Month of January 2022

| Indicator | 1/31/2022 | 12/31/2021 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $1,797.17 | $1,829.20 | $(32.03) | (1.75)% | (1.75)% | Sell-off on month-end effects & FOMC |

| Silver Bullion2 | $22.47 | $23.31 | $(0.84) | (3.61)% | (3.61)% | Sell-off on month-end effects & FOMC |

| Gold Senior Equities (SOLGMCFT Index)3 | 118.43 | 123.36 | (4.93) | (4.00)% | (4.00)% | Gold equities holding major support |

| Gold Equities (GDX)4 | $30.23 | $32.03 | $(1.80) | (5.62)% | (5.62)% | (Same as above) |

| DXY US Dollar Index5 | 96.54 | 95.67 | 0.87 | 0.91% | 0.91% | Sharp rise on widening rate differentials |

| S&P 500 Index6 | 4,515.55 | 4,766.18 | (250.63) | (5.26)% | (5.26)% | Volatile and extreme intraday price swings |

| U.S. Treasury Index | $2,452.59 | $2,499.95 | $(47.36) | (1.89)% | (1.89)% | Testing important support |

| U.S. Treasury 10 YR Yield* | 1.78% | 1.51% | 0.27% | 27 BPS | 27 BPS | Sharp rise breaking technical levels |

| U.S. Treasury 10 YR Real Yield* | (0.71)% | (1.10)% | 0.39% | 39 BPS | 39 BPS | Largest one-month BPS rise since 2013 |

| Silver ETFs (Total Known Holdings ETSITOTL Index Bloomberg) | 891.16 | 886.07 | 5.09 | 0.57% | 0.57% | Continuing sideways drift |

| Gold ETFs (Total Known Holdings ETFGTOTL Index Bloomberg) | 99.24 | 97.89 | 1.35 | 1.38% | 1.38% | Third largest monthly increase in 16 months |

Source: Bloomberg and Sprott Asset Management.

*YTD % Chg and Mo % Chg for this Index is calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points.

January Recap

In January, spot gold fell $32.03, or -1.75%, to close at $1,797.17. Gold had a closing high of $1,848 just before the January Federal Open Market Committee (FOMC) meeting but fell more than $50/oz as the market responded to the U.S. Federal Reserve's ("Fed") exceptionally hawkish statements. Month-end activity also contributed to gold's decline as funds repositioned and thin liquidity conditions exaggerated price moves; also, Asian buying likely stopped abruptly for the Chinese New Year (February 1). Throughout January, however, gold began to outperform as a safe haven asset as the selling pressure in the broader market escalated on the back of a dramatic spike in real yields. Over the past few months, gold has begun to decouple from rising real yields and rising rate hike expectations, both of which put pressure on gold for most of 2021.

The Fed's aggressive hawkish turn in policy continued to ramp up in January, triggering sharp increases in yields, particularly real yields, which increased 39 basis points in January alone, the largest increase since 2013. The market is now pricing in five rate hikes for 2022, quantitative tightening (QT) by the summer and a growing probability of a 50 basis point Fed Fund's rate hike in March. The most sensitive assets to higher rates sold off further in January. Since their peaks in 2021, many of these speculative groups (i.e., profitless hyper-growth stocks) are down more than 50%. The U.S. dollar (USD) also surged in January, adding to the tightening of financial conditions. As selling intensified, volatility indices spiked, leading to significant exposure reductions across all systematic type funds. CTAs,7 as trend followers, amplified the selling pressure to produce one of the worst sets of January returns and incredible price swings for the broad market since the GFC (global financial crisis of 2008-2010).

One could use this colorful mixed metaphor: The Fed is attempting a controlled demolition with a high potential for butterfly effects.

Short term, there is little evidence that inflation pressure is abating. By contrast, there is growing evidence of inflation broadening out and moving towards a more entrenched nature as reflected in wages, labor shortages and prices. Furthermore, recent signs point to inflation turning contractionary as consumers appear exhausted, given that real wages, although rising, are not keeping up with the pace of inflation. As January closed, we started to see downward revisions in global growth forecasts and upward revisions in inflation expectations.

