Key Takeaways

- Market Pressure and Stabilization: The uranium spot price slipped 0.83% in March due to policy and geopolitical uncertainty but stabilized around $65/lb in early April.

- Structural Bullish Case: Despite market pressures, uranium's term price remains stable at $80/lb and global supply is constrained below demand levels.

- Uncorrelated Nature: Uranium remained resilient amid broader market volatility, highlighting its uncorrelated nature and inelastic demand.

- Long-Term Outlook: Uranium and uranium equities have outperformed broader commodity benchmarks and global equity markets over the past five years, reflecting a structural supply deficit and growing global policy support.

Performance as of March 31, 2025

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

-0.83% | -12.22% | -12.22% | -27.12% | 3.53% | 18.58% |

|

Uranium Mining Equities |

-6.81% | -19.33% | -19.33% | -31.65% | -5.28% | 31.74% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 |

-8.59% | -22.07% | -22.07% | -39.75% | -13.38% | 33.69% |

|

Broad Commodities (BCOM Index) 4 |

3.55% | 7.74% | 7.74% | 6.95% | -5.07% | 11.45% |

|

U.S. Equities (S&P 500 TR Index) 5 |

-5.63% | -4.27% | -4.27% | 8.25% | 9.06% | 18.58% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 3/31/2025. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Performance Overview: Holding Firm Amid the Selloff

Uranium markets continued to face pressure in March, but a shift toward greater clarity in early April may be the turning point utilities and long-term investors have been waiting for.

The uranium spot price slipped 0.83% in March, with uranium miners down 6.81% and junior uranium miners falling 8.59%, as buyers across the market remained on the sidelines. The pullback was driven not by weakening fundamentals but by a standstill in utility contracting, as nuclear fuel buyers waited for clarity around U.S. tariff policy, trade restrictions on Russian enriched uranium, and the future of government funding support through the Inflation Reduction Act (IRA) and the Department of Energy’s Loan Programs Office (LPO). Some clarity finally emerged in early April, and the spot uranium price appeared to stabilize around the $65/lb level.

As broader markets cracked, uranium held firm — quietly proving its strength in the face of volatility.

Under the surface, uranium’s structural bullish case is still intact. Term prices remain at $80/lb, major producers have shown pricing discipline, and global uranium production remains constrained well below current demand levels. The disconnect between sentiment and fundamentals is growing, and in our view, it’s approaching a breaking point.

In a market increasingly gripped by macroeconomic volatility and rising correlation across asset classes, uranium is quietly distinguishing itself, holding firm where others have cracked.

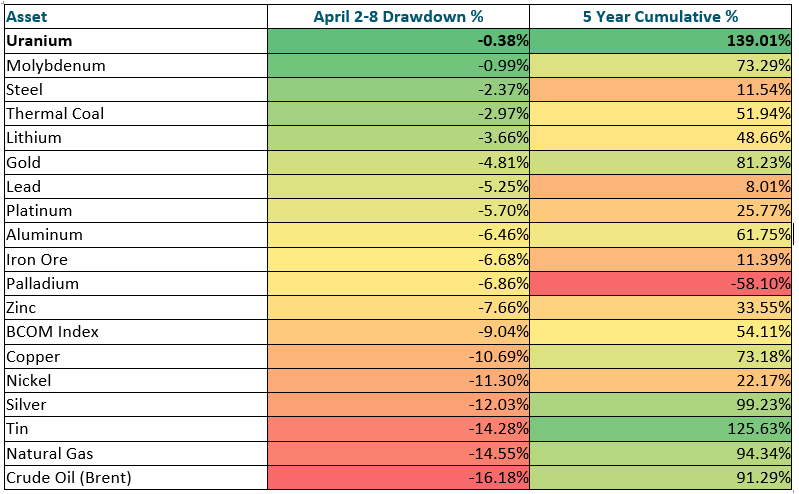

In early April, uranium remained independent from broader risk assets. Uranium held firm while the equity markets fell considerably, traditional hedges like bonds and the U.S. dollar moved in lockstep with equities, and volatility surged across financial markets. The reciprocal tariffs markets' reaction resembled crisis conditions, with rising correlations, margin calls and broad-based selling. Uranium, by contrast, remained stable, underscoring its uncorrelated nature and the inelastic demand that anchors its pricing (see Figure 1).

