Overview

Edward C. Coyne, Sprott Senior Managing Partner, Global Sales, shares Sprott's outlook on gold and explains why metals are so critical for the global energy transition, with Asset TV host Gillian Kemmerer.

Video Transcript

Gillian Kemmerer, Asset TV: Welcome to Asset TV. Today, I am joined in the studio by Ed Coyne, Senior Managing Partner at Sprott. He is here to discuss how investors should consider the energy transition to uranium and battery metals. It is always a pleasure to have you here in the studio, and congratulations on Sprott's AUM and product suite, which continue to expand. What's driving the growth?

Ed Coyne: Yes, it's been interesting. Sprott has a long history of being in precious metals — over four decades. Gold and silver have always been the foundation of our firm. Even today, at 25-plus billion, gold and silver remain the core of what we do.

Over the last half a decade, we have seen other opportunities in the metals market, particularly in the energy transition space. Whether you're talking about the storage of energy through battery technology and battery metals or the creation of energy through nuclear, we saw more and more opportunities to expand our footprint. We started exploring the uranium opportunity about two and a half years ago. We started first with the physical market and, more recently, got into the equity markets with a senior large-cap mining ETF and a small-cap or junior mining ETF.

And we've had tremendous success there. We're well north of $5 billion in capital raised in that space. And we're seeing institutions, retail investors, and financial advisors starting to move to that space to diversify their portfolios.

We're seeing the continued growth in gold and silver, the traditional precious metals market. But more recently, we're seeing dynamic growth in the energy transition space.

Gillian Kemmerer: About gold, because it's traditionally a safe haven asset. Given the negative news flow, how has gold fared recently?

Ed Coyne: It's interesting. When I talked to people this year, they're like, "Gee, why hasn't gold done better?"

And I say, "Well, it's up about seven, seven-and-a-half percent. S&P 500 is about 14."

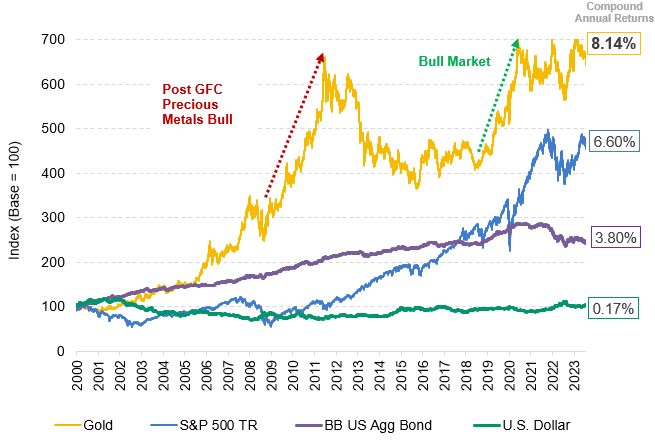

The S&P is doubling gold year to date. Or around there, it changes every day, of course. But if you look at the last couple of years, gold's outperforming the S&P. The S&P has been negative for over the previous 24 months. It's still behind the eight-ball. And gold's done quite well. If you look at it, even over five years, gold has given you S&P-like returns. And over the last couple of decades, it's outperformed the S&P. I tell people that when you think about gold, you must widen your lens. You can't look at it on a quarter-to-quarter, even a year-to-year basis. You have to look at it on a multiple-market cycle basis to judge if it is doing its job.

I think one of the things that people mistakenly believe about when they're looking at gold is they say, it doesn't pay a dividend, and it doesn't do anything, doesn't have any earnings. Why would I buy that? Why wouldn't I buy the S&P?

My response has always been the same: that's the entire point of gold. You want a different asset that performs differently at different times for various reasons. Gold's done quite well.

Now, the one thing that I think people are scratching their heads over is that we now have wars on two different fronts. We've got record-level interest rates rising. The economy, though, is doing quite well. We might call it right with a soft landing.

Who knows? There might be some people booing me right now. I've never seen so many people root for a recession. But they may be getting it right, but it has yet to be determined on that. But what's interesting is that gold has continued to play its role through that entire environment.

When you talk about it from a geopolitical standpoint, that's just a price change, right? That's interesting to talk about, and it hits the news. But it's not the value or the purpose of gold. Gold is really over those multiple market cycles, and that's how we encourage people to look at it.

[Please Note: For the 12 months ended 9/30/2023, spot gold was up 11.32% versus 21.62% for the S&P 500 Index (SPX).]1

Figure 1. Gold Performance Comparison Since 2000

Source: Bloomberg. Period from 12/31/1999-09/30/2023. Gold is measured by GOLDS Comdty Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Curncy. Past performance is no guarantee of future results. For illustrative purposes only.

Gillian Kemmerer: What else should investors be thinking about outside of precious metals?

Ed Coyne: Sure. I mentioned our energy transition suite and how that's starting to grow. You think about it really in a couple of ways. You think about energy transition in the storage of energy, which would be the battery technology space, whether you're talking about backup batteries for wind and solar or batteries to power our cars.

And then you talk about the creation of energy. For the most part, if you get away from wind and solar, you're looking at nuclear. Nuclear is the only 24-7 base load energy source out there. Whether you're a conservative or a liberal, a Democrat or Republican, everyone agrees that we need to move to a carbon-neutral footprint. Everyone agrees that nuclear needs to be part of that footprint.

Right now, we're seeing uranium on the institutional, retail and advisor sides start gaining much traction.