Gold Bullion Update

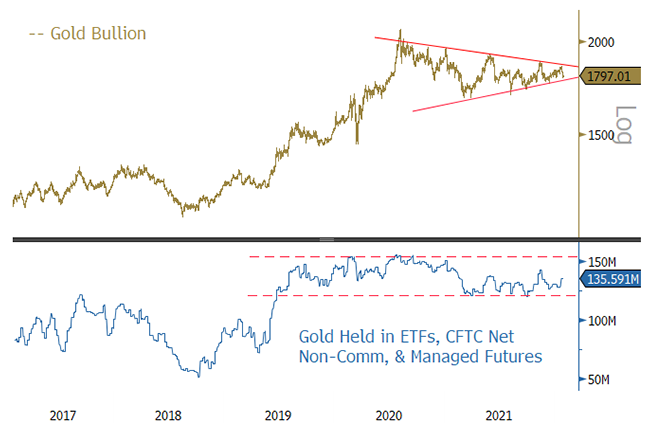

Spot gold continues to consolidate within a bull flag pattern (or pennant formation). Though gold came close to breaking out this past month, general funds de-grossing and risk reduction meant little positive net flows into gold bullion. Figure 1a shows the gold chart and the bull flag, a bullish consolidation pattern (top panel). The lower panel shows gold in millions of ounces held in ETFs (exchange traded funds), CFTC (Commodity Futures Trading Commission) net non-commercial holdings and managed futures (our proxy for investment demand and positioning). It also remains in a consolidation pattern. The market had all of 2021 to sell down gold holdings in a repeat of 2018 (the last Fed rate hike and QT period), but it did not.

Meanwhile, physical demand as measured by gold imports in India, China and central bank purchases rebounded strongly in 2021, climbing 16.6% or 1,336 tonnes (~43 million ounces) more than 2020. Overall, demand for physical gold is strong and fundamental drivers are supportive and advancing. Despite this, the timing remains elusive for investment demand to heat up, although we believe we are getting closer. Gold mining equities and silver bullion remain in consolidation patterns, testing but remaining at support levels (Figure 1b).

Figure 1a. Gold Bullion and Positioning Update (2017-2021)

Source: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Figure 1b. Gold Mining Equities and Silver Bullion (2017-2021)

Source: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Tightening Financial Conditions: The Stock Market is Not the Economy

Fed tightening cycles are painful for markets and the pain threshold appears to lower each time. As central bank balance sheets keep expanding, asset prices drift further away from price discovery, or fair value, making them more sensitive to policy tightening. With the Fed quickly turning very hawkish after being so accommodating for so long, this abrupt change has caught the market off guard.

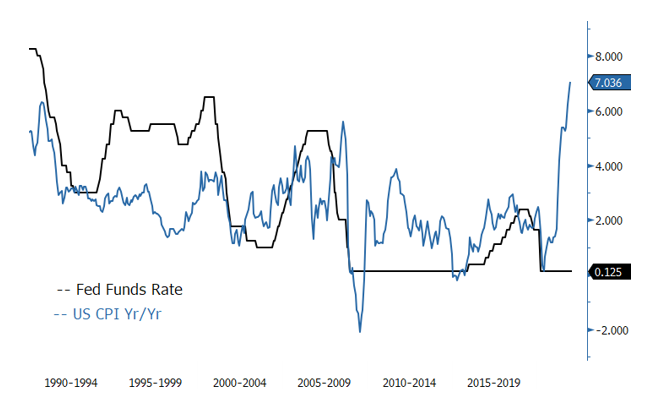

During past tightening cycles, markets advanced higher as earnings growth outpaced the decline in P/E (price-earnings) multiples. Past tightening cycles were benign because there was enough growth to allow rate hikes to prevent overheating without pushing the U.S. economy into recession. The risk in this cycle is that the Fed is aggressively tightening into an economic slowdown. This is also the first tightening cycle with inflation so far above the ~2% target rate (see Figure 2). One cannot compare this cycle to the Fed's more benign hiking cycles, in which it maneuvered to "neutral" with minor market impact. In this cycle, the Fed needs to bring down inflation from 40-year highs and signal that it would risk disrupting markets via tightening conditions. "Don't fight the Fed" has taken on new meaning.

