- View Critical Materials November 2023 Performance Table

-

For the latest standardized performance and holdings of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- Despite recent setbacks, the long-term path of the electric vehicle (EV) market may likely be upward. The U.S. crossed a critical threshold to mass adoption in 2023 with EVs representing over 5% of new car sales (source: International Energy Association).

- Lithium-ion batteries (LIBs) have entrenched their lead as the technology of choice for EVs because of their superior technical properties and decades of investment in development and infrastructure.

- The rise of LIBs in energy storage echoes the rise of photovoltaic (PV) panels in solar electricity. Both technologies have gained dominance due to their cost-effectiveness and rapid rate of technological improvement.

- Competing technologies like solid-state and sodium-ion batteries show promise, but we do not see an imminent threat to LIBs due to their technical and economic advantages.

- The Nasdaq Sprott Energy Transition Materials Index rebounded in November, driven mainly by higher uranium and copper prices.

November in Review

The Nasdaq Sprott Energy Transition Materials Index (NSETM) rebounded in November, increasing 4.31% to close the month at 910.84. Uranium miners continued to track the remarkable increase in uranium prices, while copper miners staged a rally on a snapback on copper prices. Lithium and nickel miners continued to drift lower as lithium carbonate prices fell sharply again, and nickel prices continued to decline.

For the EV market to go mainstream, two significant barriers must be overcome: the high cost of EVs and the presently inadequate charging infrastructure.

Violent macroeconomic reversals continued in November as the U.S. dollar and yields fell, sparking a risk-on rally and short covering on hedges. The equity market retraced the entirety of the previous three months of declines. The U.S. Federal Reserve (Fed) and the U.S. Treasury Department sent bullish signals to the market by discussing an end to rate hikes (and possible rate cuts), a lower Treasury quarterly refunding requirement, and a greater proportion of Treasury issuance skewed to the front end. The results were lower long-end yields (and a lower term premium) and a sharp decline in the U.S. dollar. These updates, and their coinciding with the geopolitical containment of the Israel-Hamas war, sent risk assets soaring as underexposed and over-hedged positions were reversed.

Figure 1. Nasdaq Sprott Energy Transition Materials Index: Consolidation Pattern Holds

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index (2018-2023). Data as of 12/1/2023. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Included for illustrative purposes only. Past performance is no guarantee of future results.

Updates on Critical Materials

Lithium: Prices Plunge but Miners Are Optimistic

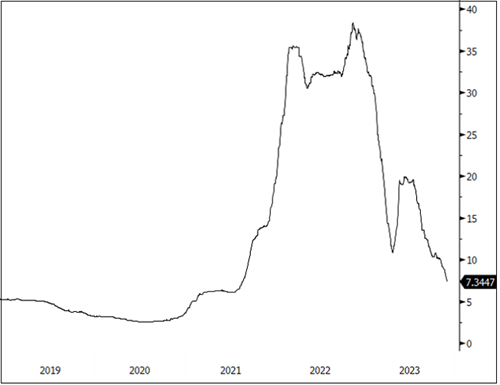

The lithium carbonate spot price continued its sharp descent in November, falling 27.57% for the month to close at $7.34 per pound (see Figure 2). Inventory destocking amid lower-than-expected EV sales has plagued the immature and volatile lithium market. The lithium carbonate spot price has fallen to levels not seen since the first half of 2021, near the beginning of its stupendous rally. (Notably, however, the November-end price of $7.34 per pound was still nearly three times the price in 2020.)

Despite the weakness in the spot price, lithium miners continue to show increased optimism. The lithium mining market segment declined only 1.15% over the month as miners ignored short-term price volatility and focused on lithium’s positive long-term demand fundamentals. Driving this home, lithium exploration budgets for 2023 were at an all-time high of $830 billion, a 77% increase from 2022.16 Only gold and copper had higher exploration budgets, and lithium beat out budgets in much larger markets such as nickel, silver, zinc and lead.

In the rapidly evolving landscape of renewable energy and EVs, LIBs have emerged as a keystone technology.

