Stephanie Pomboy and Grant Williams, hosts of the podcast Super Terrific Happy Hour, interview a true legend of the precious metals industry, John Hathaway, on February 15.

Podcast Summary

As the Super Terrific Happy Hour returns from hiatus, our guest is a dear friend of us both who is gracing the podcast for a second time: John Hathaway of Sprott Asset Management.

The genesis of John's latest appearance on the STHH was a recent presentation he gave at the Strong Conference in Colorado in which he laid out the case for gold as we enter 2022. Here, John offers his thoughts on inflation, what lies in store from the Fed, what that may mean for the gold price and how the mining companies might fare in this brave new world.

- Stephanie Pomboy, an Economist, founded MacroMavens in 2002 and is one of the most widely respected women in finance. Her firm has delivered prescient insights on emerging macroeconomic trends and their implications for global financial markets for nearly 20 years.

- Grant Williams is a Senior Advisor to Matterhorn Asset Management AG in Switzerland, a portfolio and strategy advisor to Vulpes Investment Management in Singapore and one of Real Vision Television founders. Grant's Things That Make You Go Hmmm... is one of the most popular and widely-read financial publications in the world.

Podcast Transcript

Grant Williams: Here's the bit where I remind you that nothing we discuss during the Super Terrific Happy Hour should be considered investment advice. This conversation is for informational and, hopefully, entertainment purposes only. So while we hope you find it both informative and entertaining to say nothing of super and terrific, of course, please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. And now on with the show.

Jerry Seinfeld: People always tell me, you should have your money working for you. Because you send your money out there working for you a lot of times it gets fired. You go back there. What happened? I had my money. It was here. It was working for me. Yeah. I remember your money we had to let 'em go.

Grant Williams: Welcome everybody to another edition of the Super Terrific Happy Hour. After a break over the holiday period, we are back. And I'm delighted to say because it would be none of those things without her, joining me is the fabulous Stephanie Pomboy.

Stephanie Pomboy: Thank you so much. It's so good to see you. Happy new year. Happy Chinese new year.

Grant Williams: Well, it's a new year. It's a new dynamic it seems to be in the stock market. Certainly, we've come back to a world that's different to the one we last spoke about. Stocks seem to be able to go down again.

Stephanie Pomboy: It's shocking. It really is. Well, and I guess the Fed has discovered that it can pull the levers in two directions, not just one. And so that's really breaking news for most investors. We didn't know they could move it up.

Grant Williams: Well, I mean, let's face it, they haven't yet.

Stephanie Pomboy: Right, well, that's true.

Grant Williams: But they are at least able to talk about moving it up and see what that does. Look, it's really funny. January was a really interesting month because it did remind me of the early days of the end of the dot com bubble for sure. I think the '07, '08 thing was a whole different kettle of fish. But it did take me back to some of those early days when some of the market darlings in the dot com boom were starting to crack.

Grant Williams: And at the time it's funny, you don't really realize it at the time because you just think, it's a dip. And I think back then, even we thought it was a dip it was only with the benefit of hindsight you can see what was actually happening. But I think armed with the knowledge of 2000, when looking at what's happening today, you can see so many similarities in the price action that hopefully will give people a clue beforehand, as opposed to after the wheels fall off.

Stephanie Pomboy: Even to 2007, 2008, one thing I've really had my eye on now that we've had this snap-back rally is that the corporate credit market has continued to deteriorate. you've had days where, the Nasdaq1 has rallied, crypto's rallied, S&P 500,2 broad averages everything's up, but junk yields, even investment-grade yields, continue to march higher. Effectively the credit market's tightening, regardless of whether the Fed moves or how much. Those wheels are already turning. And I think, we're going to discover pretty quickly what the threshold for pain is here, anyway.

Grant Williams: It's funny because everybody always talks about how the bond market is the smart kid in the room and the equity market always finally figures it out afterward. And history demonstrates that that's almost universally correct. And the signals being sent by the bond market and the rates markets are absolutely crystal clear. And yet people are still talking about, we're going back to new all-time highs in the equity market. I just don't get that.

Stephanie Pomboy: Not only that, but it flows into levered loan funds had their largest, weekly inflow a couple of weeks ago. So while credit's deteriorating people are running in to buy more, just... I don't know, I guess greed is good.

Grant Williams: Greed is good. We have a returning guest joining us today. Our mutual friend, John Hathaway is going to be with us in a second. And the catalyst for having this conversation was a slide deck that you and I saw, that John shared with us from his recent appearance at the Strong Conference. And just talk a little bit about that slide deck and what you thought when you looked through it.

Stephanie Pomboy: It is very reminiscent of the conversation John and I had with Bill Strong, a different strong during the summer when we looked back at the fifty-year anniversary of the establishment of Fiat money, thanks to Richard Nixon. But John lays out the case for gold in an environment where he sees inflation clearly surprising, not just the Fed, but everybody else, including most institutional investors on the high side. And he believes that's going to be lasting. But even if it isn't, the backdrop, the supply-demand dynamics for gold, which I'm sure he'll get into, are extremely positive.

What we've seen in the last several years is an environment of unprecedented monetary debasement. And the unwinding of that is probably not going to be smooth as investors would like to believe. He has a pretty compelling case for gold. I don't just say that because I'm a big believer to begin with, but looking through those slides, he put together quite an impressive presentation, I think.

