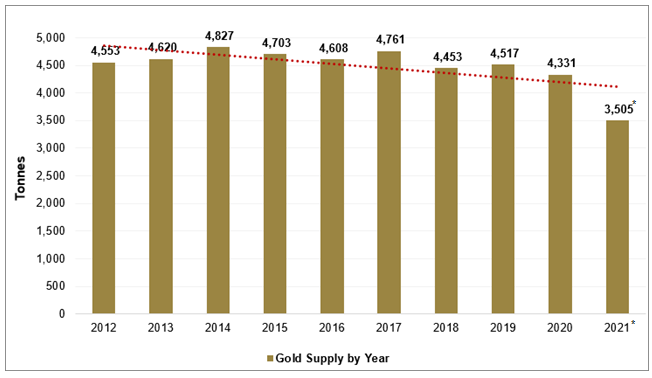

Shrinking mine supply, robust physical demand, minuscule interest rates and the advent of problematic inflation failed to generate an advance in the gold price in 2021. Gold bullion declined 3.64% in 2021, while gold mining stocks fell 9.25%.1 What stymied interest in precious metals over the past twelve months was the lure of strong equity market returns, the prospect of tighter monetary conditions and an infatuation with all things crypto. We expect things to be different in 2022.

The bullish setup of supply and demand for the physical metal will, in our opinion, start to attract notice. We expect mine supply to continue its inexorable decline, as shown in Figure 1. Based on past history and our experience, a 25% rise in the gold price ($400-$500/oz.) would not significantly increase global mine supply for at least three to five years. Investment capital to build new production remains too scarce and economically viable projects are too few to significantly change the likely path of world production. The footprint of safe jurisdictions in which to invest dwindles with each lurch away from the rule of law in locations with good geology and mining infrastructure.

Many Latin American, African and Asian countries previously considered mining friendly have become less welcoming to extractive industries of any stripe. The capital required to build new capacity bloats from cost inflation, increased regulatory risk and stretched timelines to complete construction. Mining companies, on balance, are not in an expansionary frame of mind.

Figure 1. Gold Supply by Year (2012-2021)

Source: World Gold Council. *Represents the first nine months of 2021 only. Included for illustrative purposes only.

Asian Demand for Physical Gold has Surged

While the prospect for supply growth flags, demand is turning robust. Asian physical demand gained momentum in the most recent quarter. India's gold imports in 2021 have risen to a six-year high.

Figure 2. India's 2021 Gold Imports Hit Six-Year High (2014-2021E)

Sources: The World Gold Council (2014-2020), Metals Focus Ltd. (2021 Estimate). Included for illustrative purposes only.

Through September, China's demand had surpassed the total for all of 2020 and could exceed the pre-COVID total of 2019.2 Indian and China accounted for 1,240 tonnes or nearly 60% of world jewelry demand and 25% of total global gold demand in 2021, according to the World Gold Council. The accelerated rate of the last four months from India and China alone could lead to a 15% demand increase for 2022. At the very least, Asian physical demand has historically tended to put a floor on downside price risk for gold.

Liquidations of gold-backed ETFs, the largest since 2013, have so far masked resurgent Asian demand. In 2021, total ETF outflows represented US$9 billion. We believe that a diminution, or positive turn, in gold-backed ETF liquidations combined with strong Asian demand would overpower the predisposition of macro traders to short the metal on every threat by the Federal Reserve ("Fed") to jack up interest rates. This combination also means that a potential new high in the gold price (surpassing its August 2020 high of $2,064) would come as no surprise.

Figure 3. Gold-Backed ETF Flows vs. Gold Price (2019-2021)

Source: World Gold Council Gold Hub as of 12/31/2021. Included for illustrative purposes only.

Expect Possible Gold Reset in 2022

The instance of a strong supply and demand setup for physical gold is not unprecedented and over the past twenty years, it has not necessarily guaranteed a positive price response for the metal. In fact, the average gold price rose 27% in 2020 against a backdrop of COVID-induced weak demand, versus a decline of 16% in 2019.

