"The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists." — Ernest Hemingway

As of this writing, gold has declined 6.52% year-to-date while gold mining equities (GDX)1 have declined 19.73% (through July 14, 2022). The S&P 500 Index2 has lost 19.81% for the same period.

Many investors are asking why gold's performance has been disappointing in light of what would seem to be the perfect backdrop? Interest in gold has been driven by problematic inflation, prospects of a recession, excessive public and private debt, widening credit spreads, the onset of a bear market in equities and bonds and a growing loss of confidence in the Federal Reserve ("Fed"). Commentaries on these matters can be found in my previous Insights and commentaries.

The Challenging First Half of 2022

All these concerns materialized in a significant way during the first six months of 2022. In addition, the world of crypto, a leading competitor for gold as an uncorrelated asset, has collapsed.

Dispirited gold investors appear to have abandoned all hope based on rock bottom sentiment indicators. Our view is that the game is far from over. To use a baseball analogy, the game is still in the early innings. Consider the following possibilities:

- Inflation is Likely to Remain High

While inflation may crest over the coming months, it is unlikely to return to the Fed's 2% target for months or years to come, absent a sudden deflationary collapse. I believe inflation will likely remain unacceptably high well into 2023. Cresting in the rate of inflation is not the same as price stability.

- We are in the Early Stages of a Recession

We think the recession has barely started. Economic activity is collapsing at a rate of decline that the usual indicators fail to capture on a real time basis.

- This Bear Market May have a Long Way to Go

This so-called "bear market" appears to have a long way to go in distance and time. Investment psychology is still dominated by a "buy the dip" mentality. Wall Street estimates of future earnings remain far too high because investment strategists and research analysts do not contemplate the likelihood/possibility of a protracted recession. We think the bear market will likely end only when investors no longer want to hear about stocks. The "no mas" moment comes not after the shock of the initial unexpected decline but only after a multi-year grind of disappointing results.

- The Pain of Widening Credit Spreads Has Yet to be Felt

Credit spreads have widened substantially, suggesting worsening economic conditions and higher overall risk. But the real time impact of funding difficulties for subprime and lower credit borrowers has yet to be felt. The main consequences will likely be seen in job losses and economic contraction.

- Confidence in the Fed is Likely to Prove Illusory

Confidence in the Fed has been shaken but remains inexplicably intact despite the institution's egregious policy errors. Perhaps that is because investors hold out hope for a return to less restrictive or even expansive policy once inflation has been declared dead. The unfortunate truth is that due to the mess it has created, the Fed no longer has the mythical dial, the monetary tool kit, to modulate economic activity to go faster or slower. It only has an on-off switch that we believe will continue to crater the markets or ignite a new inflationary boom.

- The Fed May Call a Premature "Cease Fire"

Another scenario that could be in play: Inflation will likely not be conquered quickly enough to gratify most investors. Under political pressure, Powell might grasp for the fig leaf of decelerating inflation to declare victory or a pause in the battle. That might seem to be preferable to continuing the full-speed collision course towards a deflationary collapse that is now in progress. Any sort of premature "cease fire" would in our view represent capitulation and a return to business as usual.

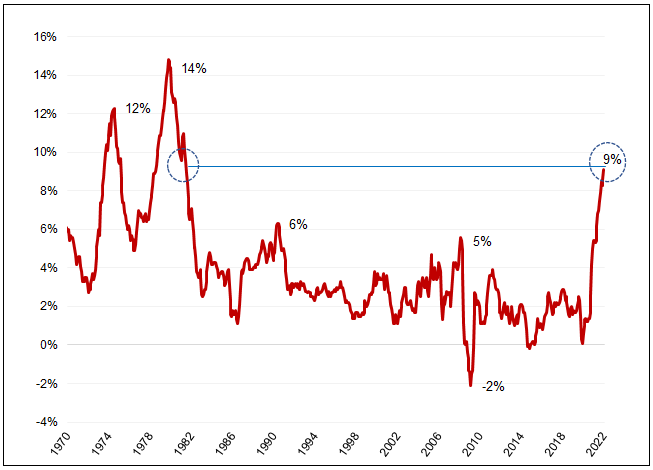

It is worth noting that inflation is now at levels not seen in 40 years. Driven in large part by higher energy prices, June CPI figures were 9% percent higher than a year ago, according to the Bureau of Labor Statistics. Inflation was last above 9% in November 1981.

Figure 1. YOY Inflation at 9%: Highest in Four Decades (1970-2022)

Source: Bloomberg and Sprott Asset Management. Based on the Consumer Price Index (CPI). Data as of 6/30/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Fed's Inflation Fandango

In our view, Fed Chair Jerome Powell and his cohorts have demonstrated little understanding of the sources of the inflation that the current Fed and its predecessors caused. They also lack the knowledge of what it will take to restore price stability.

There is a danger that the Fed will stick to its uber-hawkish stance for too long. Chair Powell has said he is willing to risk going too far because the mission of halting inflation is paramount. "Is there a risk that we would go too far? Certainly, there's a risk, but I wouldn't agree that's the biggest risk to the economy," Powell said at the ECB Forum on Central Banking 2022 in Portugal (June 27-29, 2022).

Beginning with the May 31 White House meeting between Powell, Janet Yellen and President Biden, Powell and most of the Fed cohort have been building consensus for resolve to tame inflation. "Getting it wrong in the direction of not tightening enough has much bigger consequences than the other way around," said John Roberts, former Fed economist. (Source: The Wall Street Journal, 6/29/22)

Powell and most financial media perceive today's inflation problem as the result of exogenous supply shocks. In other words, it's not the Fed's fault. Acknowledgment that inflation's origins lie in the Fed's decade-long policy of interest rate suppression through QE (quantitative easing) is scant. When asked at the February 23, 2021, Senate Banking Committee hearing about the then 26% growth rate in M2,3 Powell replied, "We've had big growths of monetary aggregates at various times without inflation, so something we have to unlearn, I guess." [Source: Grant's, Leaving the Hall of Mirrors, 6/24/2022].

There also does not appear to be any appreciation that removing excess liquidity from the system could take years. Monetary expert Lacy Hunt of Hoisington Investment Management calculates that another two years of restrictive monetary (M2) growth, 0% to be exact, would be required to return M2 growth to its long-term trend line of 7%. There has been no example of such tightness since 1974, when records of M2 growth first began to be recorded (see Figure 2.)

Figure 2. M2 vs. Other Deposits of Commercial Banks (1974-2022)

Source: Hoisington Investment Management, Macroeconomic Analysis June 2022.

Despite recent Fed interest rate hikes, negative real interest rates persist. The current 3% nominal yield on 10-year U.S. Treasuries equates to an inflation-adjusted return of negative 6%, with the CPI (consumer price index) running at 9%. Looked at another way, to reach a 2% real yield on 10-year U.S. Treasuries requires an 800 basis point yield increase (an 11% nominal yield) in order to compensate investors for the inflationary (9%) erosion of principal. In the late 1970s, "the 10-year T-bond rate increased from 6.5% to 10.5% over three years. But it did not stop rising inflation…. which was running at 13%" (Source: Fred Kalkstein, Janney Montgomery "Graphs and Comments" 6/26/2022). In our opinion, interest rates must rise much further for longer if the Fed is to succeed in quelling inflation.

Taming Inflation Will Likely Require Austerity

The road to 9%+ inflation began more than 10 years ago with the birth of quantitative easing (QE). Supply-side shocks were near-term catalysts for inflation to blossom into an obvious problem. Recession-induced declines in raw material prices, labor force weakness and easing of supply chain bottlenecks are not monetary inputs. They will address inflationary symptoms but not the disease. The consensus for price stability is too fragile, in our opinion, to survive the arduous path necessary for its restoration. Taming inflation will likely require prolonged austerity for which there is little stomach politically.

Unwinding the residue of systemic risk from QE and manipulated interest rates will be no small task. Yet the restoration of price stability would require a substantial liquidation of 10 years of misallocated capital and associated imprudent leverage fostered by these policies. Falling short of this goal would equal papering over past mistakes and constitute a booster shot in the arm for inflation.

Gold: A Defense Against Systemic Risks

Gold, as we have previously stated (Waiting for the Pivot), is not an inflation hedge. Instead, we believe gold offers a defense against the systemic risks that abound today, including the potential for sudden asset deflation. If there is an effective and honest restoration of price stability, we think equity markets will still be overvalued and vulnerable. A return to sound money should expose the trillion-dollar residue of zombie capital structures that owed their existence to the multiyear underpricing of credit risk. We believe the time frame for such a transformation must be measured in years and will likely require substantial political consensus.

If the Fed is to abandon the practice of inflating financial assets, which would represent a secular shift in direction, substantial deflation lies ahead from which the purchasing power of gold is expected to rise in real terms. If there is a return to business as usual, i.e., papering over policy mistakes, we believe that the gold price has the potential to rise to all-time highs in nominal terms.

| 1 | The S&P 500® Index represents 505 stocks issued by 500 large companies with market capitalizations of at least $6.1 billion. This Index is viewed as a leading indicator of U.S. equities and a reflection of the performance of the large-cap universe. |

| 2 | VanEck Vectors Gold Miners ETF (GDX) tracks the overall performance of companies involved in the gold mining industry. |

| 3 | M2 is a measure of the money supply that includes cash, checking deposits and easily convertible near money. M2 is a broader measure of the money supply than M1, which includes cash and checking deposits. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.