John Ciampaglia, CEO of Sprott Asset Management sits down with Andrew Bell of BNN Bloomberg to discuss the uranium market and Sprott’s growth in the space.

Video Transcript

Andrew Bell: Sprott, the commodities-focused investment manager, has been all over uranium for quite a few years now. They are in charge of a physical uranium trust and have at least two uranium ETFs that play the stocks and the actual equities. Sprott, needless to say, is bullish on this energy metal. We’re joined by John Ciampaglia, CEO of Sprott Asset Management. John, you have been preaching the gospel of uranium for quite a while, and you've been vindicated. The spot price has pretty well doubled in the past year.

John Ciampaglia: It’s been great. We’ve been very active in educating the market about this investment thesis since we acquired Uranium Participation Corp. in July of 2021. It's hard to believe that the vehicle at the time of the acquisition was $630 million, and we're now at $6.8 billion U.S. dollars, a 10x increase. Our clients have been extremely happy with their exposure to the sector. Sprott offers a number of different vehicles that focus on uranium mining equities as well, and the complex is around $9 billion U.S. dollars right now.

Andrew Bell: It’s gone up ten times in assets, but the people haven't earned ten times in returns. I think that is incredible, the amount of money that's come in. Let’s look at the uranium price because it's not far short of $100 U.S. a pound.

John Ciampaglia: Last year was a real breakout year for the price of uranium after meandering in the mid-50s for a good chunk of the year. We broke through $60 in September but did not let up. We’ve basically been rallying from $61 a pound in September to $106 a pound in the spot market right now. That’s really being driven by a number of factors. First and foremost, utilities are reloading their inventories of uranium after essentially drawing them down for the greater part of 10 years. This is really in response to the world shifting back to nuclear energy after largely ignoring it for the last ten years. You would expect a supply response to come from the market when a commodity goes up 80 or 90%. and we're starting to see one clearly, but we've also had some bumps along the road. I think this is really function of what happens when you starve a sector of capital for ten years. Many projects get put on care maintenance and then the sector shifts and you want to expand production very quickly. and you realize that it's not as easy you hoped it would be. We have some near-term supply challenges, including some of the largest uranium miners in the world at a time where there are very large anticipated supply deficits over the next 15 to 20 years.

Andrew Bell: Looking at a couple of the ETFs, you have your Sprott Uranium Mining Etf, that’s the bigger companies. I see its biggest holding is the Sprott Physical Uranium Trust. Why do you have quite a bit of money in the actual physical uranium in that ETF?

John Ciampaglia: The index tracks the whole market universe of uranium-related investments. It has about 18% exposure to physical uranium vehicles, including as you mentioned, the Sprott Physical Uranium Trust, which is there to provide liquidity and exposure to the spot market. One thing you have to keep in mind is that the entire market cap of all the uranium companies and all of the public-listed holding companies that physically hold uranium is only about 50 billion dollars. So, in order to provide liquidity and investability, we have to include some exposure to these underlying physical holding companies.

Andrew Bell: And then you have Kazatomprom and Cameco, both some of the world’s biggest producers. Then you have your Junior Uranium Miners ETF with Paladin Energy and Uranium Energy Corp. among the big holdings there.

John Ciampaglia: We find that ETFs are a very effective tool for investors to get broad exposure to the thematic and particularly technical sectors in the market. They don't want to doing individual company research in many cases. There is a disparity between winners and losers and across the investment universe, and they opt to buy the basket. The Junior Uranium Miners ETF is a really simple construct. We take largely the constituents of the larger ETF, and we take out the two biggest producers, Kazatomprom and Cameco, and we take out the exposure to the physical uranium. You really get everything below: all of the smaller producers, developers and a number of exploration companies. It’s a convenient way to get exposure to a broad basket of companies in the sector.

Andrew Bell: Your famous Sprott Physical Uranium Trust – when it goes to a premium to its net asset value, it can buy more uranium in the market. I know it gets complicated, but is it near or at a premium right now?

John Ciampaglia: We're currently at a small discount of around 6% [Sprott Physical Uranium Trust]. That reflects largely the fact that the spot price of uranium has moved so quickly this year, up around $15 a pound and the Trust is lagging a little bit behind. But the Trust has recently been at all-time highs in terms of its market price. I believe we’re up around 300% since we launched the vehicle, so it’s been a real winner in an environment that's been very hard to find big winners.

Andrew Bell: Thank you very much John. John Ciampaglia is the CEO of Sprott Asset Management.

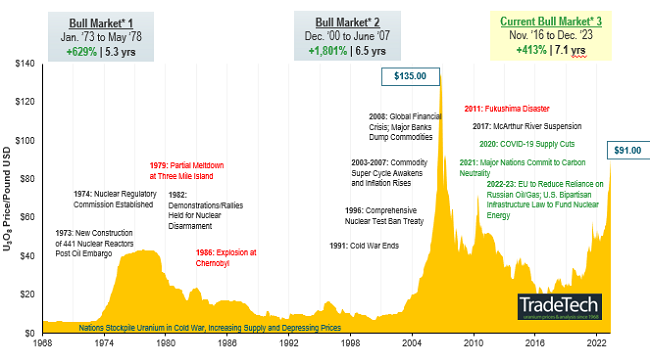

Uranium Bull Market Continues (1968-2023)

Click here to view enlarged version

Source: TradeTech, month-end prices. Data as of 12/31/2023. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/. Included for illustrative purposes only. Past performance is no guarantee of future results.

Important Disclosure

* Sprott Physical Uranium Trust is the world's largest physical uranium fund based on Morningstar’s universe of listed commodity funds. Data as of 12/31/2024.

Sprott Physical Uranium Trust (the “Trust”) is a closed-end fund established under the laws of the Province of Ontario in Canada. The Trust is generally exposed to the multiple risks that have been identified and described in the prospectus. Please refer to the prospectus for a description of these risks. Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage, and liquidity should also be considered.

All data is in U.S. dollars unless otherwise noted.

Past performance is not an indication of future results. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action. Sprott Asset Management LP is the investment manager to the Trust. Important information about the Trust, including the investment objectives and strategies, applicable management fees and expenses, is contained in the prospectus. Please read the prospectus carefully before investing.The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or operational charges or income taxes payable by any unitholder that would have reduced returns. You will usually pay brokerage fees to your dealer if you purchase or sell units of the Trust on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the Trust and may receive less than the current net asset value when selling them. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized.