Key Takeaways

- The resurgence in uranium markets continued into January, with the U3O8 uranium spot price gaining 10.96%, climbing from US$91.09 to $101.08 per pound, marking a crucial milestone.

- Kazatomprom’s announcement that it would not meet 2024 production increases was the biggest catalyst for the upward trend. The company cut its guidance for 2024 production by as much as 14%.

- Uranium miners outperformed the underlying commodity, with junior miners emerging as top performers.

- Uncertainty remains on the supply side due to the situation in Niger and efforts to ban imports from Russia.

Performance as of January 31, 2024: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

10.96% | 35.71% | 10.96% | 99.17% | 50.05% | 28.31% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

12.86% | 23.28% | 12.86% | 55.84% | 43.80% | 32.55% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 18.78% | 26.91% | 18.78% | 45.14% | 39.92% | 31.12% |

|

Broad Commodities (BCOM Index) 4 |

-0.09% | -5.79% | -0.09% | -11.84% | 7.16% | 4.07% |

|

U.S. Equities (S&P 500 TR Index) 5 |

1.68% | 16.01% | 1.68% | 20.82% | 10.99% | 14.29% |

*Performance for periods under one year are not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Reaches Another Inflection Point in Bull Market

The resurgence in uranium markets continued into January, with the U3O8 uranium spot price experiencing a significant 10.96% increase, climbing from US$91.09 to $101.08 per pound.1 This rise marks a crucial milestone, surpassing the psychological barrier of $100 per pound, a level not seen since before the 2008 financial crisis. Price momentum has accelerated, particularly since September 2023. In January, the price briefly spiked to $106 before settling back to $101, only to rise again to $106.51 on February 1.

Several factors contributed to this upward trend, with one significant development being the primary catalyst. The world’s largest uranium producer, NAC Kazatomprom JSC (Kazatomprom), announced that it would not meet its previously announced production increases for 2024 and 2025. This sudden reversal after indicating in September 2023 that it would expand production, signaled to industry participants that the supply response to the fundamental deficit in the uranium market will take longer than anticipated.

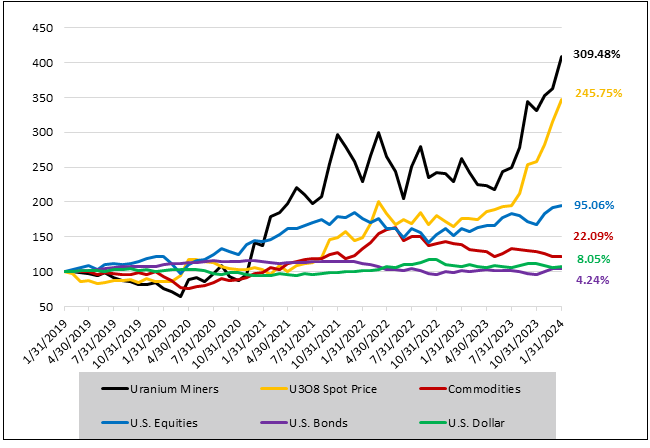

Over the longer term, physical uranium and uranium mining equities have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended January 31, 2024, the U3O8 spot price has risen a cumulative 245.75% compared to 22.09% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (01/31/2019-01/31/2024)

Source: Bloomberg and Sprott Asset Management. Data as of 01/31/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Kazatomprom’s Supply Constraints and Market Response

Kazatomprom signaled production issues on January 12 and gave an operational update on February 1; in response, the U3O8 spot price spiked 8.33% and 5.37%, respectively. The announcement noted that the company would reduce its 2024 and 2025 production guidance due to shortages of sulfuric acid and construction delays.6 This marked a U-turn from its previous positioning three months ago in September when Kazatomprom stated it would increase production in 2025 to a 100% level relative to its subsoil use agreements.7

In their operational update, Kazatomprom quantified its reduced 2024 production guidance to be nine million pounds of U3O8, or 14% lower than its previous guidance. Given that Kazatomprom is the largest and lowest-cost uranium miner in the world, this represents a 6% reduction in the global mine supply of uranium. Further, the company noted that it would unlikely meet its 2025 production targets.

