Key Takeaways

- Persistent Deficits: The platinum market is facing its third consecutive year of major supply deficits, threatening to deplete above-ground inventories within three years.

- Constrained Supply: Production challenges (especially in South Africa) along with limited recycling and no major new mines, are capping supply growth despite rising prices.

- Rising Demand: Demand is surging across automotive, jewelry, industrial and investment sectors, with notable growth in Chinese jewelry and investor interest amid slowing electric vehicle (EV) adoption.

- Price Catalyst Building: With inventories dwindling and demand outpacing constrained supply, platinum may be nearing a tipping point that could trigger a significant repricing.

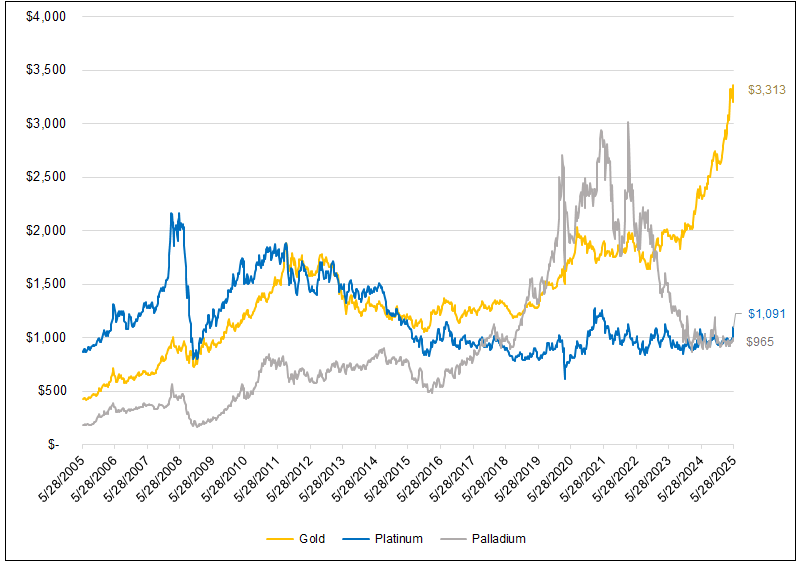

Platinum, one of the rarest precious metals, has been overshadowed by its more glamorous cousin, gold, for more than a decade (see Figure 4). Yet beneath platinum’s tepid price action lies a compelling story of supply constraints, surging demand and an unsustainable structural deficit that could propel platinum prices to new heights. According to the World Platinum Investment Council’s (WPIC) Platinum Quarterly Q1 2025 report,1 the platinum market is grappling with a third consecutive year of significant deficits, projected at 966,000 ounces for 2025 — a shortfall representing a staggering 12% of global demand. This deficit, coupled with a lack of new supply and robust demand growth across multiple sectors, sets the stage for a potentially sustained price surge. We posit that the tipping point for platinum may be nigh.

The Structural Deficit: An Unsustainable Imbalance

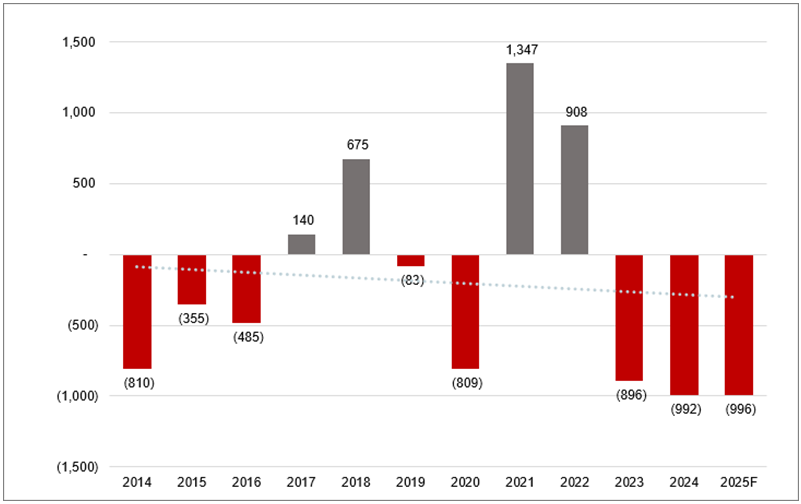

At the heart of platinum’s bullish case is the persistent and deepening structural deficit in the market. The WPIC reports that the platinum market recorded a 992,000-ounce deficit in 2024, following an 896,000-ounce shortfall in 2023, and now forecasts a 966,000-ounce deficit for 2025 (see Figure 1).

If the platinum deficit persists, inventories may be depleted in three years.

If the deficit forecast proves accurate, this will be the third consecutive year of significant undersupply. The WPIC describes this deficit as “embedded” and “unsustainable,” signaling that the market cannot continue to operate under such strain without a significant price response.

