Key Takeaways

Uranium Price Holds Steady

The uranium spot price has remained range-bound between $85 and $95 per pound,1 and ended the first half at $85.34 (June 30, 2024).

Miners Outperform Commodity

Although miners fell in June, they bounced back in early July, outperforming the commodity year-to-date.

Tax Hikes Weaken Incentives

Kazakhstan, the world’s largest uranium-producing country, announced a surprise tax increase on uranium, which has multiple implications.

M&A Activity Rises

Paladin Energy Limited has entered an agreement to acquire Fission Uranium Corp. in a deal valued at $833 million.

Geopolitical Threats Continue

The situation in Niger continues to impact uranium markets, as it has revoked Orano SA and GoviEx Uranium’s mining rights.

Performance as of June 30, 2024: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

-4.49% | -3.17% | -6.32% | 52.34% | 38.06% | 28.25% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

-11.98% | 0.82% | 3.41% | 54.24% | 21.31% | 30.71% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | -15.93% | -3.77% | 3.85% | 47.89% | 13.90% | 28.51% |

|

Broad Commodities (BCOM Index) 4 |

-1.94% | 1.51% | 2.38% | -0.48% | 2.23% | 4.86% |

|

U.S. Equities (S&P 500 TR Index) 5 |

3.59% | 4.28% | 15.29% | 24.56% | 10.02% | 15.05% |

*Performance for periods under one year are not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 6/30/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Pause Continues

The uranium spot price has remained range-bound between $85 and $95 per pound, ending June at $85.34.1 Uranium miners fell significantly in June, though they gained some of this back in the first half of July and are ultimately still outperforming the commodity year-to-date.

We believe we are in a natural correction within the broader context of a bullish market cycle.

The uranium markets continue to digest last year’s 88.54% gain and have remained apathetic to ever-strengthening fundamentals. As discussed below, over the past month, Kazakhstan has hiked taxes, M&A (merger and acquisition) activity appears to be on the rise, and geopolitical considerations continue to threaten supply. Moreover, fundamentals continue to strengthen with nuclear power plant restarts, new builds and a deepening supply deficit. Legislation continues to progress as the U.S. passed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy Act (ADVANCE Act) and the Prohibiting Russian Uranium Imports Act in May. We believe these developments should support the physical commodity and uranium miners but have been overshadowed by seasonal softness and broader commodity weakness. As such, we believe we are in a natural correction within the broader context of a bullish market cycle; we believe this continues to be a healthy sign of a functioning market.

Going forward, lower volume contacting levels may dissipate as Kazatomprom is set to release its production guidance for 2025 on August 1, seasonal summer softness comes to an end, the waiver process is worked through regarding U.S. utilities and Russian uranium services, and the World Nuclear Association symposium is held in September.

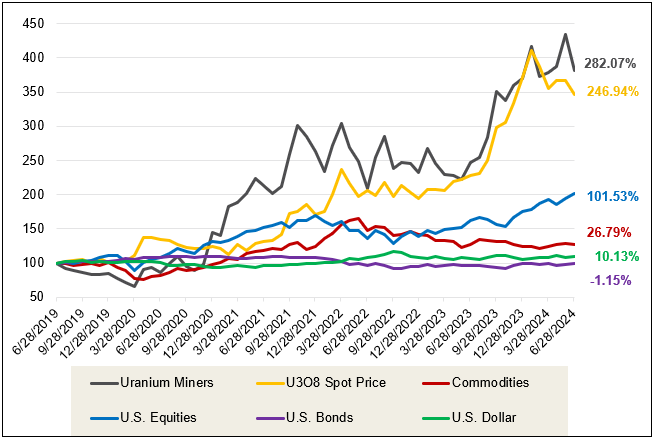

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended May 31, 2024, the U3O8 spot price has risen a cumulative 246.94% compared to 26.79% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (06/30/2019-06/30/2024)

Source: Bloomberg and Sprott Asset Management. Data as of 06/30/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Past performance is no guarantee of future results.

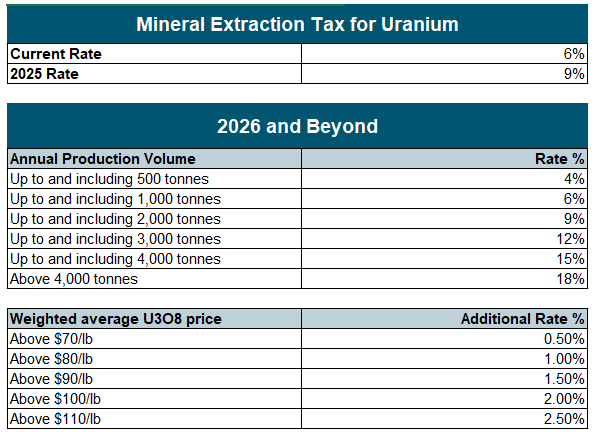

Kazakh Tax Hike Weakens Incentives to Increase Production

The government of Kazakhstan, the world’s largest uranium-producing country, announced a surprise tax increase for uranium. Currently, there is a 6% Mineral Extraction Tax (MET) for uranium. The MET will be increased to 9% in 2025, and beginning in 2026, the government is introducing a two-tier MET based on both uranium production and U3O8 prices (see Figure 2).

The tax hike was largely seen as a surprise, given that the 6% flat rate was introduced in 2023. These new rates are not minor, given a maximum of 20.50% tax, and have multiple implications. Firstly, Kazakh uranium production costs will increase. However, Kazakhstan will remain the world’s largest and low-cost swing producer due to the significant cost advantage of its in-situ recovery (ISR) mining methods (in contrast to Cameco’s Cigar Lake and McArthur River underground mining methods).

The structure of this tax hike also plays a role; given that higher annual production begets higher MET rates, NAC Kazatomprom JSC (Kazatomprom), the world’s largest uranium-producing company, will now have less incentive to increase production. This may bolster uranium prices and feed into the company’s “value over volume” strategy. For the past few years, Kazatomprom has adopted a value-over-volume philosophy, a supply discipline achieved by prioritizing the price of products/services instead of volume growth.

Incentives not aligned with increasing global uranium production strengthen the unabating supply-demand deficit. Mine supply, with 2024 forecasted production of 156 million pounds, is still well short of the world’s uranium reactor requirements, with 176 million pounds forecasted for 2024. Further, given the increasing global recognition of the importance of nuclear energy to energy security and decarbonization, the demand for uranium is forecasted at 338 million pounds in 2040. To meet these 2040 projections, the uranium mine supply needs to more than double by then, but the supply response thus far has proven to be more challenging to ramp up than anticipated.

Earlier this year, Kazatomprom stated it needed to reduce its 2024 and 2025 production guidance due to shortages of sulfuric acid and construction delays, which marked a U-turn from its announcement last September that it would increase production to a 100% level relative to subsoil use agreements. Specifically, Kazatomprom’s 2024 production guidance was reduced by nine million pounds, or 14% lower, which, due to the company’s large market share, represented a 6% reduction in the global mine supply of uranium.

Notably, Kazatomprom has not yet released production guidance for 2025. Although the uranium spot price has fallen from the triple digits fueled by Kazatomprom’s reduction in 2024 guidance, all eyes are on its August 1 announcement of 2025 guidance.

Figure 2.

Niger Instability Increasing Supply Uncertainty

The volatile situation in Niger continues to impact uranium markets. Where in recent weeks, Niger has revoked Orano SA’s (a French headquartered privately owned uranium mining company) mining permit for the Imouraren project. Niger has also withdrawn GoviEx Uranium’s mining rights to its Madaouela project.

A military junta led a coup d'état in July 2023, overthrowing the democratically elected president. Since then, Niger has adopted an increasingly anti-Western stance and, in January, stated that it would suspend new mining licenses and would review existing ones.6

As a result, the authorities requested Orano provide a proposal to restart the Imouraren project and have now determined that this plan does not “meet the authorities’ expectations”.7 The Imouraren project contains one of the largest uranium reserves in the world. It began excavations in 2012 and was suspended in 2015 due to a poor market environment. With the recent higher uranium prices, Orano had stated that it was impossible to consider restarting. Orano has since provided an update on the situation that after being engaged in Niger for more than 50 years, it will keep all channels of communication open with Niger while reserving the right to challenge the decision before the competent nation or international jurisdictions.8

GoviEx began operations on the Madouela project in 2007. Now, its mining rights are withdrawn, and GoviEx has been informed that it is now in the public domain. Ultimately, Niger’s increasingly anti-Western stance reflects increasing geopolitical risk, which we believe will increase the value of uranium miners with assets in stable jurisdictions.

