SPECIAL UPDATE: On May 23, 2025, President Trump signed executive orders to fast-track advanced nuclear energy in the U.S., aiming to boost national security and energy independence. The directives call for quicker NRC licensing, support for domestic uranium production and expanded nuclear exports. These actions have the potential to quadruple U.S. nuclear capacity by 2050 and solidify nuclear power's role in America’s energy and security strategy. Read: Trump’s Executive Orders Set Stage for U.S. Nuclear Expansion.

Key Takeaways from April

- Spring Recovery: In April, the uranium market saw a significant recovery, with spot prices climbing 5.40% to $67.70 per pound, rebounding from a late-March low of $63.20.

- Steady Climb Ahead: Despite frustrations in the first quarter, the latest upswing could signal the start of a steadier climb, driven by renewed confidence and a rebound in utility operations.

- Uranium Showing Tenacity: While other asset classes struggled, uranium remained resilient, bolstered by its strong supply-demand fundamentals, steady demand and protection from tariff-related disturbances.

- A Clearer Path Forward: After a period of volatility and hesitation, recent developments, from U.S. tariff policy clarity to utility contracting resurgence, are setting the stage for uranium.

Performance as of April 30, 2025

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

5.40% | -4.53% | -7.48% | -24.69% | 8.61% | 15.21% |

|

Uranium Mining Equities |

7.11% | -14.82% | -13.59% | -28.44% | 0.97% | 25.13% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 |

8.62% | -20.14% | -15.36% | -35.54% | -6.82% | 24.59% |

|

Broad Commodities (BCOM Index) 4 |

-5.14% | -1.33% | 2.19% | -0.74% | -7.96% | 10.63% |

|

U.S. Equities (S&P 500 TR Index) 5 |

-0.68% | -7.50% | -4.92% | 12.10% | 12.17% | 15.60% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 4/30/2025. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Performance Overview: From Frustration to Foundation

After months of price pressure and uncertainty, uranium is regaining its footing, buoyed by contracting clarity, resilient fundamentals and renewed investor interest.

The uranium market staged a meaningful rebound in April, with spot prices rising 5.40% to $67.70 per pound, up from a late-March low of $63.20. The recovery extended into early May, with prices reaching $70, a roughly 10% gain from the 2025 lows. While the first quarter left many investors frustrated, recent strength may mark the beginning of a more sustainable move higher, supported by improving sentiment and resumed utility activity.

Uranium rallies on tight supply, long-term demand and renewed investor conviction.

The uranium term price has held firm at $80 per pound, reinforcing the strength of long-term market fundamentals. The persistent premium over spot pricing has re-energized the carry trade,6 helping to support the spot market.

Uranium miners rose 7.11% in April, while junior miners outperformed with an 8.62% gain. Early May has seen further upside, fueled by improved risk appetite and short covering. Many uranium miners currently have high short interest ratios, meaning hedge funds have bet their shares will fall in value, which could set up sharp short covering rallies. While this short uranium trade has worked over the past few months, the improving market developments could quickly flip the situation and force them to cover their short positions.

Uranium’s resilience has been particularly striking against the backdrop of extreme market volatility. As other asset classes faltered, uranium held its ground, supported by its structural supply-demand story, inelastic demand and insulation from tariff-related disruptions.

