- View Critical Materials July 31, 2024 Performance Table

- For the latest standardized performance and holdings of the Sprott Critical Materials ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPP, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- Renewable energy deployments are rising exponentially and steadily displacing fossil fuels as primary energy sources.

- As manufactured technologies, renewables have an inherent advantage. Costs fall and efficiencies rise when rollouts scale, which is in sharp contrast to the old centralized, commodity-based energy sources.

- The levelized cost of electricity from renewables is now about half that of natural gas and coal and is expected to fall to about one-quarter by 2050.

- Three key drivers of the energy transition—renewables, electrification and efficiency—are all growing at exponential rates.

- Fossil fuels have powered the world for over 200 years and created geopolitical alignments around the global distribution of oil and gas reserves; their phase-out is expected to lead to a significant shift in international power relations over time.

July in Review: A Noisy Month

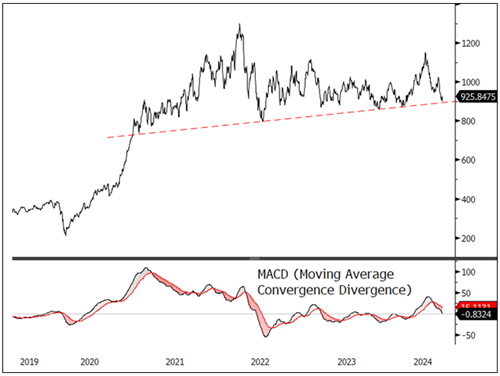

The Nasdaq Sprott Energy Transition Materials (NSETM) Index fell 25.73 (or 2.70%) in July to close the month at 925.85. All main components of the Index fell in the month, with copper miners showing the best relative strength while others recorded further downsides. The NSETM Index has now retraced back to its trendline support (Figure 1).

The S&P 500 Index closed at a new all-time monthly high, but there was a wide dispersion of returns.

July began with a bounce from June's oversold conditions. Central bank easing remained on track with stable credit conditions, while the U.S. dollar retreated along with yields, all providing generally favorable conditions for commodities. However, weakness in China continued with disappointing economic data consistent with deflation, while the property and consumer markets were soft. The recent Third Plenum16 was a disappointment, with no real attempt made to address the problems in the Chinese property market. There was an emphasis on increasing exports, which might lead to more tariffs on energy transition industries. While there was further monetary easing across China’s complex multi-tiered rate regime, there is a growing sense of panic about the state of China's economy. As China's domestic economy remains frail, there is an increasing probability of fiscal stimulus, which should boost commodities, similar to 2009 but likely on a smaller scale.

Other factors contributing to the mid-month selling included: the market pricing-in of a possible victory by Donald Trump in the U.S. presidential election (anti-electric vehicle and prior to the Kamala Harris announcement); the U.S. Supreme Court striking down the Chevron deference; some fund de-grossing (both long and short positions were decreased in various CFTC [Commodity Futures Trading Commission] metals); lower growth expectations; and the fading of the yen carry trade on signs of a potential rate hike by the Bank of Japan. Essentially, it was a multi-faceted technical selling wave despite long-term fundamentals remaining unchanged.

The S&P 500 Index closed at a new all-time monthly high, but there was a wide dispersion of returns as the small-caps rallied 10.34% (as measured by iShares Russel 2000 ETF) while the technology sector fell 3.28%. In all, it was a noisy month, exacerbated by lower summer volumes, making the market difficult to decipher.

Figure 1. NSETM Index Pulls Back to Trend (2019-2024)

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index. Data as of 7/31/2024. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Included for illustrative purposes only. Past performance is no guarantee of future results.

Unstoppable Shift: Renewables Expand Exponentially as Fossil Fuels Decline

While high-profile technologies like electric vehicles (EVs) capture headlines, it is easy to overlook one of the most important secular changes in global energy supply—the steady displacement of fossil fuels by renewables. Renewable energy, as a manufactured technology, benefits from advancements in cost and efficiency. It is seeing costs plummet and adoption rates rise quickly. In contrast, fossil fuels are extracted commodities with limited cost efficiencies and are highly energy inefficient.

New energy sources, which are manufactured, modular, scalable and clean, stand in stark contrast to old energy sources, which are centralized and both carbon- and capital-intensive.