Grant Williams: He did. For me, the big thing, and again, at the back of my head, I'm aware of all this, but every now and again, you have to check in on the numbers. But just looking at how cheap these companies are and how. I should probably say unloved because they're cheap because they're unloved.

They're not just cheap because they're cheap. It's just a reminder of what value looks like in a world that is clearly at the very least starting to pivot from growth to value. And it's tough to find anything more valuable than companies that literally pull money out the ground. Why don't we invite John to come and join us. Welcome back to the Super Terrific Happy Hour. Lovely to talk to you again.

John Hathaway: Same here. Great to see everybody.

Grant Williams: You're are looking resplendent in that lime green jacket.

John Hathaway: Well, it's a little chilly here in the desert. It's about 75 degrees.

Stephanie Pomboy: I'm sure our listeners in New York on the East Coast right now are probably cursing you right now.

Grant Williams: John a lot has happened since the three of us last got together to talk about this stuff. Steph and I thought it'd be a fantastic time to get an update on your thinking. Find out what's changed since we last got our heads together.

And the catalyst was the presentation you gave recently at the Strong Conference out there in Colorado. I figured what we'd try and do to kick off with was just, have you walk us through that presentation. The genesis of it, the message you were trying to get across. And I think the best thing to do would be to kick off with the joke that you began the presentation with because I thought it was a cracker.

John Hathaway: Okay, well on the conference Dick, who's become a good friend... He's actually somebody I called on in the 1970s when I was with a growth stock firm called Spencer Trask and we became reacquainted maybe 15 years ago, we both have homes in Vail. And for the last 20 plus years, Dick has held a conference with a limited number of attendees.

I don't know the exact number, maybe 20 and they're from all different disciplines. We had some guys speak on oil, space warfare, obviously a lot of macro inputs, and some individual stock picking; it's a great get-together. It is one of the highlights of the year. And Dick has invited me back for many years to talk about gold. And it's a great thing for me because I have to crystallize my thinking at the beginning of the year.

I guess the general train of thought is, and then we'll get to the little joke. We did something in August talking on the 50th anniversary of Nixon closing the gold window. And it was really about, inflation's going to be a problem and no need to go into it. But somehow we saw this before Jay Powell and I don't know why.

Stephanie Pomboy: Shocking.

John Hathaway: But starting with the idea that inflation is problematic and maybe more problematic than most investors would like to think leads to the thought that the medicine to cure inflation from the Fed's point of view could also kill the stock market. And we saw a little bit of that in January.

Although in my mind it was nothing compared to what we could have if in fact, we saw the five rate hikes or whatever. People are trying to get in front of each other, talking about all the rate hikes and where the 10-year [Treasury bond] is going to go in 2022. And it made me think that the thing that's been missing for gold is the fact that investors are very comfortable with how they're doing in the stock market. Should that change, and we got a taste of that in January, then they might look for something different as a strategy. And of course, gold has always been a risk mitigator and a defensive position for adverse financial market experiences.

A bear market would be good for gold, in my opinion, whether we're going to have a bear market or not I don't know. And I agree with a general train of thought that the Fed is much more likely to be resistant to market pressure. So a Powell pivot like we saw was it 2018 might take longer to materialize. One of the speakers thought and he's a fairly well-known Fed watcher actually worked at the Fed, and he thinks that this time around the Fed's reaction function will be when the S&P 500 is down 30%. That would be presumably sometime later this year.

Stephanie Pomboy: That, incidentally John, is the same number that Bill Dudley, another former Fed guy put on it, I guess they're all preaching from the same hymnal.

John Hathaway: They do talk to each other. And part of my thought process is, and maybe we have a little bit of a difference in our thinking. Stephanie, you and I agree that there are many forces that will work against inflation. The economy is definitely slowing down, but my thought is that when they do pivot and they'll probably pivot sooner than Dudley and this other fellow think, and that'll be inflationary. So I just don't see much progress taking place to dampen inflation.

And to me, the next page in the book is that the Fed can't take the heat. I mean, Stephanie, you made the great point that we have all the subprime debt maturing over the next three or four years, and it's all financed on the short end. So if we have 1% short end money, I mean, that could kill a lot of companies and lead to unemployment, bankruptcies and nothing very good for Biden in an election year.

That's how I see it. And it's either a bear market that makes Powell's super unpopular and taking a lot of heat from the administration or another round of Fed balance sheet expansion. I think it's almost down to an either-or situation.

And by the way, my little joke. What do Jay Powell, Arthur Burns, an anchovy and a dead horse have in common? And the answer for people sitting on the edge of their seats is "transitory inflation".

And then I went into the litany of excuses Arthur Burns gave in the 1970s as to why this inflation was going to go away. And the first thing he talked about was the big anchovy kill in the Pacific ocean. And I forget which kind of El Nino it was, but it was really bad for the fish, drove up fertilizer prices and then drove up food prices. And Burns, simply reacted by saying, "This is going to go away. But in the meantime, we'll take food out of the CPI." That was 25%.

Grant Williams: Genius.

John Hathaway: No, he's a PhD. Don't mean to demean him.

Stephanie Pomboy: Slander.

John Hathaway: They're very professional, highly qualified, et cetera. And then inflation didn't go away. And then it became, I think it was mobile homes, gold jewelry and a bunch of other things.

Grant Williams: Including home ownership, John.

