices once there is greater clarity in the operating environment. These dynamics underscore that, despite short-term headwinds, the fundamental supply-demand picture for uranium remains supportive.

Figure 2. Term Contracting Remains Below Reactor Requirements (2005-2024)

Source: UxC, LLC for Utility Long-Term Contracting volume. World Nuclear Association for World Reactor Requirements.

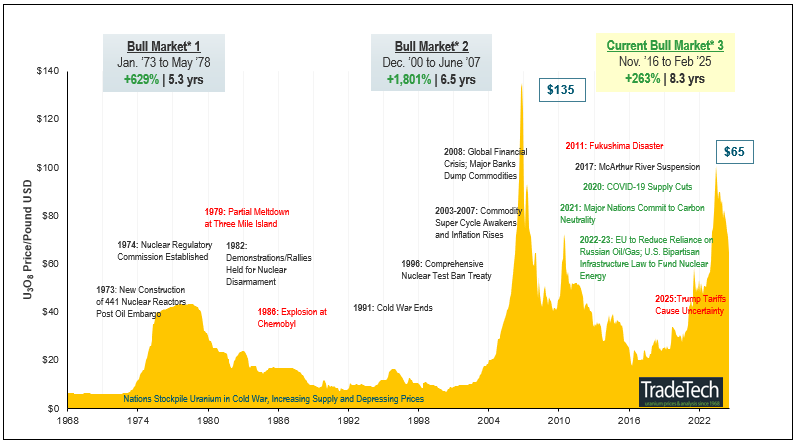

Short-Term Volatility Offers Investment Opportunity

The uranium market is grappling with short-term volatility driven primarily by policy uncertainty and forced selling. It is important to recognize that commodity markets are highly sensitive to geopolitical developments, and short-term uncertainty often clouds the intact underlying fundamentals, anchored by a persistent supply deficit and increasing global reliance on nuclear power. We believe today’s price weakness presents a potentially attractive entry opportunity for investors who appreciate the strategic value of uranium and can weather near-term turbulence. As clarity emerges on tariffs, Russian imports, and U.S. nuclear funding support, utilities are bound to return, and the market is likely to refocus on the core imbalance between future demand and constrained supply.

Figure 3. Uranium Bull Market is Still Intact on Long-Term Fundamentals (1968-2025)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices generally rise. A “bear market” refers to a condition of financial markets in which prices are generally falling.

Source: TradeTech Data as of 2/28/2025. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Source: CNN Business, 1/21/2025; Trump threatens 25% tariffs on Mexico and Canada on Feb. 1, punting Day 1 pledge. |

| 7 | Source: The White House, 2/1/2025; Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China. |

| 8 | Source: White & Case, 3/4/2025; US Tariffs on Canada and Mexico Enter into Effect; Tariff on China Rises from 10% to 20%. |

| 9 | Source: CNN Business, 1/21/2025; Tariffs on cars from Mexico and Canada delayed by one month. |

| 10 | Source: Reuters, 3/7/2025; Trump delays tariffs for goods under Mexico, Canada trade deal. |

| 11 | Source: CTVNews. 3/6/2025; ‘Pressure stays on:’ Feds keep counter-measures but delay second round of retaliation against Trump tariff. |

| 12 | Source: EIA.gov, June 2024; 2023 Uranium Marketing Annual Report. |

| 13 | Source: Energy.gov, 5/14/2024; Russian Uranium Ban Will Speed up Development of U.S. Nuclear Fuel Supply Chain. |

| 14 | Source: World Nuclear News, 11/18/2024; Russia places 'tit-for-tat' ban on US uranium exports. |

| 15 | Source: Energy.gov, 2/5/2025: Secretary Wright Acts to “Unleash Golden Era of American Energy Dominance”. |

| 16 | UxC, LLC, 2024 Uranium Term Contracting Review, 02/17/2025. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.