The shift from fossil fuels to renewable energy sources is being driven by exponential growth in clean technologies, peaking fossil fuel demand, and a global race for leadership in the energy sector. At its core, the transition embodies the dichotomy between commodities and technologies. New energy sources, which are manufactured, modular, scalable and clean, stand in stark contrast to old energy sources, which are centralized and both carbon- and capital-intensive.

The Rise, Decline and Fall of Fossil Fuels

Fossil fuels have been the cornerstone of global energy production for over a century. Oil, natural gas and coal have been pivotal in powering modern civilization. They have driven industrial growth, economic development and technological advancement. However, their extensive use has also sparked significant environmental and geopolitical challenges.

Oil is a crucial component of the global economy, fueling transportation, industry and heating. Oil is refined into various products, including gasoline, diesel, jet fuel and petrochemicals, which are used to manufacture plastics, pharmaceuticals and other goods. The global oil industry is a major employer and economic driver. Leading oil production countries are usually notable geopolitical powers.

Natural gas has gained prominence as a cleaner alternative to coal and oil. It is used extensively for electricity generation, heating and as a feedstock for chemical production. Natural gas burns more cleanly than other fossil fuels, and emits less carbon dioxide and pollutants, making it a preferred choice in the transition to a low-carbon economy. The development of liquefied natural gas (LNG) technology has expanded its global reach, enabling countries to import gas from distant suppliers.

Coal has been a significant source of energy since the Industrial Revolution, providing fuel for electricity generation, steel production and industrial processes. It remains abundant and relatively inexpensive, making it a staple in energy production, particularly in developing countries. However, coal is also the most carbon-intensive fossil fuel, contributing significantly to greenhouse gas emissions and air pollution. Despite its environmental drawbacks, coal continues to be a critical energy source in many parts of the world, although its use is gradually declining in favor of cleaner alternatives.

Inefficiencies Across the Fossil Fuel Lifecycle

Fossil fuels suffer from significant inefficiencies across their entire lifecycle. For every 600 exajoules (EJ) of primary energy, only about 225 EJ (~37%) is converted into useful energy or net generation. The rest is lost at various stages of extraction, refining, production, transportation and use.

Coal and gas power plants are particularly wasteful. They experience massive thermal waste and typically operate at around a 40% efficiency rate as energy losses occur throughout generation. Energy is lost to combustion, boiler heat, steam turbines (which convert heat to mechanical energy), condensation and the cooling of steam back to water, generators and transformers, and transmission lines.

Converting oil reserves into usable energy itself requires substantial energy. About 33% of overall potential energy is lost during extraction, refining and transportation. Another 30% is lost to end-use inefficiencies—for example, in electricity generation, automobile use and petrochemical production. The resulting overall efficiency rate is slightly less than 40%.17

Internal combustion engines (ICEs) convert only about 25% of fuel energy into useful work. The rest is lost to heat, noise and friction, which significantly contributes to air pollution and greenhouse gas emissions, creating economic and environmental costs.

Transporting fossil fuels across long distances adds significant costs as well. Shipping oil and natural gas requires sophisticated logistics and infrastructure, which means high operating costs. Pipelines are cheaper to operate but need substantial upfront capital expenditure for construction and maintenance. All these ancillary costs are critical to gauging the economic viability of fossil fuel projects.

Global Oil Demand to Flatten Out

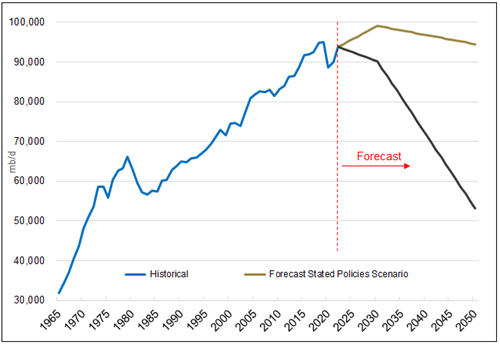

Global oil demand is expected to plateau over the next decade before declining steadily (Figure 2). Global production is expected to be 90-99 million barrels per day (Mb/d) by 2030, according to the International Energy Agency (IEA), compared to about 102 Mb/d today. The IEA estimates that if countries met their announced net-zero targets (the “Announced Pledges Scenario”), global oil demand would fall to around 53 Mb/d by 2050. Under its more conservative “Stated Policies Scenario,” which evaluates current policies and goals, the IEA estimates oil demand could remain close to 95 Mb/d out to 2050.