The reason is gold's unique stock-to-flow ratio in the world of commodities. Above ground supplies of readily marketable bullion (including London vaults, Comex warehouse stocks, global ETF holdings, etc.) as of December 2021 amounted to 14,100 tonnes or roughly four times global mine output. In U.S. dollars, above ground marketable gold stocks equate to a mere $816 billion, a rounding error in comparison to global investable assets tabulated by Institutional Investor at $250 trillion as of June 2021, and approximately the same as Bitcoin's market capitalization of $791 billion calculated by Infinite Market Cap. In light of the twin macro miscalculations by the investment consensus, which includes the already apparent "inflation is transitory" slip up and the likely to be evident "economic growth will continue into 2022" expectation, there is good reason to expect a significant reset in the gold price.

What catalyst would lead to a repricing of the $816 billion of marketable gold relative to the $250 trillion of investable assets? In our opinion, the number one candidate would be the onset of a bear market in equities. As we noted in our October 18, 2021 commentary (It's Show Time for the Fed): "Unshakeable confidence in the Fed's stewardship of the financial system and the economy has been the anchor for the bull market in financial assets."

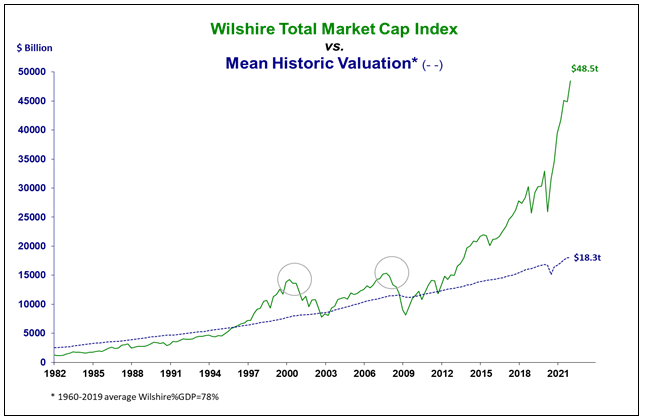

Equity Markets Poised to Falter

But what could possibly cause a bear market and when? Our answer: Extremes in valuation, speculation and indebtedness. All three seem intrinsic to the manic investment psychosis of the metaverse. Valuations stand at indisputable, well-documented nosebleed levels. The S&P 500 Index3 has traded above its current valuation of 23 times forward P/E (price/earnings ratio) only 10% of the time, prior to the 2000 dot-com crash and now in the current market.

Figure 4. The Market is "Levered-Up Absolute Perfection Infinitely into the Future"

Source: Stephanie Pomboy, MacroMavens as of 12/31/2021. You cannot invest directly in an index. Included for illustrative purposes only.

As to speculation, look no further than cryptocurrencies, meme stocks, NFTs (non-fungible tokens) and SPACs (special purpose acquisition companies). Global-debt-to-GDP (gross domestic product) checks in at 330%.4 At that ratio, minuscule increases in interest rates could trigger widespread defaults.

The answer as to "when" could be either "imminent" or "already underway". As stated recently by hedge fund manager Michael Solomon of Marlin Sams Fund5: "Bear markets do not have neat beginnings. They often have inauspicious starts, taking hold much earlier than when they become an acknowledged reality." Despite record highs in the popular averages, there is unmistakable decay. For example, only 31% of the stocks making up the Nasdaq Composite Index6 are trading above their 200-day moving averages despite the 18% gain in the Index in 2021. The picture is similar for the S&P 500 Index and Russell 3000 Index.7 Persistent poor breadth is often, if not usually, the precursor of a bear market.

