Key Takeaways

- Uranium and uranium mining stocks posted their best monthly results in two years, as the price of U3O8 reached a 12-year high.

- The World Nuclear Association (WNA) estimates that uranium demand will double by 2040 and that Small Modular Reactors (SMRs) will add to this increase by as early as 2030.

- Long-term uranium contracting is on the rise, with 2023 on track to surpass 2022, coinciding with a decade of underinvestment.

- The West continues to make strategic moves to break free of reliance on Russia for uranium supplies and services.

- Supply jitters are increasing given geopolitical concerns in Niger and the likelihood that increased production from Kazatomprom may likely cater to China and Russia.

- Over the long term, increased demand in the face of a uranium supply crunch may likely support a sustained bull market.

Performance as of September 30, 2023: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

21.03% | 30.99% | 51.88% | 52.06% | 10.15% | 21.48% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

23.93% | 41.84% | 50.61% | 46.96% | 13.97% | 25.73% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 25.43% | 39.70% | 39.03% | 38.52% | 54.54% | N/A |

|

Broad Commodities (BCOM Index) 4 |

-1.12% | 3.31% | -7.06% | -5.96% | 13.97% | 4.23% |

|

U.S. Equities (S&P 500 TR Index) 5 |

-4.77% | -3.27% | 13.07% | 21.62% | 10.15% | 9.92% |

*Performance for periods under one year not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of September 30, 2023. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Surges Above $73, Reaching 12-Year Price High

The U3O8 uranium spot price surged 21.03% in September, climbing from US$60.63 to $73.38 per pound.1 This surge marks September as the most impressive month since September 2021. Performance was driven primarily by strong demand from utilities worldwide in the face of threats to supply. The uranium price is now as high as it had been just before the Fukushima Daiichi power plant disaster in 2011, when it was $73 per pound. YTD, U3O8 uranium spot has risen 51.88%.

Uranium mining equities posted even higher gains in September. The broad sector of uranium miners rose by 23.93%2, while junior uranium miners gained 25.43%.3 This outperformance is similar to prior bull market cycles when uranium equities provided leverage to the uranium spot price. YTD uranium miners and junior uranium miners have climbed 50.61% and 39.03%, respectively.

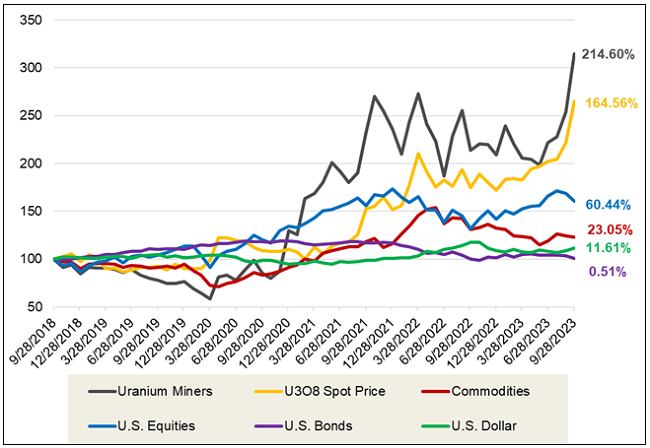

While other commodities suffered in September, largely due to China’s economic weakness, uranium remained insulated from China's economic cycle and its secular and cyclical challenges (see sidebar). Over the longer term, physical uranium and uranium equities have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended September 30, 2023, the U3O8 spot price has risen a cumulative 164.56% compared to 23.05% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed other Asset Classes over the Past Five Years (09/30/2018-09/30/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 09/30/2023. Uranium miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 spot price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Key Drivers of Uranium’s Revival

September saw the uranium price soar past its most recent high of $63.77, posted in February 2022 shortly after Russia invaded Ukraine, to reach a 12-year high. This represents the continuation of the bull market that began in 2016 and is supported by long-term structural tailwinds gaining notable momentum in 2023. We also believe these tailwinds have the power to endure for several years to come, and we explore them in more detail below.

1. Higher Uranium Demand Forecasts

The WNA released its biennial Nuclear Fuel Report in September, which industry professionals rely on for critical insights into the market. In this Report, the WNA increased its forecasted demand for uranium to nearly double by 2040.6 One of the key new contributors to this increase in demand was the Report’s inclusion of SMRs for the first time.

2. The Rise of Small Modular Reactors (SMRs)

SMRs represent a cutting-edge evolution in nuclear technology and have the potential to amplify nuclear energy's role and boost uranium demand. The International Atomic Energy Agency (IAEA) characterizes "small" reactors as those with a capacity of up to 300 MW(e) per unit — roughly a third of conventional nuclear reactors' size. The modular design of SMRs means components can be prefabricated in factories and transported for on-site assembly, reducing costs and construction time. This adaptability positions SMRs to deliver clean energy to areas previously out of reach for conventional nuclear plants and offers a promising approach to decarbonizing industrial processes.

SMRs represent a burgeoning technology, with various innovative designs in development worldwide. The heightened uranium demand from SMRs is anticipated to manifest toward decade's end and intensify into the 2030s. The World Nuclear Association (WNA) projects that SMRs might constitute up to 5% of the global nuclear capacity by 2040. However, given the infancy of the SMR industry, predictions differ. For instance, a recent forecast by BMO suggests a potential of 9%.

3. The Uranium Contracting Cycle is Accelerating

Since Russia's 2022 invasion of Ukraine, procurement strategies have come under sharp focus. While Russia contributes only 5% to global U3O8 production, it dominates with 27% of worldwide uranium conversion capacity and 39% of fuel enrichment. Even without formal sanctions on Russian uranium and with existing contracts still intact, utilities have proactively refrained from establishing new agreements with Russian entities. In 2022, due to Russia's significant presence in conversion and enrichment, utilities prioritized these areas over U3O8.

Today, the conversion and enrichment markets are still very tight, but some positive developments have occurred. In terms of conversion — when U₃O₈ is converted to UF₆ in preparation for enrichment — the market is nearly evenly divided between Russia’s Rosatom State Nuclear Energy Corporation (ROSATOM), France’s Orano SA, China National Nuclear Corporation (CNNC) and Canada’s Cameco Corporation. A few months ago, ConverDyn restarted in the United States to help address the conversion supply-demand imbalance and is expected to reach 11% of global UF6 production by 2026. In terms of enrichment — when gaseous UF₆ is used to enrich uranium to a U-235 concentration of about 3-5% — the majority of the capacity is split between ROSATOM, Urenco (UK), Orano and CNNC. Urenco and Orano, in particular, serve Western markets that plan to transition away from Russian conversion services. Both companies have also recently announced expansions in enrichment capabilities.

The costs of conversion and enrichment services skyrocketed after Russia invaded Ukraine. We believe these price increases, positive Western conversion and enrichment developments, and a potential shift from underfeeding to overfeeding have helped boost U3O8 prices. Although utilities remain conscious of the tight conversion and enrichment markets, they are expanding their focus to procuring U3O8.

Utilities and uranium producers generally contract in the term market, representing uranium sold under long-term, multi-year contracts with deliveries starting one to three years after the agreement is made. By contrast, a spot market contract is generally for one delivery priced at the time of purchase. Prior to the Russian invasion of Ukraine, uranium term contracting was suppressed for almost a decade. 2022 had the greatest volume of term contracting in a decade at 125 million pounds of U3O8e. 2023 YTD (as of September 30) is set to surpass this, with current term contracting at 121 million pounds of U3O8e.7

This increase in uranium term contracting should be viewed against a decade of underinvestment in uranium supply and decades of mine production that fell below world nuclear reactor requirements. The increased contracting has squeezed the market into a very tight state, and we believe it will continue to push uranium prices higher, incentivizing new production.

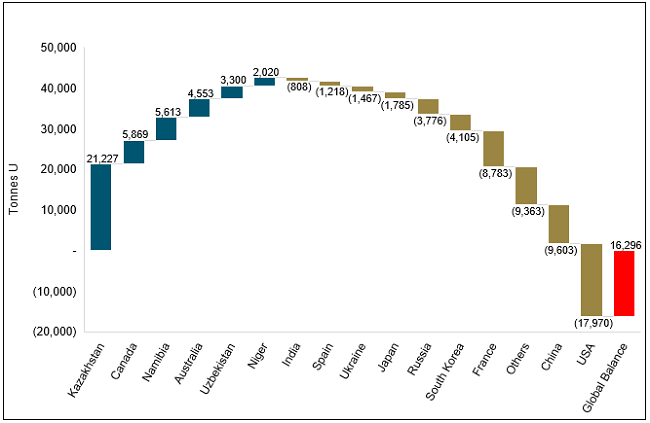

Notably, most term contracting YTD has been done by countries outside the U.S. However, U.S. contracting may be a future tailwind as the U.S. needs to replace inventory. Currently, the U.S. depends entirely on sourcing uranium from other countries for what represents the largest reactor requirements in the world, as shown in Figure 2.