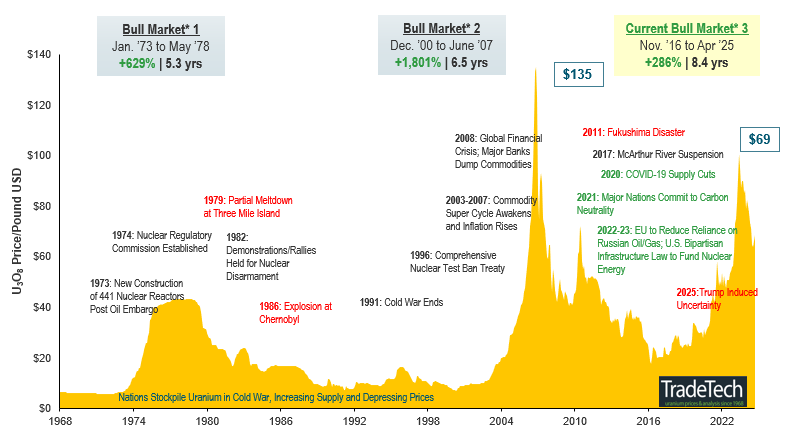

Importantly, physical uranium and uranium equities continue to outperform over longer periods. As shown in Figure 1, the strong five-year returns of physical uranium and uranium equities relative to broader commodity and equity benchmarks reinforce the metal’s role as a differentiated and strategic asset class.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (4/30/2020-4/30/2025)

Source: Bloomberg and Sprott Asset Management. Data as of 4/30/2025. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); Junior Uranium Miners are measured by the Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJT™ Index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; and Commodities are measured by the Bloomberg Commodity Index (BCOM). Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Past performance is no guarantee of future results.

Market Drivers: Momentum Catalysts

After months of hesitation driven by geopolitical and policy uncertainty, April brought a modest but meaningful shift in sentiment across the uranium market. A confluence of macroeconomic and sector-specific developments helped stabilize prices and reignite investor interest.

Tariff Pause Provides Breathing Room

The Trump administration’s decision to pause its new reciprocal tariffs for 90 days offered the clarity many utilities had been waiting for. Uranium was already excluded from these tariffs, and the pause has further calmed fears of near-term supply disruptions. Contracting activity, largely frozen earlier in the year, has resumed, helping to firm up spot prices and improve sentiment in uranium equities.

Although uranium was not subject to the April tariff package, it is included in the ongoing Section 232 investigation7 into critical minerals. While this raises the possibility of future import restrictions, it also elevates uranium’s importance in U.S. energy and security policy, especially as utilities increasingly prioritize domestic and allied sources of supply. Importantly, producers such as Cameco have structured contracts to shift potential tariff costs to end buyers, mitigating their exposure.

Carry Trade Reemerges as a Market Stabilizer

The uranium carry trade has reasserted itself in 2025, helping to re-anchor spot market activity and restore confidence in pricing. With the long-term price holding steady near $80 per pound while the spot market corrected, the economics of the carry trade have turned favorable once again. Traders and financial intermediaries are increasingly stepping in to buy pounds in the spot market for delivery into term contracts, a dynamic that provides incremental liquidity and supports prices.

The carry trade returned in force, improving spot liquidity and stabilizing prices.

According to UxC, nearly 4 million pounds, or roughly 20% of year-to-date term volume, have already transacted through carry trades, a stark difference from the dynamic in recent years. Importantly, carry trade activity highlights a core advantage of the uranium market today. While sentiment can ebb and flow, the commercial structure and long-term demand profile create recurring mechanisms that stabilize price and volume. In past cycles, sustained carry trade activity has often preceded broader price recoveries, a dynamic that may be underway again.