Figure 2. Global Oil Production—Past and Forecast (1965-2050E)

Source: Historical: Energy Institute, “Statistical Review of World Energy.” Forecasts: IEA, “World Energy Outlook 2023.”

Oil, natural gas and coal are nearing an inflection point. While they continue to play significant roles in the global energy mix, there is a growing push towards decarbonization and sustainable alternatives. Advances in renewable energy technologies like solar and wind and innovations in energy storage and efficiency are gradually reducing reliance on fossil fuels. Additionally, policies promoting carbon reduction and sustainable development are reshaping energy systems.

The fossil fuel S-curve began to flatten in the late 20th century as people became more aware of the environmental consequences and the finite nature of reserves.

Fossil fuels experienced rapid adoption and growth during the 19th and 20th centuries. This period saw significant technological advancements and widespread deployment, leading to an era of unprecedented industrial growth and economic development. However, the fossil fuel S-curve began to flatten in the late 20th century as people became more aware of the environmental consequences and the finite nature of reserves. Regulatory pressures, technological advancements and shifts in public opinion have helped slow fossil fuel growth. Energy security concerns have also affected the trend, notably in the EU, which has offset its loss of access to Russian natural gas primarily with domestic renewable energy.

Efficiencies in extracting and using fossil fuels have largely maxed out. Discovering new reserves is increasingly challenging, and extraction and production costs no longer fall dramatically over time. Development companies face higher costs, more geopolitical risk and increased environmental scrutiny. Today, we are in the late-stage plateau/decline phase of the fossil fuel S-curve as their limitations and downsides become difficult to ignore, and more sustainable alternatives proliferate.

This is likely to have substantial geopolitical implications. Access to oil and natural gas reserves has been at the heart of much global conflict. Control of resources has sparked tensions and strategic alliances for well over a century and continues today. Energy security remains a critical concern for nations, driving policies aimed at ensuring stable and affordable access to vital resources. However, as sustainable energy sources continue to replace traditional energy sources, we could see a significant realignment in the international power relations of the fossil fuel era.

Clean Technologies on an Exponential Path

The new energy sources are manufactured, modular, scalable and clean, which is in stark contrast to the old energy sources. They are growing rapidly and exceeding forecasts. (Many of these forecasts are based on linear trend projections that reflect the barriers and constraints of the old fossil fuel systems.)

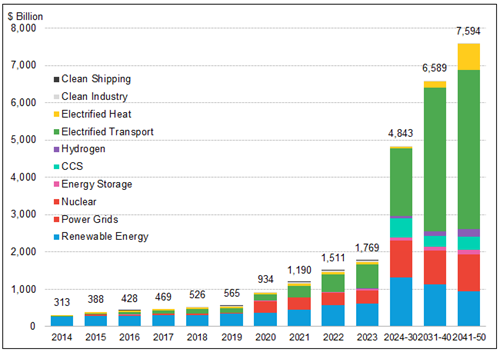

Three key drivers of the energy transition—renewables, electrification and efficiency—are all growing at exponential rates. Cleantech costs, such as those for solar and wind, are declining rapidly. They drop by around 20% for every doubling in deployment and have declined by up to 80% over the past decade. Capital investment in cleantech is also surging—the first trillion dollars of annual investment took decades to achieve, while the second trillion is expected to be reached in just four years (Figure 3).18

Figure 3. Rising Tide of Energy Investment (2014-2050E)

Source: BloombergNEF. Past performance is no guarantee of future results.

The Many Efficiencies of Renewables

Renewable energy sources are far more efficient than fossil fuels. Wind and solar technologies experience minimal energy loss during production, unlike fossil fuels, which require energy-intensive extraction, processing and transportation. Other renewable sources like hydropower and geothermal also have high production efficiencies with only minor losses to system maintenance and operations.

Transportation efficiency is another advantage of renewable energy. Renewable energy can be generated locally, such as through rooftop solar panels, which eliminates the need for long-distance transportation and its associated energy losses. While there are some losses in transmitting electricity from large-scale renewable plants, these are generally lower than the transportation losses for fossil fuels.