Figure 2. Uranium Production, Less Reactor Requirements, by Country

Source: World Nuclear Association. Production for 2022, reactor requirements estimate for 2023.

4. Uranium Supply Jitters Multiply

Although the strengthening uranium price is stimulating a supply response, recent developments underscore the complexities of introducing new supply streams and the importance of securing supply. Historically, uranium from Kazakhstan, the world's top producer, was chiefly routed through Russia for Western markets. While this transit method persists, potential disruptions loom due to possible sanctions and challenges in shipping and insurance. Given that Kazakhstan accounts for 44% of global U3O8 production, any supply disturbances could profoundly affect the market.

Supply disruptions in this tight contracting market are having a significant impact. The coup d’état in Niger has drawn international sanctions against the military junta that has hampered logistics in the country and forced Orano to halt uranium processing in Niger.8 Though Orano is reported to have enough inventory to satisfy near-term commitments, the situation in Niger is still developing, and the potential for future disruptions in shipments amplifies the need for security of supply. In other supply news, Cameco has announced a 2.7-million-pound uranium shortfall for 2023 from its Cigar Lake and McArthur River miners.9

In response to the rising demand for uranium, NAC Kazatomprom JSC (Kazatomprom), the globe's largest uranium producer, has declared an uptick in production. By 2025, it aims to fulfill 100% of its subsoil use contracts, marking the conclusion of seven years operating below contract ceilings. This move will boost Kazatomprom's projected mine output in 2025 to 30,500-31,500 tonnes, up from the 20,500-21,500 tonnes forecasted for 2023.10 Kazatomprom has struggled to meet its production targets in recent years, given an ongoing shortage of sulphuric acid and piping. Given the industry's current emphasis on diverse supply sources and geopolitical factors, we anticipate that a significant portion of Kazatomprom's augmented production will cater to China and Russia rather than Western utilities.

In the long run, as existing mines are exhausted, the uranium supply will hinge more on the revival of dormant mines and the establishment of new ones. Recent challenges, such as those faced by Cameco and Peninsula Energy in restarting mines, or the delay in Global Atomic's Dasa project in Niger, coupled with the lengthy 8- to 15-year timeline from discovery to production, underscore the industry's struggle to ramp up uranium output.

Inventories have long played a role in balancing the market, but as Uranium Insider founder and publisher Justin Huhn put it, “the only inventory that exists right now in the world is strategic — this is held by nuclear utilities, and their inventories historically speaking are relatively low”.11 Further, secondary supplies generally are forecasted to play a diminishing role by the World Nuclear Association. Current levels at 11-14% of reactor uranium requirements are moving to 4-11%.

The Long-Term Uranium Demand Thesis Is Well Supported

Ultimately, the demand for uranium and nuclear energy is rooted in the need for electricity. According to a September International Energy Agency (IEA) report, global electricity demand may grow 164.66% by 2050, relative to 2022.12 Electricity demand is expanding with population growth and as developing nations modernize and urbanize.

Growing Need for Cleaner Electricity

Furthermore, 97 countries representing 79.3% of global greenhouse gas emissions have communicated a 2050 net-zero emissions target.13 In order to fulfill these commitments and decarbonize, committed nations will have to transition their energy supply to low-emissions electricity. This means decarbonizing transport (i.e., transitioning to electric vehicles), heating and industry. Considering other positive factors, like technological advancements, enables us to believe that the demand for electricity will likely be well supported for decades.

