Key Takeaways

Uranium Market Consolidation

Thus far in 2024, the uranium spot price has stabilized between $85 to $95 per pound after a significant 88.54% increase in 2023. This phase indicates a healthy correction within a bullish market cycle.

Miners' Catch-Up

Uranium miners have shown improved performance, catching up to gains in the spot price.

Long-Term Contracting Trends

Long-term uranium contract prices have continued to rise, reaching $77 per pound by May 2024, the highest level in nearly 16 years. Contracts now include higher ceilings ($110 to $130 per pound) and floors (mid $60s to low $70s), benefiting miners in securing better terms.

Geopolitical Impacts and Demand

Geopolitical tensions and supply uncertainties persist, influencing uranium supply dynamics. Despite these challenges, global demand remains robust, driven by nuclear reactor restarts and new builds, supporting a sustained bullish outlook for uranium.

Performance as of May 2024: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8Uranium Spot Price 1 |

-0.60% | -5.55% | -1.91% | 63.67% | 42.05% | 30.26% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

11.96% | 16.55% | 17.49% | 95.83% | 24.61% | 35.20% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 12.74% | 17.35% | 23.53% | 109.21% | 17.94% | 34.33% |

|

Broad Commodities (BCOM Index) 4 |

1.30% | 6.51% | 4.41% | 5.13% | 3.52% | 5.79% |

|

U.S. Equities (S&P 500 TR Index) 5 |

4.96% | 3.91% | 11.30% | 28.19% | 9.56% | 15.79% |

*Performance for periods under one year are not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 5/31/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Consolidation and Catch-Up

After a landmark year for uranium markets in 2023, 2024 has been an important step forward. Over the past few months, the uranium spot price has largely been in a consolidation phase between $85 to $95 per pound.1 Meanwhile, uranium miners’ performance has fared better, playing catch-up to the commodity’s previous gains.2

On the commodity front, multiple factors are at play. The uranium bull market is still well underway. The uranium spot price increased 88.54% last year, with the majority of this occurring in a rapid, almost straight upward movement during the latter half of the year.1 As such, we believe a natural correction within the broader context of a bullish market cycle is a healthy sign of a functioning market.

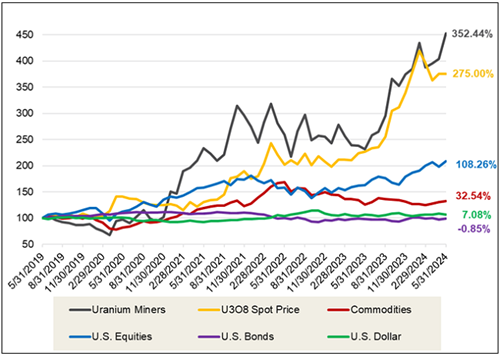

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities.

Besides being a pause in a longer-term bull market, the uranium spot market has been susceptible to broader factors like broader commodities weakness, seasonal softness and a lack of expected buying activity with the passage of the Prohibiting Russian Uranium Imports Act (more on the latter below). On the other hand, fundamentals continue to strengthen with nuclear power plant restarts, new builds and a deepening supply deficit. Notably, the spot market may have paused, but the increasingly positive fundamental picture has played out differently for both the term market and uranium miners.

Uranium contracting activity is predominantly done under long-term contracts by miners and utilities who are looking to secure future supplies of uranium for nuclear power plants. The long-term contract price has lagged the spot price’s tremendous gains. However, as the spot price consolidates, the term price continues its upward climb. Ending May at $77 per pound, the term price is now at its highest level in almost 16 years (since 2008). These long-term contracts also generally contain ceilings and floors, which have been increasing as well. Ceilings are now reported at $110 to $130 per pound, while floors have increased to the mid $60s to low $70s.6 With these higher prices, uranium miners contracting today are set to benefit directly by locking in better terms than those that existed in the past decade.

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended May 31, 2024, the U3O8 spot price has risen a cumulative 275.00% compared to 32.54% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (05/31/2019-05/31/2024)

Source: Bloomberg and Sprott Asset Management. Data as of 05/31/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

U.S. Passes Russian Enriched Uranium Import Ban

After months of waiting since the U.S. House passed the Prohibiting Russian Uranium Imports Act (the Act), the Senate unanimously passed it on April 30, and U.S. President Joe Biden signed it into law on May 13. In less than 90 days, the Act will ban Russian-enriched uranium imports to the U.S., initiating the eventual severance of roughly $1 billion in trade and 24% of the U.S.’s 2023 enriched uranium supply.

