Sprott Radio Podcast

The Yin and Yang of Tech and Gold

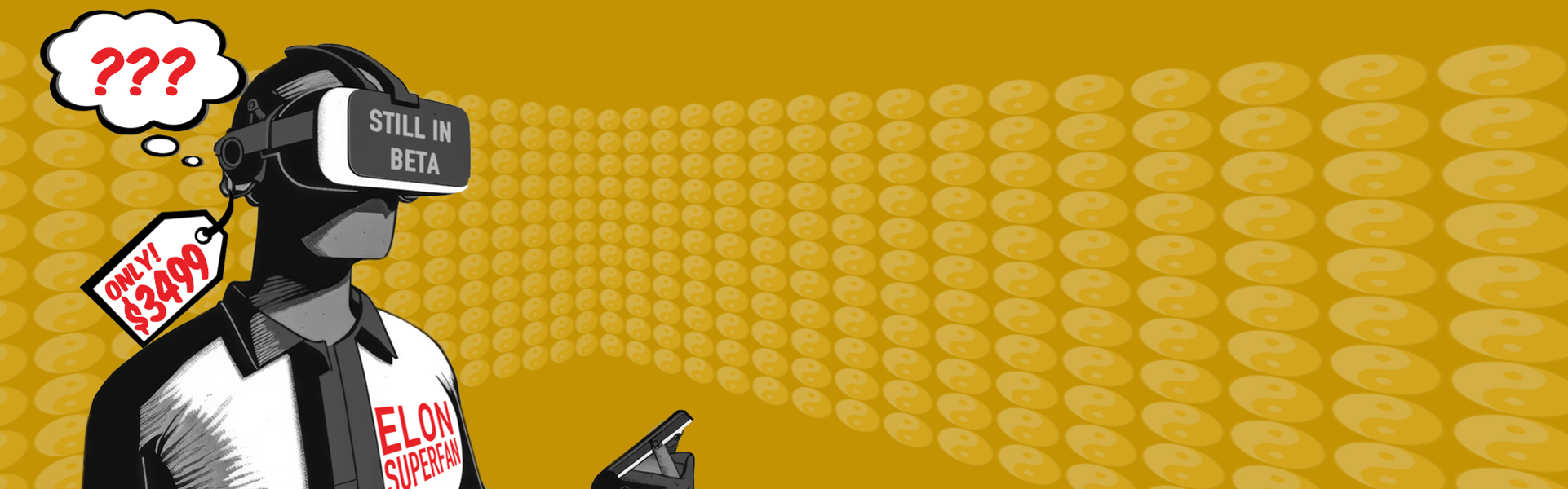

With the Fed pausing on interest rates following its June 13-14 FOMC Meeting and technology stocks looking a tad crowded and pricey, it’s time to check in with our friend Fred Hickey. We tap Fred’s 45+ years of investing in tech and gold stocks to understand their counterbalancing relationship.

Podcast Transcript

Ed Coyne: Hello and welcome to Sprott Radio. I'm your host Ed Coyne, senior managing partner at Sprott Asset Management. I'm pleased to welcome back Fred Hickey, editor of The High-Tech Strategist newsletter. Fred, thank you for once again joining Sprott Radio.

Fred Hickey: My pleasure.

Ed Coyne: Fred, in your most recent newsletter titled 2000 Deja Vu, you look to history as your guide. I'd like to jump into it and start with a postgame analysis of the most recent Fed pause. What do we see there? What are you thinking?

Fred Hickey: Usually, the Fed is pausing for a reason. The reason is that there's some trouble on the horizon. Inflation has come down quite a bit from 9% to 4%-5%, depending on what number you're using. It's not at the Fed’s target level of 2%, but there's a lot of tightness. There are a lot of other things that are tightening in the economy in the U.S. as well. No more “stimmy” checks; those are the stimulus checks they sent out. Tax refunds are down quite a bit.