Figure 2. Fed Funds Rate and U.S. CPI (Consumer Price Index) Yr/Yr: A Very Large Gap (1990-2021)

Source: Bloomberg and Sprott Asset Management LP. Data as of 2/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

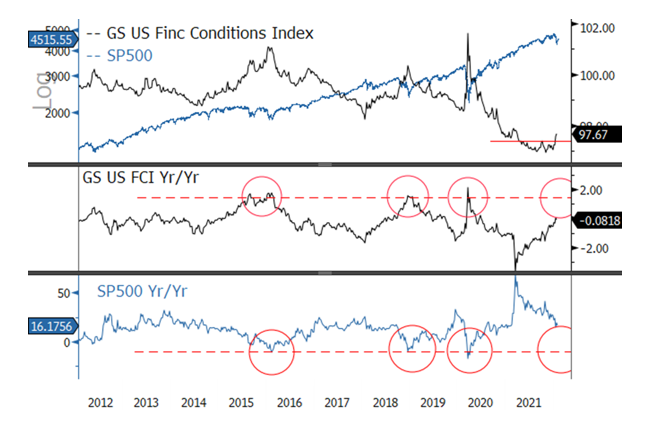

The average forecast for FOMC participants is ~4% for Q4 2022 GDP (gross domestic product) growth, which is about ~2.2% above GDP potential. The temptation to use the financial conditions channel was notable and pointedly questioned during the FOMC press conference. Telegraphing an aggressive hawkish position forces a de-rating in the equity markets via higher real yields. This, in theory, is a relatively gentle process for the economy to begin policy normalization and lower demand to allow the supply side to catch up. For equity markets, this is a far riskier process, as the experience of 2018 demonstrated. Figure 3 highlights the Goldman Sachs U.S. Financial Conditions Index (GSUSFCI) 8 vs. the S&P 500 Index. The GSUSFCI has already turned up, but there is a lag; actual rate hikes will not occur until March and QT until the summer. If the market is correct in assessing five rate hikes, an aggressive QT process and a Fed that is open to all manner of aggressive tightening, then the GSUSFCI is likely to turn up sharply, and the year-over-year change should match that heightened pace. The year-over-year change in the S&P 500 is an almost exact mirror image of the GSUSFCI.

Figure 3. Goldman Sachs U.S. Financial Conditions Index: Year-over-Year Change (2012-2021)

Source: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Comparison to 2018

With the Fed keen to hike rates soon and to follow with a large balance sheet reduction program (QT), parallels to 2018 are top of mind. At the January FOMC meeting, Fed Chair Jerome Powell emphasized how much stronger the current U.S. economy is and how higher inflation is relative to 2018. The U.S. economy no longer needs (or wants) such highly accommodative policies, but the market certainly does. The adage "the market is not the economy" is being expressed today, as in 2018.

From a market perspective, the tightening process in 2018 was already years in the making, with the Fed's target being neutral. The current tightening cycle has just started, with inflation running at 7%. Already, markets are experiencing severe volatility and selling even though the first rate hike is not expected until March. For the market, the more significant issue is how much exposure was built up and leveraged during periods of extremely low volatility and low interest rates. As the Fed rate hikes occur, QE (quantitative easing) is removed and QT begins, excess reserves will be drained and will force price discovery across almost all asset classes. Asset pricing is in the process of being transferred from the largest, most price-insensitive buyer to private investors who are most certainly price sensitive. One could use this colorful mixed metaphor: The Fed is attempting a controlled demolition with a high potential for butterfly effects.