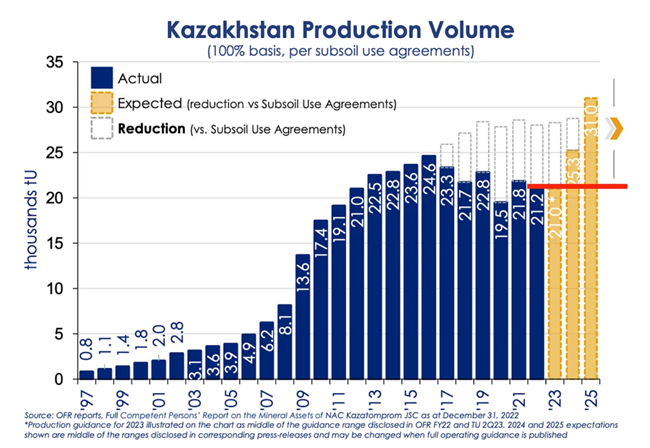

Figure 2 shows Kazatomprom’s history of uranium production and forecasted production. Responding to the previous bull cycle in the 2000s, Kazatomprom was able to ramp up production with significantly lower costs. However, it became a world-leading uranium producer at an inopportune time as its increased supply coincided with the Fukushima accident in 2011, thereby oversupplying the uranium market. In 2017, due to years of suppressed uranium prices, Kazatomprom decided to reduce its production targets and has been operating below its licensed capacity ever since. In recent years, mine supply has been insufficient to meet world reactor requirements and countries have been forced to rely on secondary supplies, predominantly commercial inventories. By 2023, we believe that the available-for-sale inventories have been largely depleted and that the security of supply has become paramount, which will lead to the rebuilding of utility uranium inventories.

Kazatomprom’s increased planned uranium production (shown below) stood to relieve some pressure from inventories, though the market would have still been forecasted to be in a deficit. Further, it's important to note that not all Kazatomprom’s production is solely their own. A considerable portion of the increase in supply may be allocated to Russia through joint ventures.

Kazatomprom’s new 2024 production guidance of 21,000 – 22,500 tU19 is relatively flat. Although we do not yet have a new target for 2025, it is likely to be significantly less than originally indicated. Therefore, the world’s largest uranium producer, which helped to end that last bull cycle with its production increases, is not able to increase production despite the U3O8 spot price increasing to over $100 per pound. This may provide a strong notice to the market and may likely accelerate long-term contracting and substantiate the need for sustained higher uranium incentive prices to spur mine production.

Source: https://thedeepdive.ca/where-did-kazatomprom-fumble-its-uranium/ Included for illustrative purposes only.

The timeline for Kazakhstan's production increases largely hinges on the availability of sulfuric acid. Kazakhstan holds the advantage as a low-cost producer due to its reliance on in-situ recovery (ISR) mining methods, in contrast to Cameco's Cigar Lake and McArthur River underground mining operations. ISR mining, however, requires significant quantities of sulfuric acid, a resource primarily allocated for producing fertilizers, crucial for global food supplies. The prioritization of sulfuric acid for agricultural needs may delay the pace of Kazakhstan's production ramp-up. To this end, Kazatomprom signed an agreement in January with an Italian company for a sulfuric acid plant to be commissioned by the end of 2026.8

The good news is that Kazatomprom has maintained its commitment to existing sales agreements. This suggests that any shortfall in production may necessitate drawing down from inventories or procuring uranium from the spot market.

Impactful Uranium Industry Developments

Multiple other industry developments bolstered the uranium markets in January.

Britain's commitment to invest £300 million in supporting domestic production of high-assay, low-enriched uranium High-Assay Low-Enriched Uranium (HALEU) demonstrates a proactive stance toward bolstering nuclear capabilities.9 Similarly, the U.S. Energy Department's up to $500 million request for proposals (RFP) for uranium enrichment services reflects efforts to establish a reliable source of HALEU, crucial for the next generation of nuclear reactors.10 This initiative is particularly significant given that HALEU is currently only produced by Russia and China, highlighting the importance of diversifying supply sources.

Moreover, the finalization of $1.1 billion in credits aimed at maintaining the operation of the Diablo Canyon nuclear power plant in the U.S. underscores the U.S. government's commitment to preserving existing nuclear infrastructure.11 Furthermore, reports suggesting that Holtec International may receive a $1.5 billion loan to restart a closed nuclear power plant in Michigan represents a landmark potential achievement.12 If realized, this would mark the first-ever restart of a decommissioned U.S. nuclear reactor, signaling a notable shift in government policy towards revitalizing nuclear energy projects.