Students haven't been paying any money on their loans for a couple of years since COVID, and late August is going to start at $393 on average per month. SNAP benefits, which are food stamp benefits, have been reduced significantly. All of these things are starting to have an impact. If you listen to the conference calls of all the major retailers from Walmart, Costco, Amazon and Target, they all say the same thing. They're seeing a slowdown first of all, but it's in discretionary spending. People are spending more on food, partly because of inflation, and shifting their spending away from discretionary items.

There are all these indications that the economy is slowing. I think we're on the cusp of a recession right now, if not already in one. There's a group called the NBER (National Bureau of Economic Research), which will officially make that designation, and they usually do it in hindsight months later. I think we're heading in that direction. Then it won't be long then after that. That's typical in history when the Fed goes from hiking to pausing to cutting rates. That will have a lot of implications.

With inflation as high as it is, the Fed may have to drag its heels a bit. That's why I think it'll take us some months to get to the cutting interest rates period. A stock market decline of significance in the fall would most likely trigger a cutting phase.

Ed Coyne: It seems like there's a lot of smoke and mirrors going on right now. Not intentionally, but it just seems to be the byproduct of what's happening. Some people are announcing the Fed's getting it right. There's a soft landing happening, but to your point, several metrics are pointing in the opposite direction. I'm not sure investors are really paying attention. Let’s look at the technology sector and briefly discuss the big seven. What does that mean; who are they and how healthy are they?

Fred Hickey: The big seven are your largest-cap tech stocks. They're also called “The Magnificent Seven”. I think Cramer may have dubbed them that. They are Apple, Microsoft, Google, Meta Facebook, Tesla, Nvidia and Amazon. They are the tech companies with the largest market caps from Apple at almost $3 trillion to Tesla.

I just talked about the economy not doing well. The end markets aren't doing well, and the businesses for these companies aren't very healthy. One example is the semiconductor stocks index. Semiconductor sales worldwide as reported by the Semiconductor Industry Association, which just released numbers about a week ago, are declining at the fastest rate since the 2009 recession, down 22% year-over-year. Sales are the worst they have been since 2009, and that was a pretty bad recession.

The SOX index [PHLX Semiconductor Sector Index] is up 50% year-over-year. I've never seen anything like this. I've never seen a disconnect this great between reality, the biggest decline in sales since the 2009 recession, and then this 50% increase in semiconductors. If we look back and talk about super bubbles, in the 1929 market, the big stock was Radio Corporation of America (RCA). It went up 10 times during the 1920s roaring stock market. Then it dropped 97%. But there were 10 rallies of more than 10% or more during that great bear market of 1929 to 1932, and the average was 23%.

In the 2000 market bubble, there were 16 double-digit rallies. Again, they averaged 23% for those 16. It’s like human nature never changes. The stock symbols change. The names change, but the actions of investors never do. It’s always driven by fear and greed. We’re in the greed stage again here, even as end markets deteriorate for technology companies. Smartphones were growing two years ago, in Q1, they were growing at 26%. Where are they now? Negative15%. We’ve gone from +26% to -15% year-over-year, so negative growth, massive decline. Yet Apple was at a record high yesterday. It’s unbelievable.

Apple was growing at 33% back two years ago, then it fell to 8% last year, and last quarter, their revenue growth was negative 4%, and the guidance going forward is negative as well. We have negative growth, yet Apple has gone up 50% this year as the end markets have deteriorated significantly. There’s no great story here, it’s that Apple’s not very well placed in its product cycle. Their last big upgrade cycle was about three years ago, and the contracts are all but done. That was 5G. They have the iPhone 15 coming out in September, but it’s a nothing burger. They’ve run out of colors, so instead of just a red color, you can have a darker red color. They have minor improvements in processing speeds and a periscope for the highest end, but there’s really nothing there.