The battery market, I think Wall Street's still figuring that one out. I think it's a longer road. There's demand there. We've got more and more battery processing plants being built, but not as many mines are being discovered and coming online.

There will continue to be a gap between the supply and demand of all those assets, and we're enthusiastic about what we're seeing in that space.

And again, thinking about energy transition from a consumption standpoint, as a consumer driving an electric car to the storage, to the creation. A lot is going on in that space, and I encourage investors to take a new look at the metals market in general and find some additional opportunities that we're seeing out there.

Gillian Kemmerer: You mentioned uranium, one of the best-performing assets here to date. What do you think is driving some of that strength?

Ed Coyne: I think it goes back to what I discussed a moment ago with supply and demand. If you look at what's happening on the demand side of nuclear power and what's happening with nuclear reactors, you had the first reactor come online in the U.S. in over 20 years in Georgia.

You've got reactors that were shuttered effectively. Not from a technology standpoint, just from a licensing operation standpoint, reopening in the U.S. Around 18-19% right now of our power in the U.S. comes from nuclear. In Europe, France is around 70-75%. And then everybody else is in between that.

And you're seeing not only existing reactors coming back online, creating more demand for uranium, but you're also seeing new reactors, both here and abroad, in the tunes of 20 or 30 different reactors, depending on what country you're talking about. In addition to that, you're seeing these small and modular reactors start to become a reality in the next half a decade or so. These are these three to four-story apartment-sized building reactors that you can almost plug and play into a community to create energy sources there.

There's a lot of demand in the nuclear marketplace for clean energy, 24-7 energy, but there haven't been a lot of discoveries. The cost of extraction for an existing mine is around 60 to 70 bucks a pound. It's probably closer to 80 or 85 a pound for a new mine to come online. And that's a moving target. Currently, it's sitting at around 65 or 70, so you haven't seen much supply hitting the market.

We think that's a multi-decade phenomenon. I think Wall Street and investors in general are looking at that and trying to fast-forward out, what does this look like in the next couple of decades? If we are moving in this direction, if we truly want to be carbon neutral by 2050 … Let's say if we get halfway there, we get halfway to carbon neutral by 2050, the demand for this will continue to rise. And there's just enough supply right now.

And that's a multi-decade issue we see, which we think will potentially drive higher prices. I think that's what's driving it right now, is the world's starting to wake up to that. I'm not saying it will go straight up; it will continue to be volatile like all these metals. But we like the long-term opportunity there.

Gillian Kemmerer: And what are some other metals that investors should consider?

Ed Coyne: If you think about what's going on in the world, as I mentioned, the battery metals, something as simple as copper. In some places, even steel. These old metals have been around forever; everyone knows what copper is. But you can't move electricity from point A to point B in most cases without copper.

Now, copper is interesting because you can recycle copper repeatedly, and it doesn't lose its connectivity. The supply-demand phenomenon is not as dire as in other metals like lithium or cobalt, which are also needed for battery technology.

There are a lot of ways you can think about that space. There's not a lot of readily available physical metal to invest in. In some cases, there are option strategies and so forth out there.

We've created a full suite of ETFs that give you exposure to that, whether it's our flagship ETF SETM on that side, that gives you exposure to all the metals. Or specific ETFs that provide you with exposure to lithium, or just nickel and so forth.

Those are also something that I would have investors think about or consider. From an investment standpoint, they will probably continue to be volatile as the world and Wall Street figure out what this battery metal movement means from an investment standpoint.

I would say there, be a little more cautious as far as how you think about allocating to that space. But that would be another thing I would put on my list when you're thinking about metals in general.

Gillian Kemmerer: How should investors consider using precious metals and energy transition materials within a larger portfolio?

Ed Coyne: Sure. If you think about it, forever, gold and silver have lived in the commodity basket. And they are commodities. All these metals are commodities. They get brought out of the ground, they get consumed, they get used, they get transferred, and they are a commodity.

But more and more of our investors are slotting them into the alternative asset bucket. And once they do that, the narrative or the vision of what these assets or these metals can do for their portfolio changes.

Because so often we say, I've got my gold allocation, I have a commodity fund, and it's got 4% in gold. That gets so buried in that fund it's not going to drive the return pattern you're hoping for by allocating to that space.

I tell investors to rethink how they look at commodities, particularly in the metals market. And when you think about it as an alternative asset or a low-cost liquid hedge, if you think about gold and other metals out there, they're liquid assets. They're relatively low-cost compared to a two-in-20 in 20 or a one-in-10 hedge fund. I'm not knocking hedge funds; I'm just saying these are different solutions.

I would tell investors to consider it a true alternative to their stock and bond portfolio. And when you look at the long-term performance patterns of gold and silver, which are the established metals, and then more recently uranium, nickel, cobalt, etc., they have a different performance pattern than the traditional market. I would encourage investors to consider it part of their alternative sleeve when allocating to this space.

Gillian Kemmerer: From the macro landscape driving the performance of these metals to the roles that they can play in portfolios, thank you so much, Ed, for taking the time to lay out all of this universe for us.

Ed Coyne: Thanks for having me.

Gillian Kemmerer: And thank you for tuning in. From our studios in New York, I'm Jillian Kemmerer for Asset TV.

Footnotes

| 1 | The spot price of gold refers to the price of one ounce of gold. The S&P 500 Index (SPX) is used for informational purposes as a proxy for the broader stock market as a whole. The S&P 500 Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity and industry group representation. You cannot invest directly in an index. |

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the funds, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.