Key Takeaways

- Record Highs, Historic Volatility: Gold and silver reached record highs in January before experiencing sharp, technically driven sell-offs at month-end. Despite the volatility, the fundamental and structural drivers for both metals remain intact.

- New Monetary Regime: Markets appear to be entering a new monetary regime shaped by rising geopolitical fragmentation, declining institutional trust and the increasing use of financial systems as policy tools.

- Gold as Outside Money: This shift in the global capital order strengthens gold’s role as a neutral reserve asset—or “outside money”—beyond the control of any single country or monetary system.

- Silver Market’s Structural Tightness: Silver’s sharp reversal was driven by leveraged liquidation, but long-term fundamentals remain strong, anchored by industrial demand, inelastic supply and dwindling above-ground inventories.

Performance as of January 31, 2026

| Indicator | 1/31/26 | 12/31/25 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $4,894.23 | $4,319.37 | $574.86 | 13.31% | 13.31% | All-time high of $5,595.47 reached. |

| Silver Bullion2 | $85.20 | $71.66 | $13.54 | 18.89% | 18.89% | All-time high of $121.65 reached. |

| NYSE Arca Gold Miners (GDM)3 | 2,743.86 | 2,442.86 | 301.00 | 12.32% | 12.32% | All-time monthly closing high. |

| Bloomberg Comdty (BCOM Index)4 | 120.70 | 109.69 | 11.01 | 10.04% | 10.04% | Broad commodity indices are breaking higher. |

| DXY U.S. Dollar Index5 | 96.99 | 98.32 | (1.33) | -1.35% | -1.35% | DXY on verge of breaking 15-year uptrend. |

| S&P 500 Index6 | 6,939.03 | 6,845.50 | 93.53 | 1.37% | 1.37% | All-time monthly closing high. |

| U.S. Treasury Index | 2,432.62 | 2,434.87 | (2.25) | -0.09% | -0.09% | Flat, narrow, low volatility since October. |

| U.S. Treasury 10-YR Yield* | 4.24 | 4.17 | 0.07 | 7 BPS | 7 BPS | Yields are higher despite Fed rate cuts. |

| Silver ETFs** (Total Known Holdings ETSITOTL Index Bloomberg) | 823.76 | 863.64 | (39.87) | -4.62% | -4.62% | Silver ETFs are selling into a run-up. |

| Gold ETFs** (Total Known Holdings ETFGTOTL Index Bloomberg) | 100.54 | 98.95 | 1.59 | 1.61% | 1.61% | Gold ETFs see steady buying. |

Source: Bloomberg and Sprott Asset Management LP. Data as of January 31, 2026.

* BPS stands for basis points. **Bloomberg Indices measure ETF holdings; the ETFGTOTL is the Bloomberg Total Known ETF Holdings of Gold Index; the ETSITOTL is the Bloomberg Total Known ETF Holdings of Silver Index.