That’s why you haven’t really heard about the iPhone 15. There’s nothing to drive this. The economy’s turning down, Apple’s numbers have been declining, and yet they keep driving the stock higher and higher and higher. We’ve seen this before. Bob Farrell of Merrill Lynch, a famed technician, said that markets are strongest when they’re broad and weakest when they’re narrow. It’s down when they’re down to a handful of stocks, and that’s exactly where we are today. Apple is up 50%, and Microsoft was up 46%. What's happened to Microsoft’s revenue growth? It hasn't gone negative, but it's gone to single digits from high double-digit growth.

Meta and Google were down to 2% revenue growth last quarter, 2% from what was high double-digit growth. These big seven I talked about are all seeing major declines except for Nvidia. Amazon, same thing, single-digit growth. Even their AWS [Amazon Web Services] business was disappointing for the last few quarters. They're all seeing huge declines in their numbers, and it's not reflected in the stocks. The stocks are all up massively because of the crowding effect, or what they call the FOMO, fear of missing out.

Investors have to be in these names, or they're going to underperform, and money managers can't underperform. That's why human nature doesn't change, and it's always the same. They all have to be part of the crowd and they're forced to.

Ed Coyne: At what point are you not investing in growth anymore, or opportunity, you're simply just chasing the dollars higher? In your estimation, what will be the thing that finally says, "You know what? I'm not buying anything, I'm just chasing the number?"

Fred Hickey: It's certainly not the numbers that are being reported by the companies. What is it? It's one word, liquidity. It was the tightening in 2022 that caused the stock market to decline so much. Then it was the liquidity that came in from not issuing any Treasuries and taking the TGA [Treasury General Account] down, and that's an injection of money into the system.

The other thing was that post the banking crisis that occurred in March [2023] when Silicon Valley Bank and Signature Bank blew up. The Fed then took its balance sheet and injected money into the system to support the banks, and the balance sheet went back up. It had fallen from $8.9 trillion to $8.4. It went back up during the March timeframe, back almost to $8.9 trillion, and now it's falling again because QT [quantitative tightening] is ongoing, and some of that liquidity the Fed had put in for the banks is coming out.

There was a huge liquidity injection in the first half of the year, and now there will be a huge liquidity outflow. The liquidity outflow, I think, will have the same impact it did last year or will have a resumption of the bear market. Now, it could take a little time. This week was the first week and the [Department of the Treasury] issued almost $300 billion worth of mostly Treasury bills and some 3s, 10s, and 30-year bonds. This is the first week, and that was a mixed result in the first big auction.

We could see failed auctions here as we go forward, as things tighten, tighten, and tighten. I didn't mention that the banking system or half of our U.S. banks are technically insolvent. They bought too many bonds when all that money was injected, and now they have too much and they're trying to sell them as well. There's now tightening as a result of banks not lending as much. You have 20-plus percent interest rates on credit cards. You have bankruptcies rising. Close to 300 corporations have gone bankrupt already, the biggest since the 2009 recession timeframe.

There is this tightening that's going to happen now in the second half. That's why I think this will culminate in some September or October event we've seen many times in history. Liquidity will be the driver, not the numbers. The numbers are falling apart already.

Ed Coyne: What about the investor? They either have to stay invested in the market or try to dollar cost average into the market. At Sprott, we're a precious metals and real assets firm. We talk about precious metals as a low-cost liquid hedge to a portfolio. You often talk about gold and gold equities in your newsletter. If you have to stay in the market and try to grow your wealth over time, but you're at this moment in time short of going all to cash, what are some of the things you would recommend? How can you diversify your portfolio right now?

Fred Hickey: You want to avoid technology stocks at all costs until the bubble breaks. But the value area, for example, the energy sector is an area where the valuations are very low even though they had a great run in 2021 and 2022. I was there, and I reduced them because I was concerned about what's happened, which that there would be a concern about the economic slowdown and demand destruction for the oil demand, which would lead to energy stocks declining, which they now have.

