Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Special Report

Gold’s Post-Election Correction Comes as No Surprise

We see gold's post-election pullback as a healthy consolidation, affirming our bullish outlook. Post-election market dislocations, historically tied to political outcomes, may present a strategic buying opportunity in precious metals and mining equities.

Sprott Critical Materials Monthly

Batteries and Minerals Driving Global Electrification

Batteries and energy storage continue to underpin electrification trends, solidifying their role as a cornerstone in the global shift toward sustainable energy. Support is being strengthened by strategic investments from governments and corporations, and resilient demand for critical minerals like lithium, copper and nickel.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Q3 Precious Metals Report

Gold and Silver Enjoy Continued Rally

Gold and silver prices surged in Q3 2024, driven by central bank buying and macroeconomic factors. While gold experienced a historic price increase, silver's price was influenced by both its precious metal value and industrial demand. YTD through September 30, gold is up 27.71% and silver has gained 30.95%.

Sprott Critical Materials Monthly

U.S. Electricity Grid Remakes Itself to Meet Surging AI-Led Power Demand

Demand for electricity over the next decade will put pressure on the U.S. power grid to keep pace. New investment in power-hungry industrial facilities is driving demand, especially the data centers that support artificial intelligence (AI), U.S. reshoring initiatives and the steady electrification of the transport sector.

Sprott Gold Report

The Stage Is Set

We believe gold mining equities are poised for growth, as they remain undervalued despite rising gold prices. Western investors have largely ignored gold, but any shift has the potential to push gold prices higher, which will likely benefit miners. In our view, the current market displays the signs of an early-stage bull market.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Special Report

Gold Tops $2,500: A Technical View

Gold has surged above the psychological $2,500 level, driven by factors not easily explained by traditional market variables, suggesting possible central bank or sovereign activity rather than usual market dynamics.

Sprott Critical Materials Monthly

The Unstoppable Rise of Renewable Energy

Renewable energy is rapidly replacing fossil fuels as costs decrease and efficiencies improve with increased deployment, making it much cheaper than traditional energy sources. This shift, driven by the exponential growth of renewables, electrification, and efficiency, is expected to significantly alter global power dynamics as fossil fuels are phased out.

Special Report

The AI Revolution and Data Centers: A New Frontier in Energy Demand

Significant investments in AI-related tech stocks have helped push the S&P 500 Index to record highs this year. The rapid growth of AI is significantly increasing the energy demands of data centers, which is likely to lead to a surge in demand for critical materials.

Special Report

Lithium: Short-Term Opportunities for a Long-Term Trend

This might be an ideal moment to re-evaluate lithium miners given their potential to benefit as the global energy transition continues. The current dip in the price of lithium miners presents a potential short-term opportunity, given the strong future demand and supply imbalance.

Sprott Uranium Report

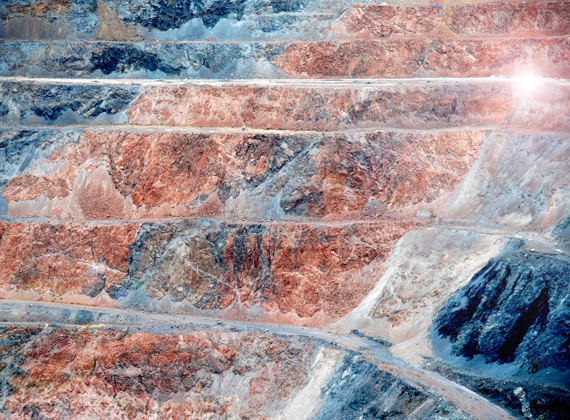

Uranium Case Strengthens

The uranium spot price has remained range-bound between $85 and $95 per pound, and ended the first half at $85.34 (June 30, 2024). Uranium miners fell in June, but bounced back in early July, outperforming the commodity YTD.

Sprott Gold Report

U.S. Dollar: Decline and Fall

Gold’s breakout may signify more than one might infer from the continuing lack of interest. Inflows into the precious metals mining space have the potential to generate compelling outcomes.

Sprott Q2 Precious Metals Report

Gold’s Record-Setting Quarter and Silver’s Resurgence

Gold gained 12.79% YTD by June 30, supported by central bank buying. Silver closed Q2 at $29.14, boosted by gold's breakout and global monetary expansion.

Sprott Critical Materials Monthly

Fourth Industrial Revolution Fuels Global Competition for Critical Minerals

The fourth industrial revolution (4IR) is driving unprecedented change. Its dominated by AI, robotics, IoT, genetic engineering and quantum computing. 4IR technologies need critical minerals, fueling a new commodity supercycle.

Sprott Uranium Report

Uranium Miners Lead Market Higher

YTD the uranium spot price has stabilized between $85-$95 per pound after an 88.54% rise in 2023, indicating a healthy correction in a bullish cycle. Uranium miners' performance improved, matching spot price gains.

