Key Takeaways

- Lithium Market Turns Bullish:1 Prices are rising again in 2025 as EV demand, inventory drawdowns and tighter regulations, especially in China, strengthen the market.

- Lithium’s Use Cases Expand: Data centers are rapidly adopting lithium-ion batteries for higher efficiency and reliability.

- Strategic Investments Are Reshaping Supply Security: The U.S., Europe and major energy companies are making significant long-term moves to secure lithium supply and reduce their reliance on China.

- Geopolitics Are Tightening the Lithium Chain: Concentrated production and China’s dominance elevate geopolitical risk, while mine shutdowns and reshoring efforts are shifting supply dynamics.

Lithium Prices Rebound

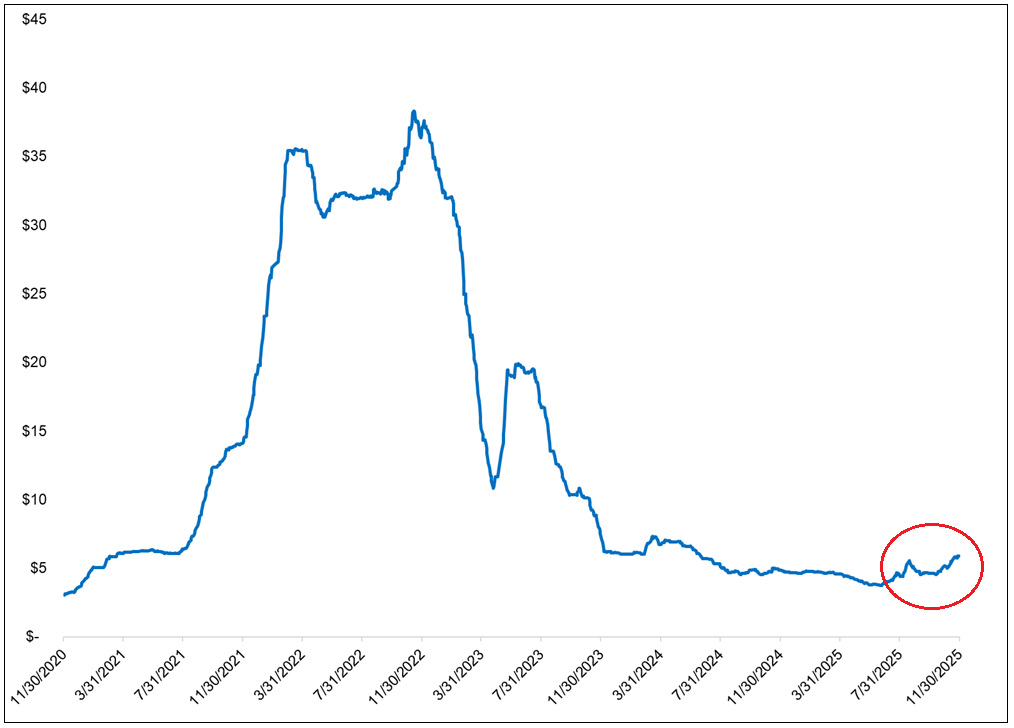

Lithium sentiment has shifted bullish in 2025 as strengthening demand expectations outside the U.S. could prompt a market surplus to turn into a deficit years sooner than previously anticipated. The space has remained volatile, with lithium prices skyrocketing until they peaked in November 2022, followed by a prolonged and steep decline that lasted until the market found its footing again in June 2025. As of November 30, 2025, lithium carbonate has gained 25.73% year-to-date.

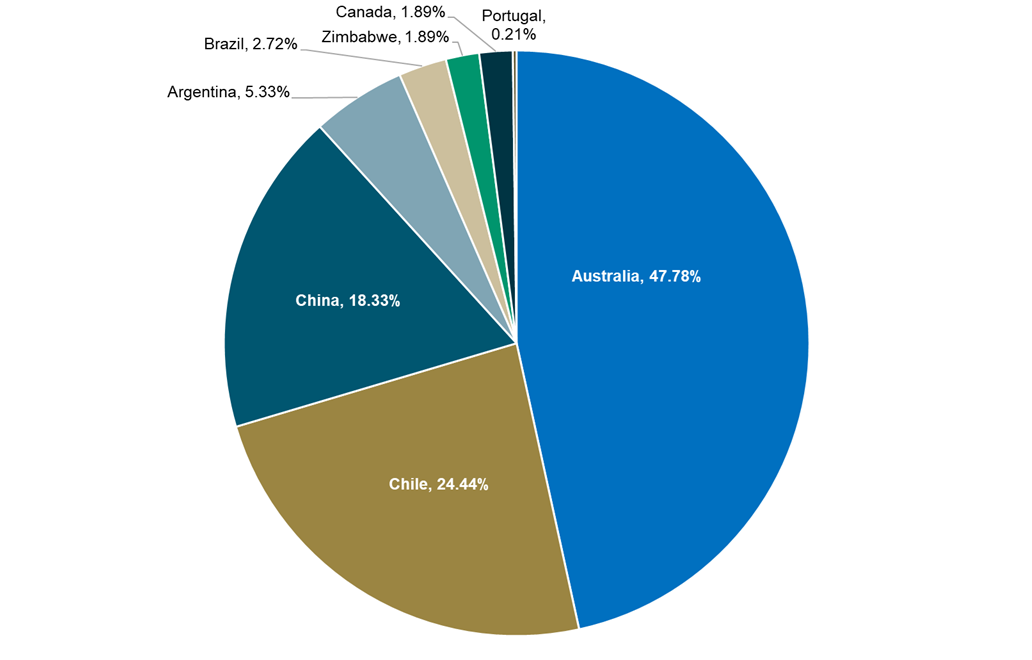

This rebound is being driven by robust demand growth and ongoing inventory reduction, alongside regulatory tightening, including the shutdown of a major Chinese lithium mine by Contemporary Amperex Technology Co. Ltd. (CATL) and new government measures aimed at preventing producers from selling lithium at unsustainably low prices. The increased recognition of lithium as a critical mineral, combined with Western concerns over China’s control of global supply chains, is bolstering the sector outside of China. These combined forces are reshaping the global lithium landscape and providing support to prices. As shown in Figure 1, Australia, Chile and China are the three largest lithium producers by volume.

Figure 1. Just a Few Countries Supply the World’s Lithium

Global Share of Lithium Production by Country

Source: USGS, Mineral Commodity Summaries (2024).

Lithium’s primary use is in lithium-ion batteries, the dominant technology for electric vehicles (EVs), consumer electronics and grid energy storage. Each EV battery, on average, can hold up to 10 kilograms of lithium and remain the primary driver of global battery demand, accounting for over 85% of usage.2 With the demand from EVs and grid battery storage expected to account for 91% of lithium use by 2035,3, lithium demand is expected to rise substantially.

As supply adjustments take hold and global EV demand remains relatively strong, our outlook on lithium remains positive. We believe price stabilization, industry consolidation and continued government stimulus measures in China should support long-term growth prospects even as shifting U.S. policies create uncertainty.

Figure 2. Lithium Demand is on the Rise*

* "Global Critical Minerals Outlook 2025," International Energy Agency (IEA), May 2025. S&P Global Market Intelligence, October 2025.

Lithium’s Emerging Role in Data Centers

Lithium-ion batteries are becoming increasingly vital for use in rapidly growing data centers. They have a longer lifespan, higher energy density and faster recharge and discharge cycles than other batteries. Given that the electricity demand of global data centers is projected to rise 2.5 times by 2030, there is significant room for growth.

Google is using over 100 million lithium-ion cells in its data centers globally.4 The company touts that these data centers take up half the space while holding twice the power and twice the life. This trend is rippling throughout the tech industry, and we believe it will continue as battery energy storage systems are increasingly adopted to optimize the energy use of data centers.

Figure 3. Data Center Electricity Growth (2022-2030E)

Source: BloombergNEF, New Energy Outlook 2025.

Global Supply Race Spurs Lithium Momentum

A wave of long-term, strategic investments aimed at securing lithium supply is driving the market’s resurgence in 2025. These moves are reshaping the economics of lithium and strengthening confidence in the sector.

- North America: The U.S. has made its most decisive move in the lithium sector yet. In October 2025, the government announced a 5% stake in Lithium Americas and its Thacker Pass project, one of the world’s most prominent lithium mines. Despite recent political headwinds against electric vehicle (EV) adoption, this landmark investment underscores that the administration views lithium as a critical resource and is stepping up to support domestic mining. This commitment sends a powerful signal to markets and investors that lithium remains central to U.S. energy and security strategy.

- Oil Majors Pivot to Lithium: Chevron and Exxon Mobil are acquiring acreage in the Smackover Formation, a lithium-rich zone spanning Florida to Texas. Halliburton is also entering the sector with plans for a geothermal-powered mine in Texas, targeting 83,500 metric tons by 2029. The entry of oil majors marks a turning point for the industry, bringing deep capital resources and operational expertise that will likely accelerate project timelines and reinforce lithium’s growing prominence in global energy strategies.

- Europe: Germany granted Vulcan Energy Resources €104 million to advance domestic lithium output, reinforcing Europe’s commitment to supply security. This investment signals strong policy support for local production, which creates opportunities for miners with European exposure.

By securing future production, governments and corporations are mitigating geopolitical risk, enhancing cost visibility and laying the groundwork for sustained demand growth. For lithium miners, this translates into stronger pricing support, improved margins, and a more favorable investment climate.

The global supply strategy is fueling momentum and maturing the lithium industry, positioning it as an indispensable pillar of electrification for decades to come.

Figure 4. Lithium Prices Have Been Rising in 2025

Source: Bloomberg. Data as of 11/30/2025.

Tightening the Supply Chain and Ending Reliance on China

The International Energy Agency ranks lithium’s geopolitical risk at 3 out of 58, with 85% of global lithium production concentrated in three countries: Australia, Chile and China. With control over refining 60% of the world’s lithium, China’s threats to disrupt global supply chains for its own political interests clearly pose a threat to lithium accessibility. Recently, lithium stocks surged after Contemporary Amperex Technology Co. Ltd. (CATL) halted operations at a large mine in China, which sent prices upwards.5

In addition to funding plants to reduce reliance on China, governments are developing new facilities for lithium-ion battery manufacturing. In 2019, the U.S. had only two battery gigafactories, with two more planned. In 2025, the U.S. has 34 factories either planned, under construction or operational, which represents a massive increase and commitment.6

Automakers and battery producers have committed nearly $112 billion to ramping up domestic cell and module manufacturing. If all planned factories hit full capacity, they could collectively deliver up to 1,200 gigawatt-hours of annual output by 2030. That’s enough energy to power approximately 18 million electric vehicles, based on Tesla’s estimate that 100 GWh supports around 1.5 million EVs.7 Over 20 million electric vehicles (EVs) are expected to be sold globally in 2025, representing about 25% of all new cars sold. This is a dramatic increase from less than 5% just a few years ago.8 The global EV market continues to grow, with sales expected to increase 27% globally in 2025.

Lithium’s Strategic Future

Lithium’s resurgence in 2025 reflects a sector that is maturing while building a stronger foundation for long-term growth. Prices have recovered from the lows but remain compressed into the cost curve, supported by structural drivers such as reshoring, accelerating EV adoption, and rising demand from data centers. Strategic investments by governments and energy majors are reinforcing supply security and signaling lithium’s critical role in global electrification.

While the extreme peaks of late 2022 are unlikely to return, the price history of the past five years illustrates how periods of imbalance can create significant volatility in either direction. With prices recovering, fundamentals strengthening, and inventories normalizing, the market appears to have entered a better position.

Lithium’s positive momentum marks the beginning of a new chapter, shaped by strategic investment and innovation, ensuring its central role in powering progress across various sectors, including electric vehicles, defense and data centers, for decades to come.

Figure 5. Data Center Growth is Providing Support for Lithium Prices

Footnotes

| 1 | Bullish is the expectation that prices will continue to rise. |

| 2 | Source: Global EV Outlook 2025 Electric vehicle batteries. |

| 3 | Source: Global Critical Minerals Outlook 2025, International Energy Agency (IEA), May 2025. |

| 4 | Source: Google. “How we got to 100 million cells in our global Li-ion rack battery fleet.” February 25, 2025. |

| 5 | Source: CNBC. “Lithium stocks surge after Chinese mine suspends production.” August 11, 2025. |

| 6 | Source: TechCrunch. “Tracking the EV battery factory construction boom across North America.” February 6, 2025. |

| 7 | Source: Tesla. “Continuing our investment in Nevada.” January 24, 2023. |

| 8 | Source: IEA. “Global EV Outlook 2025.” |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.