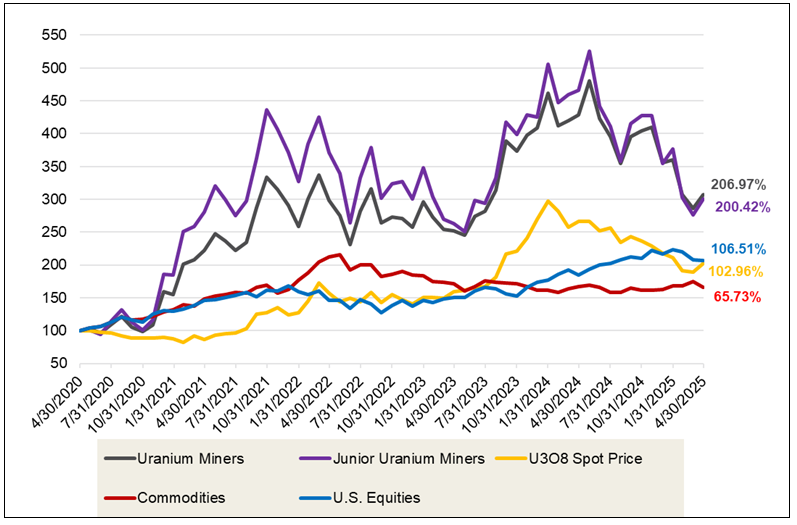

We believe the spot price should trade closer to the term price in a market with a structural supply deficit of 35-40 million pounds this year. The $17 a pound price differential at the peak between the term and spot prices was a temporary dislocation driven by market sentiment and liquidity factors.

Figure 2. U308 Spot Price vs. Long-Term Contract Price (2004-2025)

Source: Bloomberg and UxC. Data as of 4/30/2025. U3O8 Spot Price is measured by the UxC Uranium U3O8 Spot Price (UXCPU308 UXCP Index), and U3O8 Long-Term Price is measured by the UxC Uranium U3O8 Long-Term Price (UXCPULTM UXCP Index). You cannot invest directly in an index. Past performance is no guarantee of future results.

AI-Driven Demand Narrative Strengthens

Surging artificial intelligence (AI) workloads and the exponential growth of data centers are intensifying the global search for scalable, carbon-free baseload power, and nuclear is emerging as a leading solution. In April, Google announced it would fund the development of three new nuclear sites, each targeting at least 600 megawatts (MW), signaling another meaningful commercial partnership between big tech and advanced nuclear developers.8 These projects follow prior big tech commitments to nuclear energy and align with a broader U.S. Department of Energy announcement that identified 16 federal sites to co-locate data centers and AI infrastructure with new energy infrastructure, including nuclear.9

Data centers are projected to consume 2.5x more power by 2030, equivalent to Japan’s entire electricity use today, and nuclear remains one of the few non-intermittent sources capable of reliably supporting this scale.

China Doubles Down on Nuclear Buildout

China continues to lead global nuclear development by a wide margin. In April, the State Council approved the construction of 10 additional reactors, marking the fourth consecutive year of at least 10 new approvals.10 These reactors represent the continued long-term structural support for uranium markets. China’s broader plans include 58 operable reactors, 30 under construction and 40 more planned.11

Beyond sheer volume, China’s approach signals strategic intent: a desire to improve energy security, reduce dependence on imported fossil fuels and maintain control over the full nuclear supply chain. China’s nuclear expansion represents one of the most reliable and demand-insulated components in the global uranium story.

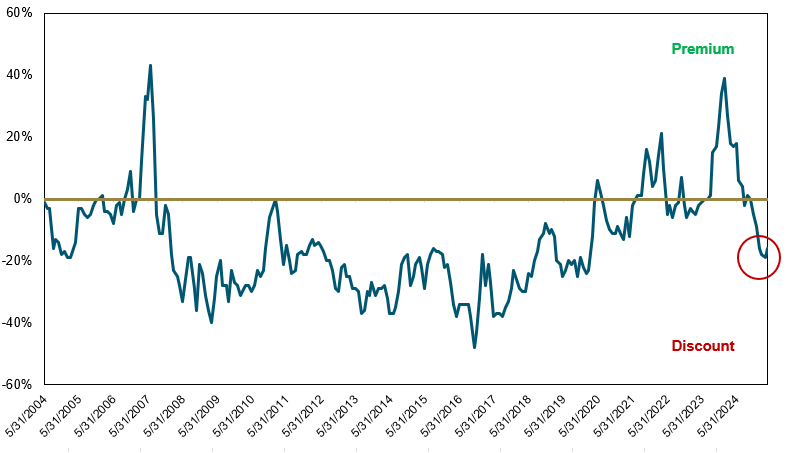

Cameco Reinforces Supply Discipline and Contracting Momentum

Cameco’s first-quarter results exceeded expectations and reinforced its continued commitment to supply discipline. The company maintained its full-year production guidance and reiterated that it will not restart idled capacity or expand output without sufficient long-term utility contracting. Importantly, Cameco highlighted a growing pipeline of contract discussions and is seeing momentum in requests for proposals (RFPs). With 67% of global utility requirements through 2045 still uncovered (3.2 billion pounds), Cameco’s patient stance is a powerful signal of long-term market tightness.

Figure 3. U308 Spot Price vs. Long-Term Contract Price (2004-2025)

Source: Cameco and UxC. Data as of 4/30/2025.

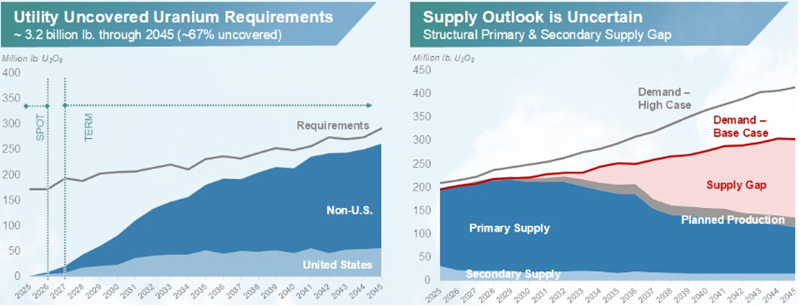

Uranium Bull Market Fundamentals Remain Intact

The uranium market is showing positive signs. After a period of volatility and hesitation, recent developments, from policy clarity around U.S. tariffs to an inevitable resumption in utility contracting, have started to clear the path forward. While short-term investor sentiment has been shaped by geopolitical noise and macro uncertainty, the long-term drivers of the uranium bull market remain solidly intact.

Supply remains constrained, with major producers exercising discipline and new projects facing delays or deferrals. The re-emergence of the carry trade highlights improving functionality in uranium markets, and demand from AI-driven energy growth and national nuclear strategies continues to build quietly in the background.

With constrained supply, resurgent demand and clearer policy signals, uranium may be poised to enter its next leg higher.

In a world where few assets are uncorrelated, uranium increasingly stands out, bolstered by inelastic demand, long lead times for new supply and a growing recognition of nuclear’s role in global energy security. While sentiment may take time to recover fully, the case for uranium continues to strengthen, and with the market beginning to reflect that shift, the path ahead may look more promising than it has in months. In our view, these conditions collectively support the next leg of the bull market. With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical.

The uranium price target as an incentive level for further restarts and greenfield development is a moving target. We believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply is likely to continue supporting a sustained bull market (Figure 4).

Figure 4. Uranium Bull Market Continues (1968-2025)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets when prices generally rise. A “bear market” refers to a condition of financial markets when prices are generally falling.

Source: TradeTech Data as of 4/30/2025. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from TradeTech, UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies involved in the uranium mining industry. These companies dedicate at least 50% of their assets to activities such as uranium mining, exploration and development. |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies involved in uranium mining-related businesses. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | In the uranium market, a carry trade involves purchasing uranium on the spot market, financing the holding costs and then selling it forward at a higher term price. This strategy capitalizes on the price difference between the spot market and long-term contracts, with traders essentially profiting from the difference in prices over time. |

| 7 | The U.S. Department of Commerce initiated a Section 232 investigation on April 22, 2025, into the effects of imports of processed critical minerals and their derivative products on U.S. national security. |

| 8 | Source: World Nuclear News, Google to fund development of three nuclear power sites. |

| 9 | Source: U.S. Department of Energy, DOE Identifies 16 Federal Sites Across the Country for Data Center and AI Infrastructure Development. |

| 10 | Source: World-Energy.org, China Approves Construction of Ten New Nuclear Reactors. |

| 11 | Source: World Nuclear Association. World Nuclear Power Reactors & Uranium Requirements. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.