Key Takeaways

- Gold reached an all-time closing high of $2,230 at quarter end and is up 8.09% YTD after rising 13.10% in 2023.

- We believe several fundamental factors are in place for gold to potentially move higher, particularly strong central bank buying.

- Central banks' strategic shift toward gold creates a new dynamic in gold pricing, breaking historical correlations. Their motivations and needs differ significantly from investment funds.

- Low options trading on gold (GLD calls and puts, CFTC futures) suggests muted price expectations despite strong central bank buying. There is potential for increased options activity to boost the gold price.

- We see three primary drivers for a higher silver price: 1) silver tracks rising gold due to central bank buying, 2) reflation trade and 3) increased solar panel demand.

Performance as of March 31, 2024

| Indicator | 3/31/2024 | 12/31/2023 | Change | QTD % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $2,229.87 |

$2,062.98 | $166.89 | 8.09% | 8.09% | New all-time high, $2,400/2,500 target |

| Silver Bullion2 | $24.96 | $23.80 | $1.17 | 4.91% | 4.91% | On the verge of a major technical breakout |

| NYSE Arca Gold Miners (GDM)3 | 883.65 | 876.44 | 7.21 | 0.82% | 0.82% | +21.94% from February extreme oversold |

| Bloomberg Comdty (BCOM Index)4 | 99.49 | 98.65 | 0.84 | 0.85% | 0.85% | Early signs of cycle lows in place |

| DXY US Dollar Index5 | 104.55 | 101.33 | 3.21 | 3.17% | 3.17% | Holding above major support |

| S&P 500 Index6 | 5,254.35 | 4,769.83 | 484.52 | 10.16% | 10.16% | New all-time high |

| U.S. Treasury Index | $2,255.31 | $2,277.09 | ($21.78) | (0.96)% | (0.96)% | Potential double bottom pending |

| U.S. Treasury 10 YR Yield* | 4.20% | 3.88% | 0.32% | 0.32% | 0.32% | Yields testing resistance |

| U.S. Treasury 10 YR Real Yield* | 1.87% | 1.71% | 0.17% | 0.17% | 0.17% | 10 YR real yields tracking nominals |

| Silver ETFs** (Total Known Holdings ETSITOTL Index Bloomberg) | 711.62 | 699.92 | 11.70 | 1.67% | 1.67% | Largest monthly buying since January 2021 |

| Gold ETFs** (Total Known Holdings ETFGTOTL Index Bloomberg) | 82.28 | 85.58 | (3.30) | (3.86)% | (3.86)% | 10 straight months of selling |

Source: Bloomberg and Sprott Asset Management LP. Data as of March 31, 2024.

*QTD % Chg and YTD % Chg for this Index are calculated as the difference between the quarter end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points. **ETF holdings are measured by Bloomberg Indices; the ETFGTOTL is the Bloomberg Total Known ETF Holdings of Gold Index; the ETSITOTL is the Bloomberg Total Known ETF Holdings of Silver Index.

First Quarter in Review

For the quarter ending March 31, 2024, gold bullion rose $166.89 (or 8.09%) to close at $2,229.87, an all-time closing high. After testing the $2,000 gold level several times in 2023, gold closed above that level in December and has not looked back. Several factors are pressing gold to new highs. Simplistically, a massive, relatively price-insensitive buyer (central banks and sovereigns) is providing persistent support. At the same time, another large cohort (investment funds as represented by CFTC7 and ETF positioning) is essentially caught in a short squeeze.8 Aiding the gold price are signs that the U.S. dollar (USD) is making a significant top, and yields are peaking as global central banks are set to begin a synchronized easing cycle.

Past extended bullish gold trends typically follow this pattern: higher price thrust, consolidation and thrust.