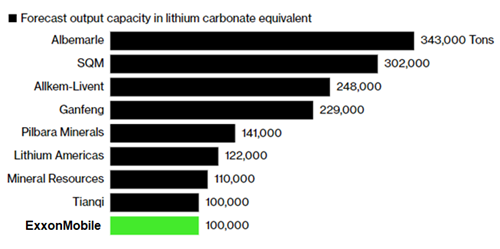

The miners were not the only lithium players to show confidence. In November, ExxonMobil — one of the world’s largest publicly traded international oil and gas companies — announced it will aim to become a leading supplier of lithium by 2030.17 ExxonMobil has significant capital to devote toward lithium production, plus a market capitalization greater than all current lithium miners combined. Bloomberg estimates that ExxonMobil’s planned lithium production would make it one of the top 10 producers globally (see Figure 3).18

Much more lithium exploration and development will be needed to meet the EV rollout, as discussed in this report. After its decline, the lithium carbonate spot price is now at a level that threatens some higher-cost projects under development and higher-cost low-grade lithium supply from China. Going forward, we believe a higher lithium price may be needed to incentivize needed supply, and weak current prices may continue to fuel mergers and acquisitions (M&A).

Figure 2. Lithium Price Falls Again in November

Source: Bloomberg. Lithium carbonate spot price, $/lb, 2018-2023. Data as of 12/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 3. ExxonMobil Shows its Lithium Ambitions

Source: Company presentations. Note: The ExxonMobil forecast is for 2030, and others are for 2027. The ranking assumes the Allkem-Livent merger goes through.

Copper: Market Rallies on Better Macro Outlook

The copper spot price rose 4.47% to $3.80 per pound in November (see Figure 4), and shares of copper miners rose 5.27%. November’s falling inflation data helped set market expectations that the Fed may not only be finished with its rate hikes but may actually cut rates, leading to greater economic demand for copper. Further, lower contracted copper treatment charges (which suggest supply is struggling to meet smelter demand), a spike in the premium of the Chinese copper price to exchange prices, and declines in already low exchange copper inventories all supported the copper price in November.

The copper market is mature, yet supply has been rife with disruptions. Latin America is the world’s largest copper-producing region, and countries like Chile and Peru are struggling to maintain production levels. In November, the market was hit by the closing of a large mine in Panama that had produced about 1.5% of the world’s copper supply. Despite this, Latin America still leads copper’s exploration budget in 2023. Globally, copper budgets increased by the most since 2013. Notably, these budgets are led by the largest major miners investing in late-stage projects.19 These large miners have made copper a strategic priority and have also been active in M&A activity, a trend we believe will continue into 2024.

Figure 4. Economic Fundamentals Lift Copper Price

Source: Bloomberg. Copper spot price, $/lb, 2018-2023. Data as of 12/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Nickel: EV Softness Weighs on Market

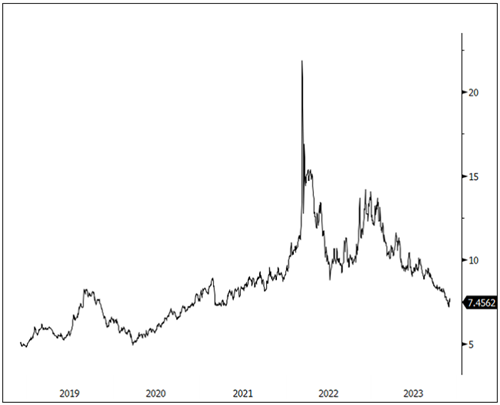

The nickel spot price fell 8.18% in November (see Figure 5) to $7.46 per pound, dropping during the month to its lowest level since 2020. Shares of nickel miners fell 0.17%. As with lithium, softness in demand for EVs has weighed on the nickel spot price and squeezed producers' margins.

Another factor weighing on the nickel market is the rising supply from Indonesia, the world's largest nickel producer with 48% of global production.20 Indonesia was historically a producer of Class 2 nickel (which is unsuitable for batteries) but is increasingly using a processing method first announced in 2021 that turns this into battery-grade nickel. The U.S. and Indonesian presidents met in November, sparking investor concerns about a possible free trade agreement between the two countries. The U.S. Inflation Reduction Act (IRA) provides a $7,500 tax credit for EVs that meet specific sourcing criteria, including that “the applicable percentage of the value of the critical minerals contained in the battery must be extracted or processed in the United States or a country with which the United States has a free trade agreement”.21 A free trade agreement between the U.S. and Indonesia would give Indonesian nickel IRA compliance and provide additional supply to the U.S. market.