One of the things I look at in the energy area is the managed money which is where hedge funds are positioned and CTAs [commodity trading advisors] are positioned. So commodity traders are now down. Usually, energy does well in bear markets. In the 1970s, for example, it was a very poor decade for stocks. Of course, it was a great gold bull market because gold does better than anything in these downturns, but energy did very well at that time because they were cheap. They pay big dividends and have very low P/Es [price-earnings ratios], making energy a great place to be in.

There aren't many plays, but uranium would be another one because the dynamics of that industry are very positive going forward. And an area I don't deal with, emerging market stocks and international stocks are also cheap relative to U.S. equities. The U.S. economy accounts for about 24% of world GDP, but it's 55% of total stock market valuation. You could see what's happened. All the money has gone into the U.S. and it's not gone into emerging or international markets. There are many places to invest outside of the big Magnificent Seven.

Ed Coyne: Let's shift to the gold story. You briefly mentioned that gold's one of those assets that does well in this environment. You do a lot of research on the physical metal itself, the underlining mining stocks, and commodities in general. We've heard the term "supercycle" being thrown around. I'd love to get your view on that. Let's start with the yellow metal first and allocating to physical gold.

Fred Hickey: Gold does well when stock markets do not. There was a great gold bull market in the 1970s and it was a terrible decade for stocks. Then you had the 20-year bull market that culminated in the 2000 tech bubble. There was a 20-year bear market for gold. Then you had the 2000s decade, which was called the Lost Decade for stocks. Then gold had a terrific time, up 600%+, silver up 900% and the miners up 1,700% over that 11-year timeframe.

Here we are now. I think we will have another downturn in the stock market from this bubble of very high valuations. I think that you'll see the same, I call it a yin yang where gold does well when the stock market doesn't do well, and of course, that's usually because you're in a recession and you have trouble in the world. There's turmoil and people gravitate to gold. One fact, and Sprott knows it, is that gold has been up since 2000 at a bigger pace than the S&P 500, including dividends.

Even in this period. Yesterday is a good example of how gold isn’t reacting negatively to the two events. Last year, for example, interest rates were rising dramatically and gold didn’t fall. Last year, the U.S. dollar was very strong and gold didn’t fall. It was a very strong performance for gold. Then yesterday, we just had the Fed pause [June 13-14 FOMC], but very hawkish talk. The market was embedding in two more rate hikes as a result of that hawkish talk. Now that could have been a trigger for a sell-up. I was braced for it, but it didn't happen. Gold went down yesterday and then rallied today. I have an explanation for why.

Ed Coyne: Yes. Why do you think that is? Because it does seem like gold’s doing its job. It’s not making headlines. People don’t really care, but last year alone, it was basically flat. The S&P 500 was off, high teens, and it didn’t really get a lot of notice from investors. Year to date, gold is doing its job again. It’s positive for the year even though the market’s rallying and everyone’s talking about tech. Why do you think people aren’t really paying attention to gold just yet?

Fred Hickey: There are two separate buyers here. There are U.S. and Canadian buyers, and both are pretty much non-existent with gold right now. The focus in the U.S. is all about the Magnificent Seven and chasing those tech stocks. That's where all the money is flowing. Then there are the physical buyers. The physical buyers aren't in the U.S. They're overseas. They're in China and India. We are seeing massive buying and that’s where you're getting your flow. Last year you had 1,343 tonnes of gold go into China imports, and it was up 64% year-over-year. The first quarter of 2023 almost 300 tonnes went into China.

You had central banks buying around the world. That was 1,136 tonnes last year and it represented a record amount. It's obviously China's buying, which was buying even when it said it wasn’t buying; they just didn't report it. You had all sorts of central banks that have been buying, and it's not just BRIC-type countries [Brazil, Russia, India and China]. India continues to buy, and it bought quite a bit last year. You have Middle Eastern buyers. Egypt bought 50 tonnes last year. UAE has been buying a lot of gold from Russia. Qatar has been buying.

