In April, the precious metals complex backed off in line with other risk assets in a month that saw the U.S. dollar climb 4.73%.5 Gold bullion1 remained up 3.70% YTD through April 30, 2022, while silver bullion2 has declined 2.28% YTD. Gold mining equities3 had a tough month but remained 12.01% higher YTD. This compares to a YTD decline of 13.31% for the S&P 500 Index6 and a historic drawdown for bond markets which have lost 8.50% YTD, as measured by the U.S. Treasury Index.

Month of April 2022

| Indicator | 4/30/2022 | 3/31/2022 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $1,896.93 | $1,937.44 | ($40.51) | (2.09)% | 3.70% | Consolidating March breakout |

| Silver Bullion2 | $22.78 | $24.79 | ($2.02) | (8.13)% | (2.28)% | Still in a long corrective range |

| Gold Senior Equities (SOLGMCFT Index)3 | 138.17 | 150.10 | (11.93) | (7.95)% | 12.01% | Overbought pullback, equity correlation |

| Gold Equities (GDX)4 | $34.99 | $38.35 | ($3.36) | (8.76)% | 9.24% | (Same as above) |

| DXY US Dollar Index5 | 102.96 | 98.31 | 4.65 | 4.73% | 7.62% | Heading into destabilizing territory |

| S&P 500 Index6 | 4,131.93 | 4,530.41 | (398.48) | (8.80)% | (13.31)% | Worst month since March 2020 |

| U.S. Treasury Index | $2,287.44 | $2,360.57 | ($73.13) | (3.10)% | (8.50)% | Worst drawdown last 50 years: -12.22% |

| U.S. Treasury 10 YR Yield* | 2.93% | 2.34% | 0.60% | 60 BPS | 142 BPS | Testing the 40-year secular downtrend |

| U.S. Treasury 10 YR Real Yield* | (0.01)% | (0.49)% | 0.49% | 49 BPS | 110 BPS | Real yields back to pre-COVID levels |

| Silver ETFs (Total Known Holdings ETSITOTL Index Bloomberg) | 902.10 | 892.92 | 9.18 | 1.03% | 1.81% | Quietly adding positioning |

| Gold ETFs (Total Known Holdings ETFGTOTL Index Bloomberg) | 106.65 | 105.73 | 0.92 | 0.87% | 8.95% | Steady increase, 4.46% away from highs |

Source: Bloomberg and Sprott Asset Management LP. Data as of April 30, 2022.

*Mo % Chg and YTD % Chg for this Index is calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points.

April Blues

Gold bullion fell $40.51 (a loss of 2.09%) to close at $1,896.93 for the month. Gold performed well into the first half of April as safe-haven flows were still trending. But in the second half, a notable de-grossing event (i.e., a major sell-off in positions) occurred with an across-the-board outflow in all asset classes as equity, bond and currency volatility surged. April ended as a hostile and volatile month for risk assets, with the S&P 500 Index down 8.80% for April while the Nasdaq Composite Index7 fell 13.26%, its worst month since 2008. The Federal Reserve ("Fed") continued to message from a full-on hawkish position, and market participants ramped up tightening expectations. Global growth expectations were lowered by the IMF (International Monetary Fund) and the World Bank. At the same time, one major Wall Street firm called for a significant recession by late next year just before a surprise -1.4% Q1 U.S. GDP (gross domestic product) posting.8 The Russia-Ukraine War shows no signs of resolution, and the effects of sanctions are spreading. China is in wide-scale COVID lockdowns, adding to the stagflationary risk by disrupting supply chains further and weakening growth.

Towards the end of April, earnings disappointments joined the geopolitical and economic concerns. Against the challenging hawkish Fed background, slowing growth and long faded global monetary and fiscal liquidity impulses, QT (quantitative tightening) will start in May, further undercutting liquidity and exacerbating any selling pressure. With inflation readings so elevated and pervasive, the U.S., the world's largest economy, may have no choice but to tighten into a recession. With the -1.4% Q1 GDP surprise posting, the bar for a recession may be lower than expected. In addition, China, the world's second-largest economy, may send itself into an economic downturn via widespread, ongoing lockdowns due to its strict zero-COVID policy.

Gold Bullion Consolidating

Gold bullion is currently consolidating the bullish flag breakout shown in Figure 1. After approaching its 2020 all-time high price of $2,064 per ounce, gold has pulled back to test support and Fibonacci retracement levels9 (blue dashed lines). Though the price volatility is elevated, our Gold Bullion Positioning Index has stayed in a narrow range, indicating that price volatility was more due to a lack of liquidity than selling pressure.

