Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Sprott Special Report

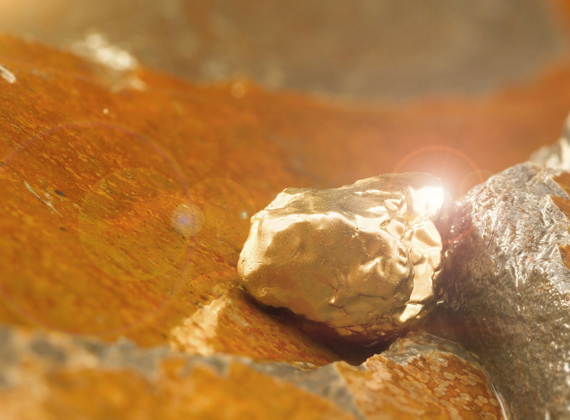

Gold’s Bold Move to New Closing High

On Friday, December 1, 2023, spot gold bullion registered an all-time high closing price of $2,072.22, surpassing the prior closing high of $2,063.54 reached on August 6, 2023.

Sprott Q3 Precious Metals Report

Central Banks Support Gold & Solar PV Demand Buoys Silver

Gold demand from sovereigns and central banks remains unwavering. Over the past decade, China has been committed to bolstering its gold reserves to enhance its economic and geopolitical standings.

Sprott Gold Report

Gold and the Debt Bubble

The Fed's "higher for longer" stance on interest rates is unsustainable and could lead to a general credit deflation and a recession. Trouble is brewing in the banking system and the labor market, which could further support a rise in gold prices.

Sprott Q2 Precious Metals Report

Central Banks Flex Gold Market Muscle

Central banks and investment funds were the main players shaping the gold market in the first half of the year. Gold is reverting to its historical role as a significant reserve asset as central banks seek to diversify amid geopolitical uncertainties.

Sprott Gold Report

Gold vs. Gold Stocks, An Unresolved Incongruity

Gold mining stocks are inextricably connected to the price behavior of gold bullion. Yet their recent response to the gold bull market has been disappointing. If gold should rise above the psychological $2,000 threshold, this may provide a strong catalyst for gold mining stocks.

Sprott Precious Metals Report

Geopolitical Risks Enhance Gold’s Role as a Reserve Asset

Gold attempted to breakout above $2,050 in early May before drifting lower as the U.S. debt-ceiling drama deepened and the U.S. dollar strengthened. At the same time, global central banks have been accumulating gold at a record pace.

Sprott Precious Metals Report

Gold Rides Higher on Recession Fears

The gold market continues to be bullish as the probability of a recession rises, regional banking stress resurfaces and the Fed seems determined " get inflation down to 2%, over time".

Special Report

A Bullion "Moat" for Your Portfolio

In Q1 2023, precious metals bullion and equities showed strong YTD momentum, with gold closing above the psychologically important $2,000 per ounce mark and silver reaching $25. Gold/silver mining equities also posted notable gains.

Sprott Precious Metals Report

Gold Bulls Run Faster as Fed Tackles Banking Crisis

Gold posted a solid Q1 2023 gain of 7.96%, and is now up 21.38% from last autumn's low (9/26/22) following the most aggressive central bank purchases in decades and gold investment flows catalyzed by the U.S. banking crisis.

Sprott Gold Report

Is My Money Safe?

"The yellow metal has no counterparty risk (unlike all other financial instruments including bank deposits and government bonds), is highly liquid and has an unbroken record of retaining value in absolute terms and relative to financial assets."

Sprott Precious Metals Report

First Gold Dip Since Central Bank Buying Spree

Gold fell in February, closing the month at $1,827 in a correction characterized by a stall in buying, but not selling. Global central banks have been buying gold at record rates; more than three times their long-term averages.

Sprott Precious Metals Report

Strong China Demand Boosts Gold Rally

January was another positive month for gold bullion. We saw strong gold buying from China, with estimated tonnes purchased at the highest level since 2017.

Sprott Precious Metals Report

2023 Top 10 Watch List

This year’s top 10 list offers Sprott’s thoughts on what will likely drive markets in the coming year and decade, from a macro perspective and the vantage of our asset classes: Precious Metals and Energy Transition Materials.

Sprott Gold Report

Connecting a Few Dots

Gold was an effective hedge in 2022, returning -0.28% for the bear market year. The yellow metal outperformed the S&P 500 Index, which declined 18.11%. Gold mining equities also outpaced the S&P 500.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.