Gold Market: Flash Crash, But Drivers Intact

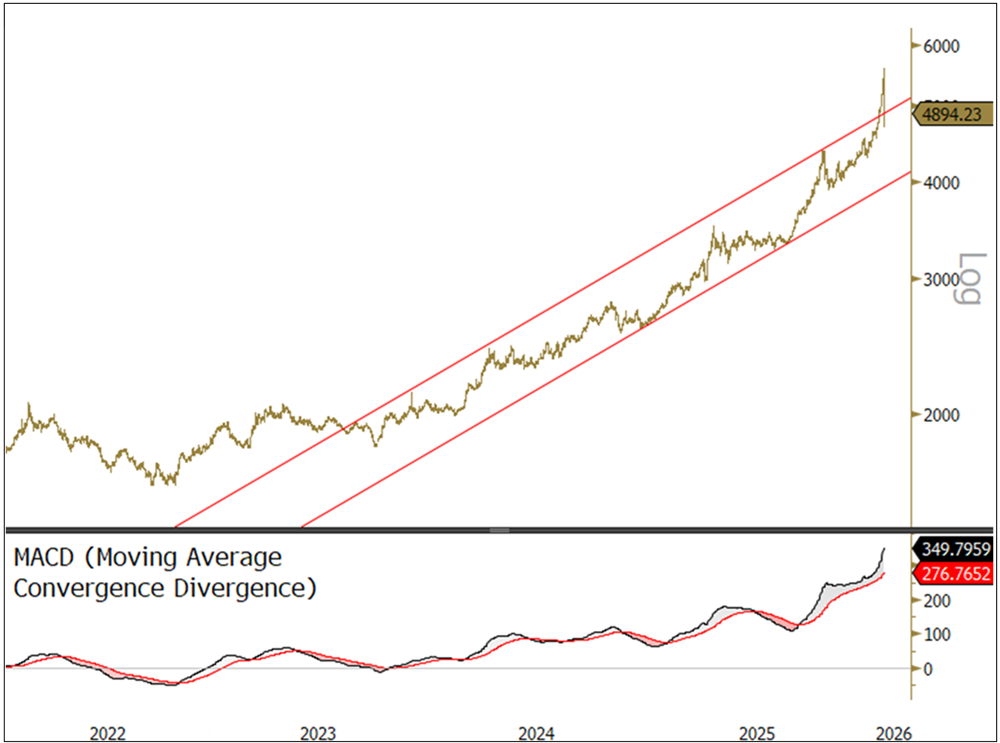

Spot gold rose $574.86 per ounce (or 13.31%) in January to close the month at $4,894.23, an all-time monthly closing high. Gold reached an intraday high of $5,595.47 on January 29 and then had its most violent one-day sell-off in almost 45 years, falling $481.01 (or -8.95%) on the last day of the month.

Gold posted one of its strongest starts to a year in decades.

We believe gold’s January surge reflected a sharp repricing of political and institutional risk rather than a conventional macro catalyst. Markets increasingly discounted a collapse in the credibility pillars underpinning fiat assets: fiscal discipline, multilateralism and central bank independence. A wave of populist, interventionist policies and open tolerance for currency debasement reinforced the sense that future deficits will be socialized and monetized. At the same time, escalating geopolitical coercion from Venezuela to Greenland underscored that asset seizure and weaponized interdependence are now tools of U.S. statecraft. The implication was that few assets are politically safe. Gold’s role as neutral, confiscation-resistant outside money—or non-sovereign reserves—became noticeably more valuable.

This regime shift drove robust flows into gold and precious metals. Prices accelerated into late January as investors priced three long-term outcomes: a structurally weaker U.S. dollar; a lasting bid for safe-haven assets other than bonds; and rising demand for outside money. Gold posted one of its strongest starts to a year in decades, breaking through key technical levels as momentum, investor reallocation and geopolitical hedging converged. The move culminated in a blow-off phase, followed by a violent, mechanical reversal as leveraged momentum trades were unwound and forced into liquidation. It is challenging to look past this flash crash, but there appears to be a repricing of systemic trust. Gold’s longer-term drivers—capital flight risk, erosion of the U.S. Federal Reserve’s independence and the search for outside money—remain intact despite the volatility.

Figure 1. Gold’s Rise and Fall (2022-2026)

Source: Bloomberg. Gold spot price, $/oz. Data as of 2/1/2026. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages. Past performance is no guarantee of future results.

Repricing Trust in the New Monetary Order

Markets are entering a new monetary regime defined by geopolitics. The breakdown of U.S. restraint, the weaponization of financial infrastructure, rising fragmentation in trade and technology, and a growing distrust of political neutrality in monetary systems are forcing nations and sovereigns to rethink what constitutes safe assets. What began as a series of isolated shocks has coalesced into a structural repricing of trust due to the breakdown of the global order, the emergence of capital conflict and the resulting erosion of the U.S. dollar's safety.

The events at Davos 20267 signaled a regime change for markets and for gold. Canadian Prime Minister Mark Carney captured a structural break in the U.S.-led order with his warning that the world faces a “rupture, not a transition.” For decades, the system relied on mutual dependence and U.S. self-restraint regarding open access to the U.S. dollar, technology platforms, predictable supply chains and institutional guarantees that functioned as global public goods. That foundation has cracked.

Carney’s framing of “weaponized interdependence”8 reflects how U.S.-controlled choke points, such as dollar clearing, cloud infrastructure, digital services and logistics networks, have shifted from cooperative platforms to coercive tools. The sanctions architecture that Washington set up after 9/11 institutionalized its ability to exclude entities from the dollar system (U.S. dollar weaponization). What began as a tool for counterterrorism has evolved into a bipartisan framework for disciplining states, firms and counterparties. Nations now recognize that the dominant platform can be deployed selectively against anyone, ally or foe.

“A distant, predictable authoritarian power is often seen as safer than a proximate, unpredictable one.” Carney, Frell, Ferrell

The deeper break is the loss of American restraint. From the U.S. point of view, alliances are increasingly transactional, with partners fearing exploitation rather than anticipating protection. President Donald Trump accelerated this shift, treating alliances as leverage points for obtaining short-term concessions. This type of behavior reduces geopolitical predictability, erodes soft power and forces countries to reassess the privilege and safety of relying on U.S.-controlled systems.