The Eventual Dovish Pivot

As discussed, the market is pricing the end of QE in March, five rate hikes for 2022 and QT by summer. The next few months are likely to see continuing supply chain problems, hot wage growth and high rent growth keeping core CPI levels elevated. Ending QE, hiking rates and starting QT will not change these readings much, keeping Fed policy risk skewed to the hawkish side and market risk elevated. Relative to 2018, 2022 appears far more daunting from a market perspective, yet in Q4 2018, the S&P 500 experienced a drop of approximately 20%.

Though the U.S. economy grew by 2.2% in Q4 2018, financial conditions deteriorated rapidly. Real yields surged, reaching ~1%, the USD spiked over 9% and volatility emerged from two years of suppressed action. The $1 trillion VIX ETN 9 universe blew up in early 2018, allowing volatility to rise back to market-clearing levels. Though unrelated to the economy, rolling portfolio VaR (Value at Risk, a risk management calculation) spiked across various positions, causing forced selling and mechanical deleveraging, which in turn drove a self-feeding selling loop.

The question is how long before the market forces a dovish pivot, which we view as a high probability but very difficult to determine precisely when Fed policies, market dynamics and economic conditions are in such a fluid state. If 2018 proves to be the correct analog, falling equity prices, spiking real yields, a surging USD and tightening financial conditions will lead to wider credit spreads and credit stress, eventually signaling the end of QT. Gold reached a low of $1,200 in August 2018 while real yields and the USD rose sharply, ignoring its typical inverse correlation pattern. Instead, gold became more correlated to volatility and financial conditions as its function as a safe haven asset took hold. From the Powell Pivot in January 2019 to August 2019, when the market discounted rate cuts, gold advanced to $1,525. We are now seeing early signs of this pattern emerging.

Gold Compared to Bonds

Rate volatility continues to live up to its reputation as the central connection point of cross-asset volatility. Since mid-2020, after the initial COVID-related extreme volatility passed, the MOVE Index10 (a bond volatility index) has been outpacing the VIX index11 (equity volatility index) despite massive levels of QE. Though the rate shock has come to life this month, the tension has been building for some time. When the risk-free asset becomes the primary source of volatility, all asset classes are likely to be impacted, with risk assets most negatively.

In our 2022 Top 10 Watch List, we highlighted the outperforming trend of gold bullion to the U.S. Treasury Index. Figure 4 provides more detail on gold bullion versus U.S. Treasuries. Gold has outperformed Treasuries by a significant amount (the 5-year annualized return of gold bullion is 11.51% compared to 3.28% for the U.S. Treasuries Index). Gold’s risk-adjusted returns, as measured by sharpe ratio,12 have also outperformed U.S. Treasuries. In terms of correlation to the broad equity market (using the S&P 500 Total Return Index), gold shows no correlation to the equity markets. As we and many others have pointed out, since March 2020, bonds have lost their negative correlation to equity markets, effectively losing their ability to hedge equity markets. Bonds are not likely be a safe haven asset with an aggressive hawkish Fed unless a black swan event or sudden rapid fall in economic growth forces the Fed into a sudden dovish reversal.

Figure 4. Gold Bullion vs. U.S. Treasury Index: Returns, Sharpe Ratios and Correlation to the S&P 500 Total Return Index