Figure 1. Uranium Leads Both April Stability and Long-Term Strength

Source: Data as of 4/08/2025 in USD. Uranium is the uranium spot price from TradeTech. Thermal coal is from S&P Capital IQ. All other assets are from Bloomberg.

Uranium equities, however, remain under pressure. Investor sentiment has diverged from fundamentals, with rising short interest6 reflecting broader macro jitters rather than uranium-specific weakness. Australian-listed names like Paladin and Boss Energy, two of the most shorted stocks on the Australian Securities Exchange (ASX), have been targeted amid softness in the spot price and derisking in small capitalization equities. However, this wave of short positioning appears misaligned with the underlying market, where term prices remain firm, and the supply deficit is ever-present. In our view, recent equity weakness is a sentiment story, not a structural one, and may set the stage for a sharp reversal when contracting resumes.

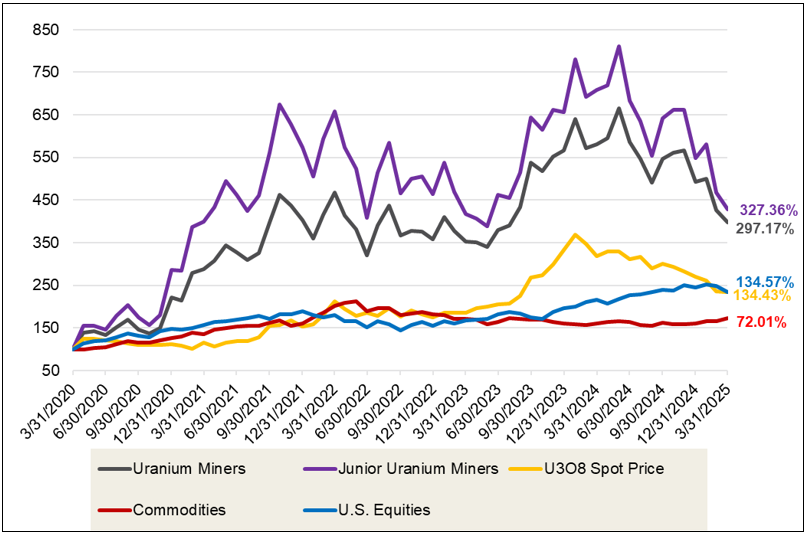

While uncertainty has weighed on short-term performance, uranium continues to stand apart in its resilience and long-term outlook. In fact, despite recent weakness, uranium and uranium equities have meaningfully outperformed both broader commodity benchmarks and global equity markets over the past five years. This durability reflects a structural supply deficit, inelastic demand, and growing global policy support. The next leg of the cycle may be defined by utilities finally returning to a market that never stopped tightening (see Figure 2).

Figure 2. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (2020-2025)

Source: Bloomberg and Sprott Asset Management. Data as of 03/31/2025. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); Junior Uranium Miners are measured by the Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJT™ Index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; and Commodities are measured by the Bloomberg Commodity Index (BCOM). Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Sprottlight: Uranium Market Misread

From Triple Digits to $65: Down, But Not Broken

After peaking at $107/lb in early February 2024, the uranium spot price has pulled back sharply, recently stabilizing near $65/lb. This drawdown has been unexpected and disappointing for many investors, particularly given that nothing material has changed in uranium’s long-term bull market thesis. In fact, several key indicators have continued to tighten.

In this sharp correction, questions have emerged over whether the uranium bull market is finished. We believe this is a misreading of market mechanics. The decline in spot price and equity performance is better explained by macro-driven sentiment headwinds, policy uncertainty, and technical selling rather than any erosion in the commodity’s core thesis.

Understanding this dynamic is critical. The pullback has felt like a shift in market direction, but it is not. We’ve experienced a pause in buying activity, not a reversal in the cycle. Many of the perceived headwinds are already easing or have been misinterpreted.

Sentiment Over Substance: What’s Been Driving the Pullback

With uranium’s long-term bull thesis intact, inaction and market noise have driven the recent softness in spot market pricing and equities. Several widely cited concerns have weighed on sentiment, but closer inspection shows they are either misinterpreted or resolving.

Utility Contracting Freeze

A significant driver of recent price weakness has been the pause in utility contracting activity. Rather than reacting to price levels or long-term supply concerns, Western fuel buyers have largely stepped back due to elevated policy and geopolitical uncertainty, particularly surrounding the ever evolving U.S. tariff landscape and global trade tensions.

Uranium's pullback may feel like a reversal — but we believe it is merely a pause in a still-intact uranium bull cycle.

That uncertainty is beginning to ease. Importantly, uranium was explicitly excluded from the U.S. reciprocal tariffs announced on April 2, providing clarity for utilities regarding procurement strategies.7 With uncovered requirements growing and spot prices stabilizing, a return to contracting appears increasingly likely as buyers regain confidence in the policy environment.

Misconceptions About a Russia Peace Deal

Some investors have speculated that a peace deal between Russia and Ukraine could unlock a wave of uranium supply. This misunderstands the nature of uranium flows: Russia is a net importer of U3O8, not a potential swing supplier. A resolution might ease tightness in enrichment and conversion markets, where Russia is a key player, but it would not materially increase the global availability of natural uranium. Conversely, improved access to enrichment services could draw utilities back to the natural uranium market, reinforcing demand, not softening it.

Technical Market Pressure

Uranium prices have also been pressured by technical market mechanics. The liquidation of ANU Energy, a Kazakhstan-based investment fund, released physical pounds into the market at a time of thin liquidity. Meanwhile, reduced activity from financial buyers and elevated short interest in uranium equities, particularly Australian-listed names like Paladin Energy Ltd. and Boss Energy Ltd., has added to the pressure on the sector. These factors represent short-term imbalances that tend to resolve as contracting resumes and broader market volatility stabilizes.

AI Demand Questions and Broader Volatility

Recent headlines, including Microsoft's announcement that it will scale back near-term data center leases, have raised concerns about whether AI-related demand for nuclear power could soften. However, AI remains a longer-term structural demand driver, not uranium's primary near-term growth engine.

Global nuclear fleet expansion continues to drive the bulk of uranium demand growth. These buildouts are largely driven by government policy and energy security objectives, making them resilient to fluctuations in private-sector tech investment cycles.

At the same time, data centers are still proliferating, and nuclear power remains one of the few scalable, non-intermittent power sources capable of meeting that demand. Any short-term delays in capital expenditures are unlikely to change the structural need for reliable baseload electricity.

Importantly, uranium has also remained largely insulated from broader financial market stress. Unlike other commodities, uranium is not heavily traded through derivatives or used as collateral, making it less prone to margin-call dynamics, algorithmic de-risking, or ETF-driven flow volatility.

What the Market Is Missing

Beneath the short-term volatility, the supply-demand picture continues to tighten, and forward-looking signals from utilities, governments, and the fuel cycle all point to renewed strength.

Structural Supply Deficit Is Deepening

Uranium remains in a multi-year structural supply deficit, a dynamic shaped by years of underinvestment during the last bear market. Supply growth has been slow to return, and production responses have been constrained even as prices have risen.

Uranium supply is constrained by setbacks, delays and a chronic need for consistent higher incentive pricing.

Restarts have faced setbacks, greenfield projects remain delayed, and developers like Deep Yellow have recently deferred investment decisions, citing the need for higher incentive pricing.8 Meanwhile, companies like Cameco and Kazatomprom continue to emphasize that any material production increases will be tied to sustained contracting, adding further friction to any potential supply response.

Even in Kazakhstan, a historically low-cost jurisdiction, the difficulty of sourcing sufficient sulfuric acid continues to limit the ability to ramp up production.9

Further, NexGen Energy’s flagship Rook I project has been pushed to a two-part hearing process, with final approval hearings now scheduled for early 2026, effectively delaying its startup timeline.10 This underscores how even the most advanced, high-profile uranium projects face significant permitting delays, further deepening the market’s supply imbalance.

Carry Trade Conditions Are Re-emerging

One of the more overlooked dynamics in the uranium market is the role of the carry trade, in which financial players purchase uranium at the spot price and sell it forward through long-term contracts or structured agreements. This strategy only becomes viable when the spread between spot and term prices is sufficiently wide to compensate for storage, financing, and timing risks.

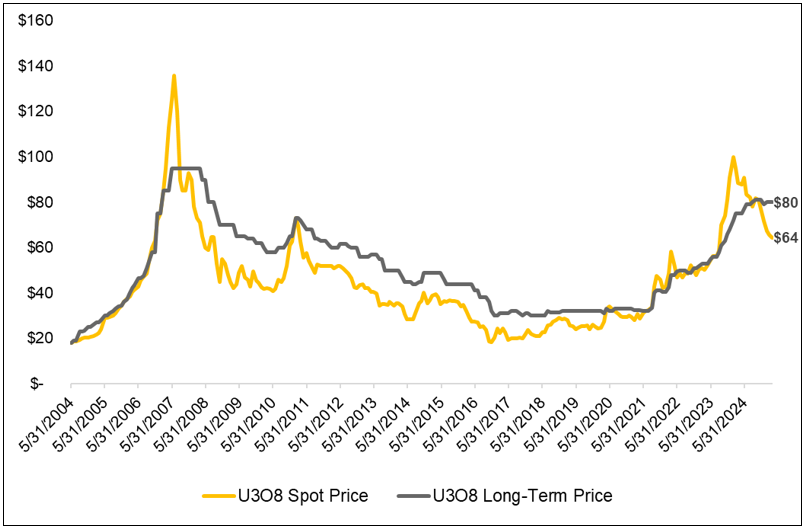

After recent volatility drove spot prices down, the math for the carry trade now appears attractive once again. With the spot price stabilizing around $65/lb and the term market holding above $80/lb (Figure 3), the arbitrage opportunity has re-opened. As volatility moderates and macro clarity improves, conditions are aligning for financial participants to return.

Historically, moments like this have drawn carry traders back into the market, tightening physical availability and supporting the spot price.

Figure 3. U308 Spot Price vs. Long-Term Contract Price (2004-2025)

Source: Bloomberg and UxC. Data as of 03/31/2025. U3O8 Spot Price is measured by the UxC Uranium U3O8 Spot Price (UXCPU308 UXCP Index), and U3O8 Long Term Price is measured by the UxC Uranium U3O8 Long-Term Price (UXCPULTM UXCP Index). You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Term Market Strength and Utility Outlooks

While short-term spot price weakness has captured attention, term market pricing remains strong and stable. Major producers have already committed the majority of their future production through long-term contracts, giving them stronger pricing power.

At the same time, the latest UxC survey shows that a growing majority of utilities expect spot uranium prices to rise, a notable departure from their typically negative stance on future prices.

With uncovered requirements rising and procurement timelines tightening, utilities appear poised to return to the market with greater urgency, especially now that tariff-related uncertainty is beginning to clear for this market.

Supportive Backdrop Endures

Despite recent volatility and investor hesitation, the uranium market remains one of the most structurally sound and fundamentally supported stories in the commodity complex. Supply remains constrained, long-term demand is accelerating, and policy tailwinds are increasingly aligned. While short-term price action has been noisy, the underlying thesis has only grown stronger. As contracting resumes and structural tightness reasserts itself, we believe uranium is well-positioned to resume its upward trajectory.

Looking Ahead: Resiliency, Clarity and Reacceleration

The uranium market enters the second quarter on more stable footing, with improving visibility across several key fronts. Tariff-related uncertainty, which kept utilities sidelined for months, has begun to clear.

In a world of rising risk and correlation, uranium remains resilient, uncorrelated and increasingly essential.

From a macro standpoint, uranium remains one of the few commodities largely insulated from traditional economic cycles. Demand for nuclear fuel is inelastic. The fears that have triggered volatility across equities, bonds, and commodities, namely, slowing global growth and resurgent inflation, have minimal bearing on uranium. There is no substitution, thrifting, or immediate response from demand, regardless of broader macro conditions.

This resiliency is one reason uranium remains an uncorrelated asset, both fundamentally and behaviorally. This quality stands out in a world of increasing correlation and policy risk.

At the same time, the long-term demand picture continues to strengthen. China shows no signs of slowing its buildout of new reactors. In the U.S., the Trump administration has reaffirmed its support for nuclear energy as a strategic priority. Large technology companies, such as Amazon, Google, and Meta, have joined the chorus, backing the expansion of tripling nuclear power by 2050 to meet growing baseload power needs.11

On the supply side, few new projects are moving forward, and the market continues to face material barriers to production expansion. Juniors like NexGen, Deep Yellow and Paladin have all announced delays, while Kazatomprom’s guidance leans toward the lower end amid ongoing input supply and cost constraints.

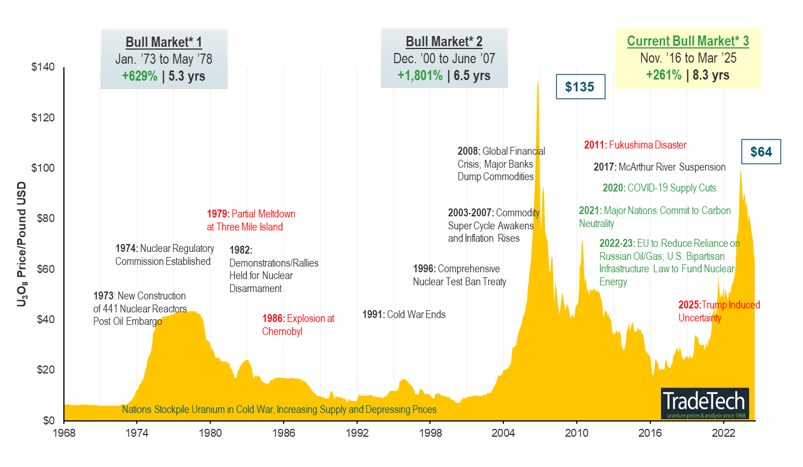

In our view, these conditions collectively support the next leg of the bull market. With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 4).

Figure 4. Uranium Bull Market Continues (1968-2025)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets when prices generally rise. A “bear market” refers to a condition of financial markets when prices are generally falling.

Source: TradeTech Data as of 3/31/2025. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from TradeTech, UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies involved in the uranium mining industry. These companies dedicate at least 50% of their assets to activities such as uranium mining, exploration and development. |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies involved in uranium mining-related businesses. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Refers here to equity positions that have been sold short but not yet covered or closed, implying investors' expectations that prices will continue to decline. |

| 7 | Source: Whitehouse.gov, ANNEX II. |

| 8 | Source: World Nuclear News, Deep Yellow defers Tumas decision pending price improvement. |

| 9 | Source: Boom in uranium stocks fizzles as Ukraine ceasefire talks build. |

| 10 | Source: NexGen Energy's Canada Project Timeline Delays May Boost Uranium Sector Sentiment, Euroz Hartley Says. |

| 11 | Source: Amazon, Google and Meta support tripling nuclear power by 2050 |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.