In terms of end-use efficiency, renewable energy technologies excel. EVs are 2-4 times more efficient than ICEs and convert a higher percentage of electrical energy into movement. Electric heat pumps are also much more efficient than natural gas boilers, providing heat with significantly lower energy input.

Overall, renewable energy systems are much more efficient due to reduced losses in production, transportation and end-use, and they also bypass the costly and inefficient extraction and processing stages that fossil fuels must undergo.

Deployment Up, Costs Down

The synergy between renewables, electrification and efficiency creates a positive feedback loop that sustains rapid change. As more renewable energy technologies are deployed, their costs fall, making them more accessible and appealing. Solar generation capacity is doubling every 2-3 years, and battery storage capacity is doubling annually. Shifting to new electric technologies continues to drive out inefficient fossil fuel supply and end-use.

Electricity has been a growing force for over a century and is now the largest supplier of net usable energy.

Electricity has been a growing force for over a century and is now the largest supplier of net usable energy, (the portion effectively harnessed and utilized after accounting for upstream losses). Efficiency improvements have reduced overall energy demand by one-fifth over the last decade, driven by advancements in technology and increasing electrification across sectors.

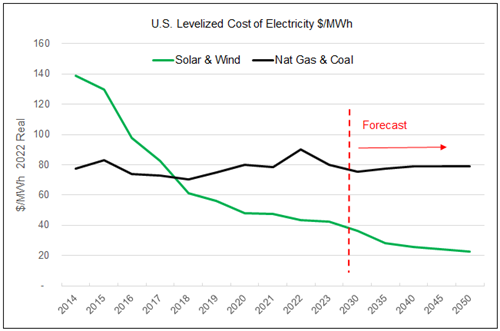

The levelized cost of electricity for wind and solar has decreased dramatically, as shown in Figure 4. In 2014, the average cost of solar and wind electricity was about $139 per MWh, almost double that of electricity from natural gas and coal at $78 MWh in the U.S. By 2023, solar and wind electricity costs had declined by 69% and were half the cost of natural gas and coal-fired power. BloombergNEF and others forecast that solar and wind power costs will continue to fall over the coming decades as technology, learning curves and economies of scale compound. Natural gas and coal-based electricity costs, however, are forecast to remain flat, demonstrating how manufactured technologies can continue to drive lower costs while extracted commodities have inherent cost floors.

Figure 4. The Cost of Renewable Energy Continues to Decline (2014-2050E)

Source: BloombergNEF. Levelized U.S. electricity costs by source in $/MWh.

Tipping Point: Clean Tech’s S-Curve

As fossil fuels enter the latter stage of their S-curve after being the backbone of the global energy system for over 200 years, renewable energy sources are in the exponential phase of their S-curve (Figure 5). The have passed the tipping point when new technologies begin to rapidly disrupt old industries, such as EVs displacing ICE vehicles and solar and wind displacing fossil fuel-fired electricity plants.

Renewable energy technologies not only address fossil fuel inefficiencies but provide a more sustainable and cost-effective energy future. With higher efficiency and lower economic and environmental costs, their rapid adoption is now transforming the global energy landscape.

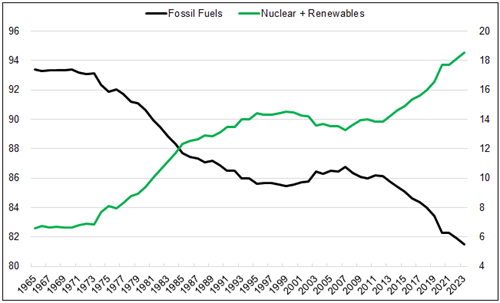

Figure 5. Where the Energy Comes From? (1965-2023)

Source: Our World in Data. https://ourworldindata.org/energy-mix.

As the transition to clean energy accelerates, significant changes are expected in the global energy landscape. If current S-curve trends continue, solar power sales could reach over 1,000 GW annually and battery sales could exceed 6,000 GWh annually by 2030. Solar and wind generation is expected to triple to over 12,000 TWh by 2030, and EVs could comprise two-thirds of car sales globally.19 The annual rate of electrification is likely to more than double, primarily driven by the transport sector's inclusion and electrification efforts. Additionally, annual efficiency gains are expected to double from the historical average as the share of renewables increases and end-use efficiency becomes a greater focus.