| Year | Gold Bullion Annual Return |

U.S. Treasury Annual Return |

∆ |

Gold Bullion Annual Sharpe |

U.S. Treasury Annual Sharpe |

∆ |

Gold Correlation to S&P 500 TR |

Treasury Correlation to S&P 500 TR |

| 2016 | 8.14% | 1.04% | 7.10% | 0.39 | 0.14 | 0.24 | (0.33) | (0.38) |

| 2017 | 13.53% | 2.31% | 11.22% | 1.12 | 0.47 | 0.64 | (0.22) | (0.36) |

| 2018 | -1.56% | 0.86% | -2.42% | (0.52) | (0.26) | (0.27) | (0.04) | (0.28) |

| 2019 | 18.31% | 6.86% | 11.45% | 1.35 | 1.10 | 0.25 | (0.28) | (0.51) |

| 2020 | 25.12% | 8.00% | 17.12% | 1.21 | 1.20 | 0.01 | 0.00 | (0.11) |

| 2021 | -3.64% | -2.32% | -1.32% | (0.46) | (0.58) | 0.11 | 0.12 | (0.38) |

| Compounded Return |

Compounded Return |

∆ |

5-YR Sharpe | 5-YR Sharpe |

∆ |

5-YR Correlation | 5-YR Correlation | |

| 5-Year | 11.51% | 3.28% | 8.22% | 0.57 | 0.42 | 0.15 | (0.01) | (0.36) |

Source: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2022. ∆ represent the "delta" or difference between two data figures. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

MBS Reduction and Spread Risk

The question of MBS (mortgage-backed securities) reduction vs. U.S. Treasuries remains unknown. MBS purchases have fueled the U.S. housing bubble and soaring house price effects are now entering into the inflation data given the usual lag. Historically, MBS reduction has caused more significant market stress, likely because it is a spread product (pricing based on Treasury spreads). The problem is twofold. The first is that rates are rising. The second is that the Fed is an outsized buyer with zero price sensitivity that will soon disappear and go into reverse. Since the MBS market is enormous, it will negatively impact other spread product markets. The Fed will no longer act as a buffer or insulator to future contagion or collateral risk events but may act as an accelerant until it takes action. The other direct risk is that rising mortgage rates and a slowing economy may burst another housing bubble.

Market Risk in the Early Innings

For the next few months and likely more, the market is likely to be at risk from the combined effects of Fed interest hikes, tighter financial conditions and decelerating growth. The Fed is committed to fighting inflation and will likely tighten into a slowdown, but the alternative looks equally unattractive if the Fed falls further behind – inflation becomes embedded. Rapid rate hikes mean the Fed will approach the market-implied terminal rate quickly. The challenge for all is that the neutral rate remains unknown. Hiking interest rates past the neutral rate will exacerbate an already slowing economy, cause various yield curves to invert and may initiate a repeat of 2018's equity markets rout.

We continue to view gold as an incredibly attractive safe haven asset for investment funds. Bonds under current conditions are not a haven asset but are a current source of market risk. Cryptocurrencies, with their extreme volatility, are an unlikely hedge and their recent high correlation to speculative risk assets precludes them as a haven asset. Cryptocurrencies may be many things, but a safe haven is not one of them. We believe that market risks are rising and gold, as it did in 2018, is likely to break out to higher levels in response.

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Spot Price. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT) aims to track the performance of larger-sized gold mining companies whose stocks are listed on Canadian and major U.S. exchanges. |

| 4 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | CTAs=Commodity Trading Advisors, i.e., quant funds, investment funds that select securities using advanced quantitative analysis. |

| 8 | The Goldman Sachs US FCI is defined as a weighted average of riskless interest rates, the exchange rate, equity valuations and credit spreads, with weights that correspond to the direct impact of each variable on GDP. |

| 9 | The VelocityShares Daily 2X VIX Short-Term ETN (TVIX) was an exchange-traded note (ETN) that tracked the CBOE Volatility Index (VIX) Short-Term Futures Index; issued by Credit Suisse Securities (CS) on Nov. 29, 2010, it was ultimately de-listed in June of 2020 along with several other VelocityShares leveraged ETNs. |

| 10 | The Merrill Lynch Options Volatility Estimate (MOVE) index is constructed in a roughly similar way to the VIX. It is a yield curve weighted index of the normalized implied volatility on 1-month Treasury options which are weighted on the 2, 5, 10, and 30-year contracts over the next 30 days. |

| 11 | The CBOE Volatility Index, or VIX, is a real-time market index representing the market's expectations for volatility over the coming 30 days. |

| 12 | The Sharpe Ratio measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment (i.e., its volatility). |

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management LP (“SAM LP”) and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. SAM LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affiliates may hold a short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not residents of Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, or considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2024 Sprott Inc. All rights reserved.