The broad stock market has been moving higher as the Federal Reserve (Fed) maintains its outlook for three interest rate cuts in 2024, the U.S. economic growth outlook improves, inflation (though bumpy) continues to track lower, and the U.S. Treasury continues to place more issuances into the shorter maturity end of the yield curve. A phenomenal AI (Artificial Intelligence)-driven growth outlook has sparked higher earnings revisions while financial conditions remain highly accommodative, allowing equities ample scope for price multiple expansions. A soft landing, moderating inflation, accommodative central banks, ample system liquidity, a secular growth engine (AI) and easy financial conditions have fueled this "everything rally”.

Gold Bullion Breakout

Figure 1 highlights the bullish gold chart progression over the past 10 years. After the 2016-2019 consolidation breakout, gold surged to $2,064 in August 2020 and went into a three-year consolidation trading pattern before breaking to new highs in March. In a familiar recurrence, the 2016-2019 gold price consolidation was driven by the Fed attempting to normalize its balance sheet (QT or quantitative tightening), and the breakout triggered by the Fed pivoting (the "Powell Pivot") to easing and ending balance sheet normalization as the Repo market (a systematic important source of market function liquidity)9 became dysfunctional. The final thrust to $2,064 in August 2020 was due to the massive monetary response to the COVID-induced recession and financial system crisis. In the current situation, parallel to 2016-2019, the Fed has pivoted with pending interest rate cuts, the end of QT is in sight, and during Q4 2023, the U.S. Treasury market showed signs of extreme liquidity impairment, much like the Repo market experienced in the prior cycle.

Past extended bullish gold trends typically follow this pattern (although due to different causes): higher price thrust, consolidation and thrust. We believe several fundamental factors are in place for gold to potentially go higher, which we highlight in Figure 1.

Figure 1. Gold Bullion's Technical Breakout (2014-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

Central Bank Buying Overwhelms Investment Funds Flow

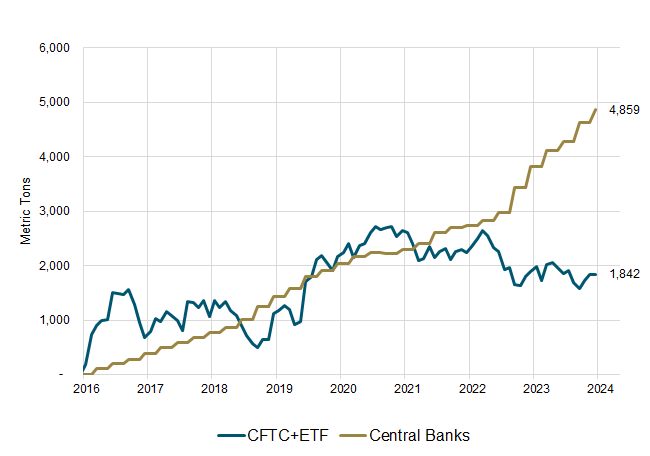

Figure 2 highlights a comparative analysis of the two large cohorts of gold buyers: Central banks and CFTC plus ETFs combined (investment flows). The chart calibrated to zero starting December 31, 2015, the low of the current gold cycle. Initially, until mid-2020, central banks and investment funds were accumulating gold at the same pace on a net basis. Since Q3 2020, the buying pattern has diverged dramatically, with central banks adding a net 2,630 metric tons (MT) while CFTC and ETFs sold a net 854 MT to the end of 2023. Notably, around mid-2022, the buying of central banks intensified during the Russia-Ukraine war and the subsequent seizure/freezing of Russia's FX (foreign exchange) reserves. As of December 2023 (last reported central bank positioning), the delta has widened to over 2,980 MT (or 95.8 million ounces).

We have discussed the motivations for aggressive central bank buying in past commentaries, especially our February 2023 posting (First Gold Dip Since Central Bank Buying Spree). Factors influencing their decisions include the pressing need to diversify reserves in light of potential sanctions and the risk of foreign exchange reserve seizures. There is also a growing preference for "outside money" (assets not linked to any specific country) in central bank reserves, a reaction to the trend of USD weaponization and moves toward de-dollarization, a strategy to hedge against inflation and the impact of relaxed monetary policy on global currencies and sovereign bonds, and a means of insuring against the escalating geopolitical tensions associated with deglobalization.

