Investment Team

Maria Smirnova, MBA, CFA

Managing Partner, Sprott Inc. and Senior Portfolio Manager & Chief Investment Officer, Sprott Asset Management

Managing Partner, Sprott Inc. and Senior Portfolio Manager & Chief Investment Officer, Sprott Asset Management

Maria Smirnova is Managing Partner, Sprott Inc. and Senior Portfolio Manager & Chief Investment Officer, Sprott Asset Management. She has over 20 years of investment experience. She first joined Sprott Asset Management LP in 2005 as a research associate supporting the metals and mining team. She currently serves as Lead Portfolio Manager of the Sprott Silver Strategy, Co-Portfolio Manager of the Sprott Global Gold Strategy and Portfolio Manager of Sprott Active Gold & Silver Miners ETF (GBUG). Maria is also a Portfolio Manager on the investment team for Sprott Gold Equity Fund (SGDLX). Prior to joining Sprott, Maria served as a Product Development Analyst at Fidelity Investments. Ms. Smirnova holds a Master of Business Administration degree and a Bachelor of Commerce degree from the Rotman School of Management, University of Toronto. She has been a CFA® charterholder since 2002.

Insights by Maria Smirnova

Interview

Sprott CIO on Gold/Silver Miner Selection and Silver Outlook

James Connor of Bloor Street Capital speaks with Maria Smirnova, Sprott CIO, about the firm’s approach to gold and silver miner selection. Smirnova remains bullish on silver, citing a deep supply deficit and its essential role in electrification, despite prices lagging gold due to weak central bank demand and stagnant supply.

Interview

Gold & Silver Forecast 2025

Sprott CIO Maria Smirnova and Rick Rule discuss key drivers for gold and silver in 2025. They emphasize central bank buying, Eastern demand and the erosion of purchasing power as major factors for gold. For silver, industrial demand, particularly from solar and EVs, is crucial.

Silver Report

Silver's Impressive Strength in 2024

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Topics: Silver

Interview

Core Conversations on Silver Featuring Maria Smirnova

Chief Investment Officer Maria Smirnova talks silver with Mark Bunting of Red Cloud Financial Services, RCTV LIVE. Maria takes a deep dive into what is providing support for silver in 2024, which is up 21.90% as of July 31, 2024.

Topics: Silver

Sprott Silver Report

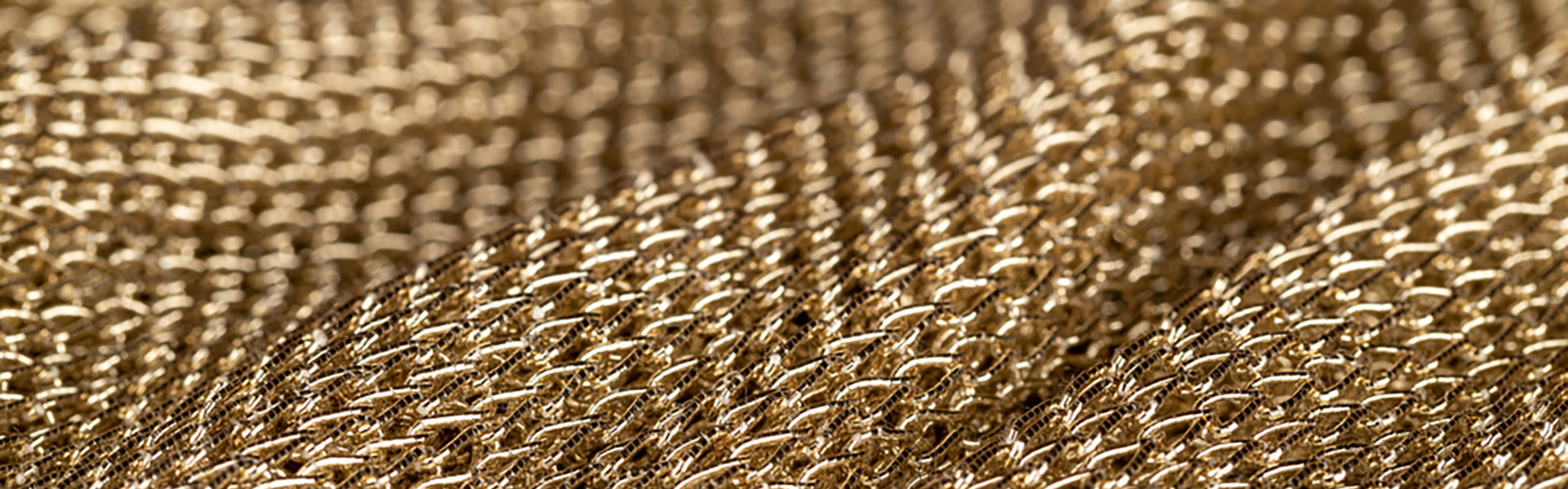

Silver’s Critical Role in the Clean Energy Transition

Silver is crucial in the shift to cleaner energy, vital for solar panels and EVs, which reduce greenhouse gases. New technologies like AI have increased demand, while overall silver supply has declined.

Topics: Silver, Critical Materials

Sprott Webcast Replay

Gold and Silver: Precious Metals On the Move

Replay our webcast on gold and silver with John Hathaway and Maria Smirnova. Gold is supported by central bank buyers like China, while silver benefits from increased demand for PV solar panels.

Topics: Gold, Silver, Critical Materials

Sprott Webcast Replay

Looking Ahead to Metals and Miners

2022 has been a difficult year for many asset classes. Markets were historically volatile, with higher-than-expected inflation, quickly rising interest rates, the Russia-Ukraine war and the threat of a global economic recession.

Interview

Red Cloud Summer Silver Conference 2022

Maria Smirnova is interviewed by Taylor Combaluzier, Red Cloud Financial Services. Maria joins Tavi Costa, Crescat Capital LL. and Peter Krauth, Author of "The Great Silver Bull".

Topics: Silver

Sprott Silver Report

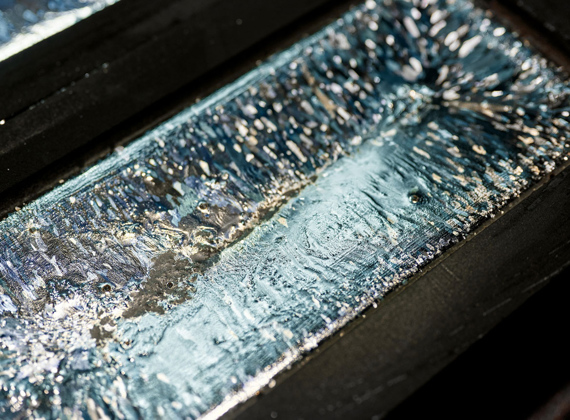

Silver Demand and Supply Trends to Watch

Silver is historically undervalued relative to gold and offers an attractive investment opportunity. Silver market fundamentals are strong, given that declining supply trends cannot keep up with rising, longer-term demand.

Topics: Silver

Sprott Silver Report

Silver's Clean Energy Future

Silver climbed more than 47% in 2020, reaffirming its value as a safe haven portfolio asset during the COVID pandemic. But our bullish outlook for silver is based on its unique role as an industrial metal. Silver should be integral to any "green revolution" discussions, given that it is critical to the success of EVs, solar energy and 5G cellular networks. We believe that silver demand will likely explode in the next 10 years, and we don't foresee supply growth keeping pace.

Topics: Silver, Critical Materials

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.