Former U.S. Secretary of the Treasury Lawrence Summers recently warned of the possibility of a market crash. At the December 14, 2021, American Council for Capital Formation (ACCF) webinar, Summers stated that there is a risk of "spontaneous deflation of capital markets". He added that "The Fed will have a very difficult time of organizing a soft landing…. All the efforts at disinflation we have had historically, where it was clearly established that inflation has been too high and the Fed acted, have ended in recession."

Similar warnings abound from experienced investors. At the November 4, 2021, Boston Investment Conference, investor Stanley Druckenmiller stated, "This bubble is in everything. Every asset on the planet." He noted that the dot.com crash of 2000 was limited to a narrow segment of the market. In a May 2021 CNBC interview, he stated: "I have no doubt, none whatsoever, that we are in a raging mania in all assets. I also have no doubt that I don't have a clue when that's going to end." 8 In other words, in his view (and ours), speculation is more pervasive and the potential damage greater than 20 years ago.

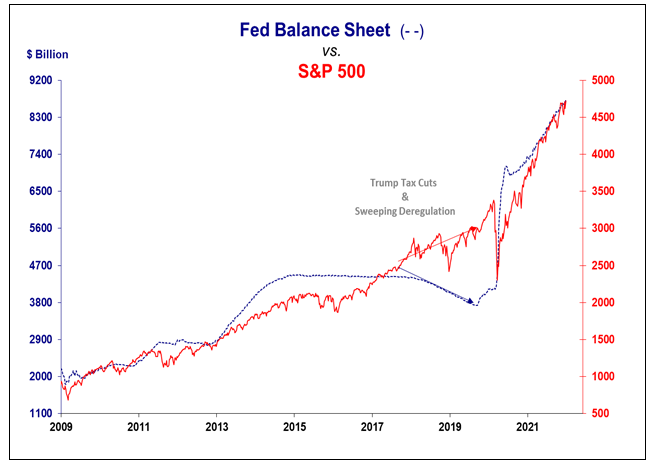

With Fed policy taking a more hawkish turn, the fire hose of liquidity that has fueled the mania is being turned off. Should the Fed not flinch (a major assumption), bubble days would seem to be numbered. The correlations between the financial markets, the economy and debt are very tight. A deflation of financial assets would very likely trigger a downturn in economic activity, even more unacceptable politically than the current high rate of inflation. For that reason, another "Powell Pivot" is still very much in the cards. It may just take longer and create more damage than the 2018 pivot.

We believe that CPI inflation9 will not respond to restrictive monetary policy in the absence of a market reversal that disrupts manic psychology. CPI inflation and overvalued financial assets are twin manifestations of a decade of easy money (see Figure 5). The explanation that inflation is the result of supply chain bottlenecks, and therefore transitory, ignores its deeply rooted monetary origins. As noted by former Fed Governor Kevin Warsh, "This [supply chain bottlenecks] is a description of the state of affairs, not its [inflation's] source." 10

Figure 5. S&P 500 Rise Closely Tied to Fed's Accommodative Fiscal and Monetary Policies

Source: Stephanie Pomboy, MacroMavens as of 12/31/2021. You cannot invest directly in an index. Included for illustrative purposes only.

The investment consensus that financial assets are reasonably valued is dependent on the view that inflation will go away on its own. If inflation remains stubborn and is difficult to stamp out, financial asset valuations will need a major rethink. The market cannot handle the prospect of a Volcker Redux.

Despite the emergence of high inflation, gold has thus far failed to respond in the manner expected by many. We agree with the findings of Duke University Professor Campbell Harvey and Claude Erb, former commodities Portfolio Manager at the TCW Group: Gold only protects purchasing power when measured over "very long periods, a century or more…and over shorter periods its real or inflation-adjusted price fluctuates no less than that of any other asset".11

Gold Protects Against Systemic Risks

It would be a mistake to position gold narrowly as an inflation hedge. While gold performed well during the inflationary 1970s, it also did so from 1999-2011 when inflation wasn't on the front page. Gold is a hedge against systemic risks, including inflation, deflation, monetary regime change, or just the plain monetary malpractice that seems prevalent now, consequences still to be determined.