The critical point is that over the past one and a half years, central banks have increased their average quarterly gold purchases to 313 metric tons versus the pre-2022 decade of 127 metric tons (2.5x greater), altering their strategic rationale. Central banks' objectives and purchasing logic have diverged significantly from those of investment funds. This change is a crucial driver for the current departure of gold bullion pricing from the correlations and patterns observed in the last 20 years. Also, note that the size of central banks (and sovereigns) dwarfs any investment flow, and their definition of a “store of value” for sovereign reserves vastly differs from an investment fund's definition of a “store of value”, both in meaning and size.

Figure 2. Central Bank vs. Investment Fund Net Cumulative Gold Purchases, Metric Tons (2016-2023)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

Investment Funds, CFTC and ETFs, Are “Effectively Short Gold”

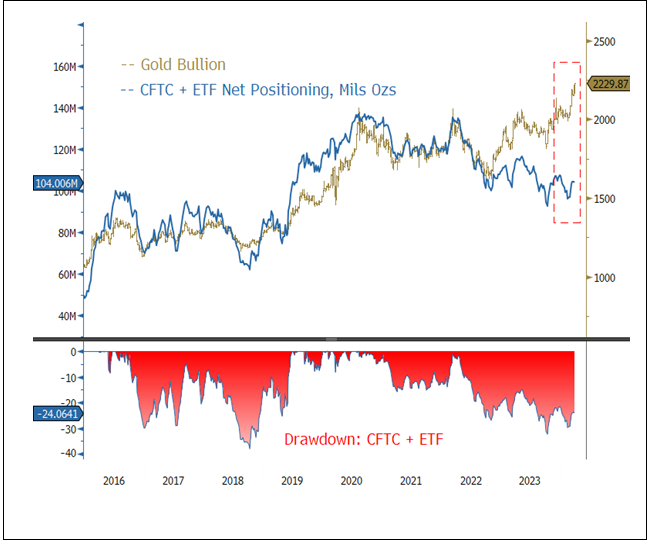

Figure 3 illustrates a significant divergence in the gold market. While central banks and sovereign purchases have driven gold prices to record highs, the gold holdings by CFTC and ETFs have decreased, falling back to levels last seen in mid-2019 when gold was at the $1,375 resistance. This trend has continued into the year-to-date (YTD) 2024, with further reductions in their gold positions. The lower panel of Figure 3 shows that the current scale of drawdown in CFTC and ETF positions would typically be associated with a sharp gold price correction or even a bear market, yet gold prices are at all-time highs.

Despite no significant news events or market catalysts on Friday, March 1—particularly with Asian markets closed—gold prices broke out from a multi-year consolidation pattern. The breakout was not driven by any clear external trigger, suggesting that it may have resulted from forced short-covering. Unlike spikes caused by specific risk events, which tend to reverse as traders take profits quickly, this sustained breakout suggests the market has more enduring strength. Investment funds, including CFTC and ETFs, appear to be "effectively short gold," given their very low gold exposure. Our previous commentaries have pointed out that the widening gap between gold prices and CFTC and ETF positions was unsustainable and may likely to lead to a price squeeze, which the market is now witnessing unfolding. The purchasing behavior of central banks and sovereigns is creating a rising price floor for gold, acting as a de facto "gold put".

Figure 3. Gold Bullion versus Investment Fund Holdings, Visualizing the Squeeze Potential (2016-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Shanghai Gold Price Premium