Updates on Critical Minerals

Copper: Prices Soften Despite Strong Fundamentals

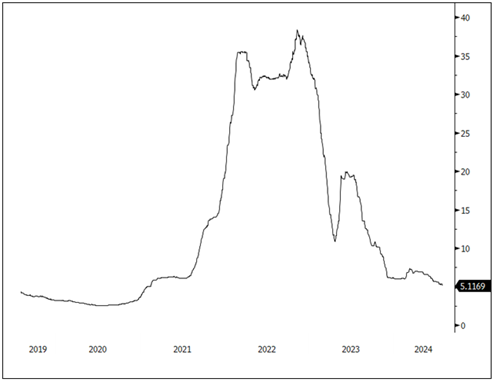

Weaker economic data, a stronger U.S. dollar, the unwinding of the yen carry trade, and disappointing outcomes from China's Third Plenum have contributed to a broad decline in commodities and equities markets, from which copper was not immune. The copper spot price fell 3.74% in July (Figure 6) and copper miners were down 3.11%. Despite this, the sector remains a standout for the year, with copper and copper miners up 7.54% and 21.5% year-to-date through July, respectively.

Copper market fundamentals continue to strengthen despite the negative macro factors. One market driver is a disruption in mine supply, which led to a shortage in the copper concentrate market. This caused a sharp drop in treatment costs, the fees that smelters charge miners, forcing Chinese smelters (which are responsible for roughly half of global refined copper production) to cut output. China’s copper smelters may now be forced to cut production further. Copper scrap supply—copper collected from products that have ended their useful life—may be in jeopardy. Due to unintended consequences from China’s Fair Competition Review, which takes effect in August, some copper scrap processors have been forced to stop production, and more may be set to do the same. (The Fair Competition Review is designed to curb monopolies and ensure a level playing field for market participants.) This is important, as 30% of China’s refined copper production in 2023 came from copper scrap.20 China is not the only region with smelting production cuts. Zambian smelters and miners have faced disruptions due to an El Niño-induced power crisis and state electricity rationing. In July, Zambian mining companies were tasked with doubling their power-saving curtailments to 40%.21

More broadly, we continue to see demand from the energy transition sector outweighing weakness from traditional large sources like Chinese construction and industry. For example, the State Grid Corp. of China, the world’s largest single consumer of copper, responsible for 80% of the country’s copper use, announced in July that it would increase spending by 13% to $83 billion this year.22 We believe that copper is set to become less correlated to the broader economic health of the world and more to high-growth sectors like artificial intelligence, data centers, air conditioning and energy transition.

Merger and acquisition activity in copper mining continues to advance. After BHP’s failed attempt to purchase Anglo American, BHP and Lundin Mining agreed in July to acquire Filo Mining for C$4.1 billion. This represents a 32% premium to Filo’s 30-day volume-weighted average price (through July 11) and a 12% premium to the latest closing price.23 Continued strategic interest in pure-play copper miners adds another tailwind to the space. While M&A may benefit pure-play copper miners, it does not create additional copper supply. As a result, the long-term fundamentals for copper remain strong, driven by escalating supply deficits, and we believe copper miners are set to ultimately benefit.

Figure 6. Copper Succumbs to Global Sentiment (2019-2024)

Source: Bloomberg. Copper spot price, $/lb. Data as of 7/31/2024. Past performance is no guarantee of future results.

Lithium: Entry Point Near as Floor Looms?

The lithium spot price fell 10.35% in July to a three-year-plus low on weak demand sentiment and inventory destocking (Figure 7). Mining stocks fell 4.10% as equities and commodities generally sold off due to negative economic data, fund de-grossing and the unwinding of the yen carry trade.

Figure 7. Lithium Tests Three-Year Low (2019-2024)

Source: Bloomberg. Lithium carbonate spot price, $/lb. Data as of 7/31/2024. Past performance is no guarantee of future results.

