- View Critical Materials May 2023 Performance Table

-

For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- China’s dominance in critical minerals poses risks to the West’s manufacturing base and national security, highlighting the need for onshoring and friend-shoring energy transition supply chains.

- Western countries are forming strategic industrial policies to increase domestic sourcing and manufacturing capabilities and reduce reliance on imports. These methods include subsidies, tax credits and trade alignment measures.

- The scarcity and importance of critical minerals for the energy transition underscore the need for collaborative efforts, strategic partnerships and international agreements to ensure fair access and sustainable practices.

- Inflation has proven to be stickier than expected. The emerging U.S. industrial policy, which is driven by national security concerns and therefore relatively price-insensitive, will add to long-term inflationary pressures.

- Metals markets were mixed in May. Lithium rebounded on restocking and a pickup in electric vehicle (EV) sales, while copper and nickel continued to fall due to concerns regarding China's economic recovery and U.S. monetary policy.

May in Review

The Nasdaq Sprott Energy Transition Materials™ Index fell 4.66% in May to close the month at 879.27. The Index remains in a broad consolidation trade range (see Figure 1). Lithium and lithium miners staged a sharp rebound rally, but copper and copper miners were weighed down by disappointing data from China, ongoing global growth concerns and the U.S. debt ceiling drama. China's economy was expected to rebound following the end of its zero-COVID policy in December and the completion of its regulatory reform this year, but signs of economic recovery are now limited, particularly within China's industrial sector. Metals traders that had built inventory in anticipation of a China rebound have been destocking aggressively, putting downward pressure on the prices of most metals commodities.

Lithium prices rebounded in May as customers resumed restocking their supply chains. The month also saw more merger and acquisition (M&A) activity as Allkem (ASX: AKE) and Livent (NYSE: LTHM) announced a merger of equals to create a $10 billion market-cap lithium miner.16 Industry leader SQM (NYSE: SQM) expects lithium demand to grow at least 20% this year and sales volume will recover despite China's uneven economic recovery.

At the same time, the broader equity markets continued to display unusual activity. In early March, signs of a slowing economy led to expectations of cooling inflation and the end of Federal Reserve (Fed) tightening. This sparked a rally in long-duration assets, especially mega-cap technology stocks. Near the end of May, a dot-com-like frenzy occurred in AI (artificial intelligence) related equities, further accelerating and narrowing market breadth to a half-dozen stocks.

Figure 1. Nasdaq Sprott Energy Transition Materials™ Index Continues to Consolidate in May (2019-2023)

Source: Bloomberg. NASDAQ Sprott Energy Transition Materials™ Index (2018-2023). Data as of 6/01/2023. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Included for illustrative purposes only. Past performance is no guarantee of future results. You cannot invest directly in an index.

Loosening China's Grip on Strategic Minerals

The last decade of globalization saw commodity oversupply, minimizing supply disruptions and emphasizing financial-macroeconomic relationships over physical market fundamentals. In the West, ESG (environmental, social and governance) investing called for limited investment in carbon-intensive sectors, resulting in lower reinvestment ratios. Growth in resource commodity production was nominal, leaving the East to develop its own metals markets. Following a decade or more of below-expected reserve replacement in the West, there is still a lack of CapEx in mining and metals required for the energy transition. This has created long lead times and potential supply shortages in energy transition metals.

China's dominance in mining and processing strategic energy transition materials is a vulnerability for Western countries. The concern is that China could restrict the supply of critical minerals, such as lithium and rare earth elements, for commercial advantage or as leverage in political or trade disputes. Disrupting the China-controlled supply chain could lead to shortages and hamper civilian and defense manufacturing in the U.S. and other Western countries.

In addition, long and fragile supply chains have proven to be brittle and risky. Hence, efforts are underway in the West to develop non-China-based alternative sources or substitutes, as illustrated by recent developments in U.S. industrial policy.

U.S. Energy Transition Industrial Policy Takes Shape

The Inflation Reduction Act (IRA) of 2022 and the Infrastructure and Investment Jobs Act (IIJA) of 2021 form the current basis for U.S. industrial policy for clean energy. This policy calls for targeted public investment aimed at unlocking opportunities to "crowd in" the private sector to build out U.S. capacity for the energy transition.

We would not be surprised if the U.S. were to establish a critical metals strategic reserve akin to the Strategic Petroleum Reserve.