The Greenland episode crystallized the risk. Threats of tariffs and forced concessions showed how unstable U.S. demands have become. Carney’s point was clear: Hegemons cannot endlessly monetize relationships without provoking hedging behavior from other nations. Countries are building redundancies such as new supply chains, alternative financing channels, diversified reserve portfolios and sovereign capabilities. Fragmentation is now a structural cost: inflationary, capital-intensive and difficult to reverse.

This dynamic is also accelerating multipolarity. By undermining confidence, Washington is pushing partners toward China as a risk hedge. A distant, predictable authoritarian power is often seen as safer than a proximate, unpredictable one. Yuan-denominated trade is expanding, and more U.S. partners are entering financial, technological and trade systems linked to China.

Davos represented global acknowledgment of this shift. Carney’s speech served as a coordination point, aligning policymakers and markets around the reality that the old global order is ending and a fractured order is emerging. Investors now face a world defined by higher geopolitical risk, lower policy predictability, weaker U.S. credibility and accelerating fragmentation across finance and technology. In such an environment, the natural bid is likely for politically neutral safe-haven assets, with gold foremost among them.

From Trade Wars to Capital Wars: Turning Gold into Neutral Money

The Greenland tariff drama revealed how trade conflict now transmits directly into capital markets. Capital inflows finance trade deficits. When trade relationships come under threat, so do funding relationships. As tariff tensions escalated, equities, bonds and the U.S. dollar sold off, while gold rallied significantly. Combined, the market action was not a simple risk-off move but a signal of falling confidence in fiat stability. Trade, capital and geopolitical conflict are funneling into a single transmission channel.

As financial assets become policy tools, gold becomes the hedge against the system itself.

While trade wars dominate headlines, capital wars carry far more leverage. Capital wars involve restricting access to assets, settlement networks, reserves or financial infrastructure. Unlike tariffs, these tools are immediate, high impact and systemic.

Central banks have already begun repositioning. Reserve managers are reducing exposure to foreign sovereign debt and increasing allocations to gold. Holding another country’s currency increasingly means bearing geopolitical risk, not just economic risk. Rising deficits and unrelenting debt issuance have weakened the supply-demand equilibrium for sovereign bonds just as geopolitical risk around ownership is increasing.

A willingness to rewrite trade rules naturally leads markets to question whether financial rules might be rewritten as well. Taxes on flows, capital restrictions or settlement limits—once unthinkable in advanced economies—are now openly discussed. For reserve holders and sovereign funds, the rational response is to accumulate assets that cannot be frozen, repudiated or restructured by political discretion, such as gold.

In this environment, gold is reasserting itself as outside money, an asset with no issuer, no liability chain and no counterparty risk. Capital wars make fiat assets inherently vulnerable, while we believe gold’s neutrality makes it inherently valuable. Central bank accumulation of gold reflects this logic, in which diversification9 is not ideological but a form of geopolitical and balance-sheet risk management. As financial assets become policy tools, gold becomes the hedge against the system itself.

De-Dollarization, Eroding Trust and the Safe Haven Shift

Reserve currency status ultimately rests on confidence and trust in the issuing state. The U.S. dollar’s dominance benefited from U.S. neutrality and rule-based behavior. That perception has weakened considerably. As the U.S. dollar system is increasingly used for sanctions, freezes and political leverage, governments are reevaluating the safety of holding U.S. assets. This reassessment now includes allies and non-aligned states, not just rivals or foes. It has led central banks and sovereigns to become more sensitive to geopolitical risk, lifting the premium on assets outside the political system, especially gold.

The U.S. dollar’s transactional dominance remains overwhelming in foreign exchange trading, global lending, offshore dollar credit and trade invoicing. But the official reserve sector is changing dramatically. The diversification of reserves away from U.S. dollars is now structural. It is driven not by macroeconomics but by sovereignty concerns and fear of asset immobilization. Private-sector dollar usage remains sticky because transactional infrastructure changes slowly, but official reserve portfolios are moving because incentives have changed.

Central bank independence is the institutional anchor of a reserve currency. Political encroachment often erodes credibility long before any economic deterioration appears, whether through pressure on monetary policy, tolerance for higher inflation, or hints of financial repression. Markets tend to be early in pricing in the risk of institutional weakening.