Expectations for EV demand are still sufficient to put the Class 1 nickel market into deficit before the end of the decade and have original equipment manufacturers concerned about the security of supply. To that end, Ford Motor Co. has said it will directly invest in a battery-grade nickel plant now under construction in Indonesia alongside PT Vale Indonesia and China’s Zhejiang Huayou Cobalt Co., with a projected total investment between the three companies of $4.5 billion.22

Figure 5. Nickel Tests 2020 Lows

Source: Bloomberg. Nickel spot price, $/lb. 2018-2023. Data as of 12/1/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Despite Disruptions, the Long-Term Trajectory for EVs is Positive

The electric vehicle market is going through a challenging time. Automakers have recently revised expectations downward as they grapple with lower consumer demand, financial constraints and infrastructure-related hurdles. However, this does not mean that the transition to EVs is failing. Instead, we believe it is a typical pattern in the early adoption phase of a new technology as it advances and falls back while battling for market share and being affected by the business cycle.

Economic pressures like rising interest rates, high vehicle prices and concerns over charging infrastructure have contributed to the slowing pace of EVs. Significant automakers like General Motors, Ford and Honda have said they will reduce or delay EV projects; however, the industry's commitment to electrification remains strong. Developed-world automakers may have pared back forecasts, but EV sales trends in China continue to be strong, and the country is expected to export 1.8 million EVs in 2023, up 70% from 2022. Significant investments are still being announced: Toyota, for example, is investing heavily in battery production to bolster its EV offerings.23

Sales figures offer a more realistic view. EV sales in the U.S. have surged, outperforming all other auto market segments, and were up 50% year-over-year in the third quarter of 2023 (although this growth was down from 2022's record level). Cox Automotive expects EVs to account for 8% to 9% of total U.S. auto sales in 2023, with certain brands like BMW, Audi and Mercedes projected to surpass these percentages.24

For the EV market to go mainstream, however, two significant barriers must be overcome: the high cost of EVs and the presently inadequate charging infrastructure. While EV prices have gradually decreased, they remain out of reach of many consumers. The number of public charging ports is growing but remains insufficient for the expected rise in EV proliferation by 2030. (For historical context, a similar concern existed in the early days of the automobile industry as cars were expensive and their reliability was questionable. Long-distance travel by car was also a novelty, given the lack of infrastructure we take for granted today, such as roads, refueling stations, repair shops, motels and roadside diners.)

There are several promising developments to meet these EV challenges. A federal program is underway to install high-speed chargers alongside major highways, with a collaborative effort by several automakers to establish 30,000 fast chargers by 2024. Additionally, the industry is moving to standardize the charging experience. For example, Tesla is opening some of its Supercharger network to other EV brands.

Concerns from automotive executives and analysts primarily reflect falling product prices and market share battles, but these are what are likely to drive faster penetration rates. The U.S. crossed a critical threshold in the first nine months of 2023 as EVs now represent over 5% of new car sales, indicating a significant shift toward mass adoption. The road ahead may be unpredictable, but the journey toward an electrified automotive future is underway.

Lithium-Ion Batteries May Likely Remain Keystone Technology for EVs

The EV market, which is estimated to reach a valuation of approximately $1 trillion by 2030,25 owes much of its growth to advancements in lithium-ion battery (LIB) technology.

In the rapidly evolving landscape of renewable energy and EVs, LIBs have emerged as a keystone technology. These batteries — known for their superior energy density, cost-effectiveness and enhanced safety — are propelling the transportation sector toward electrification at an unprecedented pace. As the backbone of EVs, LIBs enable longer ranges and support rapid technological innovations in vehicle design.

Beyond vehicles, LIBs are revolutionizing energy storage. The demand for robust storage solutions escalates as the world shifts toward renewable sources like wind and solar. LIBs are at the forefront, enabling efficient energy storage at building and grid scale. These large-scale batteries are critical in managing the intermittency issues inherent in renewable energy sources, and the market for them is projected to keep growing at about 30% annually.

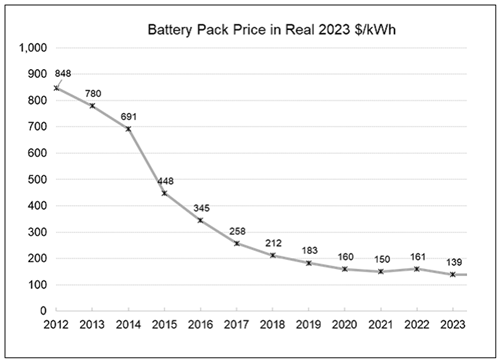

Interesting Parallel with Photovoltaic (PV) Solar Panels

The continuous innovation and falling prices in LIBs echo the early days of personal computing, mobile technology and, in particular, solar panel electricity. LIB prices have fallen by about 80% over the past decade (see Figure 6), as their use has expanded beyond cars to trucks, buses, data centers and the electrical grid. This not only makes them more accessible but also opens doors to new markets and applications.

The rise of LIBs in energy storage echoes the rise of PV (photovoltaic) panels in solar electricity. Both technologies have gained dominance mainly due to their cost-effectiveness and rapid rate of technological improvement. Both technologies have faced challenges — like scarcity of constituent materials and safety concerns for LIBs as well as environmental and efficiency issues for solar PVs — but these issues have not significantly hindered their growth.

While LIBs compete with other battery chemistries and energy storage technologies, their early market penetration may prove a significant advantage. It is likely that LIBs are on their way to becoming as entrenched in energy storage as PV panels are in solar electricity.

Figure 6. LIB Costs Keep Falling

Source: Bloomberg NEF. Data as of 9/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

What About Alternative Battery Technologies?

Any battery technology competing with lithium-ion would need to be markedly superior to gain a foothold and have a payback projection that exceeds the cost and time required to convert. The two most promising alternatives are solid-state batteries and sodium-ion batteries. Other emerging technologies include lithium-sulfur and lithium-air batteries. Notably, three out of these four rely on lithium-based chemistry.

Solid-State Batteries

Solid-state batteries currently appear to be the front-runner in the race to challenge LIBs. As the name suggests, solid-state batteries use a solid electrolyte instead of the liquid or gel electrolytes in traditional LIBs. However, lithium remains a crucial component in many solid-state battery designs, particularly in the electrodes.

The primary innovation in solid-state batteries is replacing the liquid electrolyte with a solid one, which can be made from various materials like ceramics, glass or solid polymers. This solid electrolyte still facilitates the movement of lithium ions between the anode and cathode during charging and discharging, similar to LIBs. Using a solid electrolyte improves battery safety (as it reduces the risk of leaks and fires) and potentially increases energy density. However, the fundamental lithium-ion chemistry is central to how these batteries store and release energy.

Sodium-Ion Batteries

Sodium-ion batteries use sodium ions as the charge carriers instead of lithium ions. These batteries offer a promising alternative to LIBs, with advantages in cost, abundance and potential environmental impact. However, they currently face significant challenges in energy density (size and weight), which is the most important issue for EVs.

Figure 7. How Three Battery Technologies Stack Up

| Technical Factors | Description | Lithium-Ion | Solid-State | Sodium-Ion |

|---|---|---|---|---|

| Energy Density | Amount of energy stored per unit of weight | Very high | Potentially higher | Lower than lithium-ion |

| Lifespan | Number of charge-discharge cycles without significant capacity loss | Long | Expected to be long | Moderate |

| Self-Discharge | Rate of charge loss when not in use | Low | Low | Low |

| Memory Effect | Ability to recharge without losing maximum energy capacity | No | No | No |

| Charging Rate | Speed of recharging the battery | Fast | Potentially fast | Moderate |

| Electrical and Thermal Stability | Performance under various conditions for safety and reliability | Good | Potentially very good | Good |

| Industry Factors | Description | Lithium-Ion | Solid-State | Sodium-Ion |

|---|---|---|---|---|

| Scalability and Versatility | Ability to adapt to different sizes and applications | Highly Scalable | Scalable (in development) | Scalable |

| Costs | Trends in pricing and affordability over time | Decreasing | Currently high | Decreasing but higher than lithium-ion |

| Technological Advancements and Investment | Progress in research, development and investment | Significant | Growing | Moderate |

| Environmental Considerations | Impact on the environment and sustainability | Moderately favorable | Potentially more favorable | Favorable |

| Market Momentum and Infrastructure | Establishment in the industry and related infrastructure | Well-established | Developing | Emerging |

Source: Sprott Asset Management, as of 11/30/2023.

The Advantages of LIBs

While there is interest in exploring alternative battery technologies for EVs, we do not believe there is an imminent threat to LIBs due to their technical and economic advantages. LIBs’ advantages include:

- Established Infrastructure: Mature manufacturing base and supply chain that creates a high barrier to entry for any competing technology.

- Proven Reliability: Strong track record in various applications and particularly in EVs, offering a good balance of energy density, power density and lifespan that newer technologies would need to match or exceed.

- Energy Density: Higher energy density than alternatives, which is crucial for EV range and consumer acceptance.

- Cost-Efficiency: A consistent decline in price over time, and economic viability, compared to emerging technologies, which would face high hurdle costs.

- Recycling and Sustainability: Advances in recycling processes that are addressing environmental concerns, which is a challenge not yet met by newer technologies.

- Market Acceptance: Widely accepted and trusted by automobile manufacturers and consumers.

Critical Materials: November 30, 2023 Performance

| Metric | 11/30/2023 | 10/31/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 910.84 | 873.22 | 37.62 | 4.31% | (2.47)% |

The violent macro reversals continued in November as most resource commodity assets rallied on the lower U.S. dollar and lower yields. Consensus has given way to a soft-landing scenario and the end of the Fed's rate-hike cycle. Although China continues to show softness, recent weak data from China is decelerating. |

| Nasdaq Sprott Lithium Miners™ Index2 | 655.45 | 663.11 | (7.65) | (1.15)% | (28.93)% | |

| North Shore Global Uranium Mining Index3 | 3,743.29 | 3,515.70 | 227.59 | 6.47% | 54.24% | |

| Solactive Global Copper Miners Index4 | 129.08 | 122.63 | 6.46 | 5.27% | (0.93)% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 673.49 | 674.65 | (1.15) | (0.17)% | (25.99)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 855.47 | 815.81 | 39.67 | 4.86% | (0.34)% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 1,464.19 | 1,362.74 | 101.45 | (7.44)% | 42.66% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 7.34 | 10.14 | (2.79) | (27.57)% | (78.51)% | Lithium fell to H1 2021 levels. Uranium hit $80 for first time in 80 years. Copper bounced on macro reversal. Nickel fell back to 2020 levels. |

| U3O8 Uranium Spot Price $/lb9 | 80.73 | 74.48 | 6.25 | 8.39% | 67.10% | |

| LME Copper Spot Price $/lb10 | 3.80 | 3.64 | 0.16 | 4.47% | 0.27% | |

| LME Nickel Spot Price $/lb11 | 7.46 | 8.12 | (0.66) | (8.18)% | (45.00)% | |

| Benchmarks | ||||||

| S&P 500 Index12 | 4,567.80 | 4,193.80 | 374.00 | 8.92% | 18.97% |

Dovish signals from the U.S. Fed and Treasury and the containment of risk from the Israel-Hamas war catalyzed a dramatic fall in long-end yields and the U.S. dollar, resulting in a marked risk-on rally. |

| DXY US Dollar Index13 | 103.50 | 106.66 | (3.17) | (2.97)% | (0.02)% | |

| BBG Commodity Index14 | 101.81 | 104.62 | (2.81) | (2.69)% | (9.75)% | |

| S&P Metals & Mining Select Industry Index15 | 2,797.94 | 2,532.85 | 265.09 | 10.47% | 9.66% | |

Source: Bloomberg and Sprott Asset Management LP. Data as of 11/30/2023. Past performance is no guarantee of future results. Included for illustrative purposes only. You cannot invest directly in an index.

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | International Energy Agency. “World Energy Outlook 2023” |

| 17 | Exxon news release. November 13, 2023. “ExxonMobil drilling first lithium well in Arkansas, aims to be a leading supplier for electric vehicles by 2030.” |

| 18 | Bloomberg. November 13, 2003. “Exxon Aims to Produce Lithium in Rare Foray From Fossil Fuel.” |

| 19 | Metals and Mining Metals |

| 20 | U.S. Geological Survey, Mineral Commodity Summaries, January 2023. Nickel. |

| 21 | U.S. Treasury Department press release. March 31, 2023. “Treasury Releases Proposed Guidance on New Clean Vehicle Credit to Lower Costs for Consumers, Build U.S. Industrial Base, Strengthen Supply Chains.” |

| 22 | Yahoo! Finance. December 4, 2023. “Ford Takes Stake in Indonesia Nickel Project.” |

| 23 | AXIOS Raleigh. October 31, 2023. “Toyota's North Carolina battery plant is getting even bigger.” |

| 24 | Cox Automotive. October 12, 2023. “Another Quarter, Another Record: EV Sales in the U.S. Surpass 300,000 in Q3, as Tesla Share of EV Segment Tumbles to 50%.” |

| 25 | Source: BloombergNEF Data and Research as of 9/30/2023. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.