John Hathaway: Home ownership. You're right. And then by 1975, I think 63% of the components of CPI had been removed. You fast forward to where we are today, when Powell finally fessed up that inflation really is a problem. We had this thing about supply chain bottlenecks.

And I don't mean to get into all of that, but I love what Kevin Warsh said about all of that. And that is that supply chain, bottlenecks, chip shortages, the ports being clogged, you name it is a state of affairs. It's not the root cause. And Warsh was a candidate to be the new Fed chair and interviewed Trump among others. And he was on record as he would've stopped QE [quantitative easing], I believe three or four years after it started.

Needless to say, he didn't get the job, but to me, he's a right-thinking former Fed governor. And his point is that inflation has monetary causes first and foremost. And I know there are those who are well schooled in economics who look at velocity of M2 and say, "It's just dying on the vine." And therefore all these reserves are stuck in the banking system. My dog is disagreeing with me.

So these reserves are stuck in the banking system and what I think, and I have absolutely nothing more than just my own observations to go with on this is that the transmission for inflation is no longer the banking system. It could be the shadow banking system. It could be the stock market. And Volcker when he wrote his memoirs pointed out asset price inflation. And he was referring to the stock market is a source of inflation that may transmit into CPI inflation.

But I think most of the dialogue today is about CPI inflation and deconstructing it, parsing it. And we could do that and I would have a comeback to a lot of the things that people would say. But I agree with you, Stephanie, that the economy is weakening maybe faster than people realize. We have huge amount of debt, which not only slows growth, but it's a systemic risk because of the amount of debt that's financed on the short end.

I mean, a lot of reasons to be negative on the economy for the Fed to make a mistake. And again, I don't get it. And you pointed out that the last institution that people have confidence in is the Fed. And they have to, because you can't explain high stock valuations, unless you think the Fed knows what it's doing. And so my train of thought is that we're in a bear market. People might debate that, but I think it's pretty clear that we're in it. And maybe we need further to go with disappointing returns in the market for people to have a recognition of that.

I think that's where we're headed. And I think that is closely linked to confidence in the Fed and therefore a bear market. Or just a long period of lackluster returns would lead people to think of something else. And that something else it's not the only thing, but something else would be gold, which has been waiting in the wings for many years now, as I've been counting them.

Stephanie Pomboy: You and me, both John.

John Hathaway: Maybe the last 10, but there are a lot of reasons to think that all of this could come together. And if you look at what's happening in the gold space, getting away from the macro, you have really strong demand in Asia. Both India and China, which are about 60% of physical offtake in Asia, but the rest of Asia looks pretty much the same. India and China are running at rates that are well above pre-COVID levels, 2019 being that benchmark.

And then one could ask the question, why hasn't that had an impact on the gold price? And the reason is that Western investors have been liquidating their holdings of gold-backed ETFs, the biggest one being SPDR® Gold Shares (GLD ETF).FN And they've been liquidating because they've been doing well in the equity markets.

And then two, because of this narrative that really took hold last June after the FOMC [Federal Open Market Committee] meeting, that the Fed was really going to get tough on inflation and that rates were going to go up. And so most of the quants and algorithmic traders just position gold as a short, against a long long U.S. dollar.

And that, I think that basically explains the narrative for why, between the strong stock market and the expectation of higher interest rates for half a year, gold was overlooked, or left out in the cold. But in the first few weeks of this year, inflows have taken off into GLD. And in my mind, if you combine inflows into gold-backed ETFs with continuing strong demand in Asia, you have the ingredients for a gold price that could trade well above its high, during COVID, which was around $2,100.

I don't know why you couldn't see gold trading $300-400 above that previous high, and nobody expects it again. I mean, probably nobody expects a lot of things that I expect. Which is that interest rates aren't going to go up because they can't that the economy's going to be slowing down and earnings are going to reflect that. And that inflation is going to be a problem longer than anyone thinks. And for all of these reasons, we could see a bear market, which I think would supercharge interest in gold, which has been lying in the weeds.

I need to mention cryptocurrencies because I always get that question. And I think the aspirations that the cheerleaders for crypto had for it to be a replacement for gold, a currency, have been totally upset because of the price behavior. I don't know where Bitcoin or the others are going to trade six months from now, but if you overlay a chart of most of the cryptos with Nasdaq, it looks pretty darn similar.

And that would suggest that crypto has been, if nothing else, a great speculation. But to then say, it's a risk diversifier to me is absolutely nuts and maybe we'll see a digital... We're seeing, for example, Mitsubishi, I think just announced a gold stable coin that they're going to launch. I don't think they'll be the only one.

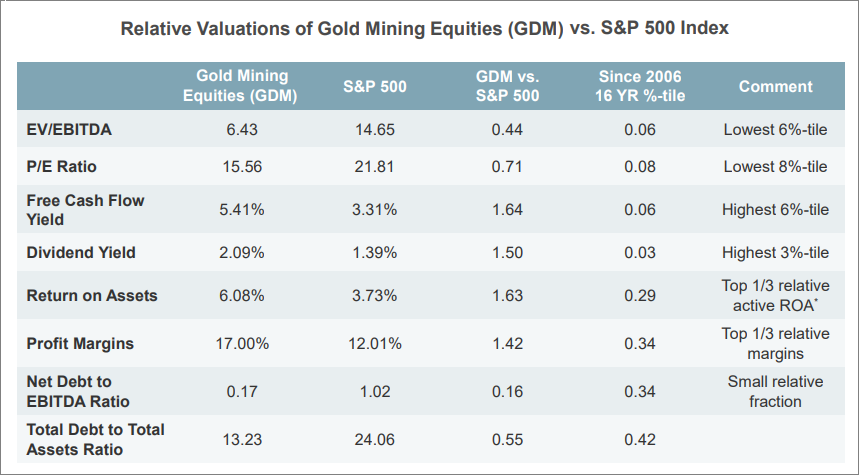

I think we'll see the digital currencies and gold co-exist. And I think it's a natural thing to use gold as a stable coin. We'll see. I mean, certainly, digital currencies are the way of the future, but maybe not crypto. Let me just address gold stocks, which trade at a tremendous discount to the S&P 500 Index. I guess, the one thing that sticks in my mind is that enterprise value [EV] to EBITDA, just one metric, is about 40% of the S&P 500 [See Figure 2].

Figure 2.

Source: Sprott Asset Management, Bloomberg. Data as of 12/31/2021. See footnotes for definitions of S&P 500 and GDM Indices. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

In my 20 years of following this space, I've never seen gold stocks cheap in absolute terms and on relative terms. Again, that speaks to the fact that there's no interest and I can vouch for that because we see very low lackluster flows into, or out of our mutual fund, the Sprott Gold Equity Fund, and it's mirrored by the fact that GDX,3 VanEck Gold Miners ETF, has actually lost assets over the last two years.

And net over the last two years, the price of gold is up. In fact, I didn't mention this earlier, but the average gold price in 2021 was actually higher than the average in 2020. Not by a lot. [For 2021, the average gold price was $1,799.27 compared to the 2020 average price of $1,770.25, increasing $29.47 or 1.66%.] For all the headlines about the Fed getting tough on inflation and raising interest rates, which was the narrative that hurt gold, it actually ended up the year in not bad shape.

And so, the one fundamental we care about for the mining companies, the one universal explanation of how they do well or don't do well is the gold price. And so when you have a group that's trading so cheap in absolute terms, many, and I didn't mention this, but dividend yields from gold miners are higher than the benchmark S&P 500.

It's like 2.09% versus whatever the S&P is [1.39%; see Figure 2], but it is higher. So you have value going for you. You have the confluence of very positive developments in the physical sector, and then you have potential for a bear market and the Fed getting egg all over their face. One more time, sorry, Mr. Dudley. And I think that's a pretty terrific setup for gold.

Stephanie Pomboy: Well, in gold's performance, as you said in the face of this 180 by the Fed from "it's transitory, we don't have to do anything about it" to Wall Street doing a one-up-manship contest to see whether they can forecast 6, 7, 8 rate hikes or 50 basis points out of the gate in March. Gold has actually performed incredibly well, I would say, in the face of that.

John Hathaway: I agree. It's shown a lot of resilience. Fred Hickey pointed out in his latest newsletter, The High Tech Strategist, that if you look at a 10-year chart of gold, it looks fantastic. It's a cup and handle, which not to get too much into that, but to your point, Stephanie, it has resisted all of this blather about the Fed getting really tough, and it just hasn't broken out.

But my experience with this is when it does break out, it will leave a lot of people behind. And that will explain, why I think it could have an explosive move. I'm not sure what the day-to-day catalyst would be, but I think the setup is there for that kind of event. So end of story.

Grant Williams: John, let me ask you, when you spoke about the fact that everyone's expecting a bunch of rate hikes, the Fed are talking tough for the first time in a while. And you mentioned that you thought if Powell actually ultimately lets the stock market fall and then pivots back to lower rates and QE, you said that, that would be inflationary.

And I'm just curious because again, I understand that, but obviously that's been the narrative for the longest time and it does now feel that we're at the point where the gears are synchronized and Fed policy might actually lead to translatable inflation to the man in the street. But what do you think the difference is this time around? Is it the fact that the inflation's already built into the system and this will just trigger it? Or is there something else that might mean that finally we get to the point where the reaction function to Fed policy translates directly into CPI inflation to the man in the street.

John Hathaway: Okay, good. Let me just say that this discussion of inflation - and I'll come back to that - is important when it represents a potential systemic risk, but there were times when gold did very well. For example, from 1999 through 2011, inflation was not a front-page issue. So gold should not be thought of but it is widely thought of, but I think it's incorrect to position gold as an inflation hedge.

It's really a hedge against monetary malpractice of the kind we've seen from this Fed for the last 20 years. Sorry, again, Bill Dudley. And so I don't want this to be so much about inflation from my point of view, but more about the systemic risk that arose from ultra-low interest rates, following the dot com smash the housing bubble, the bubble in the stock market since QE. And now the huge amount of debt that we're issuing to sustain economic growth.

I think that is really more the backdrop and inflation. If you look at what happened in the 1970s, we had a recession, I think it was '75, two years of down GDP, not a huge down, but I think it was '74, '75, I think that was it. And of course, it was a different Fed different tactics, but it was definitely rapid growth of the monetary aggregates and the Fed being behind the curve in terms of real interest rates. And after that recession, it just amped up that policy, that strategy.

And of course, we all know how that worked out. So, I don't know how this is going to play out. But I do think that the pivot, when it comes, will be read as inflationary. Perceived as inflationary and whether it actually turns out to be CPI inflation in the way that you hear talked about in all of the financial media, maybe not, but I think it will.

And you can have inflation coexisting with high unemployment. You saw that throughout the seventies. You had lackluster growth and you had high inflation. So I think you have to go back to monetary and again, not to get hung up on CPI inflation, it's really what's behind that and the cause of it. And today it's Fed balance sheet expansion. In The seventies, it was expansion of the monetary aggregates.

And the transmission mechanism to the CPI we could argue or discuss all day long, but I think there's a high component of it that is perception, behavior, which then gets imprinted in the way people think and behave, including purchasing managers, consumers, et cetera. And it takes on a life of its own. That's what I fear could happen. But as far as I'm concerned, I'm just happy if the Fed loses complete faith and people lose confidence in it. I think that'll be enough to get people to think about gold. And the Fed is in a really tough spot and may not know what they're doing.

Stephanie Pomboy: Well, this brings me the question I've been chomping at a bit to ask you. And that is, you've got the Powell pivot as really propelling gold higher. And I agree with you a 100% gold is not just a traditional hedge against inflation and currency defacement, but against financial stability or instability as well. And we've seen that repeatedly. So the question begs if a Powell pivot will work? Because if it doesn't work, he does the 180 like he did in the fourth quarter of 2018, but the market doesn't respond the way it did then.

We continue to see rising volatility and financial stress. That's where I think you and I part company on the inflationary implications, because I see that as very disinflationary, even deflationary. But I guess it ultimately comes down to your view of whether the Feds pivot will have the same result it did in the fourth quarter of 2018 and all the times prior or whether they're finally going to lose the credibility that has mystified all of us for so long or they've maintained. Do you have thoughts on that?

John Hathaway: No, I think that's right. I mean, loss of credibility could come from a lot of things. And one of them could be that this medicine or this playbook that they've had for the last really 20 years is no longer potent, and that it's become useless. And then where do we go from there?

Stephanie Pomboy: Where do they cut rates?

John Hathaway: They can't cut rates. We haven't even talked about the fiscal issues, but I think they go hand in hand with the dilemma that the Fed's in. But I agree. I think that it is the loss of confidence in the playbook that has made so much money for so many people that didn't know what they were doing, they just had to be in the game. One of the speakers at Dick's conference has a large investment firm in Texas and he's a real veteran. He said, "He's never seen investors so complacent about, I guess, the state of the world, because they've made so much money for so long and they're not attentive to what's going on."

And that's a very interesting observation, but I think we could all agree that the complacency that is still resistant to the thought process that we're talking about and maybe just the warning across the bow in January with the Nasdaq being down 10%. I guess it just has yet to sink in.

I think there were inflows into stock mutual funds in all but two days in January. The buy-the-dip crowd is alive and well, and maybe they'll be right, but I would sure bet against it.

Grant Williams: I wonder how the buy-the-dip crowd in the gold equities have been doing, because they've been buying dip after dip after dip after dip.

John, let's just go back to the stuff you mentioned about Arthur Burns. Because I think this is a really great lesson for people when they're trying to think about, okay, what options do policymakers have? And you demonstrated a tremendous one there that really won't be on many people's radars. And that's what they did to CPI5 calculations back when this became a problem in the 1970s.

When you look at it from our perspective and you look back, you can see all these things and you realize how crazy it is to adjust the inputs. And we have had decades of hedonics and substitution and all kinds of things done deliberately to massage that CPI number lower. Investors need to be aware that these are the kinds of things that happen in critical points. The rules of the game get changed and the calculations get changed to make them lower.

But do you think today they'd be able to get away with that because there's just so much more commentary. There's so many more people looking at moves like that. And with platforms and wide audiences that they can debunk what the Fed are doing, that if they did something like that.

Grant Williams: If they did try and change the, I don't know, the percentage of owner equivalent rent, or they're trying to change the components in the basket. Do you think that would actually this time round be a dangerous thing to them to do just because of the sheer ease with which people can pick that apart in the public arena?

John Hathaway: For sure. I mean, if they try and I think that would be one more building block to the case for the Fed losing the trust of the investment world. I can't believe they would be so dumb as to do that, but in the seventies it was different. People were gullible. I guess, people are still gullible today. But I think you're right. I think it's so closely watched. I don't think they could get away with it.

Stephanie Pomboy: Also, the man on the street knows what his experience is. I just ordered something on Amazon and I went to check out and I guess some items I had bought months ago, they announced some items you had have changed in price and they have on the top, all the ones that went up in price and on the bottom, all the ones that went down in price. So, I'm not even shopping for that stuff and it's in my face I think everyone's experienced this.

John Hathaway: Yes that's right exactly. Amazon'd be a great example. I don't think they could get away with it.

Stephanie Pomboy: That may not stop them from trying though they might try desperate times call for desperate measures.

John Hathaway: Wage and price controls.

Stephanie Pomboy: Yes. John you in your prologue talked about China and demand from Asia in general for gold that we've seen. And then a segue to commentary about digital currencies and the emergence of digital backed gold. And I want you to link those two together because China we know is starting to work on doing a digital currency. Do you think gold will play a role in that? Is it something that factors into your thesis for gold or is that just that would be gravy on the top if it happened?

John Hathaway: Yes, I think it more the latter, but gold hasn't had much usage as a transactional medium close to a century.

Stephanie Pomboy: Did you see the video that's going around of this guy, Mark Dice on the street, offering people to swap his Canadian maple leaf for their sunglasses or T-shirt or whatever they happen to be carrying? It's great. I mean, this thing goes on for a good 10 minutes and he is talking to people right and left and saying, "I've got this Canadian maple leaf. We can verify it's real right over here. No, I can't give you my $20 GAP T-shirts.

John Hathaway: No, people just don't think of it that way. And that's a good example of ignorance by the grassroots, although they may talk about it. So I think it's going to be a while before that happens, but I do think it can happen. And to the extent that it does, it's obviously a positive, but I don't think we need that to happen. I guess that the bottom line is for the investment world to lose confidence in the Fed. I think that's the nub and it could happen several different ways. It could happen through a combination of things. But I think that really, I guess you could say gold is to put on confidence in the Fed.

Grant Williams: John, let ask you about the gold mining companies, because obviously you've focused on those pretty strongly. What have you seen happening in the last couple of years in terms of actions taken by gold miners to position themselves better for the next bull run?

Grant Williams: Because there's been a lot of excellent work done on the state of their balance sheets when gold was really on the outs the last few years. Talk about the change in the companies' set up and they're prepared for the next run in the gold price.

John Hathaway: Well, they went through this near death experience through over expansion, as gold was hitting its peak in 2011. Bad balance sheets, bad investing, poor rates of return. And I don't think they recovered from that. I think there are a few are thinking more aggressively, but I would say on balance, there is a prevailing mood of caution, unwillingness to risk balance sheets.

And then one other thing I'll mention is that resource nationalism is rampant almost everywhere you can think of. So in addition to capital starvation, which is what I just talked about the unwillingness to invest or the reluctance to invest, the world that we can invest in has really shrunk by maybe 50%.

There's a coup of the weak in West Africa. Chile is I guess, voting on a new constitution. Previously attractive areas, not only because of geology, but because the governments were cooperative and you didn't have this resource nationalism that it's really all over is a huge game stopper for new investment.

So with all the other hurdles, and then I haven't mentioned ESG, that's another hurdle that we didn't have to deal with. And I think the industry has done a poor job of talking about the good that they've done in the areas where they have worked. So that's one thing, but we now have this thing, woke capitalism.

Progressive values are taking over corporate America and the mining industry is not immune. So you put all of that together. And I would say the case for dwindling supply of newly mined gold is very, very strong. And as far as we go, we're investing in fewer and fewer countries. And we invest where we think there's a rule of law because these mines, if they're significant have a 20 year, 30 year life and governments come and go rule of law is really important.

And so I think you have a really powerful case for a very muted response in terms of new production to a big jump in the gold price. I just posit that a $500 increase in the gold price, which would be wonderful for anybody who's already in production or about to ready a mine for having run the gauntlet of all the permitting and so forth that will be producing. That's going to be spectacular for them, but as far as encouraging new investment, I would say it probably is going to have much less of an impact than people might think.

Stephanie Pomboy: John, you talked about ESG and that dovetails with oil prices at $90 a barrel. Obviously, that's not incentivizing a whole lot of production either. Is there a point at which that becomes a real problem for them? Or if we see a hundred dollar oil, I guess it just means you get even less supply, which should be bullish for the price, but for the companies themselves-

John Hathaway: Well, there's no question. I think the question is profit margins with higher energy prices, higher labor costs. I mean, I could go through the list of a lot of things where it's not the consumer. But here's an industry which is faced with tremendous price inflation and then additional costs layered on that because of ESG COVID protocols, all of that stuff.

So, the all-in cost of mining an ounce of gold say it's roughly $1,100 or it was in 2021. It'll probably be up 10% in 2022. And the cost of building new capacity. We've seen huge blowouts in capital spending on projects that were thought to be call it $500 million or maybe going to be $700 million and add to that delays because of permitting and compliance with ESG protocols, permitting all of that stuff.

So, in a way we need for the industry to maintain its very high level of profitability. We do need for the gold price to move off the dime from where it has been, which is basically around 1800, more or less. And so I think we'll see that, but without it, I think that probably is one of the negative arguments you could make against investing in miners, as opposed to just in buying the metal itself.

Grant Williams: John let me ask you, you rounded off your presentation with a look at the gold mining stocks relative to the broader index. And while there will be people listening to this conversation who've been long certain gold equities for a while.

And in and out of the sector, there'll be others who are really starting to take a look at this stuff for the first time, given the change in the inflation background, which is, as you say, is the reason most people tend to automatically reflexively look at gold. So just if you can quantify the gold mining equities versus the broader market, because until you do that, you really don't realize just how cheap these damn things have become.

John Hathaway: Yes, I could just, there are a bunch of things you could compare PE ratio 15 times versus 21 for the S&P, free cash yields, 5% return on capital's twice what you see for the typical S&P company profit margins are 50% higher. I think that's probably operating profit and their balance sheets are actually quite strong, very low debt, probably surplus cash. So if you look at the financial picture for the gold miners, it's a pretty healthy situation.

And again, I say the one negative is the potential for margin squeeze in a flat gold price environment, but their ability to withstand another six months or a year of this, I hope it doesn't happen just because I'm running out of patience. They're going to be around. What they represent are out of the money calls on a higher gold price. And they can provide that and higher octane than just being long, the metal itself, particularly in a sequence where the gold price is moving dynamically, you're likely to get 2 or 3X that move in the gold price in shares of mining companies.