“Gold’s continued strength reflects a structural shift in how the world evaluates safety, trust and monetary stability.” Paul Wong

De-dollarization need not mean reallocating to another currency. Historically, when confidence in monetary regimes erodes, capital migrates into real assets: commodities, real estate and monetary metals. The 1970s illustrated how weakening policy credibility, higher inflation and higher interest rates led to strong real asset performance. Gold’s role, in our view, is not to replace the dollar but to absorb capital fleeing soft money.

Digital currencies, stablecoins and new payment rails are changing transaction mechanics but not the fundamentals of monetary confidence. These technologies improve speed and access but cannot address political risk concerns. Paradoxically, U.S.-promoted stablecoins can expand global dollar usage in the short run by making digital dollars widely accessible, but wider usage does not necessarily translate into deeper trust. The long-term driver remains geopolitical, centered on credibility, neutrality and rule-of-law risk. We believe gold benefits precisely because it sits outside these systems.

Gold is reemerging as a neutral reserve asset in a less trusted monetary order.

Gold’s continued strength reflects a structural shift in how the world evaluates safety, trust and monetary stability. The erosion of U.S. restraint, the rise of capital conflict as a geopolitical tool and the creeping fragility of the U.S. dollar’s institutional foundations have fundamentally changed the opportunity set for sovereigns and investors. In a system in which financial assets can be frozen, politicized or devalued, gold stands out as neutral, unencumbered outside money. As fragmentation deepens, geopolitical risks rise, and confidence and trust in fiat architecture become more conditional, gold’s long-term appeal is shifting from a hedge to a neutral reserve asset in a new monetary regime that is still taking shape.

Asset tokenization is accelerating, and after years of false starts, gold-backed digital solutions are gaining traction, while the importance of physical ownership has likely never been greater.

Figure 2. The Rise of Digital Assets Like Stablecoins

Definition: A stablecoin is a type of digital asset designed to maintain a stable value by pegging its worth to a reserve asset, such as a fiat currency like the U.S. dollar, a commodity like gold or a basket of assets.

Silver Market: Sell-Off Masks Strong Fundamentals

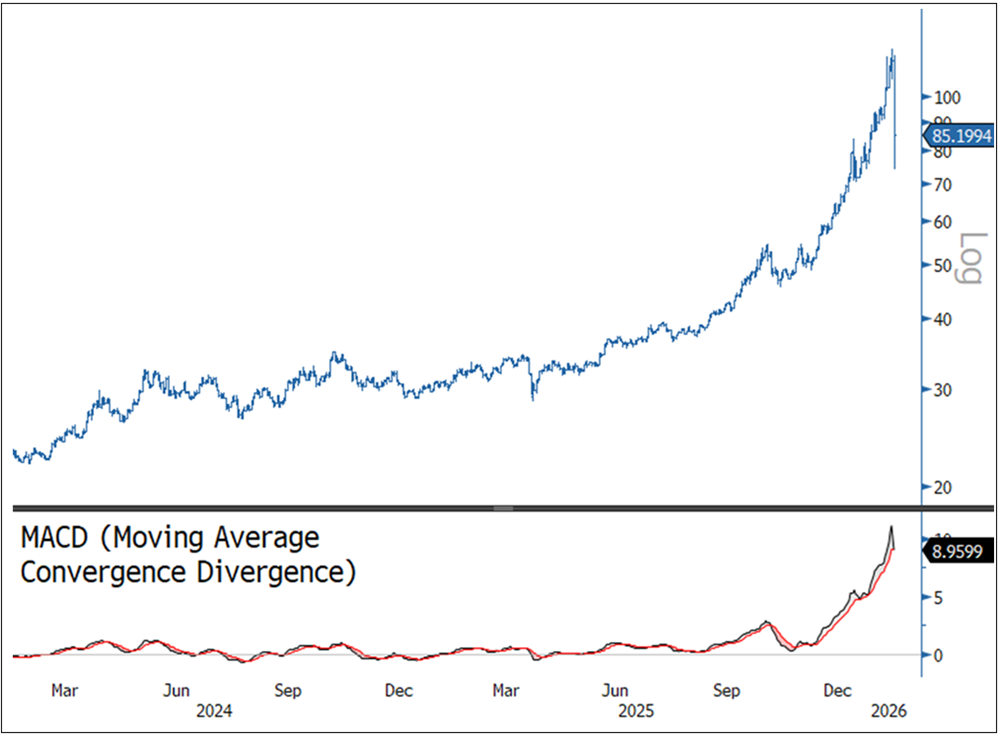

In January, spot silver rose $13.54 per ounce (or 18.89%) to close at $85.20, an all-time monthly closing high. Silver reached an intraday high of $121.65 on January 29 and then had its most violent one-day sell-off ever, falling $30.50 per ounce (or 26.36%) on a closing basis on the last day of the month.