The Nuclear Energy Renaissance

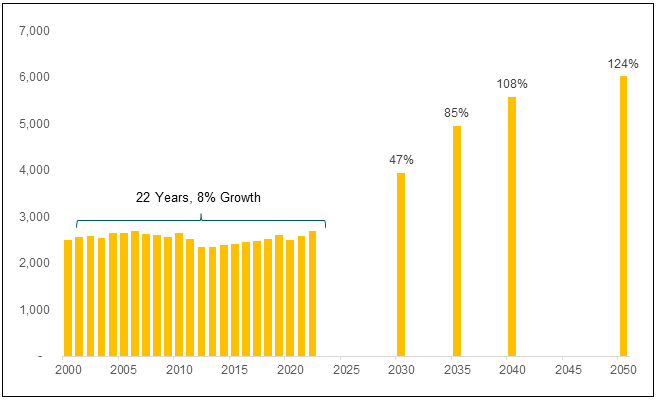

Given the positive electricity outlook, nuclear energy’s forecasted prevalence is the next step in uranium’s outlook. Historically, nuclear had significant growth from the 1970s to 1990s but then plateaued since 2000 (Figure 3). Going forward, the nuclear energy industry is forecasted to be ushered back into an era of increasing demand.

Figure 3. Nuclear Energy Generation in Gigawatts (GW) (2000-2050E)

Source: Ember data prior to 2022. Post 2021 from the IEA “Net Zero Roadmap: a Global Pathway to Keep the 1.5 °C Goal in Reach – 2023 Update”.

Other industry participants are even more bullish with a “Net Zero Nuclear” initiative launched in September calling for global nuclear capacity to triple by 2050.14 The case for greater nuclear generation has been building for some time. Nuclear energy is:

- Clean: producing similar CO2 equivalent emissions to renewables

- Reliable: provides reliable baseload energy to offset intermittency from increasing renewable energy sources

- Efficient: high energy density reducing the impact of extraction and transport

- Safe: nuclear energy’s impeccable long-term safety track record is gaining acceptance

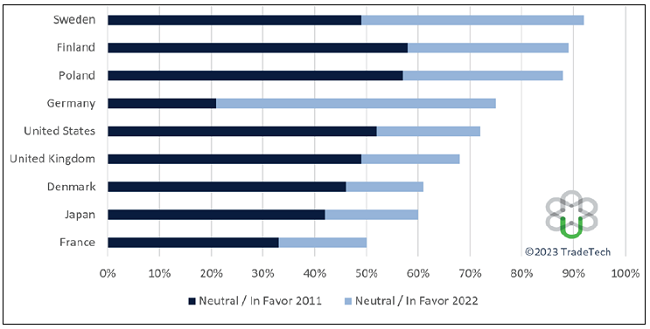

Nations have been planning to decarbonize and realize they need reliable baseload power, which nuclear is primed to provide (see Figure 4). After the Russian invasion of Ukraine in February 2022, many European countries realized how problematic reliance on Russian natural gas was and that nuclear power offered greater energy security.

Figure 4. Public Acceptance for Nuclear Power, 2011 vs. 2022

Source: Source: TradeTech. Data as of 12/31/2022.

Source: Source: TradeTech. Data as of 12/31/2022.

These realizations have resulted in an increased appetite for nuclear reactors, and there now are 60 under construction and another 110 planned globally, relative to 436 operating today.15 Notably, China accounts for a significant portion of these, with 24 under construction and 44 planned. China may be leading the development of new reactors, but significant demand is attributable to other countries due to reactor extensions and restarts.

Extending the Life of Existing Nuclear Plants and Restarts

Most nuclear power plants have an operating lifetime of 25 to 40 years, but many can be extended to 60 years or, in the U.S., 80. For example, the U.S.'s Diablo Canyon nuclear power plant has been in operation since 1985 and was scheduled to close by 2025, but regulators gave an extension to operate for five more years.16 Further, Pacific Gas & Electric is seeking permission to operate for up to 20 additional years. The extensions of planned operating lifetimes incrementally increase the demand for uranium. The Nuclear Fuel Report stated that upward of 140 reactors could be subject to extended operation in the period to 2040.17

Nuclear reactor restarts have also contributed to the increasing demand for uranium. Many countries have now made U-turns in their nuclear energy policies and are restarting reactors that were closed in the decade past. The quintessential example of this is Japan. Japan has restarted 11 nuclear reactors, and another 16 are at various stages in the process of restart approval.18 Japan was not the only example of a country reversing its nuclear energy policy. South Korea fully reversed its nuclear phaseout policy and expanded its program.