Stephanie Pomboy: Well, to give you a ray of hope for that, there's a headline that just came across Bloomberg, that if we get a hot CPI it increases the odd the Fed's going to tighten 50. And I'm sure you saw the cover of the Economist this week which was, how high are rates going to go. -

John Hathaway: Yes, that should make you happy because...

Stephanie Pomboy: It does.

John Hathaway: They're not going to go anywhere. Fred Hickey, I just read his newsletter. The title of it was Irritable Powell Syndrome.

Stephanie Pomboy: That's genius.

Grant Williams: I've been kicking myself.

Stephanie Pomboy: I'm so jealous.

Grant Williams: When I'm thinking of that I know.

Stephanie Pomboy: Yes. That is brilliant. Mic drop right there.

John Hathaway: These next three or four months are going to be very interesting. As far as I guess, to what the CPI print is tomorrow.

Stephanie Pomboy: Yes.

John Hathaway: I mean, near term, I don't see that doing anything to make anybody happy. So there you're right. The headlines will be 50 basis points.

Stephanie Pomboy: Yes.

Grant Williams: John, if I can just to finish up, I'd love to talk a little bit about the seventies because obviously none of the three of us were around, but your father was around John. So perhaps we could talk about conversations you may have had with him about what actually happened in the seventies and how things played out?

Because obviously before the seventies and all the stuff we've talked about a little bit, they were in a situation not unfamiliar with the one we're in now. Where people didn't believe this was going to be a problem and it wasn't a problem. And then they fought it for a while and then eventually it got out of hand. So just talk a little bit, if you can, about any parallels your father may have shared with you about how this next phase might play out.

John Hathaway: Well, he was telling me about these gas lines. We had these demonstrations, it was at the end of the Vietnam War. And I'm sure that affected valuations of financial assets, just that social tension, which could be around the corner for us now. Frankly, the seventies were a little bit like the sixties, which Timothy Leary said, "If you remember them, you weren't there." And that was a little bit my case in the seventies.

I remember being with a growth stock firm and basically being a cheerleader for the nifty 50 stocks. And then post-1975, going to a value shop where stocks just kept getting cheaper and cheaper. And good companies traded for six times earnings with 6% dividend yields. And thank you for reminding me of the seventies. What I think is most important to remember about it is that it was a bear market.

It lasted for 10 years. It wasn't the stupid definition you hear on Bloomberg or CNBC, down 20%. It's a bear market. It was like, "Man, I don't want to go to work today. This really sucks." And I remember people would look at me with pity that I was in the investment business. It was really bad.

Dow went nowhere for 10 years. I mean, there's nobody around today. I mean, I'm one of the few passing up to my real age that remembers that. And it was just a death march to Corredor. Nobody that I see, that I talk to very few remember that. And I love..., First of all, I love your chart, Stephanie, which I used in my presentation of showing the similarity between the Fed balance sheet growth and the S&P-

Just to recall another veteran of those days, Bob Farrell, the great strategist with Merrill Lynch said that markets that go straight up go further than you think, but when they correct, they don't correct by going sideways. And so again, I'm struck by the fact that there's so much complacency that we saw in the midst of a rout of Nasdaq stocks in January, the buy the dip crowd was unfazed.

And so to return to the state of mind of the 1970s, which had inflation, but it had a lot of other things that nobody in today's market has experienced would be such a 180 from where we are today. And again, I would say given the speculation that we've seen, the speculation in financial asset prices, the speculation in non-fungible tokens, cryptos, all of that kind of thing. I guess another clincher for that is the renaming of the, I guess, it's the Rams Stadium as Crypto Stadium.

We're so far away from what I remember in the seventies. You had to wait in line for gas. I mean, it wasn't the end of the world, but was a very different world in terms of financial markets. And it was a time when gold did really well. And it's hard to know exactly the sequences that are going to get us to that.

But it seems to me just in proportionality reversion to mean, and that kind of thing, if we just go halfway there, I think we could see gold over $3,000, big numbers that nobody is even thinking about. And of course, it's hard to talk about it to prospective investors because if you say that, man, I've got CrowdStrike, I've got Tesla, don't you ruin my day. So you have to be really careful about how you talk about it, except in a very edified group like this.

Grant Williams: John, the one thing you haven't done is ruin anybody's day, certainly on this podcast. John, thanks so much again for doing this with us. Perhaps if you'd be so generous, you wouldn't mind sharing the slides that we've been talking about with the audience, because I'm sure there'll be plenty of people that would want to see them. It is just a fantastic deck.

John Hathaway: Thank you. Be happy to do it.

Grant Williams: All right. Brilliant. I'll attach that with the transcript, anything else?

John Hathaway: I do have to run it by compliance, but I'm sure they'll find it's fine.

Grant Williams: All right. Okay. Well, we can always redact things from it if we need to before it goes out. These things always look much more important with the black bars over certain words. Fantastic. John, look, thanks again. It's always a real pleasure to get a chance to talk to you.

Stephanie Pomboy: Well, hopefully we'll do it when gold is significantly north of $2,000 or maybe three.

John Hathaway: Sounds good for me.

Stephanie Pomboy: See, I am an optimist.