Amid government initiatives to bolster the nuclear industry, there is increasing uncertainty on the market's supply side. The situation in Niger after its coup d'état in July 2023 is still unresolved and continues to impact the production and export of uranium. In January, Niger suspended new mining licenses and stated it would review existing ones.13 This prompted a release from uranium developer Global Atomic Corp. to try to ease concerns that this negatively impacted its Dasa mine.14

Supply uncertainty of enriched uranium is palpable, given legislative efforts in the U.S. to ban imports from Russia. The Prohibiting Russian Uranium Imports Act (the Act) passed the U.S. House in December and is still pending a vote in the Senate. The Act would limit imports of Russian supply to 2027 and ban them after that. However, Tenex, a Russian state-owned uranium company, has warned American customers that if this Act were to pass, Russia might preemptively bar exports of its supply to the U.S., further exacerbating supply uncertainty, especially in the U.S.18

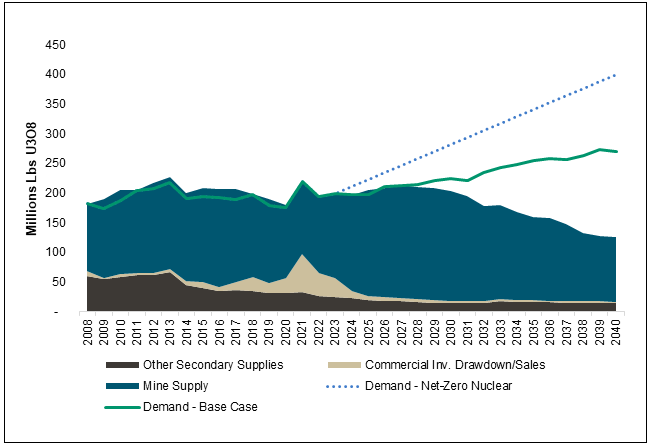

Oddly, U.S. utilities decreased their procurement of uranium under long-term contracts from 2023 to 2022. This is in sharp contrast to the global figures of long-term contracting, which grew from 124.6 to 160.8 million lbs. of U3O8e. Globally, this represented the highest rate of contracting in more than 10 years and almost a return to replacement rate contracting (contracting a sufficient level to meet the world’s annual reactor requirements). The U.S. and global long-term contracting figures may also be set to increase, given that the peak of contracting in the previous cycle was 250 million lbs. and given the size of impending deficits. Per Figure 3, there is a forecasted 1-billion lb. deficit to 2040, and under Net-Zero Nuclear, the pledge to triple global nuclear capacity by 2050, there is a 2.2-billion lb. deficit.

Figure 3. Uranium Supply and Demand Imbalance May Likely Grow

Sources: UxC LLC. and Cameco Corp. Data as of Q4 2023. Included for illustrative purposes only.

Junior Uranium Miners are Critical for Meeting Demand

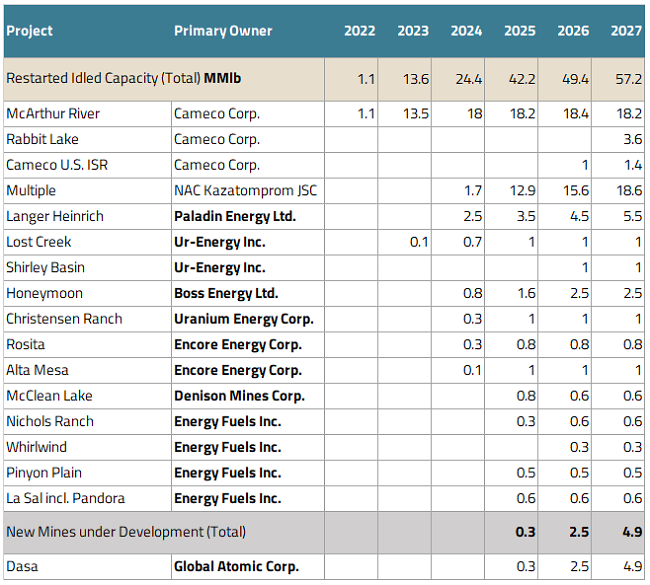

Junior uranium miners led the charge in January, appreciating 18.78%.3 Supported by the increases in the uranium spot price, junior uranium miners continue to announce restarts of shuttered uranium mines.

Uranium Energy Corp. (UEC) announced the restart of its Christensen Ranch project.15 The Project is located in Wyoming and was put on care and maintenance in 2018. It is projected to begin its first production in August and has a licensed capacity of 2.5 million pounds of U3O8.

