Sprott Radio Podcast

Gold The Original Alternative Asset

For the first episode of our new podcast Sprott's Ed Coyne discusses how gold can function as a non-correlated alternative asset within an investment portfolio.

Podcast Transcript

Ed Coyne: Welcome to Season 1, Episode #1 of Sprott Gold Talk. I am Ed Coyne, and I'll be your host today talking about precious metals, specifically physical gold. People often think about physical gold as a non-productive asset. Today, we will talk about how to make physical gold a productive asset within a diversified portfolio. For those who aren't familiar with Sprott, I will explain who we are as a firm and then pivot right into today's topic, physical gold.

Sprott is a unique firm in that we focus primarily on precious metals, whether it's the physical market, the equity market or the lending market.

As I mentioned, gold can be approached in several ways from an investment standpoint, whether it's the physical market, equities on the small-cap/junior mining side or the large-cap/senior mining side, or even raising capital and loaning it to mining companies for operating leverage. There are many ways to invest in this space, but first, I will focus on why simply allocating the physical gold market is essential.

Ed Coyne: Investors often think about physical gold as just a yellow rock on a shelf and nothing more. They don't see it as a productive investment asset. Gold bullion doesn't pay a dividend. There are no earnings, no income, no management. Gold just sits there.

One of the most famous investors out there, Warren Buffett, notoriously talks down gold in his annual shareholder letters and sometimes for good reason. What does gold do?

Unlike an asset that you can technically "set and forget" ― like a stock of a company that pays a dividend and has earnings and so forth ― gold is different in that you have to manage that allocation to make it a productive asset.

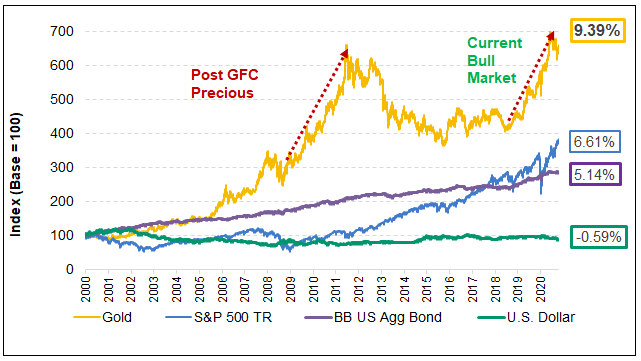

Ed Coyne: If you look at gold's performance over the last four-plus decades, gold has served as one of the better diversifiers in a portfolio. Gold is liquid, it's low cost, and it has produced quite nice returns for investors, particularly when you're looking at gold relative to other assets. Over the past 20 years, in what I call the "modern era of gold investing," it has been one of the best performing assets out there.

Figure 1. Gold vs. Stocks, Bonds and USD

Returns for Period from 12/31/1999-12/31/2020

Source: Bloomberg. Period from 12/31/1999-12/31/2020. Gold is measured by GOLDS Comdty: S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Curncy. You cannot invest directly in an index. Past performance is no guarantee of future results.

Ed Coyne: But the reason for owning gold is really what people need to think about as investors. If you get caught up on the idea that gold doesn't pay a dividend, if you get caught up on the idea that there are no earnings, if you try to compare gold to a typical large-cap company in the S&P 500 Index, you will typically not invest in gold because you are comparing an apple to an orange. But suppose you think about gold not as a commodity but as a true alternative asset. In that case, the potential opportunities start to widen on how to think about gold in a portfolio.

We like to say at Sprott that "gold is the original alternative investment." And what we mean by that is when you look at gold over the last four-plus decades, since it has been able to trade freely in the open market in the U.S., gold has a history of performing differently than stocks and bonds over multiple market cycles.

Ed Coyne: 2020 was just another reminder of gold's ability to provide diversification within a portfolio. We have been seeing this positive shift since the fourth quarter of 2015, when the Federal Reserve attempted to tighten interest rates. Before that, during the Global Financial Crisis of 2008, gold, yet again, served as a wonderful diversifier. When you look at gold over the last 20 years, gold's been a fantastic diversifier in a portfolio and delivered notable returns.

Now, how do you make an asset like gold that simply sits on a shelf productive? How do you put it to work?

You have to manage that allocation. For example, suppose you decide that you will have a 3-5-10% allocation to the physical market as a diversifier in your portfolio. In that case, you have to be mindful of that weight and rebalance it over time. Whether that's every quarter or on an annual basis, depending on the investment account's tax sensitivity, you have to review the portfolio. Last year, gold outperformed the S&P 500 Index, so you would consider trimming back your gold allocation to the desired weight. If you are targeting a 5% gold allocation and it grows to 6%, you would trim that position. Conversely, in years where the S&P 500 Index has outperformed gold, and your 5% gold allocation shrinks to 4%, you would think about adding to your gold allocation to build it back to 5%.

Ed Coyne: Over multiple market cycles, if you manage your physical gold allocation, you are taking a "non-productive asset" and making it productive. You would typically sell gold when it is working and you buy gold when it's selling off relative to the rest of your portfolio, not in absolute terms, but in relative terms. That is the way to make physical gold a productive asset in a portfolio. You'll find over time when you do that gold will be one of your better-performing assets as a diversifier.

Before you go down the path of a "2 and 20" or a "1 and 10" alternative asset strategy through a hedge fund and invest in a product that in some cases is very hard to understand and very hard to articulate to your shareholder base, think about gold as a straightforward, simple, low cost, liquid way to get a portion of your capital outside the traditional markets and into a different part of the market that has a history of performing differently.

I just wanted to get a message out there that physical gold is a true alternative for today's podcast. Physical gold can be a productive asset if you put it to work. For those that want to be more opportunistic, you can always look at the gold equity story. There are certainly times when you want to own gold stocks, and there are times when you don't.

Ed Coyne: We believe that we're in a phase of the market today where you want to own both gold bullion and gold equities because of the overall narrative in the marketplace. We all know we are going to be in an environment of lower-for-longer interest rates. We all see that money is being printed daily, which is very supportive of gold.

We encourage you to tune in to our next episode to hear more about gold mining equities. Thank you for listening.

Important Disclosure

This podcast is provided for information purposes only from sources believed to be reliable. However, Sprott does not warrant its completeness or accuracy. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument.

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal. Furthermore, no asset class provides investment and/or wealth “protection”.

Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments, or strategies. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein.

While Sprott believes the use of any forward-looking language (e.g, expect, anticipate, continue, estimate, may, will, project, should, believe, plans, intends, and similar expressions) to be reasonable in the context above, the language should not be construed to guarantee future results, performance, or investment outcomes.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Sprott. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitute your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Sprott.

©Copyright 2025 Sprott All rights reserved