Grant Williams: There you go. Thanks again, John, take care.

John Hathaway: Thank you.

Stephanie Pomboy: Thank you, John.

Grant Williams: Well, there we go, Steph. I have to say, I love talking to John because he's seen this stuff. He such a balanced perspective on it all. He has the experience he's not... We're all making guesses about the future, but he has the kind of grounding in making guesses about a future that's likely very similar to a past that so many people don't remember.

Stephanie Pomboy: Well, it's interesting. When you asked him about the seventies as he described it, it just sounded like the mirror image of today, where now people come into trade the markets every day and they expect they'll be up. And as many institutional managers have never seen a bear market before and have no idea what he is talking about.

The whole cadre of retail investors who have just recently joined the market. I mean, they obviously have been shocked to learn that stocks actually can go down in price. So it's a refreshing perspective after so long where things just seemed to march higher for no apparent reason.

You remember post 2000, you remember all the people who were day trading. You forget that it was a very similar mania to the one we're seeing today. But what happened in the Nasdaq bubble, all those people just stopped day trading. They just couldn't take it anymore. And that's the thing, everyone today who's on their phone checking their phone 15 times a day. And using apps and trading stuff, they can't conceive of a world where they don't want to do that. But the markets have a habit of putting you in that position.

Grant Williams: I had lunch here in Sydney with some guys yesterday, and one of them told me that he was talking to a guy that runs a fund and the traders on his desk. I mean, we have these conversations about, there are people that don't remember this, or don't remember that. The trainers on his desk were amazed when the 10-year bund yield went positive.

Stephanie Pomboy: Oh my God. That is terrifying.

Grant Williams: Just imagine that.

Stephanie Pomboy: That's your timeframe.

Grant Williams: But also your mindset being, wait, these can trade with a positive yield? And think about what that does.

Stephanie Pomboy: And we're still trying to wrap our head around the fact that they actually went negative.

Grant Williams: I know, but imagine what that does, if you didn't really think that through and suddenly these things are trading with a positive yield and you're going to go I have to rethink everything.

Stephanie Pomboy: Yes.

Grant Williams: If these things can trade with a positive yield. And that's where we are, it's amazing.

Stephanie Pomboy: Absolutely. And I don't know about you, but anecdotally, the friends that I have who have been day trading were smacked around in January and complained about it a lot, but they still haven't stopped. I think it's going to take a lot of water torture before they finally give in.

Because they are just so acclimated to things immediately turning around. Which is why I asked John that question about whether the pivot will work? Because that, buy-the-dip mentality is so Pavlovian, so programmed now that... sorry, speaking of Pavlovian the dog barked. Folks, we did not plan that. Oh my God, this is brilliant.

Stephanie Pomboy: I kept kicking the dog when she got really loud. And I did finally figure out I could mute my microphone, but yes, that wasn't me snoring through the presentation.

Grant Williams: I'm a witness because I could see that. Well Steph, I guess that remains is for us to thank our guest, John Hathaway. As always, it's always great fun talking to him. To thank you for joining me once again and to thank everybody out there for listening. You can follow us on Twitter if you'd like to do so.

Stephanie Pomboy: And at @spomboy. Very clever.

Grant Williams: See we thought you might never ever get the hang of it.

Stephanie Pomboy: 100 times the charm.

Grant Williams: That's all. Now we will be back again at some point in the not too distant future. I hope.

Stephanie Pomboy: Absolutely looking forward to it.

Grant Williams: Nothing we discuss during the Super Terrific Happy Hour should be considered as investment advice. This conversation is for informational and hopefully entertainment purposes only. So while we hope you find it both informative and entertaining to say nothing of super and terrific, of course. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets.

| 1 | The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. |

| 2 | S&P 500® Index represents 505 stocks issued by 500 large companies with market capitalizations of at least $6.1 billion. This Index is viewed as a leading indicator of U.S. equities and a reflection of the performance of the large-cap universe. |

| 3 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. |

| 4 | The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs. |

| 5 | The CPI measures the change in the out-of-pocket expenditures of all urban households and the PCE index measures the change in goods and services consumed by all households, and nonprofit institutions serving households. |

| 6 | The NYSE Arca Gold Miners Index (GDM) is a modified market capitalization-weighted index comprised of publicly traded companies primarily involved in mining gold and silver in locations worldwide. |

Important Disclosure

This material must be preceded or accompanied by a prospectus. Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectus which should be considered carefully before investing. Click here to obtain the prospectus or call 888.622.1813.

Past performance is not a guarantee of future results. All data is in U.S. dollars unless otherwise noted. Sprott Gold Equity Fund invests in gold and other precious metals, which involves additional and special risks, such as the possibility for substantial price fluctuations over a short period of time; the market for gold/precious metals is relatively limited; the sources of gold/precious metals are concentrated in countries that have the potential for instability; and the market for gold/precious metals is unregulated. The Fund may also invest in foreign securities, which are subject to special risks including: differences in accounting methods; the value of foreign currencies may decline relative to the U.S. dollar; a foreign government may expropriate the Fund’s assets; and political, social or economic instability in a foreign country in which the Fund invests may cause the value of the Fund’s investments to decline. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED

Sprott Asset Management LP is the investment adviser to the Fund. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Sprott Global Resource Investments Ltd. is the Fund’s distributor.

© 2024 Sprott Inc. All rights reserved.