Orano Canada Inc. and Denison Mines Corp. also announced a restart of their McClean North deposit.16 The McClean Lake deposit is located in the Athabasca Basin region in Saskatchewan, Canada, and was put on care and maintenance in 2010. The project has 800k pounds of U3O8 production targeted for 2025.

In Namibia, Paladin Energy Ltd. announced that its Langer Heinrich mine restart is now 93% complete and commercial production is expected within the next few months.17 The mine’s operations have been suspended since 2018.

As shown in Figure 4, multiple uranium juniors have reacted to the uranium price environment, albeit with small volumes. Notably, as opposed to well-established producers, many junior uranium miners have not yet sold their production forward under long-term contracts. This may indicate that they may be well-positioned to benefit from future price increases.

Figure 4. Scramble to Reopen/Build Uranium Mines

Source: Mike Kozak, Uranium Analyst, Cantor Fitzgerald, December 2023. Assumes certain miners will be restarted that have yet to be announced. Included for illustrative purposes only.

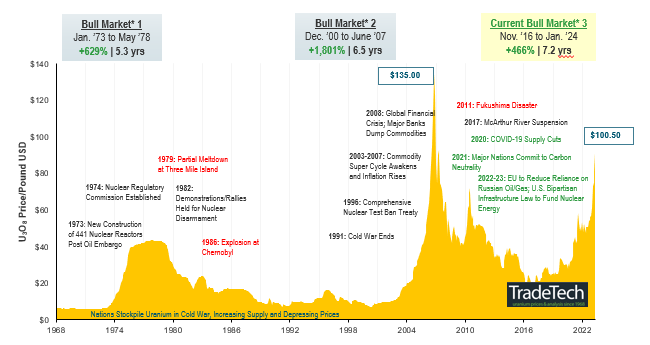

The $100 Inflection Point

Uranium reaching $100 per pound signals another inflection point in this bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and adapted their procurement strategies to the new market realities.

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 5).

Figure 5. Uranium Bull Market Continues (1968-2023)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 01/31/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | https://www.world-nuclear-news.org/Articles/Supply-chain-issues-prompt-Kazatomprom-to-adjust-p |

| 7 | https://www.world-nuclear-news.org/Articles/Kazatomprom-plans-2025-uranium-production-increase#:~:text=The%20board%20of%20the%20Kazakh,to%20anticipated%20global%20primary%20supply. |

| 8 | https://sightlineu3o8.com/2024/01/kazakh-italian-partnership-seals-sulfuric-acid-plant-deal/ |

| 9 | https://www.reuters.com/business/energy/britain-invest-300-mln-pounds-next-generation-nuclear-fuel-programme-2024-01-07/ |

| 10 | https://www.energy.gov/articles/doe-announces-next-steps-build-domestic-uranium-supply-advanced-nuclear-reactors-part |

| 11 | https://www.reuters.com/world/us/us-finalizes-11-billion-credits-california-nuclear-plant-2024-01-17/ |

| 12 | https://www.bloomberg.com/news/articles/2024-01-30/biden-to-offer-1-5-billion-loan-to-restart-michigan-nuke-plant |

| 13 | https://www.bloomberg.com/news/articles/2024-01-24/top-uranium-producer-niger-launches-mining-sector-overhaul |

| 14 | https://www.newswire.ca/news-releases/global-atomic-clarifies-niger-s-suspension-of-new-mining-permits-871040268.html |

| 15 | https://www.world-nuclear-news.org/Articles/UEC-to-restart-Wyoming-uranium-operation#:~:text=First%20uranium%20production%20at%20Christensen,at%20prevailing%20spot%20market%20prices. |

| 16 | https://www.prnewswire.com/news-releases/orano-canada-and-denison-announce-jv-approval-to-restart-mcclean-lake-mining-operations-302042652.html#:~:text=Mining%20is%20planned%20to%20commence,first%20mining%20cavities%20planned%20for |

| 17 | https://www.world-nuclear-news.org/Articles/Uranium-production-process-restarts-at-Langer-Hein |

| 18 | https://www.bnnbloomberg.ca/russia-uranium-supplier-warns-us-clients-to-brace-for-export-ban-1.2011820 |

| 19 | Production volume U3O8 (tU) (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV “Inkai” LLP, where the annual share of production is determined as per Implementation Agreement as disclosed in IPO Prospectus. Precise actual production volumes remain subject to converter adjustments and adjustments for in-process material. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.