The energy transition is in full swing, and record investment1 is flowing into this emerging sector globally. While some miners of minerals critical to the clean energy transition, particularly those focused on copper, have seen considerable gains so far in 2024, lithium miners have significantly underperformed. However, the tides may be set to turn. What does this mean for the energy transition, and are there opportunities for investors?

Lithium in 2024: Facing Challenges

Lithium is a critical material essential to lithium-ion batteries, the dominant battery type used in electric vehicles (EVs). As EV proliferation intensifies, a lithium supply deficit may likely last through the upcoming decades.

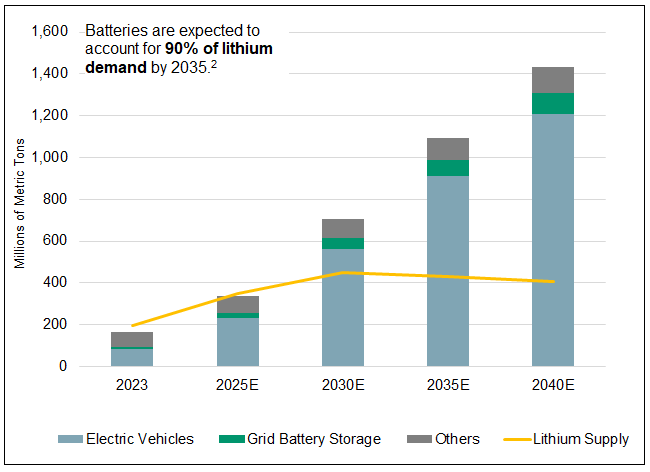

Figure 1. Lithium Supply Unlikely to Keep Up with Demand2

Source: “Global Critical Minerals Outlook 2024,” International Energy Agency (IEA), May 2024. Demand data shown for Net Zero Emissions Scenario. Supply is from existing and announced projects.

According to Benchmark Mineral Intelligence (BMI), the lithium supply shortage is forecasted to begin as soon as 2025. There are currently only 101 lithium mines in the world, and even as more mines and exploration projects come online, the added supply may likely not be able to keep up with demand. China alone is expected to drive a 20% yearly increase over the next decade.3 This is especially evident given that the current unsustainably low lithium prices have led to project curtailments and driven some miners to reduce capital expenditures and investments in future supply. We believe that the lithium price may have bottomed, and higher lithium prices may be necessary to incentivize the required future production.

Well-Supported Value Chain

The value of lithium is not limited to the mineral itself. Opportunities exist along the entire lithium supply chain, including exploration, mining, processing and compound manufacturing. Lithium miners and companies involved in the processing and refining of raw lithium may likely be poised to benefit as the demand for lithium grows. Recycling will also come into play as batteries begin to reach their end-of-life and recycled elements are reused for new batteries.

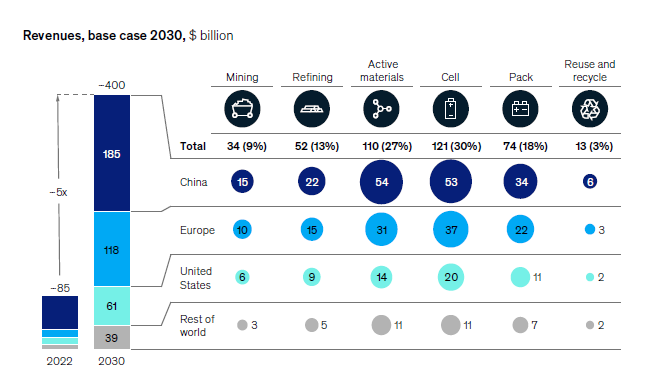

The lithium battery industry is projected to create $400 billion in annual revenue opportunities worldwide.4 The lithium production component of the chain has recorded margins as high as 65%, potentially making it a highly profitable sector.

Lithium miners, in particular, may be well positioned as they can give leverage to rebounding lithium prices. In contrast, non-vertically integrated lithium processing/refining companies may see their expenses rise.

Figure 2. McKinsey Model Estimates that Lithium-Ion Battery Value Chain May Provide Revenue Opportunities of >$400 Billion by 2030

Source: McKinsey & Company. Battery Insights, 2022.

Unprecedented Investment from Mining Companies and Auto Manufacturers

The growing demand for lithium is drawing unprecedented investment from the public and private sectors. In pursuit of future growth, specialized lithium miners are investing in their businesses and have a reinvestment ratio5 of about 60%, compared to 25% for diversified miners.6

Automakers are concerned about the availability of lithium, a mineral essential to their ability to manufacture EVs. In a move that harkens back to the days of Ford setting up rubber plantations to guarantee materials for tires, automakers are investing directly in the lithium mining space. As a result, Tesla, VW Group, General Motors, Stellantis, BMW and Mercedes-Benz are creating long-term offtake agreements with producers to buy lithium that will be mined in the future,6 while General Motors and Stellantis are investing directly in the equities of lithium mining companies.

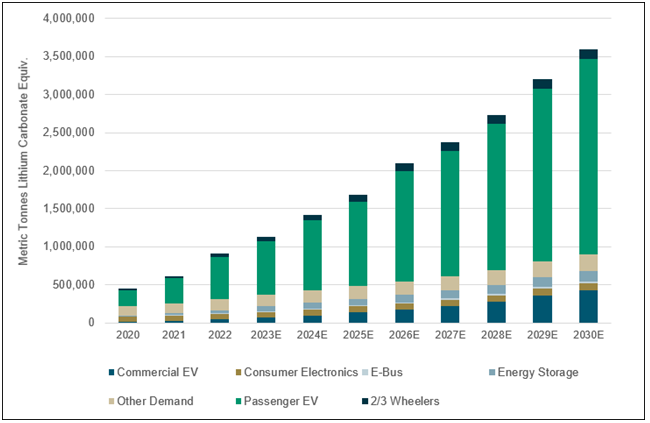

Figure 3. Demand for Lithium Is Expected to Grow More Than Sevenfold between 2020 and 2030

Source: BloombergNEF Transition Metals Outlook 2023.

Realizing lithium’s role in the energy transition, the U.S., Canada and the European Union have added lithium to their critical minerals lists. This designation makes it easier for companies to apply for grants and subsidies that support the lithium and EV industries.

Is There a Short-Term Opportunity?

There may be a short-term opportunity at hand. Despite the long-term investment outlook for lithium miners, many producers of this critical mineral have seen their stock prices drop considerably in 2024. Given the scale of this descent juxtaposed with the stark demand-supply imbalance in the upcoming years, lithium miners may be well positioned going forward. This means that investors who want to add an allocation to lithium miners to their portfolio may have an opportunity to do so at prices significantly lower than 2023.

Footnotes

| 1 | BloombergNEF Energy Transition Investment Trends. |

| 2 | “Global Critical Minerals Outlook 2024,” International Energy Agency (IEA), May 2024. Data shown for Net Zero Emissions Scenario. |

| 3 | CNBC. “A world lithium shortage could come as soon as 2025.” |

| 4 | McKinsey & Company. “Battery 2030: Resilient, sustainable and circular.” |

| 5 | The reinvestment ratio compares the cash inflows generated by a company to the cash outflows required for re-investing in the company. It measures how much of the company’s annual cash flow is being reinvested back into the business for future growth. |

| 6 | IEA Critical Minerals Market Review 2023 |

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the funds, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.