In the past, a program such as the Federal Aid Highway Act of 1956 provided 90% of the construction cost for interstate highways. The Pacific Railroad Act of 1862 and 1864 provided significant federal financial support (land grants, loans, bond purchases and other incentives) to build the transnational railway system. These historical acts helped lay the foundation for future private investment by providing incentives and more predictable long-term returns. However, by the 1980s, supply-side economics (or trickle-down economics) became popular. Government investment was viewed unfavorably. That path eventually led to the lowest-cost strategy (globalization and off-shoring) and China’s dominance in the U.S. supply chain, which is today the primary source of non-resiliency and the leading U.S. national security concern.

Though it will undoubtedly evolve, the U.S. energy transition industrial policy currently differs from other Western countries in its scale, level of protectionism and alignment with trade agreements.

1. Scale: The initial read-through of public funding to the private sector is roughly $1 trillion over 10 years. This covers open-ended subsidies and tax credits to global firms that meet specific requirements to manufacture domestically in the U.S. However, the figure will likely be much higher due to the unfunded nature of the tax incentives and likely future initiatives.

2. Protectionism: There are considerable requirements for domestic content in electric vehicles (EVs) and batteries or stipulations that components come from countries in a Free Trade Agreement (FTA) with the U.S. These measures are designed to create U.S.-based jobs rather than provide support to U.S. firms. To qualify in 2023, a minimum of 40% of the critical minerals value in an EV must be sourced from the U.S. or countries with which the U.S. has an FTA. This threshold will increase by 10% annually to 100% by 2029. In addition, for an EV to be eligible for this credit, no critical minerals may be extracted or processed by a "foreign entity of concern" (which include China and Russia) from 2025 onwards.

3. Trade Alignment: The policy thrust is to continue to build and expand supply chains with strategic partners. Other countries and non-American private sectors may benefit from U.S. support in constructing an energy transition supply chain. A good example would be Argentina, a fast-growing lithium producer that wants to access the U.S. market. Argentina currently lacks an FTA with the U.S. and has been lobbying to secure an exemption.

Lithium-ion battery production capacity in the U.S. is expanding. Sourcing battery components appears manageable, but battery metals supply remains a bottleneck. This is a concern for EV carmakers, which have responded by investing directly in mines. The government can provide policy assistance to critical metal miners and we have already seen financing for mining projects from various governments and related entities.

In the future, we would not be surprised to see any combination of guaranteed offtake agreements and pricing mechanisms to de-risk future cash flows. The goal would be continuous production of critical metals, bypassing any slowdowns due to shorter-term commodity price cycles. Lastly, we would not be surprised if the U.S. were to establish a critical metals strategic reserve akin to the Strategic Petroleum Reserve and well beyond the capacity of the Defense National Stockpile Center.

Welcome to the EU's Critical Minerals Club

The European Union (EU) passed its Critical Raw Materials Act in early 2023. It aims to ensure the EU can access a secure and sustainable supply of critical raw materials crucial to the clean energy transition. The EU has acknowledged that full raw material self-security is impossible. Still, it would like to establish a critical raw materials "club" of interested countries to strengthen global supply chains. While the EU initiative lacks the reach and funding power of the U.S. and China policies, it will lead to new investments and affect the global trade flows of metals.

The EU has strategic partnerships with several countries but needs to do more to reduce its reliance on China for energy transition materials. The EU will increase in-country extraction by simplifying permitting and increasing access to financing. By 2030, the EU is targeting domestic sourcing for at least 10% of strategic raw materials and 40% of refined and processed metals consumed, while no more than 65% of consumption can be imported from a single non-EU country.

The U.S. government's significant spending powers (as enabled by the IRA and the Defense Production Act (DPA) of 1950) have made Europeans concerned that they may be excluded from a U.S. green-tech boom. The IRA includes protectionist measures favoring American-made components for electric vehicles, leading to concerns about market access among European manufacturers.

The U.S. has committed significant incentives through the IRA and invoked the DPA multiple times to accelerate clean energy production and domestic manufacturing of energy transition materials. Overall, the U.S. government's actions to stimulate the green economy and strengthen domestic industries provide potential market opportunities for North American collaboration with the EU while reducing reliance on China.

The Energy Transition is Inherently Inflationary

After being absent for decades, inflationary forces are reshaping the world economy. The economic trends that previously exerted downward pressure on consumer prices have reversed. Bringing inflation back down to desired levels and maintaining stability may prove difficult and will present economic challenges. While headline inflation in the U.S. has fallen below 5% from its peak of 9% due to falling energy prices and easing supply chain pressures, a more challenging phase likely lies ahead.

Transitioning to a greener economy necessitates substantial spending on infrastructure, which may likely increase inflation, particularly given protectionist policies and national security concerns.