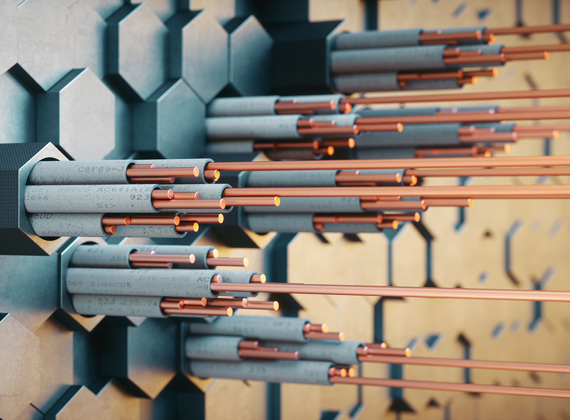

Sprott Critical Materials Monthly

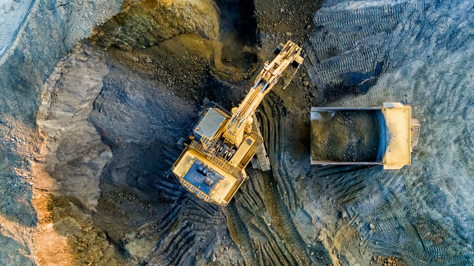

A New Copper Supercycle Is Emerging

The copper market is entering a new supercycle. Demand is surging as countries invest in clean energy and protect their access to copper, while supply is constrained by a lack of new mine development.

Sprott Silver Report

Silver’s Critical Role in the Clean Energy Transition

Silver is crucial in the shift to cleaner energy, vital for solar panels and EVs, which reduce greenhouse gases. New technologies like AI have increased demand, while overall silver supply has declined.

Sprott Critical Materials Monthly

AI's Critical Impact on Electricity and Energy Demand

The rise of AI and data centers will boost global electricity demand, challenging power grids but benefiting clean energy sources like nuclear. This trend will also increase demand for copper.

Special Report

The Case for Investing in Nickel Miners

Nickel's future is bright due to its role in net-zero goals. Stricter regulations and government support for EVs are driving demand, benefiting nickel mining companies in the long run.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global nuclear energy commitments make uranium a compelling investment. Despite a slight dip in spot prices, there's potential for growth.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

In March, the uranium market saw mixed results: spot prices fell, but miners' stocks rose due to a positive long-term outlook. We believe the uranium bull market has more room to grow.

Sprott Critical Materials Monthly

Battery Storage Is the Technological Cornerstone for a Sustainable Energy Future

The energy sector has experienced a remarkable transformation, primarily driven by the rapid growth and integration of renewable energy sources. Central to this transition is the advancement of battery storage technology.

Sprott Gold Report

What Does the Gold Price Breakout Mean?

The breakout in gold prices since February has been largely ignored by mainstream investors. Gold bullion’s breakout is significant in that it represents the positive resolution of a three-year consolidation.

Sprott Q1 Precious Metals Report

Gold Is on the Rise and Reaches All-Time High

Gold reached an all-time closing high and is up 8.09% YTD (as of 3/31/2024) after rising 13.10% in 2023. We believe several factors are in place for gold to move higher, such as strong central bank buying.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. News from Kazatomprom and Cameco reinforce uranium markets' structural supply deficit.

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was lackluster for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment surged to an unprecedented $1.77 trillion.

Special Report

Copper: Wired for the Future

The demand for copper in energy grids, electric vehicles and clean energy technologies, combined with diminishing ore grades and limited inventories, underscores copper's growing importance.

White Paper

Copper: The Red Metal's Central Role in Powering Our Net-Zero Carbon Future

In the U.S. alone, copper is a crucial element in nearly 7 million miles of electrical wires. This white paper introduces the trends that are driving copper markets and copper miners, and explains our positive outlook.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January, fueled in part by Kazatomprom's cut in guidance for 2024 production. Junior uranium miners were top performers , climbing 18.78%.

Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this is a fundamental transformation powered by the fall in renewable energy costs.

White Paper

Unearthing Opportunity: Uranium Miners and the Global Clean Energy Transition

Energy infrastructure and commodity markets are coming into high focus. A new wave of technological changes geared towards higher energy efficiency is underway. We believe that nuclear energy and uranium miners are poised to benefit from this shift.

White Paper

A New Era: How Critical Minerals Are Driving the Global Energy Transition

Critical minerals are essential for the global energy transition as we gradually phase out CO2-intensive energy sources with cleaner sources, including nuclear, solar, wind, hydro and geothermal energy and greater use of electric vehicles (EVs).

Sprott Gold Report

Gold Mining Stocks, A Clear and Compelling Investment Case

Gold mining equities offer a compelling value case. Patience is key as investors recognize their long-term attraction.

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.