The Act prohibits the importation of unirradiated, low-enriched uranium produced in Russia or by a Russian entity. It does include a waiver provision that authorizes the importation of uranium if the Secretary of Energy determines that there is no alternative viable source of uranium to sustain the continued operation of a U.S. nuclear reactor or if the importation of Russian-produced uranium is in the national interest. It also limits the imports of low-enriched uranium as follows (these are identical to those in the Russian Suspension Agreement):

- 476,536 kg in calendar year 2024

- 470,376 kg in calendar year 2025

- 464,183 kg in calendar year 2026

- 459,083 kg in calendar year 2027

Further, any waivers issued shall terminate no later than January 1, 2028. The implementation of legislation with a certain date, at the latest 2028, for which the U.S. will absolutely prohibit the imports of Russian uranium has multiple simultaneous benefits.

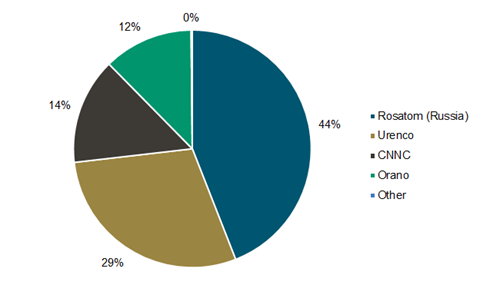

The Act increased energy security by decreasing dependence on Russian-supplied fuels. As evidenced by the energy crisis spurred by Russia’s invasion of Ukraine, reliance on Russian fuels and fuel services can pose significant threats. This is not different for the uranium market, where Russia controls 5% of the world’s uranium mine production, 29% of conversion and 44% of enrichment capacity. However, the West is reliant on Russia for only 30% of its enriched uranium. Even so, the world is dependent on Russian uranium and uranium services, especially enrichment (see Figure 2), and the Act forces these connections to unwind.

Figure 2. World Enrichment Capacity 2022 (SWU)

Source: World Nuclear Association, Nuclear Fuel Report 2023

The Act also paves the way for increasing capacity in the U.S. uranium supply chain. Without access to cheap Russian uranium services, there will be an increased need for domestic uranium, including conversion and enrichment capacity. Further, the Act unlocks $2.7 billion of government aid to rebuild domestic nuclear fuel production. The $2.7 billion is part of a larger package totaling $3.4 billion to buy domestically produced nuclear reactor fuel.7 As soon as June, the U.S. plans to solicit bids for up to $3.4 billion for companies to buy domestically produced nuclear fuel. These developments benefit the entire U.S. nuclear value chain, including uranium miners, as U.S. enrichment may likely favor domestically mined uranium sources.

The Act may also spur an increase in utility uranium-buying activity, especially considering that after the House initially passed the Act, Tenex, a subsidiary of Russia’s state-owned nuclear power company Rosatom, warned American customers that if this Act passes, Russia might preemptively bar exports of its supply to the U.S., further exacerbating supply uncertainty.

That said, we believe utilities have been focused on how waivers will be issued to allow for Russian-enriched uranium imports and avoid potential reactor outages. This may have been further complicated as Tenex sent a notice of force majeure to U.S. utilities after the Act was signed. Per S&P Global, the notice stated that “the waivers would cause Tenex to either stop enriching and delivering uranium for U.S. customers or receive financial guarantees that customers would pay for the material regardless of their ability to secure a waiver.”8 The notice also stated either to “accept an indefinite delay in receiving their enriched uranium or make financial arrangement to pay regardless of a waiver within 60 days of May 14, the date of the notice.”

Term contracting in 2024 stands at a modest 28.1 million pounds of U3O8 as of the end of May, but may stand to increase significantly. Term contracting increased from 124.6 million pounds of U3O8e in 2022 to 160.8 million pounds of U3O8e in 2023. This represents the highest global contracting rate in over a decade and nears "replacement rate contracting," which aims to meet annual nuclear reactor fuel needs. Ultimately, world uranium mine production falls well short of world uranium reactor requirements, and therefore, utilities must either contract for future uranium requirements or drawdown inventory levels.