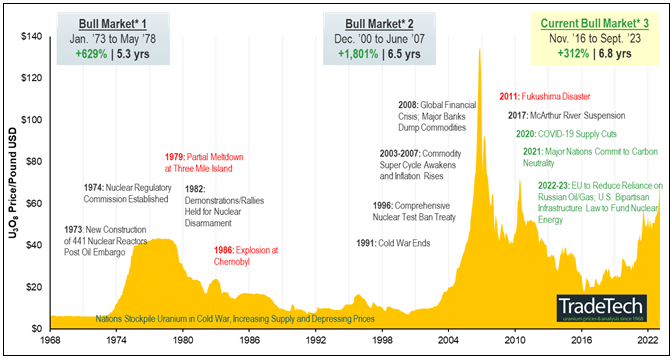

Overall, positive sentiment toward nuclear energy has been growing for some time, and we believe it is likely to persist in the decades to come. With support for the nuclear industry increasing, we expect that market participants will have to shift their psychology to contend with higher demand for uranium supporting higher prices. Utilities may not be able to complacently draw down existing inventories in the hope that uranium prices will come down. Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market (Figure 5).

Figure 5. Uranium Bull Market Continues (1968-2023)

Please click here to see an enlarged chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech. Data as of 09/30/2023. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Appendix A. The Uranium Fuel Cycle

Source: Sprott Asset Management.

U₃O₈, commonly referred to as "yellowcake," is a product of the first stage of the nuclear fuel cycle and is derived from mined uranium ore. Before it can be used in nuclear reactors, U₃O₈ undergoes a series of processes:

- Conversion to UF₆ (Uranium Hexafluoride): U₃O₈ is typically converted to UF₆ in preparation for enrichment. This is because UF₆ is gaseous at relatively low temperatures, facilitating the isotopic separation process used in enrichment.

- Enrichment: The natural concentration of the fissile isotope, U-235, in U3O8 is approximately 0.7%. Most commercial nuclear reactors require uranium to be enriched to a U-235 concentration of about 3-5%. This enrichment is done with gaseous UF₆.

- Conversion to UO₂ (Uranium Dioxide): After enrichment, UF₆ is converted to UO₂. This uranium dioxide is then processed and fabricated into fuel pellets, which are subsequently loaded into fuel rods for use in nuclear reactors.

Source: World Nuclear Association.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | https://www.world-nuclear.org/our-association/publications/global-trends-reports/nuclear-fuel-report.aspx |

| 7 | Source: Bloomberg. Orano Halts Uranium Treatment in Niger Because of Sanctions on Junta |

| 8 | Source: Cameco. Cameco Provides Production and Market Update. |

| 9 | Source: Mining.com. Kazatomprom to end uranium production cuts in 2025. |

| 10 | Source: Investing News Network. Justin Huhn: Uranium Facing "Supply Black Hole," Price Spike Likely. |

| 11 | Source: International Energy Agency (IEA). Net Zero Roadmap A Global Pathway to Keep the 1.5 °C Goal in Reach. |

| 12 | Source: Climatewatchdata.org at https://www.climatewatchdata.org/net-zero-tracker as of 8/2/2023. Included for illustrative purposes only. |

| 13 | Source: World Nuclear Association (WNA). ‘Net Zero Nuclear’ Initiative Calls for Global Collaboration to Triple World Nuclear Capacity by 2050. |

| 14 | https://world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme.aspx |

| 15 | Source: WNA. World Nuclear Power Reactors & Uranium Requirements. |

| 16 | https://calmatters.org/environment/2023/03/diablo-canyon-nuclear-power-plant/ |

| 17 | Source: WNA. The Nuclear Fuel Report, Global Scenarios for Demand and Supply Availability 2023-2040. |

| 18 | Source: WNA. Nuclear Power in Japan. |

| Uranium Has Been Less Sensitive to Economic Conditions in 2023 | ||

|---|---|---|

| Type | Commodity | YTD % Change |

| Metals | Uranium | 52% |

| Gold | 1% | |

| Aluminum | -1% | |

| Copper | -2% | |

| Lead | -6% | |

| Silver | -7% | |

| Zinc | -12% | |

| Platinum | -15% | |

| Palladium | -30% | |

| Rare Earths* | -34% | |

| Cobalt | -36% | |

| Nickel | -38% | |

| Lithium | -70% | |

| Energy | Crude Oil, WTI Future | 13% |

| Nat Gas, Future | -35% | |

| Agriculture | -8% | |

Source: Bloomberg. Data as of 9/30/2023.

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management LP (“SAM LP”) and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. SAM LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affiliates may hold a short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not residents of Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, or considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2024 Sprott Inc. All rights reserved.