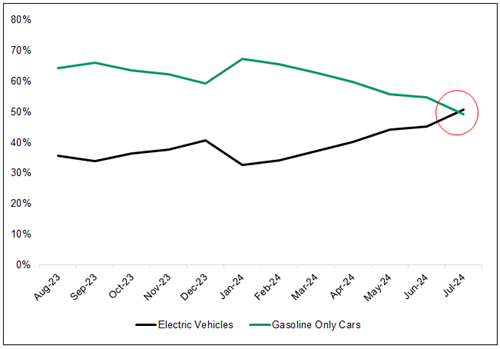

Weak demand and EV sales deceleration are overriding absolute growth in the EV sector. Global EV sales growth was up 24% in the first quarter of this year compared to 2023. In China, the largest EV market, that number jumped to 37% over the prior period, making it the biggest year-on-year quarterly leap. Despite negative sentiment, particularly in the U.S., electric vehicles globally remain robust. China has continued to lead the way in this regard, passing a significant milestone in July of having EV sales surpass 50% of total car sales for the first time (Figure 8).24

Figure 8. EVs Overtake Gas-Powered Vehicles in China (2023-2024)

Source: Bloomberg. Share of total car sales in China by month. Past performance is no guarantee of future results.

As uncertainty mounts about the upcoming U.S. elections, U.S. government departments are issuing grants and loans already approved under existing laws to bolster the domestic EV supply chain. In July, the U.S. Department of Energy announced $1.7 billion to support the conversion of 11 shuttered or at-risk auto manufacturing and assembly plants to produce and supply electric vehicles.25

Given the substantial rise in EV sales over the past three years, and the fact that lithium prices have plummeted to a three-year-plus low, this may be a compelling entry point. With prices now cutting even deeper into the cost curve, we believe the lithium spot price is nearing a floor. A seasonal boost in electronics and EV sales could help markets, starting in September, as would an interest cut by the U.S. Federal Reserve, which could provide a tailwind to capital-intensive industries like mining.

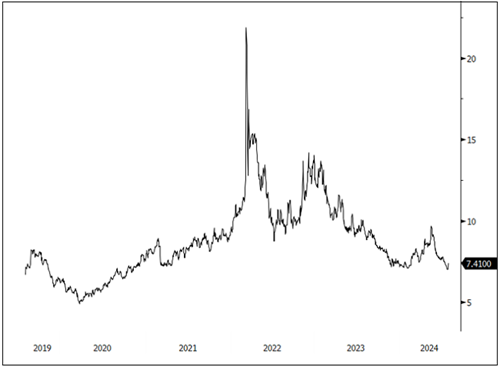

Nickel: Overhang Still Haunts Market

July was challenging for nickel as the spot price fell 4.13% and brought down the year-to-date return to -0.24% (Figure 9). Nickel miner stocks also lost ground, falling 6.19% for the month, and declining 12.33% year-to-date. Like copper and lithium, nickel was negatively impacted by the general selloff of equities and commodities in July.

Indonesian nickel supply is still flooding the market and pressuring the nickel spot price. This supply overhang and lower prices have led producers to continue curtailing production. BHP announced on July 11 that it would suspend its Nickel West operations and West Musgrave project, both located in Western Australia. Notably, BHP is not exiting the nickel business and continues to reserve optionality on these projects. Australia has been hard hit by the recent round of mine closures, which began in April when First Quantum Minerals placed its Ravensthorpe operations on care and maintenance. Among other notable closures, BASF SE and Eramet SA announced they would abandon plans to build a $2.6 billion nickel-cobalt refinery in Indonesia given decelerating EV sales and weak market sentiment, particularly in the U.S.

On the positive side, nickel suppliers are facing some challenges that have helped curtail production in the short term. These include Indonesia’s RKAB (Work Plans and Budget) permitting initiative, which temporarily pushed down the country's nickel production, and continued unrest in New Caledonia, a major nickel producer. Although EV sales in the U.S. have weakened, we continue to see growth overall, with Q1 2024 sales growth rising 24% over the same period last year. Notably, however, it is stainless steel that accounts for most of the world’s demand for nickel (70%), most of it from China. Given this, all eyes continue to monitor the health of China’s economy and hope for signs of improvement, which would likely benefit many critical materials.