Figure 1. Gold Consolidating the March Breakout (2020-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Inflation Still Surprisingly Uncertain…

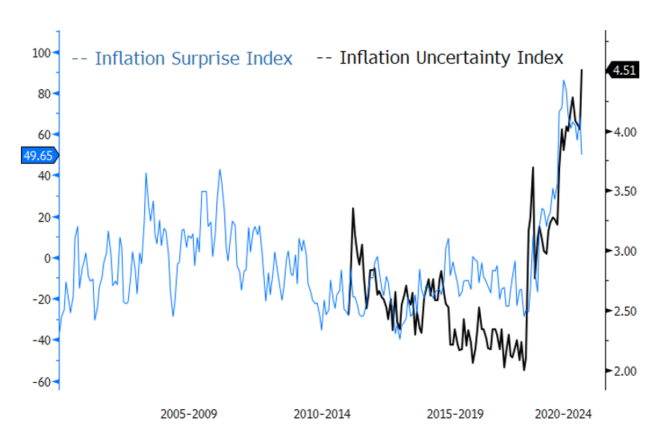

In April, inflation continued to be the main narrative as global inflation data posted multi-decade highs, and global central banks started hiking aggressively. Expectations for more hawkish Fed hikes have reached three 50-basis points hikes and a total of 275 basis points of tightening to year-end. If the Fed can deliver such an aggressive, brute force attack on inflation, it may likely lead to collateral damage and consequences. But with 8.5% inflation, a little demand destruction will not be sufficient. Despite the fixation and focus on inflation for more than a year, there is surprisingly little consensus on the inflation outlook. Figure 2 highlights that inflation surprises are still elevated and that the level of uncertainty is likely to continue to increase. Looking ahead, inflation and expectations will continue to rile markets.

Figure 2. Inflation Surprise Index and Inflation Uncertainty Index (2005-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

… And Stagflationary Pressures Still Rising

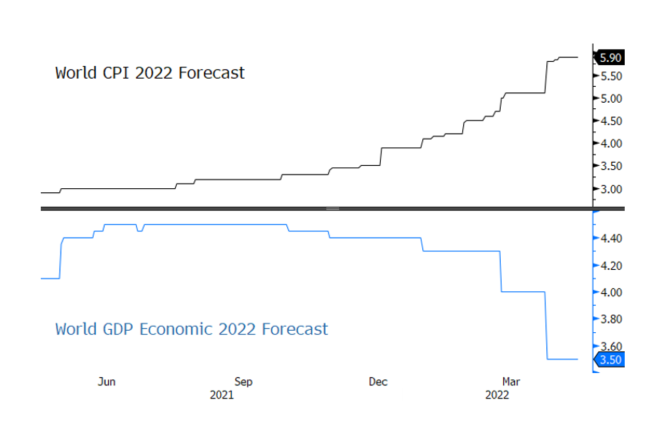

Global GDP saw further downward revisions for 2022. The IMF downgraded 2022 global GDP from 4.4% to 3.6% and the World Bank lowered its estimates from 4.1% to 3.2%. The effects of the Russia-Ukraine War, now entering its third month, continue to ripple through supply chains, commodity markets, trade and financial linkages. With few signs of a resolution or end, spillover effects will likely continue to accrue. Globally, inflation pressures continue to rise and inflation indices are reaching new all-time highs. Figure 3 highlights the growing global stagflationary stress: Rapidly increasing inflation expectations and GDP expectations tumbling.

Figure 3. Global Stagflation Pressure is Accelerating (2021-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

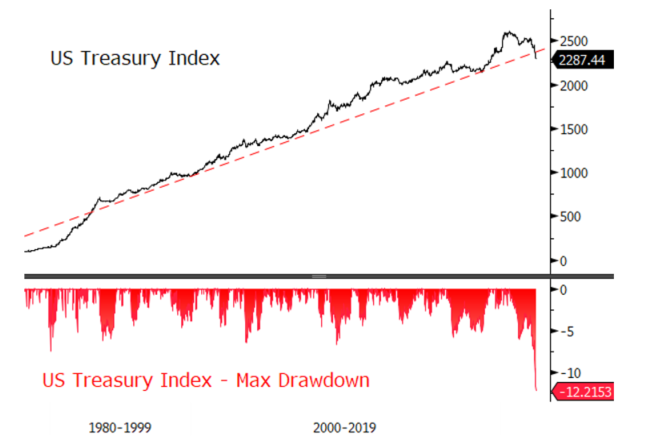

Unprecedented Drawdown on Bonds

During the May 4, 2022, Federal Open Market Committee (FOMC) meeting, the Fed will announce its quantitative tightening (QT) or balance sheet runoff/reduction schedule. The expectation is that the runoff caps will be larger and quicker, and when combined with aggressive rate hikes, it will likely lead to a policy of tightening that is possibly greater than what the market is expecting. QT is likely to be a massive change in the flow of funds in and out of U.S. Treasuries, affecting every asset class. In short, QT will lower the tipping point of a potential overshoot in Fed rate hikes. The expected fastest rate hike since 1989 (0 to 300 basis points in 12 months, including three 50 basis point rate hikes) plus QT is an off-the-charts level of tightening and this will likely impact equities, credit and especially bonds. Mortgage-backed securities (MBS) runoff remains an underappreciated risk as the Fed may target home prices to reign in inflation and inflation expectations more quickly. As we mentioned before, an aggressive MBS runoff runs a high contagion risk to credit market risk because of its spread product nature.

The U.S. Treasury Index's YTD 2022 return is now -8.5%, representing a significant loss in the value of U.S. government bonds. But it is the drawdown that highlights the pressure facing most multi-asset funds. The drawdown is the worst in nearly 50 years, at twice the prior maximum drawdown levels ever experienced (see Figure 4). Bonds typically function as a hedge or protective asset in multi-asset portfolios. Global bond aggregates are experiencing even worse drawdowns (-15.48%), highlighting the dearth of safe-haven assets.

Figure 4. Max Drawdown on the U.S. Treasury Index (1980-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Divergent Monetary Policies Adding to Global Risk

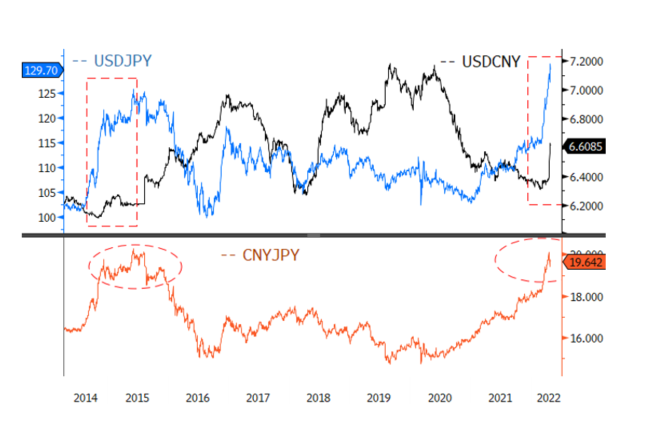

We last saw pronounced yen (JPY) weakness and a weakening yuan (CNY) response in 2014, culminating in the People's Bank of China (PBoC) series of yuan devaluations in 2015. Figure 5 highlights a similar setup marked by the red dashed boxes and shows the CNYJPY (Yuan-Yen) cross (lower panel) at the same level as the last time the yuan was devalued. The yen has recently fallen to 20-year lows due to rate differentials. With the Bank of Japan (BOJ) defending its 10-year yield cap of 0.25% (yield curve control, or YCC), the yen is likely to weaken as long as the Fed raises rates. Consequently, the yen (JPY) is now directly correlated with U.S. yields, as the BOJ can only maintain YCC at the expense of a free-falling yen. Such an extreme move in one of the world's most important currencies will have consequences, as expressed by the yuan (CNY).

CNY weakened considerably and could be in the early stages of a devaluation event similar to 2015. The yuan has an on/off semi-soft peg to the U.S. dollar (USD), and with USD strength and yen weakness, the yuan had reached a four-year high this past February. With most other currencies weakening against the USD, the yuan has likely reached a competitive disadvantage breaking point. In general, a weaker yuan correlates with softening resource commodities and resource equities, as 2015 demonstrated. Since China is the world's largest consumer of all commodities, a weakening yuan implies weakening demand. A weaker yuan also points to lower liquidity and slower growth, something the world needs more of, not less. Significant yuan weakness in 2015 and 2018 was a contributing factor to the S&P 500 Index declining by more than 10%. However, predicting CNY levels is very difficult as the PBoC/Politburo dictates the levels and pivots. The lockdown in China will only exacerbate pressure on commodities through a weaker demand outlook.

The risk of a competitive currency war is brewing again, with the root cause being wildly divergent central bank monetary policies. Japan and China have GDP growth concerns and need to remain dovish, while the U.S. has far too much inflation and needs to hike aggressively. The widening rate differentials are pushing their respective currencies in opposite directions. They are also increasing macro-level correlations closer to "1". As a result, USDJPY now has an extremely high 0.93 R-squared10 to U.S. 10-year Treasury yield since last summer. One can argue cause and effect, but when macro-level correlations rise, volatility will increase too, and market depth will fall even further in a negative feedback loop. Down the road, there is a risk that BOJ may lose control or abandon YCC (like Australia's experience with YCC), leading to further chaotic pricing action but on a much larger scale. There are two growing risks: 1) a potential Asian Foreign Exchange (FX) war; and 2) spiking USD strength as the incentive to sell yen and yuan are so intense that all G1011 currency pairs are impacted. We have all seen this picture before; the situation is potentially explosive and highly destabilizing. Currency markets trade trillions of dollars a day, and currency volatility (stress/risk) will quickly channel into other asset class volatility.

Figure 5. Both Yen (USDJPY) and Yuan (USDCNY) Weakening Against USD, CNYJPY Cross at Highs (2014-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

A Look at Silver: Why So Weak?

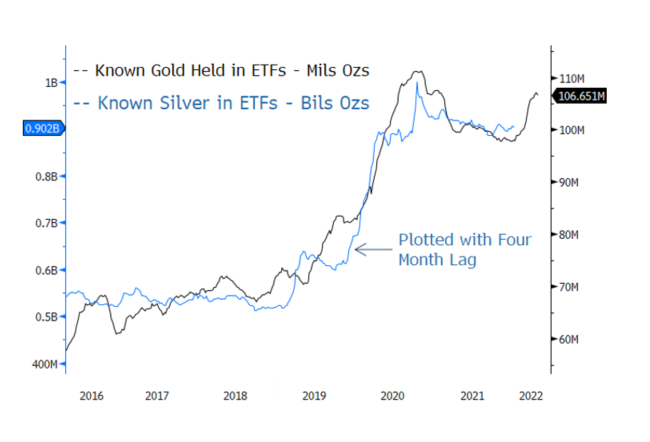

Silver has a unique duality pricing function that, at times, may be contradictory due to its industrial component and its monetary role. Historically, gold pricing tends to lead silver pricing and ETF (exchange traded funds) positioning provides an excellent illustration. Gold in ETFs has sharply increased this year and continues to climb as the safe-haven flight takes hold. Figure 6 plots known gold held in ETFs and known silver held in ETFs but with a four-month lag for silver. Silver in ETFs lags gold in ETFs positioning by about four months, meaning we should see a notable increase in silver positioning in ETFs. A noteworthy confirmation is that the time-lagged adjusted R-square is 0.94 versus 0.88 for non-lagged data.

Figure 6. Silver Held in ETFs Lags Gold in ETFs by Four Months (2016-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Pricing Behavior of Silver

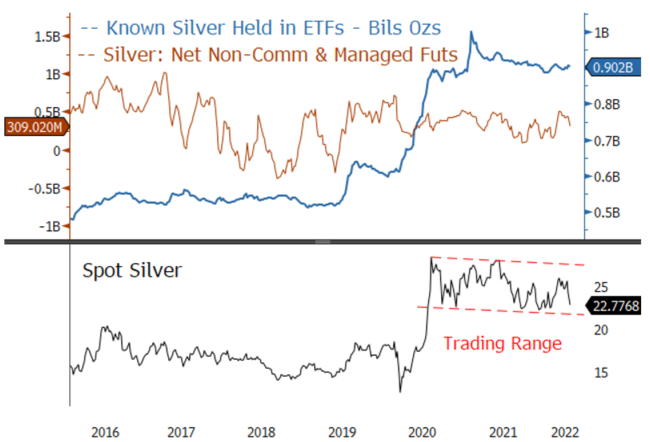

In Figure 7, we break out silver positioning (upper panel) into two groups: 1) known silver in ETFs represents the most significant known aggregation of silver investment, about 906 million ozs (blue line) and 2) the other significant holdings of silver would be CFTC (Commodity Futures Trading Commission) net non-commercial positions plus silver in managed futures (orange line) typically held by CTAs (Commodity Trading Advisors, i.e., quant funds, an investment fund that selects securities using advanced quantitative analysis). The lower panel is spot silver, but notice the tight fit between silver held in ETFs with the silver price. The CFTC and managed futures line is directionless but mean-reverting with shifting trading ranges. CFTC and managed futures holders do not set long-term price direction but affect trading ranges and are the primary cause of price volatility. As long as gold remains in a primary bull market, we believe this pricing relationship will hold. The silver chart in the lower panel of Figure 7 remains in a consolidation trading range which will resolve higher.

Figure 7. Spot Silver vs. Silver Held in ETFs and CFTC Positioning (2016-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Silver: Energy Transition Play

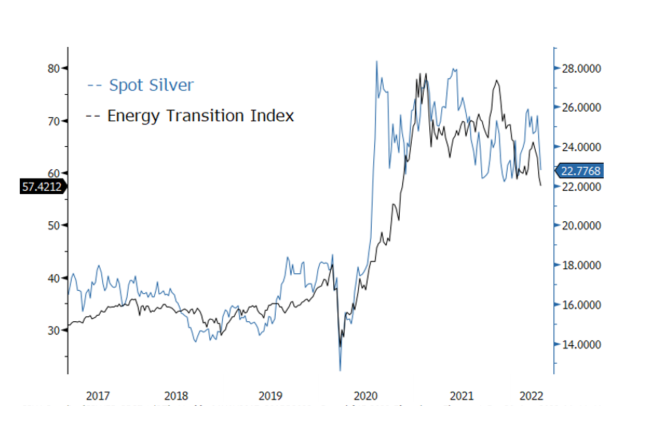

Silver has long had an industrial demand component, but this component has changed over the years. The Silver Institute's data from its "World Silver Survey 2022" indicates all the growth in silver demand has come from photovoltaics (solar panels) over the past nine years. Photovoltaic is forecasted in 2022 to be 11.5% of all silver demand, growing at a 10.8% annual rate over the past nine years. All other combined sources of silver demand have decreased at -0.4% annually over the same period. With solar panel growth expected to be in the 7-8% range to 2030, we see the growth drivers for silver continuing. Longer term, silver loading in electric vehicles will likely surpass photovoltaic usage, continuing and increasing silver's role in the unfolding energy transition growth story.

Silver pricing has become highly correlated (R-square of 0.82) with energy transition equities, as illustrated in Figure 8. This Energy Transition Index is comprised of 12 large ETFs in the energy transition space (solar, renewables, wind, carbon, infrastructure, uranium, etc.).

Figure 8. Silver Correlates with Energy Transition Equities (2017-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Silver vs. Industrial Metals and the Global Liquidity Cycle

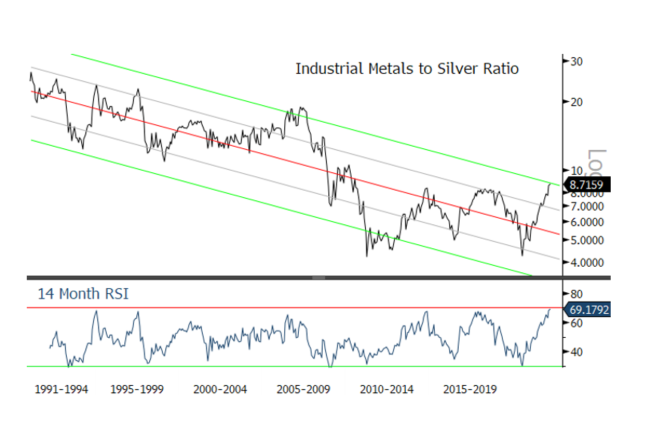

Since August 2020, silver has underperformed the base industrial metals (mainly due to low base effects) as the cyclical recovery took hold. With the global slowdown accelerating, we see signs of a reversal in place. Figure 9a. highlights the 30-year Bloomberg Commodity Index (BCOM) Industrial Metals to Silver ratio chart. Industrial metals relative to silver have been in a long-term underperforming trend but have just reached the upper +2 standard deviation trading channel. The monthly Relative Strength Index (RSI)12 has reached the overbought levels that have marked every relative top over the past three decades. From a technical perspective, we have reached a likely cyclical peak.

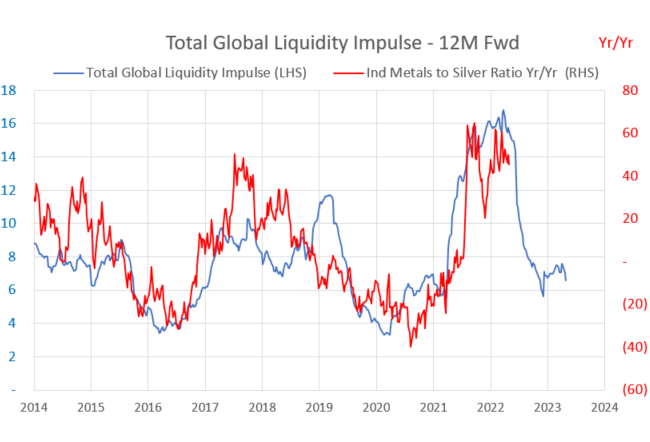

Figure 9b. adds to the evidence that a reversal is in place from a macro point of view. The blue line is our measure of global liquidity impulse, a combined calculation of global M213 year-over-year and global credit impulse forwarded 12-months in advance. Essentially the tailwind from monetary and credit impulses has peaked. Headwinds in the form of slowing global growth, a significantly elevated USD, a brewing Asian FX war, hawkish central banks, etc., are gathering strength. Supply remains the wild card due to the Russia-Ukraine War and the resultant financial stress on commodity trading houses. As we approach the eventual Fed pivot, which the Eurodollar futures market is already pricing, silver's monetary function will begin to exert itself. Silver will rise on the expectations of massive central bank stimulus, while base metals are likely to react negatively to the worsening economic and financial conditions.

Figure 9a. Industrial Metals vs. Silver (1991-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Figure 9b. Industrial Metals to Silver Ratio: Liquidity Tailwind Turning into a Headwind

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Ongoing Macro Risk Factors and a Silver Lining

With one of the worst year-to-date returns, risk assets may have discounted a significant amount of policy tightening and some QT. However, a large amount of historical QE (quantitative easing) and its legacy effects still need to unwind (Fed balance sheet, suppressed volatility, PE multiples). Meanwhile, many challenges remain or are building, not limited to geopolitical risk, global stagflationary pressures, potential currency war, earnings disappointments, rising volatility, lockdowns in China impacting supply chains further and not least, a committed hawkish Fed. We remain bullish on gold for these reasons and the spillover effects of these risk factors, which will likely evolve given that we are just four months past and down only -13.86% from the S&P 500's all-time peak. The relentless and titanic levels of macro risk factors appear far from peaking and not entirely discounted.

We believe silver will offer an excellent buying opportunity in the coming months. Pricing may become volatile as silver trades with roughly one-tenth of gold's liquidity, and CFTC traders disproportionately determine short-term pricing but not LT pricing. Gold leads silver by first acting as a safe-haven asset and then as a monetary asset as central banks inevitably capitulate to pressures and restart the liquidity cycle. Silver typically is not considered a safe-haven asset but is a monetary asset and quickly plays catch-up with gold when the monetary expansion phase resumes.

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Spot Price. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT) aims to track the performance of larger-sized gold mining companies whose stocks are listed on Canadian and major U.S. exchanges. |

| 4 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | The Nasdaq Composite Index is a stock market index that follows nearly 3,400 stocks listed on the Nasdaq stock exchange. |

| 8 | Real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 6.9 percent. |

| 9 | Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. They are based on Fibonacci numbers. Each level is associated with a percentage. The percentage is how much of a prior move the price has retraced. The Fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. While not officially a Fibonacci ratio, 50% is also used.The indicator is useful because it can be drawn between any two significant price points. Source: Investopedia. |

| 10 | R-squared values range from 0 to 1 and are commonly stated as percentages from 0% to 100%. An R-squared of 100% means that all movements of a security (or another dependent variable) are completely explained by movements in the index (or the independent variable(s) you are interested in). Source: Investopedia. |

| 11 | The Group of Ten or G10 is a group of 11 industrialized nations that have similar economic interests. Source: Investopedia. |

| 12 | The Relative Strength Index (RSI) is a momentum indicator that evaluates overbought or oversold conditions by measuring the magnitude of recent price changes for various assets. |

| 13 | M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money. M2 is a broader measure of the money supply than M1, which just includes cash and checking deposits. |

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management LP (“SAM LP”) and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. SAM LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affiliates may hold a short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not residents of Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, or considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2024 Sprott Inc. All rights reserved.