When inflation translates into systemic risk, gold becomes relevant. In our judgment, the current round of high inflation has the potential to topple financial markets. Lawrence Summers, Kevin Warsh, Stanley Druckenmiller and many other luminaries agree. That is because the remedy for persistent high inflation is poison for super high valuations. From Paul Volcker's memoir Keeping at It, he writes: "The real danger comes from the Fed encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excess threaten financial markets."

The Fed may take longer to flinch than it did in 2018. Unflattering accounts of that flip-flop have undoubtedly landed on the desks of Fed officials. Possibly embarrassed by that miscue, well informed as to the misfortunes of the pre-Volcker Fed in the 1970s, and still smarting from their retreat on "transitory", Powell & Co. may decide to dig in their heels. It could be dangerous to underestimate the Fed's hawkish turn. If the Fed stays the course, prepare for a third policy mistake in three years, i.e., tightening into and exacerbating an economic slowdown already underway.

The Fed Needs a "Hail Mary"

Optimists will hold out hope that this gang that could never seem to shoot straight will engineer a soft landing. A fourth-quarter "hail mary"12 down a touchdown with seconds to play offers better odds, in my opinion. Recall Bob Farrell's rule of market corrections: "Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways." (View Farrell's 10 Rules.)

Confidence in the Fed and attraction to gold at the moment appear to be binary. We stand by our comments from our July 2021 You Gotta Have Faith report, "Faith in the Fed's omniscience is convenient to the investment consensus because it underpins the extraordinary overvaluation of financial assets. Let's face it, despite pious subservience to the goals of full employment and price stability, the Fed's real mandate is to keep financial markets from coming unglued. The relationship between overvalued financial assets and belief in an all-knowing Fed is symbiotic. Loss of that faith for heavily sedated markets would lead to losses of trillions of dollars in the world of financial assets. That very real possibility is sufficient rationale for investment in gold and the expectation of much higher gold prices."

The Fed's adventure into hawkishness suggests that it is unknowingly straying from its implicit mandate of keeping markets from coming unglued. It appears the Fed does not understand that lip service rather than strict attentiveness to price stability is politically expedient. This error-prone institution is bound to become even more so given the two-decade legacy of monetary malpractice. The miracle is that investor confidence remains unbroken. We think a position in gold offers a very favorable asymmetric risk-reward proposition on the possibility that confidence will not survive 2022.

| 1 | Gold bullion price is measured by spot gold; and gold Mining equities are measured by the Gold Senior Equities SOLGMCFT Index. |

| 2 | LAWRIE WILLIAMS: China's 2021 gold demand already exceeds full year 2020. |

| 3 | The Standard and Poor's 500 is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States. |

| 4 | According to Statista.com, a leading provider of market and consumer data. |

| 5 | Please note that Marlin Sams Fund is an investor in Sprott Hathaway Special Situations Fund. |

| 6 | The Nasdaq Composite Index is a stock market index that follows nearly 3,500 stocks listed on the Nasdaq stock exchange, which includes many high-growth technology stocks. |

| 7 | The Russell 3000 Index is a market-capitalization-weighted equity index that seeks to track 3000 of the largest U.S.-traded stocks. |

| 8 | Source: CNBC Druckenmiller is riding the 'raging mania' in stocks but expects to sell before year's end. |

| 9 | The Consumer Price Index (CPI) measures the average change in prices over time that consumers pay for a basket of goods and services. |

| 10 | Source: The Wall Street Journal, Rising Prices Are a Consequence of Bad Politics. |

| 11 | Source: The Wall Street Journal, Gold as an Inflation Hedge: What the Past 50 Years Teaches Us. |

| 12 | A long, typically unsuccessful pass made in a desperate attempt to score late in a U.S. football game. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.