Structural deficits occur when supply consistently fails to meet demand, depleting above-ground stocks and creating upward pressure on prices. In platinum’s case, above-ground stocks are projected to dwindle to just 2.5 million ounces in 2025 — a critically low level. To put this in perspective, if deficits persist at this rate, global platinum inventories could be effectively exhausted within three years, a scenario that would force prices to rise dramatically to balance the market. Unlike temporary imbalances, this structural deficit is driven by fundamental supply and demand dynamics that show no immediate signs of resolution, making it a potentially powerful catalyst for price appreciation.

Figure 1. Platinum Supply-Demand Gap (koz2) (2014-2025F)

Source: SFA Oxford (2014-2018), Metals Focus (2019-2025f).

A Constrained Project Pipeline Points to Continued Deficits

One of the most critical factors underpinning the platinum deficit is the severe constraint on new supply. According to the WPIC, mine supply is projected to decline by 6% for 2025, with global production in Q1 2025 falling 13% to its lowest level since 2020, largely due to power outages and disruptions in South Africa. South Africa is the single most dominant mining jurisdiction for platinum, accounting for nearly 80% of global mined platinum output.

We believe platinum’s supply ceiling is likely to support higher prices.

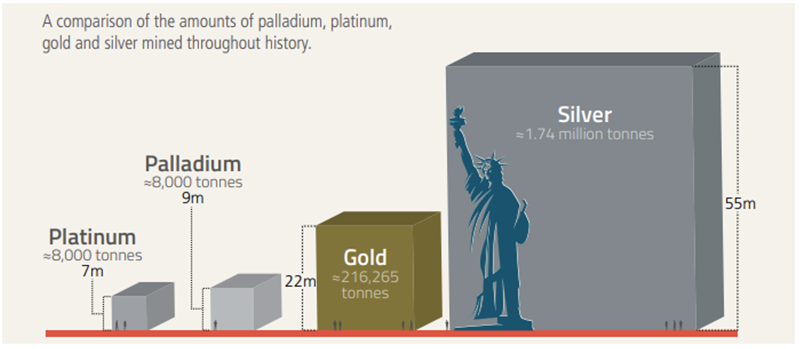

Depending on the year in question, for every 17-18 ounces of gold that is mined, we extract a single ounce of platinum. Platinum is significantly rarer than gold, occurring at very low concentrations in the earth’s crust (see Figure 2). All the platinum ever produced (approximately 8,000 tonnes) would fill just one Olympic-sized swimming pool to ankle depth. This rarity makes scaling up platinum production a formidable challenge.

Figure 2. The Amount of Platinum That Has Been Mined

Sources: Best available data as of 12/31/2024. USGS, How much silver has been found in the world?. The World Gold Council, Gold Above-Ground Stock. Note: “m” refers to meters. For instance, approximately 216,265 tonnes of gold would fit inside a cube 22 meters in length, width and height.

Bringing new platinum mines online is a capital-intensive and time-consuming process, often taking over a decade. Platinum’s supply is slow to react to price signals, unlike other commodities with shorter production cycles. South African producers face additional hurdles, including seasonal weaknesses and infrastructure challenges, as seen in Q1 2025. Recycling, another key supply source, is also underperforming, with only a modest 2% increase in 2024 and 1% in 2025, far below what is needed to offset mining declines. Even with a sharp rise in platinum prices, the supply side will take considerable time to deliver the metal.

Exchange-traded funds (ETFs) are often cited as a potential supply source to alleviate deficits, but we believe this assumption is flawed. The WPIC notes that ETF holders are not price-agnostic; they seek returns and are unlikely to sell unless prices rise significantly above their acquisition costs. Thus, ETFs are not a viable long-term solution to the supply crunch.

With no major new mines on the horizon and recycling growth stunted, the platinum market faces a supply ceiling that amplifies the impact of growing demand.

Surging Demand: A Multi-Sector Renaissance

With supply stagnant, demand for platinum is experiencing a resurgence across multiple sectors, further tightening the market. According to the WPIC, robust growth in automotive, jewelry, industrial and investment demand is contributing to the structural deficit.

- Automotive Demand: Platinum’s role in catalytic converters for internal combustion engines remains critical, especially as the adoption of electric vehicles (EVs) faces headwinds. WPIC projects automotive demand to reach an eight-year high of 3,245,000 ounces in 2025, a 2% increase from 2024, despite market uncertainties. Recent policy shifts, such as U.S. President Donald Trump’s rollback of environmental commitments and “green” incentives, are expected to slow the adoption of battery electric vehicles (BEVs), boosting the demand for platinum in traditional ICE (internal combustion engine) vehicles. WPIC estimates that each 1% reduction in BEV market share increases platinum group metal (PGM) demand by 25,000 ounces annually.

- Jewelry Demand: The jewelry sector is witnessing a renaissance, particularly in China, where platinum demand surged 300% year-over-year in Q1 2025. Globally, jewelry demand is forecast to grow by 5% in 2024 and 2% in 2025, driven by strong fabrication in India and platinum’s enduring appeal as a symbol of love and strength. Platinum’s rarity and durability make it a premier choice for high-end jewelry, and cultural shifts in key markets are amplifying its allure.

- Industrial Demand: While industrial demand is expected to decline 9% in 2025 to 2,216,000 ounces due to tapering capacity expansions, it remains above the 10-year average, reflecting platinum’s critical role in applications like hydrogen fuel cells and chemical manufacturing. Platinum’s use in green technologies, such as hydrogen production, positions it as a cornerstone of the energy transition, ensuring sustained industrial demand even in a slower-growth environment.

- Investment Demand: Perhaps the most striking development is the 300% surge in investment demand highlighted by WPIC, driven by strong Chinese bar and coin demand and a doubling of speculative net long positions. Investment demand is forecast at 688,000 ounces in 2025, marking the third consecutive year of net positive investment. This shift reflects growing investor recognition of platinum’s undervaluation, especially as prices break a 15-year downtrend and speculative interest pivots from short to long positions.

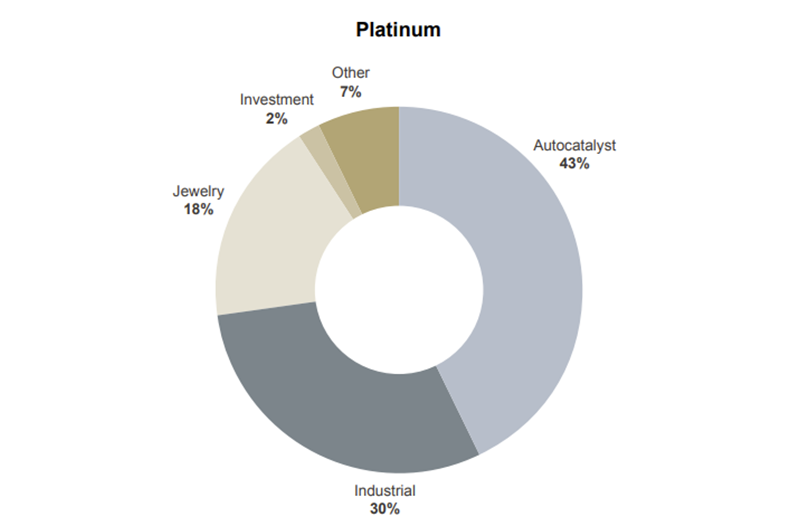

Figure 3. Platinum Uses

The primary driver of demand for platinum is the automotive industry. Platinum is a key element in manufacturing catalytic converters, which help reduce toxic emissions from automotive exhaust. Rising car production (especially in emerging economies) and tightening emissions standards worldwide have fueled steady growth in the use of catalytic converters.

Source: PGM Market Report May 2024. May not add up to 100% due to rounding.

The Price Catalyst: Why Platinum Is Poised to Move

From 2016 to 2021, palladium enjoyed a strong run from just under $600 per ounce to over $3,100, catalyzed by factors we highlighted above. While we are not sticking our necks out for a similar move in platinum over a similar time frame, we would like to point out that recent market activity is reflecting optimism and momentum for platinum, with prices reaching $1,100 in May 2025, which we see as a significant climb from recent lows.

Platinum is showing fresh signs of strength and momentum.

Platinum has been overlooked for far too long. Amidst widespread inflation, finding something priced similarly to two decades ago is remarkably rare. Yet this is the current situation with platinum. What has shifted over time is the cost of mining the metal, which ties into the challenges of initiating new production. Although we are bullish in our outlook on the platinum market in 2025, we expect markets to be volatile given the fluctuating tariffs and trade policies in the U.S. and the consequent impact this may have on the global economy.

Finally, above-ground stocks are near historic lows, and deficits continue to erode inventories. The confluence of structural deficits, constrained supply and robust demand has created a perfect storm for platinum prices. We believe the platinum market is approaching a tipping point where supply scarcity could trigger a sharp repricing.

Figure 4. Platinum Prices vs. Gold and Palladium (2006-2025)

Source: Bloomberg. Data as of 5/28/2025. Platinum is measured by the XPT Curncy (USD) index. Palladium is measured by the XPD Curncy (USD) index. Gold is measured by the GOLDS Comdty (USD) Index. Past performance is no guarantee of future results.

Footnotes

| 1 | World Platinum Investment Council’s (WPIC) Platinum Quarterly Q1 2025 Report. |

| 2 | “Koz” refers to 1,000 troy ounces. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.