Uranium M&A Momentum

Paladin Energy Limited (Paladin) and Fission Uranium Corp. (Fission Uranium) announced that they have entered into an agreement under which Paladin will acquire 100% of Fission. The all-share deal is valued at $833 million and represents a 26% premium.

Fission Uranium is a prominent junior uranium mining company developing the Patterson Lake South project (PLS). The PLS project is located in the Athabasca Basin in Saskatchewan, Canada. This location places it within one of the world's top mining jurisdictions, known for its prolific uranium resources.

Paladin is an Australian uranium miner that has recently become a producer. The company’s flagship project is the Langer Heinrich mine. The mine is located in Namibia, Africa, the third largest uranium-producing country, in a globally significant uranium province.

Restarting and new mines are critical to help address the entrenched supply-demand deficit, and with the uranium spot price consolidating at levels not seen in over 16 years, junior uranium miners may be well positioned to benefit from takeover bids such as these. We believe that further M&A may be likely, as it provides uranium juniors with the potential for premium bids and acquirers the ability to increase market share ahead of a continuing uranium bull market. Further consolidation may also be likely for companies with top-tier assets in stable jurisdictions.

Positive Nuclear Developments Continue

We believe that governments' continued support for nuclear energy helps bolster the uranium market and uranium miners. Nuclear energy developments are broadly gaining momentum globally, like France's President Emmanuel Macron's confirmation of plans to build eight new reactors and strong movement in the U.S.9

After being introduced in the Senate in March 2023, the ADVANCE Act was signed into law with bipartisan support in July. The ADVANCE Act will encourage more investment and innovation in domestic nuclear technologies and help increase the efficiency of the Nuclear Regulatory Commission.10

This follows the passage of the Prohibiting Russian Uranium Imports Act in May, which bans Russian-enriched uranium imports to the U.S., eventually severing roughly $1 billion in trade and 24% of the U.S.’s 2023 enriched uranium supply. The act also unlocks $2.7 billion of government aid to rebuild domestic nuclear fuel production. The latter has already begun as on June 27, the U.S. Department of Energy (DOE) announced that it issued requests for proposals so that it could start to buy up to $2.7 billion of domestically supplied enriched uranium.

Finally, the DOE also announced $900 million to accelerate the deployment of next-generation small modular nuclear reactors.11 Ultimately, we believe that these rising global commitments to nuclear energy are helping to make uranium and uranium miners a compelling investment.

Potentially Attractive Entry Point

We believe uranium's recent pause may be an attractive entry point in the overall uranium bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and failed to adapt their procurement strategies to the new market realities.

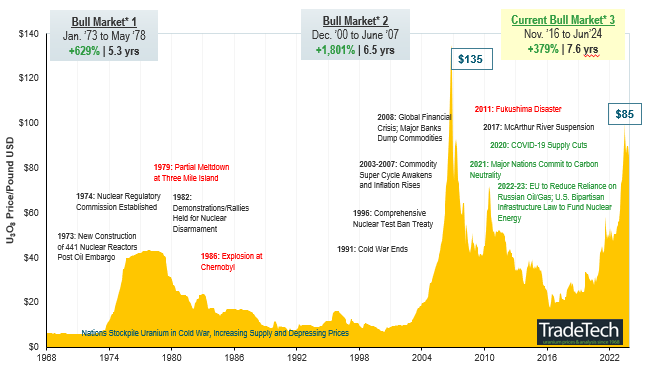

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 3).

Figure 3. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 06/30/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Uranium Producer Niger Launches Mining Sector Overhaul. |

| 7 | Niger revokes mining permit for Imouraren project. |

| 8 | Update on the situation of the Imouraren mining project in Niger. |

| 9 | French president confirms project to build eight new nuclear reactors. |

| 10 | SIGNED: Bipartisan ADVANCE Act to Boost Nuclear Energy Now Law. |

| 11 | DOE Announces $900 Million to Accelerate the Deployment of Next-Generation Light-Water Small Modular Reactors. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.