Heightening Geopolitical Risks, Supply Uncertainty and Ubiquitous Demand

On May 2, NAC Kazatomprom JSC (Kazatomprom) announced that the completion of the construction and the start of production of its new sulfuric acid plant was to be postponed from 2026 to 2027.9 This follows the announcement at Kazatomprom's previous operational update that it would reduce its 2024 and 2025 production guidance due to shortages of sulfuric acid and construction delays. This amounted to a 14% reduction in production guidance, and given that Kazatomprom is the largest and lowest-cost uranium miner in the world, this represents a 6% reduction in the global mine supply of uranium. Given Kazatomprom’s global significance, the sulfuric acid shortage may continue to dampen uranium supply and increase the risk of another production guidance reduction for 2025 (to be released in August).

In May, a restart of the Azelik mine in Niger was announced.10 The mine had started operation in 2010 but was suspended nearly a decade ago, given the lower uranium price environment at the time and higher production costs. The announcement did not include a specific date for the restart, but it is a welcome development for the industry with an annual capacity of 1.82 million pounds U3O8. In July 2023, the Nigerian government at that time signed a memorandum of understanding with China Nuclear International Uranium Corporation, a Chinese state-owned company, to restart activities. However, since then, the government of Niger has been overthrown. A military junta led a coup d'état in July 2023, overthrowing the democratically elected president. Niger has adopted an increasingly anti-Western stance, and the current state remains in flux, reflecting increasing geopolitical risk.

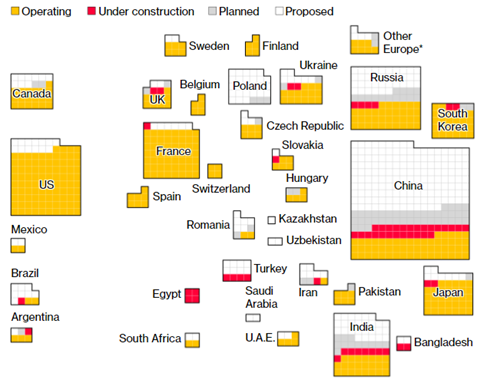

Uranium demand remains ever-present, with nuclear reactor buildouts in full force. Bloomberg reported that the world’s biggest nuclear power plant may likely resume generation this year after more than a decade offline. This joins the increasing numbers of nuclear reactors coming online, creating a growing need for uranium (see Figure 3). Globally, there are 440 nuclear reactors in operation, 60 under construction, 92 planned and 343 proposed.

Figure 3. World Nuclear Power Reactors

Source: Bloomberg and World Nuclear Association. https://www.bloomberg.com/news/features/2024-06-12/uranium-price-surge-helps-deadly-metal-dominate-commodity-market and https://world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme

Potentially Attractive Entry Point

We believe that uranium's recent pause may be an attractive entry point in the overall uranium bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and failed to adapt their procurement strategies to the new market realities.

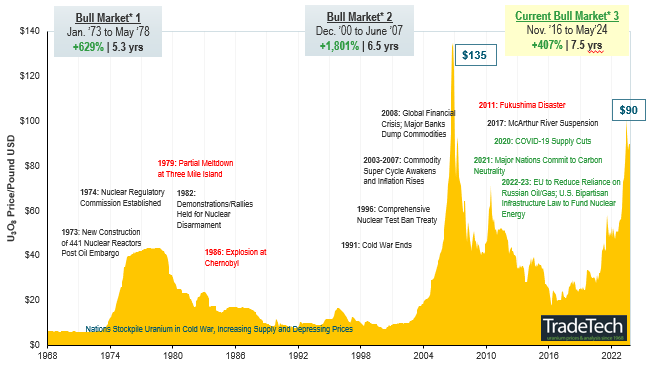

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 4).

Figure 4. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 05/31/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | UxC, Uranium Market Outlook, Q2 2024 |

| 7 | Source: Bloomberg, US Seeks $4.3 Billion for Uranium to Wean Off Russia Supply. |

| 8 | Source: S&P Global, US DOE issues process for utility waivers of Russian enriched uranium ban. |

| 9 | Source: Kazatomprom 1Q24 Operations and Trading Update. |

| 10 | Source: Enerdata.net, The Chinese-owned group Somina plans to resume uranium mining at Azelik (Nigeria). |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.