Silver had started the year on a seemingly relentless climb, driven by robust physical demand from technology end-use markets, supply constraints from China's export controls on silver and expected U.S. tariffs under Section 232 rulings. Then, the events at Davos and their ramifications triggered a surge in all precious metals. However, extreme, one-sided, large-leveraged positions began to build rapidly beyond the limits of the silver market's underlying liquidity. These types of overextended positions, likely through options derivatives, are inherently unstable and prone to collapse under their own weight when pushed to extremes.

Above-ground silver inventories continue to erode after multiple consecutive years of structural deficits.

Whether the spark was the nomination of Kevin Warsh, with his hawkish10 reputation, to Federal Reserve chair or a rise in the U.S. dollar index (DXY), silver crashed intraday. It was driven by funds or overleveraged positions unwinding trades, cascading margin calls, stop-outs,11 forced mechanical liquidation and generalized panic as the momentum trade collapsed under its own weight and fueled further selling. The lack of buying liquidity was exacerbated by the absence of Chinese and Indian buyers, the biggest source of demand in recent weeks, as their markets were closed for the weekend.

Figure 3. Silver’s Violent Decline (2024-2026)

Source: Bloomberg. Silver spot price, $/oz. Data as of 2/1/2026. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages. Past performance is no guarantee of future results.

Despite silver’s extreme one-day drop, we believe its fundamentals remain positive. A potent mix of structural industrial factors anchors silver’s long-term demand outlook. Solar photovoltaics (PV) remain the dominant engine. Global PV installations are consuming record volumes of silver as renewable energy targets accelerate worldwide. Electrification trends from electric vehicles to charging networks add a second central pillar. Broader technological demand is surging as well, with semiconductors, 5G infrastructure, data centers and AI‑related power systems all needing silver’s unmatched conductivity. Grid modernization, advanced electronics and medical applications provide additional, steady consumption. Layered on top of this is silver’s dual identity as both a growth commodity and a monetary metal, which tends to benefit from investment flows amid geopolitical uncertainty.

Silver’s long-term outlook is driven by inelastic supply and accelerating strategic demand.

Silver’s supply is becoming structurally tighter, as geopolitical interventions now compound long-standing physical constraints. Mine supply remains largely inelastic since roughly 70% to 80% of global output still comes as a byproduct of other production processes. This limits producers’ abilities to respond to price signals, even at elevated prices. Above-ground silver inventories continue to erode after multiple consecutive years of structural deficits. But the new supply story is increasingly shaped by geopolitics. China is implementing selective export controls on critical metals and processing technologies. This creates latent risk in the availability of refined silver given its central position in global electronics, solar manufacturing and metallurgical throughput. At the same time, U.S. tariff risk on silver imports has distorted trade flows.

Silver lease rates and spot-futures spreads remain volatile and elevated, indicative of tight physical markets. Governments are also recognizing silver’s strategic importance. The U.S. designation of silver as a critical mineral underscores rising national security sensitivity to supply chains. Europe and parts of Asia have made similar classifications. Meanwhile, the breakdown of global metal inventory systems, with historically low stocks, shifting exchange holdings and declining free-float inventories, reflects a market in which physical metal is increasingly segmented, financialized and constrained by trade barriers.

The combination of inelastic mine supply, politically influenced trade flows, critical-mineral status and fragmented inventory systems creates a tight supply environment and increasingly brittle markets, magnifying impacts on silver's price. In the near term, with very elevated silver prices, we would expect demand destruction from those industries with the lowest economic value added. In the medium and long term, with supply constrained by years of structural deficits, we believe the conflation of positive structural drivers positions silver for long‑term strength.

Footnotes

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Index. |

| 2 | Silver bullion is measured by the Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The NYSE Arca Gold Miners Index (GDM) is a rules-based index designed to measure the performance of highly capitalized companies in the gold mining industry. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indices. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | The World Economic Forum Annual Meeting 2026, or Davos 2026, took place from January 19–23, 2026, in Davos, Switzerland, under the theme "A Spirit of Dialogue". |

| 8 | Farrell, H., Newman A.L. (2019, Volume 44, Issue 1). Weaponized Interdependence: How Global Economic Networks Shape State Coercion Open Access. International Security. |

| 9 | Diversification does not protect against loss. |

| 10 | A hawkish stance means favoring higher interest rates to fight inflation, even if it slows economic growth. |

| 11 | A stop-out refers to a situation in which a broker automatically closes a trader's open positions because the account's equity has fallen below a certain margin level, preventing further losses. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.