Figure 9. Supply Surplus Undermines Prices (2019-2024)

Source: Bloomberg. Nickel spot price, $/lb. Data as of 7/31/2024. Past performance is no guarantee of future results.

Performance as of July 31, 2024

| Metric | 7/31/2024 | 6/28/2024 | Change | % Chg | YTD Chg | Monthly Comment |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 925.85 | 951.58 | (25.73) | (2.70)% | (6.09)% |

The first half of July saw a rebound after June's selloff. However, continuing weak economic data from China and disappointing announcements from its third Plenum weighed on the entire commodity complex. Some political effects, weaker growth outlook, fund degrossing, and a fading yen carry trade all pressured commodities resource equities. |

| Nasdaq Sprott Lithium Miners™ Index2 | 433.05 | 451.57 | (18.51) | (4.10)% | (41.20)% | |

| North Shore Global Uranium Mining Index3 | 3,717.30 | 3,977.39 | (260.09) | (6.54)% | (3.35)% | |

| Nasdaq Sprott Copper Miners Index4 | 1,271.27 | 1,312.13 | (40.86) | (3.11)% | 21.50% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 579.51 | 617.76 | (38.25) | (6.19)% | (12.33)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 1,127.66 | 1,140.93 | (13.26) | (1.16)% | 16.56% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 1,406.38 | 1,510.79 | (104.41) | (6.91)% | (3.32)% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 5.12 | 5.71 | (0.59) | (10.35)% | (16.94)% |

Potentially compelling entry point on mulit-year lows. |

| U3O8 Uranium Spot Price $/lb9 | 85.48 | 85.34 | 0.14 | 0.16% | (6.16)% |

Continues to consolidate. |

| LME Copper Spot Price $/lb10 | 4.13 | 4.29 | (0.16) | (3.74)% | 7.54% |

Falling on weaker economic data. |

| LME Nickel Spot Price $/lb11 | 7.41 | 7.73 | (0.32) | (4.13)% | (0.24)% |

Indonesian supply increases take a toll. |

| Benchmarks | ||||||

| S&P 500 Index12 | 5,522.30 | 5,460.48 | 61.82 | 1.13% | 15.78% |

The S&P 500 Index posted an all-time monthly close as the market broadened out, with small-cap stocks rallying 10.34% (iShares Russel 2000 ETF). DXY fell to an important support level, while commodities fell on a weaker growth outlook, mainly from China. |

| DXY US Dollar Index13 | 104.10 | 105.87 | (1.77) | (1.67)% | 2.73% | |

| BBG Commodity Index14 | 96.45 | 100.99 | (4.54) | (4.50)% | (2.23)% | |

| S&P Metals & Mining Index15 | 3,247.02 | 3,039.77 | 207.25 | 6.82% | 5.98% | |

*Mo % Chg and YTD % Chg for this Index are calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points.

- For the latest standardized performance and holdings of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPP, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Nasdaq Sprott Copper Miners™ Index (NSCOPP™) is designed to track the performance of a selection of global securities in the copper industry. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | Third Plenum: A major meeting held roughly once every five years to map out the general direction of the China's long-term social and economic policies. |

| 17 | U.S. Energy Information Administration (EIA), “More than 60% of energy used for electricity generation is lost in conversion,” July 21, 2020. |

| 18 | BloombergNEF, “Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time,” January 26, 2023. |

| 19 | RMI, “The Cleantech Revolution,” June 2024. Climate Central, “A Decade of Growth in Solar and Wind Power: Trends Across the U.S.,” April 3, 2024. |

| 20 | Source: Bloomberg Terminal Link |

| 21 | Mining.com, “Zambia asks mines to curtail normal power use by 40% amid crunch,” July 19, 2024. |

| 22 | BNN Bloomberg, “China Grid Giant Plans Record Spending to Ease Power Bottlenecks,” July 28, 2024. |

| 23 | Cision.com,” Lundin Mining and BHP to Acquire Filo and Form a 50/50 Joint Venture to Progress the Filo del Sol and Josemaria Projects,” July 29, 2024. |

| 24 | Bloomberg, “EVs, Hybrids Set to Exceed 50% of China Car Sales for First Time,” August 7, 2024. |

| 25 | Utility Dive, “DOE allocates $1.7B to convert auto factories to EV production and supply,” July 12, 2024. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.