Several structural factors are contributing to the rise in inflation. Trade patterns are evolving from globalization and outsourcing towards more expensive supply chains (onshoring and near-/friend-shoring). Industrial policy is emphasizing security, redundancy and resilience over low cost, resulting in higher fixed costs. Previously cheap global outsourced labor is being reshored to more expensive labor regions. Demographic challenges include the fact that baby boomers are retiring and are being replaced by a much smaller cohort, Gen Z, resulting in worker shortages. Technology, which has historically been deflationary, is facing increasing regulation and data localization, reducing its potential value as a counter to inflation.

Global climate change and the need to transition to greener economies are fundamentally inflationary. Transitioning to a greener economy necessitates substantial spending on upstream and downstream infrastructure and technology. Higher spending may increase inflation, particularly given protectionist policies and an overriding national security concern. Additionally, the aggressive transition away from fossil fuels raises the possibility of temporary imbalances between the global energy supply and aggregate demand, further contributing to inflationary pressures.

Commodity Prices Mark the Path of Future Inflation

U.S. industrial policy will lead to considerable fiscal spending on reshoring the U.S. industrial base, advancing energy transition and rearming. These initiatives will be commodity- and labor-intensive but not interest rate sensitive to the same degree. The Fed could raise interest rates significantly, but reshoring, energy transition and rearming would still occur due to national security considerations.

The theme here is secular inflation, which will impact r* (the natural rate of interest)17, as higher interest rates will be required to control inflation. Given tight labor markets, wage pressures, above-target core inflation and U.S. industrial policy set to accelerate under the IRA, inflation may likely prove stickier than expected.

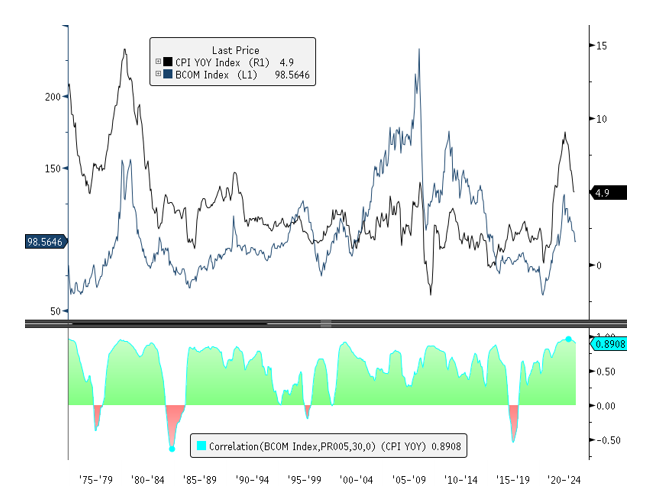

Inflation is highly correlated with commodity prices over the long term. Figure 2 plots the relationship between inflation and commodity prices, with inflation represented by the U.S. consumer price index (CPI). Correlation is shown in the lower panel as depicted by the rolling 30-month correlation coefficient.18 A correlation coefficient approaching 1.0 indicates a strong positive relationship between the two. The 2004‒2008 period, when inflation did not track the surge in the commodity index, marks the emergence of China as an exporting low-cost manufacturing power. China had a nearly insatiable demand for commodities, but the inflationary pressure from this was more than offset by the country’s impact on reducing producer prices through low-cost exports. The "great moderation" was not a new normal but a reprieve from the long-term history of macro volatility.

Figure 2. Inflation and Commodity Prices are Closely Linked (1975-2023)

Source: Bloomberg. CPI Index Urban Consumers Y/Y and Bloomberg Commodity Index. Data as of 6/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results. You cannot invest directly in an index.

Updates on Critical Materials

Lithium: Market Rebounds on Restocking and EV Sales

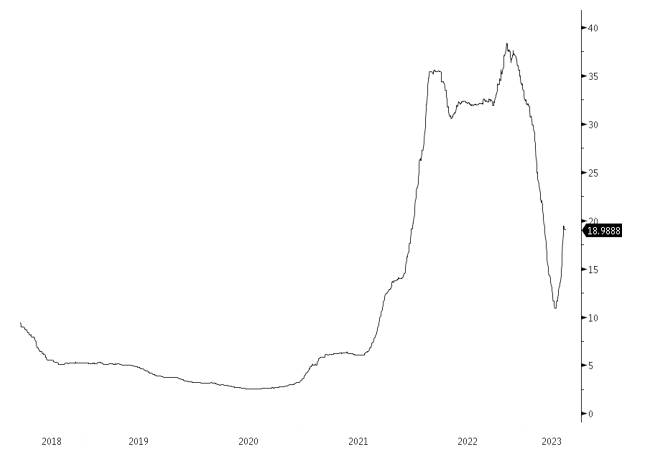

The lithium commodity market experienced a significant rebound in May, with prices rising more than 60% after a massive sell-off from the November 2022 peak. Market sentiment improved given that high demand has depleted lithium inventories, restocking has started to heat up and global EV sales recovered in May.

In China, lithium carbonate imports surged by 84% in April compared to March, reaching a volume of 17,500 metric tons of lithium carbonate equivalent. This is an important indicator of demand growth. It represents the second-highest import volume ever recorded and suggests that domestic demand in China is rising. Market sentiment had been weak for months, but it has improved, increasing consumption of existing lithium stockpiles.

In May, there was another significant realignment in the lithium mining space. Livent and Allkem, two prominent players and the only two lithium producers in Argentina agreed to merge in a deal valued at $10.6 billion. The combination will form the world's third-largest lithium company.

Argentina, a fast-growing emerging lithium supplier, is making progress in gaining access to the U.S. market. Argentina is actively lobbying to secure an exemption to current regulations as it lacks a free trade agreement with the U.S. This move to secure end-market access comes during intense global competition between the U.S. and China for critical EV minerals.

The Livent-Allkem merger followed Liontown Resources' rejection of a $3.7 billion proposal from Albemarle Corporation in March. Liontown’s market capitalization rose significantly the day after it rejected the proposal, to $3.8 billion from $2.2 billion, indicating potential tailwinds from further mergers and acquisitions. Similar large gains in lithium miners have occurred recently due to EV carmakers making direct equity investments into miners to secure lithium supplies.

Figure 3. Lithium Prices Stage a Snapback (2018-2023)

Source: Bloomberg. Lithium carbonate $/lb. Data as of 6/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper: China’s Weakness Disappoints

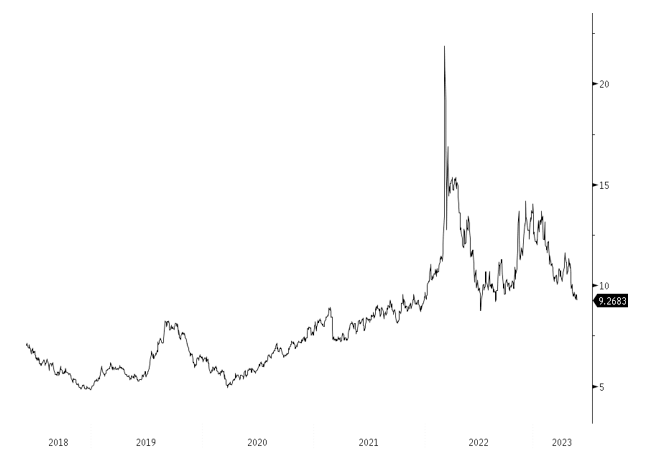

Copper prices fell in May after China’s economic data was weaker than expected and failed to meet expectations that demand would increase with the post-COVID reopening. Renewed concerns about further U.S. rate hikes also dampened sentiment in the metals market at large. These appear to be typical shorter-term cyclical pricing effects within a longer secular commodity supercycle.

Chinese economic data released in May included two items that indicated the depth of the country’s economic weakness and negatively affected metals prices. One was industrial output for April, which was a very disappointing 5.6% year-over-year vs. an expected 10.9%. The other was April's credit data, which showed new loans were the lowest in six months and total social finance growth was well below expectations. Mid- and long-term household loans (a proxy for mortgages) recorded the sharpest drop in 15 years after a strong March. China's consumers remain reluctant to enter the property market.

These two data points hurt sentiment and drove a sharp sell-off across most industrial metals. However, China's economic policy committee may announce stimulus initiatives to boost economic growth as it has done repeatedly over two decades.

Copper inventories, meanwhile, remain very low across all three major exchanges and the inventory coverage ratio19 continues to decline. Long-term and short-term copper markets are expected to remain in deficit. Mine supply growth continues to miss expectations while demand, particularly in China, surpasses previous forecasts. The global copper concentrate market remains on track for a steep deficit during 2025‒2027 as significant new smelting capacity comes online in Asia while mine supply growth lags.

