Reasons to Own

Sprott Physical Gold and Silver Trust

Sprott Physical Gold and Silver Trust

Sprott: Raising the Bar in Precious Metals Investing

Managing precious metal investments for more than 40 years

Transformed the Central Fund of Canada in 2018

Serves over 250,000 clients and manages US$31.5 billion*

*as of 12/31/2024.

6 reasons why investors should own CEF

1 Fully Allocated

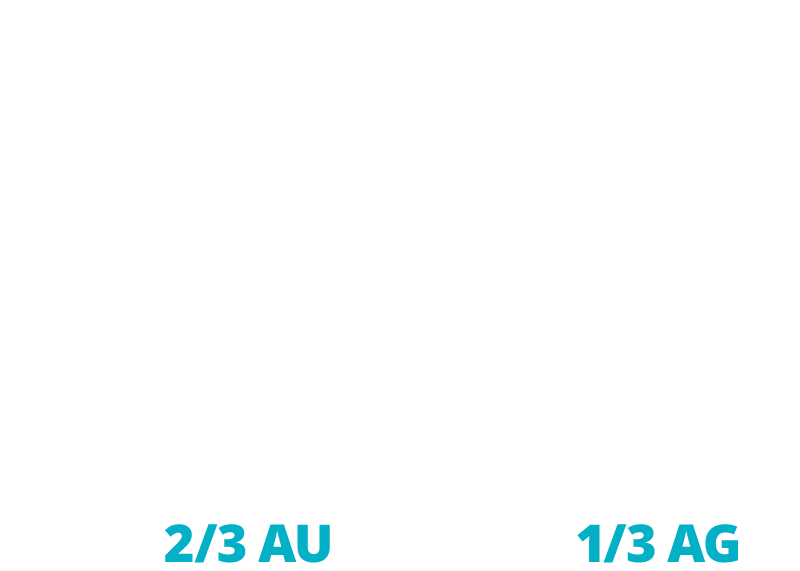

Every 100 shares* of the Trust is equal to owning:

Bullion in the Trust is 100% allocated and unencumbered with no exceptions

Total Gold and Silver Held in the Trust*

$ 3.44 billion 1.310 million oz Gold

$ 1.57 billion 54.412 million oz Silver

2 Redeemable for Metals

The Royal Canadian Mint will facilitate the delivery of bullion bars to almost anywhere in the world

via an Armored Transportation Service Carrier – and all physical redemptions are equal to 100%* of the net

asset value (NAV) per unit.

* Minus redemption and delivery expenses, including the handling of the notice of redemption in the applicable

bullion

storage-in and

-out fees. Subject to certain minimum requirements.

3 Trustworthy Storage

Sprott Physical Gold and Silver Trust

Bullion Banks

4 Potential Tax Advantage

5 Easy to Buy, Sell and Own

Sprott Physical Gold and Silver Trust Benefits

Average volume of US$8.6 million traded per day*

Buying Physical Bullion Downsides

6 A Liquid Investment

The proceeds from selling your Trust units are deposited to your brokerage account two business days after the trade date (T+2).