Saudi Arabia doesn't report, but I'm sure it’s buying because they do what China does every few years. They'll say, "Oh, we were buying 400 tonnes and we just hadn't told you." They're doing that again, I'm sure.

Then also other non-Eastern countries like Poland, for example, bought 15 tonnes. Singapore, which is very friendly to the U.S., bought 69 tonnes in the first quarter. We have all of these central bank buyers. Central banks used to only account for 8% to 15% of world gold demand, yet it is close to 25% now. They've taken up the slack from the Western buyers. All the money that's flowing out of the ETFs has been taken up by Eastern buyers.

In China, it's not just central bank buying, it's also the average person. If you look at where their wealth is, 80% of it is in housing, and obviously, that's been a bad place lately. China has a gigantic housing bubble and prices have been falling there. Their stock market is doing very poorly too. It's young people in China that are buying gold. The biggest buyers in China are aged 25 to 34. The next biggest buyers are the 34 to 45 level. What these people are saying is, "Well, gold's outperforming. It's outperforming the stock market." Whereas it's not really outperforming here in the U.S., there is no Magnificent Seven in China, so gold is outperforming in China.

They know that the Chinese economy has been very weak and they haven't gotten the bounce that they thought they were going to get early this year. Just like here, gold is of interest when things aren't going well, and it's not going well in China. You have all this buying going on around the world, physical demand and I think that is giving us those gold price higher lows over and over again even though there's been this exodus of money that's come out of gold. There are really virtually no positions here among Western investors.

Now, Western investors do come in. They're the ones that drive the gold bull market moves, the big moves. They currently have no positions, but they will, but when will they? If you go back to 2000, the buyers didn't come in until 2002. It wasn't until the bear market that they really knew we were in trouble. Meaning that U.S. investors knew we were in trouble and the stock market was dead, and they capitulated. Then the money started pouring into gold. Usually, it's the Western investors who'll drive the market to its top. We are not there yet, but Western investors will come in when the stock market declines.

Ed Coyne: Fred, we could spend another two hours just having these conversations. You have so much great intel. I know you do a monthly newsletter. I know people would love to hear more from you. I've always told people, I encourage you, on all of our guests, to really follow up. You have a wonderful following and you accept emails at thehightechstrategist@yahoo.com. I love that you have Yahoo.com. You don't hear that too much these days. It just shows how long you've been around doing this, which is fantastic.

Fred Hickey: At least I don't have an AOL account. What happens is my trusty assistant will send out all the details.

Ed Coyne: Wonderful. The most recent piece, 2000 Deja Vu, was chock full of information. Always a pleasure to have you on and to read your newsletter. I really appreciate you taking some time to speak with us once again.

Fred Hickey: That's been my pleasure.

Ed Coyne: Well, once again, my name's Ed Coyne, and thank you for listening to Sprott Radio.

For our listeners who'd like to learn more about Sprott and our full suite of uranium opportunities, both on the physical side and the equity side, as always, we encourage you to visit us at sprott.com. That's S-P-R-O-T-T.com. Per, once again, it was really great to have you on, and enjoy some much-earned time off.

Per: Thank you very much, Ed. Any time. I'm always happy to come back.

Ed: Thank you. Once again, I'm your host, Ed Coyne. As always, thank you for listening to Sprott Radio.

Important Disclosure

This podcast is provided for information purposes only from sources believed to be reliable. However, Sprott does not warrant its completeness or accuracy. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument.

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal. Furthermore, no asset class provides investment and/or wealth “protection”.

Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments, or strategies. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein.

While Sprott believes the use of any forward-looking language (e.g, expect, anticipate, continue, estimate, may, will, project, should, believe, plans, intends, and similar expressions) to be reasonable in the context above, the language should not be construed to guarantee future results, performance, or investment outcomes.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Sprott. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitute your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Sprott.

©Copyright 2025 Sprott All rights reserved