Figure 4. Copper Still on a Downward Path (2018-2023)

Source: Bloomberg. LME (London Metal Exchange) copper $/lb. Data as of 6/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Nickel: Macro Concerns Weaken Sentiment

Nickel prices fell 15.6% in May—the fourth steepest monthly drop in a decade. Nickel is a minor commodity compared to other metals, making its prices more volatile. The nickel market was affected by the same macro news out of China as the other metals markets in addition to reports that Chinese nickel producers are seeking to have their nickel cathodes "certified LME deliverable."20

This news follows efforts by the LME to bolster the liquidity of its nickel contract, including shortening contract terms for new brands from one year to three months and waiving fees. Anecdotal reports suggest market participants are concerned this could quickly inundate LME warehouses with currently non-deliverable material, putting considerable downward pressure on LME nickel prices. (We believe this would likely have a very short-term trading effect on nickel prices.)

Figure 5. Nickel Prices Continue to Fall (2018-2023)

Source: Bloomberg. LME nickel $/lb. Data as of 6/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Critical Materials: May 31, 2023 Performance

| Metric | 5/31/2023 | 4/30/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 879.27 | 922.26 | (42.98) | (4.66)% | (5.85)% | Disappointing China data and concerns about the U.S. growth outlook negatively impacted the resource commodity group. Poor market breadth further exacerbated the downside price action. Lithium miners bucked the downtrend due to a sharp rally in lithium prices. |

| Nasdaq Sprott Lithium Miners™ Index2 | 1,002.23 |

965.59 | 36.64 | 3.79% | 8.66% | |

| North Shore Global Uranium Mining Index3 | 2,307.58 | 2,376.39 | (68.81) | (2.90)% | (4.92)% | |

| Solactive Global Copper Miners Index4 | 126.64 | 144.81 | (18.17) | (12.54)% | (2.80)% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 791.96 | 867.18 | (75.22) | (8.67)% | (12.98)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 872.95 | 991.96 | (119.00) | (12.00)% | 1.70% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 858.96 | 900.53 | (41.56) | (4.62)% | (16.31)% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 18.97 | 11.65 | 7.32 | 62.88% | (44.45)% | Sharp rebound as restocking resumes |

| U3O8 Uranium Spot Price $/lb9 | 54.59 | 53.85 | 0.85 | 1.58% | 12.99% | New 52-week high, prices breaking out |

| LME Copper Spot Price $/lb10 | 3.66 | 3.89 | (0.23) | (5.91)% | (3.52)% | Weak China data, destocking and traders sell |

| LME Nickel Spot Price $/lb11 | 9.27 | 10.98 | (1.71) | (15.60)% | (31.63)% | Same as copper plus new LME deliverables |

| Benchmarks | ||||||

| S&P 500 TR Index12 | 4,179.83 | 4,169.48 | 10.35 | 0.25% | 8.86% | A most unusual market: extremely narrow breadth led by AI in a dot com-like frenzy, debt ceiling concerns, China's disappointing economic data have created a bifurcated market. |

| DXY US Dollar Index13 | 104.33 | 101.66 | 2.67 | 2.62% | 0.78% | |

| BBG Commodity Index14 | 97.96 | 104.31 | (6.35) | (6.08)% | (13.16)% | |

| S&P Metals & Mining Select Industry TR Index15 | 2,273.29 | 2,530.68 | (257.39) | (10.17)% | (10.91)% | |

Source: Bloomberg and Sprott Asset Management LP. Data as of May 31, 2023.

Past performance is no guarantee of future results. You cannot invest directly in an index.

- For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in copper exploration, mining and/or refining. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining-related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index classified in the GICS metals & mining sub-industry. |

| 16 | Source: PR Newswire - Allkem and Livent to Create a Leading Global Integrated Lithium Chemicals Producer. |

| 17 | The natural rate of interest, or r-star, is defined as the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable. It is the rate of interest that prevails when the economy is operating at its full potential and is in some form of equilibrium. R-star is a theoretical rate—it is not observable but must be estimated. In the U.S., r-star has fluctuated between 0.3% and 1.8% over the past 10 years, according to estimates published by the Federal Reserve Bank of New York. |

| 18 | The correlation coefficient is a statistical measure of the strength of the linear relationship between two variables. Its value can range from -1.0 to 1.0. A coefficient of 1.0 indicates a perfect positive correlation, -1.0 shows a perfect negative (or inverse) correlation, and 0 indicates no linear relationship. |

| 19 | The inventory coverage ratio or stock coverage ratio is a metric—usually expressed in days—showing how long an exchange can meet customer demand with the available inventory in its warehouses. It is derived by dividing the amount of inventory stored in the facility by the average daily sales for a given period. |

| 20 | "Certified LME deliverable" is a designation given to a metal or commodity that meets specific criteria (for example, purity, size, shape, packaging, etc.) set by the London Metal Exchange for delivery on its exchange platform. The LME is a global marketplace for trading industrial metals. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.