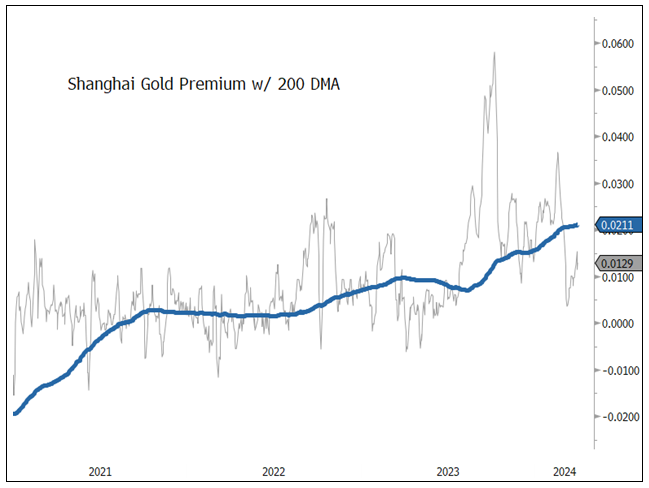

The Shanghai gold price premium is the difference in price for an ounce of gold between the Shanghai Gold Exchange (SGE) and the global gold price, typically benchmarked against the London Bullion Market Association (LBMA) or New York COMEX. The higher the premium, the more willing buyers in China are to pay for gold over the international price, providing a live implied demand indicator (see Figure 4). The blue line in Figure 4 is the 200-day moving average of the gold premium, indicating a growing demand trend. The spike in Q3 2023 was related to the turmoil in China's real estate market as prices fell amid negative credit headlines, and the recent pullback is associated with the recent price spike. There is clear evidence—although difficult to fully quantify—that the general population is buying gold as a hedge to protect against their high wealth exposure to the fragile property market.

There is no live data on central banks and sovereign buying, but typically, they do not chase higher prices but resume buying on pullbacks. For example, the Shanghai gold price premium fell from a +1.8 standard deviation reading to a -2 standard deviation level (two-year range), meaning gold buying from China faded as prices spiked. In the longer term, the question will be what the new floor price is likely to be for gold from central banks and sovereigns. Assuming global tensions persist and the trend toward deglobalization continues, central banks and sovereigns may likely maintain a supportive influence on gold prices, similar to the "Fed put" in financial markets.

Figure 4. Shanghai Gold Price Premium Is Trending Higher (2021-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

Options Are Another Potential Gold Market Mover

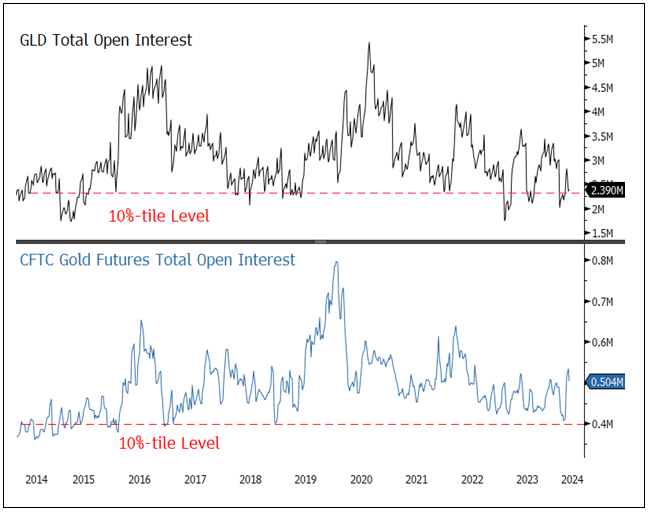

Options trading has a historical precedent for affecting gold prices. Figure 5 shows the total open interest on GLD 10 and CFTC gold futures contracts. Both show that low multi-year readings were reached (the red dashed marks the 10% percentile level over the past 10 years). If options activity picks up (especially if implied volatility increases), there could be another significant source of bullish market influence for gold. The low open interest readings suggested that price expectations were muted for gold despite the enormous central bank and sovereign buying.

The first panel of Figure 5 shows that GLD's total open interest (calls plus puts) is at the low end of its 10-year range, near the 10%-tile 10-year range. The notional value11 of the GLD total open interest is about $49.2 billion at quarter end. The second panel highlights the total open interest in CFTC gold futures over the past 10 years, reaching the 10%-tile level in February. The notional value of the CFTC gold total open interest is about $112 billion and has picked up in March. Relative to historical positioning levels, there is considerable potential for GLD and gold futures to increase open interest levels and serve as a potent bullish force on the gold market.

Figure 5. Total Open Interest Contracts for GLD and CFTC Gold Futures (2014-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

Silver Update

For the March 31, 2024 quarter, silver bullion rose $1.17 (or 4.91%) to close at $24.96, just below some critical technical price levels. Figure 6 highlights silver sitting just below a significant breakout level of a bullish triangle. There are several possible bullish patterns (fractal iterations), with the differences mainly related to the timing and pattern progression of the price trend. The main point is that multiple bullish configurations (market psychological imprinting) are not typical and reinforce the bullish narrative. All the potential chart patterns on silver bullion project a price of at least $30, the breakout level required to set multi-decade-long chart patterns into motion.

Figure 6. Spot Silver On the Cusp of a Breakout (2019-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Main Drivers for a Silver Price Breakout

We see three primary drivers for a higher silver price: 1) silver maintaining its monetary value as gold prices go higher from central bank and sovereign buying, 2) silver's correlation to the reflation trade and 3) the massive consumption of silver for photovoltaic panels due to the new growth phase for U.S. electricity demand.

1. Monetary Value of Silver Holding

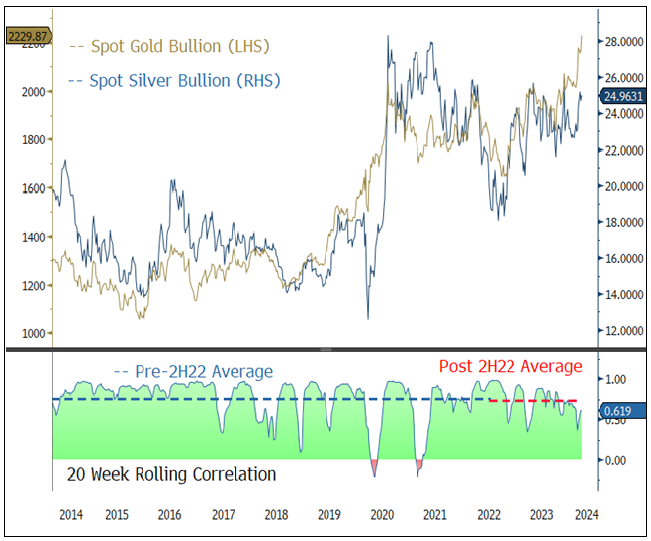

The primary macroeconomic driver remains central banks and sovereigns buying gold. Silver has lagged mainly because central banks and sovereigns are not buying silver. Despite this, with its associated reserve monetary value, silver has not broken its correlation with gold. Figure 7 highlights the rolling 20-week correlation of gold and silver over the past 10 years. The pre- and post-2H2022 correlations (the start of the massive central bank and sovereign gold buying) remain identical. Silver prices are anticipated to be drawn upward in tandem with gold due to its continuing alignment with gold's monetary value.

Figure 7. Silver Maintains Its Correlation with Gold (2014-2024)

Source: Bloomberg. Data as of 3/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

2. Silver’s Economic Correlation

Silver has long correlated with economic activity due to its wide range of industrial applications. For this reason, silver and copper are well correlated with a 0.73 R-square12 since 2000. Global central banks (ex-Bank of Japan) are now entering a synchronized easing cycle, which is likely to benefit the reflation trade. Commodities like copper—and, by extension, silver due to their similar economic correlation—may likely perform well as high beta plays of this reflation trade. Generally, the higher the reflation expectations, the better the commodity cyclical trade plays out. We believe most reflation-linked assets are underweighted as recession forecasts have only recently dissipated.

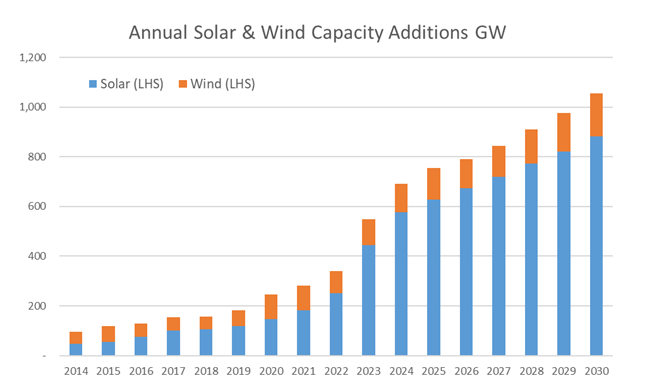

3. Silver in the Solar Energy Sector

Our February 2024 Energy Transition Materials Commentary highlighted the explosive growth in solar power generation now that it's the most cost-effective source of electricity. For the past 20 years, growth in electricity demand has been only 0.4% per annum, well below GDP (gross domestic product), mainly due to gains in energy efficiencies. We will have more details in our upcoming Energy Transition Materials report on electricity demand growth, but U.S. electricity demand is on the brink of a significant growth phase. U.S. policy and the accompanying fiscal spending continue to accelerate the reshoring of the U.S. industrial and manufacturing base and their associated supply chains. The preliminary data for the rise in electricity demand from the expected growth in AI-related use are staggering. Demand from other electrification strategies, cryptocurrency mining, data centers, etc., is expected to increase the electricity demand growth curve.

Figure 8 highlights the sharp increase in the deployment of photovoltaic systems by 2030, with a pronounced spike in 2023 followed by consistent growth. This forecast suggests that current estimates of solar power demand may be too conservative, especially considering the uptick from AI technology, manufacturing reshoring and broader electrification trends. Notably, the demand for solar power in 2030 is projected to be more than triple that of 2022 on this conservative forecast.

For more information on silver and photovoltaics, please see our two prior reports:

• Central Banks Support Gold & Solar PV Demand Buoys Silver

• Silver Demand Grows as Solar Leads Renewables

Given these considerations, silver inventory and production dynamics are poised to play a significant role in the silver market. The combination of a potentially dwindling free float of silver, steady demand from traditional sectors, and escalating requirements from the burgeoning solar energy industry, particularly with the transition to more silver-intensive technologies, underscores the likelihood of a more pronounced impact on silver prices. This scenario, coupled with the three previously outlined drivers—silver's monetary value, economic correlation and critical role in the solar sector—further solidifies the case for a silver price breakout in the foreseeable future.

Figure 8. Solar Growth Driving Silver Demand (2014-2030)

Source: BloombergNEF, Energy Transition Investment Trends 2024. "GW" indicates "gigawatt". A watt is a measure of power and there are 1 billion watts in 1 GW.

Footnotes

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Index. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The NYSE Arca Gold Miners Index (GDM) is a rules-based index designed to measure the performance of highly capitalized companies in the Gold Mining industry. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indices. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | A short squeeze describes a phenomenon in financial markets when a sharp rise in the price of an asset forces traders who previously sold short to close out their positions. The strong buying pressure “squeezes” the short sellers out of the market. |

| 8 | Commodity Futures Trading Commission's (CFTC) Gold Non-Commercial Net Positions weekly report reflects the difference between the total volume of long and short gold positions existing in the market and opened by non-commercial (speculative) traders. The report only includes U.S. futures markets (Chicago and New York Exchanges). The indicator is a net volume of long gold positions in the United States. |

| 9 | Short for repurchase agreements, the repo market is a complicated yet important area of the U.S. financial system where firms trade trillions of dollars worth of debt for cash each day. |

| 10 | The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs. |

| 11 | In options trading, the term "notional value" refers to the total value of the position represented by the options contract. It's calculated by multiplying the number of options contracts by the number of units in each contract (usually 100 shares per contract for stock options) and then by the option's strike price. |

| 12 | R-squared values range from 0 to 1 and are commonly stated as percentages from 0% to 100%. An R-squared of 100% means that all movements of a security (or another dependent variable) are completely explained by movements in the index (or the independent variable(s) you are interested in) (Source: Investopedia). |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.