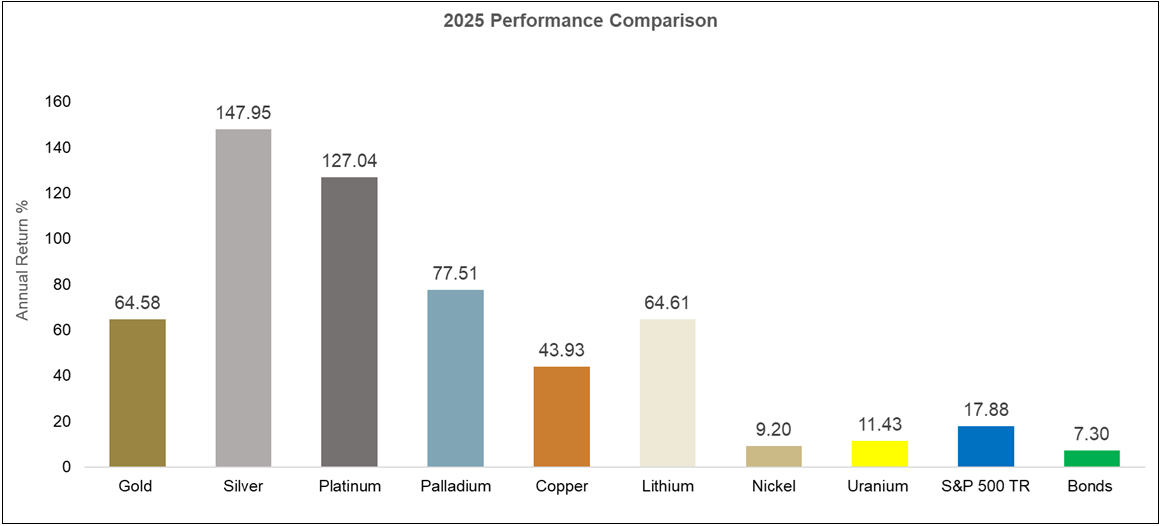

Metals delivered standout performance in 2025, led by exceptional gains across the precious metals complex. Gold surged 64.58%, reaffirming its role as a core portfolio diversifier, while silver soared 147.95% and platinum climbed 127.04%, dramatically outperforming traditional asset classes. Palladium added to the strength with a 77.51% gain, underscoring broad-based momentum across precious metals.

Sources: Gold is measured by the Gold Spot Price; Silver is measured by the Silver Spot Price; Platinum is measured by the Platinum Spot Price; Palladium is measured by the Palladium Spot Price; Copper is measured by the LME Copper Spot Price; Lithium is measured by the China Lithium Carbonate 99.5%; Nickel is measured by the LME Nickel Spot Price; the U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from TradeTech, UxC, S&P Platts and Numerco; the S&P 500 TR is measured by the S&P 500 Total Return Index; Bonds are measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index).

Beyond the precious metals space, industrial and energy-transition metals posted solid results, with copper up 43.93% and lithium rising 64.61%. By comparison, the S&P 500 Total Return Index gained 17.88% and bonds returned 7.30%, highlighting how metals were among the most powerful return drivers of 2025.

This powerful performance was driven by a combination of persistent inflation pressures, rising geopolitical uncertainty and growing central bank demand for gold, which reinforced the appeal of hard assets as stores of value. At the same time, years of underinvestment in mining and tightening supply met accelerating demand from energy transition, electrification and infrastructure spending, creating a favorable backdrop for metals prices.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.