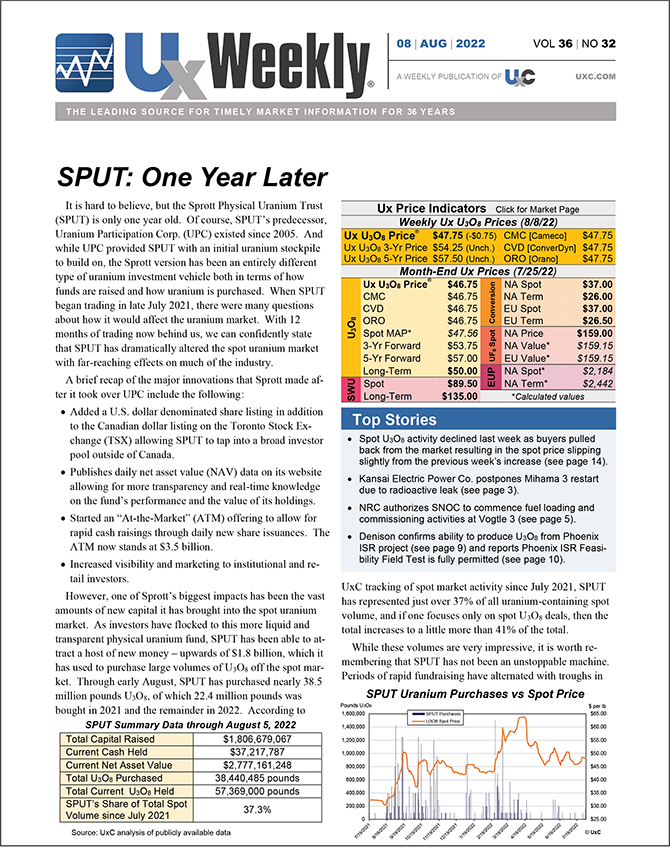

Jonathan Hinze, UxC President: "When SPUT began trading in late July 2021, there were many questions about how it would affect the uranium market. With 12 months of trading now behind us, we can confidently state that SPUT has dramatically altered the spot uranium market with far-reaching effects on much of the industry."

Reprinted with permission from UxC.

About UxC

UxC, LLC ("UxC") is one of the nuclear industry's leading market research and analysis companies. UxC offers a wide range of services spanning the entire nuclear fuel cycle with a special focus on market-related issues. UxC was founded in March 1994 as an affiliate of The Uranium Exchange Company ("Ux") in order to extend and provide greater focus to Ux’s analytical and information services capabilities. Visit Uxc.com for more information.

Additional Resources

Dawn of a New Nuclear Renaissance?

The Sprott Physical Uranium Trust (“SPUT”, TSX: U.U ($US); U.UN ($CA)) was launched just over a year ago in July 2021. While we were optimistic about the prospects for uranium, we could not foresee the tectonic shifts in the uranium sector that followed the launch and SPUT’s significant impact.

The Sprott Physical Uranium Trust (“SPUT”, TSX: U.U ($US); U.UN ($CA)) was launched just over a year ago in July 2021. While we were optimistic about the prospects for uranium, we could not foresee the tectonic shifts in the uranium sector that followed the launch and SPUT’s significant impact.

Important Disclosure

* Sprott Physical Uranium Trust is the world's largest physical uranium fund based on Morningstar’s universe of listed commodity funds. Data as of 12/31/2024.

Sprott Physical Uranium Trust (the “Trust”) is a closed-end fund established under the laws of the Province of Ontario in Canada. The Trust is generally exposed to the multiple risks that have been identified and described in the prospectus. Please refer to the prospectus for a description of these risks. Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage, and liquidity should also be considered.

All data is in U.S. dollars unless otherwise noted.

Past performance is not an indication of future results. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action. Sprott Asset Management LP is the investment manager to the Trust. Important information about the Trust, including the investment objectives and strategies, applicable management fees and expenses, is contained in the prospectus. Please read the prospectus carefully before investing.The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or operational charges or income taxes payable by any unitholder that would have reduced returns. You will usually pay brokerage fees to your dealer if you purchase or sell units of the Trust on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the Trust and may receive less than the current net asset value when selling them. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized.