Key Takeaways

- Market turbulence in response to the Trump administration’s tariff actions is delivering a clear verdict: global investors are losing faith in the U.S. financial architecture, which no longer looks reliable.

- Gold is a major beneficiary of these events. While U.S. equities, bonds and the U.S. dollar were falling simultaneously in April, a phenomenon not seen since the 1970s, gold hit an all-time high, reaching $3,500, and its monetary appeal continues to grow.

- We believe the decline of the U.S. dollar is driving the emergence of a multi-asset reserve system, which will likely need a widely accepted, neutral reserve asset as its key reference point. Gold is uniquely suited to this role.

Performance as of April 30, 2025

| Indicator | 4/30/2025 | 3/31/2025 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $3,288.71 | $3,123.57 | $165.14 | 5.29% | 25.31% | Gold touched $3,500, support ~$3,200 |

| Silver Bullion2 | $32.62 | $34.09 | $(1.47) | -4.31% | 12.85% | Silver's industrial value > monetary value |

| NYSE Arca Gold Miners (GDM)3 | 1,377.21 | 1,288.51 | 88.70 | 6.88% | 43.97% | GDM breakout past 2020 high |

| Bloomberg Comdty (BCOM Index)4 | 100.93 | 106.40 | (5.47) | -5.14% | 2.19% | Global recession tariff threat hitting |

| DXY US Dollar Index5 | 99.47 | 104.21 | (4.74) | -4.55% | -8.31% | DXY breaking multi-year support |

| S&P 500 Index6 | 5,569.06 | 5,611.85 | (42.79) | -0.76% | -5.31% | Wild volatility, +15% range |

| U.S. Treasury Index | $2,372.05 | $2,357.12 | $14.93 | 0.63% | 3.57% | Volatile month, see comment section |

| U.S. Treasury 10 YR Yield* | 4.16% | 4.21% | (0.04) | -4 BPS | -41 BPS | Volatile month, see comment section |

| Silver ETFs** (Total Known Holdings ETSITOTL Index Bloomberg) | 736.19 | 719.79 | 16.40 | 2.28% | 2.79% | Potential large base building |

| Gold ETFs** (Total Known Holdings ETFGTOTL Index Bloomberg) | 88.90 | 87.98 | 0.92 | 1.04% | 7.30% | ETF buyers returning slowly vs. gold price |

Source: Bloomberg and Sprott Asset Management LP. Data as of April 30, 2025.

* BPS stands for basis points. **ETF holdings are measured by Bloomberg Indices; the ETFGTOTL is the Bloomberg Total Known ETF Holdings of Gold Index; the ETSITOTL is the Bloomberg Total Known ETF Holdings of Silver Index.

Gold Market: Structural Tailwinds Intact

Spot gold soared by $165.14 per ounce (or 5.29%) in April to close the month at $3,288.71. Gold has risen each month in 2025, and by the end of April, it had increased 25.31% year-to-date. Gold had a wide trading range in April after briefly selling off along with most other assets in a systemwide financial degrossing and deleveraging selling event. Gold reached a closing low of $2,983 in April before rallying to touch $3,500 in overnight Asian trading on April 22 as U.S. financial assets came under enormous stress.

Gold's 25% YTD climb highlights its strength amid a volatile landscape of tariffs and potential stagflation.

The volatile month of April began with President Trump's announcement of “Liberation Day” tariff rates, which shocked the markets with their extremely draconian levels and nonsensical calculation methods. Markets swiftly sold off as the global economic consequences of such high tariff rates became evident. Selling and related hedging overwhelmed available market liquidity, causing extreme pricing dislocations across all asset classes.

However, the most troubling development was the simultaneous decline in U.S. long-dated bond prices, U.S. equities and the U.S. dollar. This had the markings of an emerging market facing capital flight. During this selling event, gold rose by over $400 per ounce as safe-haven flows dominated trading. On April 9, less than a day after implementing the reciprocal tariff portion, Trump announced a 90-day pause. At that point, the U.S. bond market was distressingly close to seizing up in a way last seen in the 2008 global financial crisis (GFC) and the 2020 COVID-19 pandemic meltdowns.

The Trump administration followed up this announcement of the 90-day pause with a brief threat to terminate Federal Reserve Chairman Jerome Powell. Since then, the administration has been steadily walking back its harsher rhetoric, talking up potential trade deals and downplaying threats to Fed independence. In response, equity markets have rallied and were back to their April 2 pre-reciprocal tariff levels by the end of April.

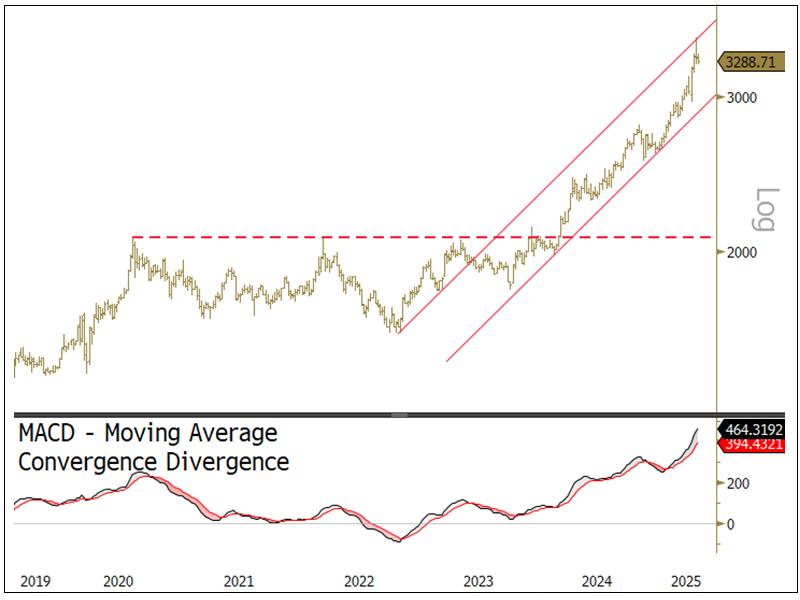

The April 22 gold high of $3,500 was followed by a sharp drop that sparked algorithmic selling from leveraged speculators on Shanghai's futures exchange. However, physical demand from Chinese gold ETFs (exchange traded funds) surged in April, accounting for over half of global ETF inflows. In the U.S., managed-money positioning is flat following forced deleveraging in early April, leaving little incremental supply from that cohort. We see support around $3,200 as gold's structural tailwinds remain intact. In our view, these include a worsening U.S. fiscal deficit situation, U.S. dollar weakness, rising long-bond yields and stagflation7 pressures from the extreme tariff regime. As shown in Figure 1, gold remains in a well-defined uptrend with positive confirmation from the technical indicators.

Figure 1. Gold’s Well-Defined Uptrend (2019-2025)

Source: Bloomberg. Gold bullion spot price, US dollar/oz. Data as of 4/30/2025. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs). Past performance is no guarantee of future results.

As America’s Financial Pillars Shake, Gold Soars

The market turbulence that began in early April and the White House’s subsequent 90-day “pause” on new reciprocal tariffs initially seemed to tell two different stories. First, outright panic by investors, then a sharp relief rally. Both episodes delivered the same verdict: global investors are losing faith in the U.S. financial architecture that has been seen as reliable for decades. For the first time since 1977, U.S. equities, U.S. Treasury bonds and the dollar fell together, while gold vaulted to record highs. What was once a stable pattern of flight to quality in U.S. assets has flipped. We believe this inversion is a warning sign that something fundamental has changed.

The pillars of America’s exorbitant privilege have not collapsed, but they are shaking, and the world is paying attention.

The catalyst for the selling panic was the Trump administration’s announcement of a sweeping 10% “base tariff” on all countries, paired with draconian reciprocal tariffs based on a nonsensical formula that blindsided markets. Within hours, investors priced in a stagflationary future. Equities cratered, the CBOE Volatility Index (VIX)8 spiked above 45, Federal funds futures began to discount four rate cuts for 2025, credit spreads ballooned and growth-sensitive commodities slumped. More extraordinarily, U.S. Treasuries and the U.S. dollar, the two traditional safe-haven assets, sold off sharply in tandem, a pattern more commonly seen in emerging market crises when capital flight occurs.

Ten- and 30-year bond yields jumped roughly 70 basis points in days, the steepest surge since 2001. Meanwhile, the U.S. dollar index (DXY) crashed through multi-year support on its way to a 10% drawdown. Such synchronized declines are almost unheard of for U.S. Treasuries, the world's benchmark reliable asset, and the U.S. dollar, the world’s reserve currency, and in our view, it points to incipient capital flight rather than a typical flight to safety or liquidity contraction.

Investors cited several forces behind the U.S. dollar's slide — the prospect that the tariff regime would cause more economic damage to the U.S. than to the rest of the world, eroding faith in American institutions, accelerating de-dollarization, and funding stress as the market sold assets to raise liquidity and meet margin calls. Additionally, dealers struggled to make markets as some of the heavily leveraged $1 trillion Treasury-futures basis trade9 began to unwind abruptly, overwhelming liquidity.

Fears mounted that the Federal Reserve was losing control of rate volatility and that the U.S. Department of the Treasury was losing control of the long end of the yield curve. Meanwhile, anxiety over U.S. fiscal arithmetic magnified the damage. Federal debt stands at $36 trillion, with roughly $10 trillion set to roll over within a year. Even before that refinancing wave hits, a tariff-induced recession could push the fiscal deficit from about 6% to well above 10% of gross domestic product (GDP). This would force up to $4 trillion of new issuance into a market that is already struggling to find buyers.

As the bond market threatened to reach crisis conditions, Trump quickly announced a 90-day tariff pause, sparking a violent bout of short covering. However, the bond market’s reaction revealed deeper cracks. Yields at the long end remained elevated, confirming that the sell-off was also due to concerns about eroding confidence in the “full faith and credit” of the U.S. financial system. The 10-year term premium has broken out of a decade long base and now points toward successively higher levels, signaling that investors will demand ever larger compensation to hold U.S. Treasuries. On the currency side, the decline of the U.S. dollar is no longer about growth or rate differentials but trust, governance and credibility. Foreign investors are trimming overweights to U.S. assets, currency volatility is increasing and other safe-haven alternatives such as the Swiss franc and Japanese yen have become more bullish.10

Gold responded with a historic rally. It soared over $400 to all-time highs in early April while U.S. equities, bonds and the dollar fell sharply in tandem. The last time these three U.S asset classes all fell together was in 1977, when gold embarked on a similarly dramatic surge during the second great inflation wave of the 1970s. With both the U.S. and China presiding over weakening currencies, gold's monetary appeal keeps growing.

The “Trump put”11 does appear to exist — bond markets forced policymakers to step back from the brink. However, that safety net is thin because the underlying stresses remain. Unpredictable tariffs, ballooning deficits, a leveraged financial system and a reserve currency that visibly lost part of its haven aura continue to threaten stability. In ourview, unless institutional credibility is restored quickly, investors should brace for further stress in Treasuries, continued U.S. dollar weakness and an extended bull market in gold. The pillars of America’s exorbitant privilege have not collapsed, but they are shaking, and the world is paying attention.

Foreign Ownership of U.S. Assets Provides a Tailwind for Gold

Foreign investors hold a large (and, after April’s developments, increasingly consequential) slice of U.S. financial markets. Overseas owners are estimated to hold roughly $18 trillion in U.S. equities and about $7 trillion in U.S. bonds and $5 trillion of U.S. corporate credit, representing about 10% of all U.S. financial assets.

Figure 2. Total Foreign Holdings of U.S. Equities, Treasuries and U.S. Credit

Source: Federal Reserve, Apollo Chief Economist.

Although significant net inflows of foreign capital into the U.S. have occurred since the COVID pandemic, most of the growth in this foreign exposure over the past 15 years has come from capital gains. These unrealized gains lower the hurdle for foreign investors to trim positions or hedge U.S.-dollar risk. Essentially, locking in profits is easier when the bulk of the position is “house money,” especially with the immense uncertainty brought on by U.S. tariffs and Trump's mercurial tariff policy actions.

As trust in U.S. assets wavers abroad, gold gains a global tailwind.

Currency-hedging mechanics may amplify the potential for outflows. Deutsche Bank estimates that every 1% increase in foreign exchange hedge ratios12 would translate into roughly $280 billion of U.S. dollar selling. If global investors decide they need more protection against a potential further weakening U.S. dollar, even a slight shift in hedge ratios could unleash meaningful pressure on the dollar and, by extension, U.S. bond yields.

The mismatch between shrinking foreign demand (“the delta”) and expanding supply may push term premiums higher and weigh on the U.S. dollar further. Should concerns about “U.S. institutional erosion” persist, larger sales of U.S. assets are likely.

Finally, the positive price boost foreign ownership has provided U.S. markets since the GFC appears poised to reverse. In the future, changes in the rate of foreign buying or selling, rather than the still-large stock of existing holdings, may negatively influence the direction of U.S. asset prices, bond term premiums and the U.S. dollar. Conversely, gold is the direct beneficiary of this possible negative trend in U.S. assets.

Undermining the Fed May Risk a U.S. Bond Crisis…or Worse

A legal and political campaign may be underway to allow the U.S. president to dismiss Federal Reserve chairs at will. The mechanism runs through Wilcox v. NLRB, a Supreme Court ruling in April 2025 that provisionally upheld Trump’s firing of Gwynne Wilcox from the National Labor Relations Board. This could lead to overturning the 1935 Humphreys Executor precedent protecting independent agency heads. If the Court scraps that safeguard, Trump could fire Fed Chairman Powell and any successor whose policy deviates from White House wishes.

If Trump fires the Fed, he may risk a full-blown bond crisis.

This prospect echoes Turkey under President Erdogan, where central bank governors are routinely sacked for resisting ultra-low rates. Markets already sensed the danger when Trump tweeted about terminating Powell. The dollar, bond and equity markets fell sharply in response before Trump walked back his earlier comments.

Crucially, forcing Fed Funds rates lower would not ease overall financial conditions, in our view. More likely, markets would re-price the entire yield curve due to lost credibility, resulting in a bear steepener.13 Long-term mortgage rates, corporate and consumer loan benchmarks, and 30-year Treasuries would likely spike higher to compensate for the greater risks to inflation and governance. With $36 trillion in Treasury debt (about 120% of GDP) and foreign investors holding roughly one-third of U.S. Treasuries, the U.S. could not afford such a surge in borrowing costs and potential loss of foreign capital access.

Further, if the White House were in a position to set monetary policy and dictate interest rates (the price of money) by decree, markets would question what a U.S. dollar is worth, whether Treasuries should receive a sovereign risk premium and whether “full faith and credit” would still have meaning. Sovereign currencies and bonds rest on the foundation of the rule of law, strong governance and independent institutions. Eroding the Fed's autonomy would attack all three and risk catalyzing a fragile backdrop into a more profound bond market crisis. In such an event, gold would likely soar, as the world’s otherwise reliable asset (U.S. Treasuries) and the world’s currency reserve (U.S. dollar) would likely face a potentially irrecoverable loss of credibility and significant loss of value. Even more damaging cascading risk events are possible.

The Strategic Case for Gold Gets Stronger

Markets are experiencing a regime change. For more than a decade, many investors have built portfolios on the assumption that central banks would dampen volatility, backstop liquidity and keep carry trades and leveraged funding positions both profitable and safe. The Trump administration's erratic tariff policy has shattered that assumption. Abrupt shifts in trade rules and unpredictable tariffs have pushed policy uncertainty indices to post-GFC highs, upended VaR (value-at-risk)14 models, and forced funds to cut exposure simultaneously. The result is wider bid-ask spreads, flash-crash-style swings in stock futures and Treasury yields and a creeping recognition that the old “Fed put” is no longer available or is now stuck much lower.

Eroding confidence in U.S. Treasuries and the U.S. dollar is helping gold take on the role of the real risk-free asset.

U.S. Treasuries, traditionally the world's primary safe-haven asset, are now behaving like a risk asset in times of market stress. Early April's bond rout, coupled with a falling U.S. dollar, showed how a forced unwind of the highly leveraged $1 trillion basis trade could overpower dealer balance sheets. Complacency is being reversed amid a ballooning U.S. fiscal deficit, rising recession fears and fluctuating foreign demand for U.S. assets.

These stresses cast gold in a new light. First, gold is reasserting and building its safe haven role. Investors who question the reliability of U.S. Treasuries or the U.S. dollar increasingly view gold as a store of value beyond any sovereign's reach. This role once defaulted to Treasuries and the dollar.

Second, gold remains a non-correlated diversifier. During liquidity squeezes, equities and bonds can fall together due to the forced sale of liquid assets. Gold may be caught in that initial liquidation, but history shows it recovers quickly once forced sales abate, restoring its low or even negative correlation to mainstream risk assets.

Third, gold is an effective inflation and stagflation hedge. Tariffs that raise production costs weaken the U.S. dollar, reduce supply efficiency and embed a cost-push inflation impulse even as growth slows. Gold outperformed most financial assets in every major stagflation episode, from the 1970s oil embargo to emerging market crises.

Finally, we believe structural demand from central banks and sovereigns is building a durable floor. Since late 2022, official sector buyers, led by developing emerging market central banks looking to diversify away from the U.S. dollar, have been the dominant marginal purchasers. Their steady accumulation creates what amounts to a “central bank put” beneath the gold price: dips attract sovereign buying, while the upside could remain uncapped if private investors join the bid.

Shifting risk perceptions, eroding policy credibility and rising liquidity stress have combined to reduce confidence in traditional havens and bolster the appeal of gold. As long as volatility stays elevated and faith in U.S. economic stewardship wavers, we believe gold's strategic case as a safe haven, diversifier, inflation hedge and central bank reserve asset will only strengthen.

Gold’s Role as a Reserve Asset in a Multipolar World

The world is rapidly deglobalizing, breaking into a multipolar world with an unknown outcome. Various geopolitical and economic factors, including trade wars, regional conflicts and the rise of nationalist policies, are driving this shift. The global economic landscape is transforming as countries become more self-reliant and less interconnected.

Central banks are diversifying away from the U.S. dollar and gold is being recast as the foundation of a multi-asset reserve system.

In a multipolar world, traditional reliance on a single dominant reserve currency like the U.S. dollar is becoming less viable. The dollar, while still the largest reserve currency, is facing challenges, and its dominance is decreasing. This decline is partly due to strategic decisions by various countries to reduce their dependency on the currency, driven by concerns over monetary policy volatility and geopolitical risks.

A multi-asset reserve system may be necessary to support the new global order. This system likely requires an agreed-upon and accepted neutral reserve asset to act as both the “glue” and valuation benchmark for a multi-asset reserve system.

For now, we see gold as the only neutral reserve asset of sufficient size, liquidity and acceptability. Gold's unique properties make it an ideal candidate for this role. Gold has a large and liquid market, making it accessible for central banks and financial institutions. Gold is recognized and trusted as a store of value, independent of any single nation's policies or economic conditions. Unlike fiat currencies, gold is not subject to the monetary policies of any one country, making it a politically and monetarily neutral asset.

It is important to note that this is not a return to the old gold standard. The gold standard was a monetary system in which the value of a country's currency was directly tied to a specific amount of gold. What we are seeing now is different and still forming. Gold may be used as a reference point and a stabilizing asset in a diversified reserve system rather than as the sole basis for currency valuation.

If the above reasoning is correct, factors driving gold prices higher will continue to grow. These factors include:

- Higher long-term structural demand from central banks: As countries diversify their reserves away from the U.S. dollar, central banks are likely to increase their gold holdings.

- Geopolitical uncertainty: Ongoing geopolitical tensions and economic instability drive demand for gold as a safe-haven asset for central bank reserve managers.

- Inflation and currency devaluation: Concerns over inflation and the devaluation of fiat currencies could further boost gold's appeal as a store of value.

In the evolving global economic landscape, gold is being positioned as a critical component of a multi-asset reserve system. Its role as a neutral reserve asset is becoming increasingly important, and this shift will likely have significant implications for gold prices in the future.

Silver Market: Violent Trading Range

Spot silver fell $1.47 per ounce (or 4.31%) in April to close the month at $32.62. Silver has had a mixed performance trend so far, but has gained 12.85% year to date as of April 30, 2025. Silver had a violent trading range in April, selling off sharply in the financial systemwide degrossing and deleveraging selling event before recovering most of its losses. As reflected in the CFTC’s Silver Non-Commercial Net Positions report15, traders sold the equivalent of ~36.7 million ounces in April while retail investors (represented by silver held in ETFs) bought 17.4 million ounces. In other words, retail demand was overwhelmed by forced liquidation from discretionary traders. Due to this forced liquidation, silver has a much stronger correlation to copper in the short term than it has to gold. Over the medium term, silver’s correlation to gold remains unchanged, meaning that we believe silver’s monetary value will reassert itself in time, as it has over the decades.

As shown in Figure 3, we continue to see $35 per ounce as a critical level for silver, and we would expect an impulsive move higher on a successful breakout.

Figure 3. Silver’s Impulsive Upward Move (2019-2025)

Source: Bloomberg. Silver spot price, U.S. dollar/oz. Data as of 4/30/2025. RSI = relative strength indicator, a momentum indicator that measures the speed and magnitude of price changes to evaluate overvalued or undervalued conditions. The area above the red line indicates buying pressure or overbought conditions, while the area beneath the green line indicates selling pressure or oversold conditions. Included for illustrative purposes only. Past performance is no guarantee of future results.

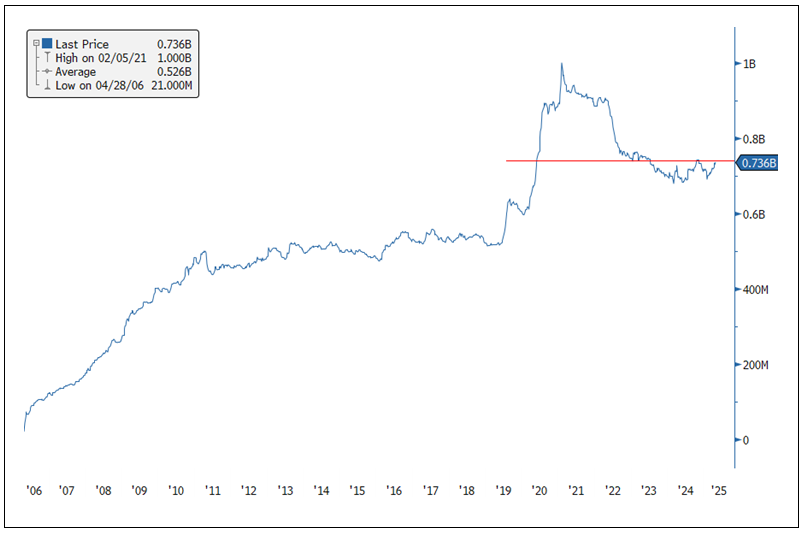

We refer to our March commentary (Part 4. Silver On the Cusp of a Major Breakout), for a review of silver market fundamentals, which we view as being unchanged despite the tariff developments and market sell-off. In our view, silver fundamentals are at the cusp of a potential squeeze higher. The critical driver remains retail buying, as represented by silver held in ETFs (see Figure 4). Retail buying of silver is notoriously gappy. Given the underlying fundamentals, we believe a buying wave would create a price spike, as the available free-trading inventory of silver is much lower than most expect.

Figure 4. Silver Holdings in ETFs (2006-2025)

Source: Bloomberg. Silver held in ETFs, million/billion oz. Silver held in ETFs is a proxy for retail demand for silver. Data as of 4/30/2025. Included for illustrative purposes only. Past performance is no guarantee of future results.

Footnotes

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Index. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The NYSE Arca Gold Miners Index (GDM) is a rules-based index designed to measure the performance of highly capitalized companies in the gold mining industry. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indices. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | Stagflation is when an economy experiences slow growth, high unemployment and rising inflation at the same time. |

| 8 | The CBOE Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is seen as a way to gauge market sentiment, particularly the degree of fear among market participants. |

| 9 | The Treasury futures basis trade is an arbitrage strategy that involves exploiting price differences between Treasury securities (cash Treasuries) and their corresponding Treasury futures contracts. |

| 10 | Bullish refers to a positive outlook where investors expect prices to rise. |

| 11 | “Trump put” is the belief by market participants that President Trump is sensitive to how financial markets respond to his policy actions and would step in to adjust or mitigate policies that weaken the markets. Recent events have tested this belief to the limits. Similarly, the “Fed put” refers to the widespread belief among investors that the U.S. Federal Reserve will intervene in the financial markets by lowering interest rates or other monetary policy tools to prevent significant stock market declines. |

| 12 | A hedge ratio is the proportion of an asset or investment position covered or protected by a hedge. It can range from 0% to 100%. |

| 13 | A bear steepener occurs when long-term interest rates rise faster than short-term rates, causing the yield curve to steepen. This often reflects expectations of higher inflation. |

| 14 | Value at risk (VaR) is a statistic that quantifies the extent of possible financial losses within a firm, portfolio, or position over a specific time frame. |

| 15 | The Commodity Futures Trading Commission's (CFTC) Silver Non-Commercial Net Positions weekly report reflects the difference between the total volume of long and short silver positions existing in the market and opened by non-commercial (speculative) traders. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.