The precious metals complex continued to rebound in March as other markets faltered. Gold bullion1 is up 5.92% YTD through March 31, 2022, and silver bullion2 has increased 6.37%. Gold mining equities3 rallied strongly and gained 21.68% YTD. This compares to a decline of 4.60% for the S&P 500 Total Return Index6 and losses in bond markets.

Month of March 2022

| Indicator | 3/31/2022 | 2/28/2022 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $1,937.44 | $1,908.99 | $28.45 | 1.49% | 5.92% | Highest quarterly close |

| Silver Bullion2 | $24.79 | $24.45 | $0.34 | 1.40% | 6.37% | Still in long-term consolidation range |

| Gold Senior Equities (SOLGMCFT Index)3 | 150.10 | 135.91 | 14.19 | 10.44% | 21.68% | Notably outperforming bullion YTD |

| Gold Equities (GDX)4 | $38.35 | $34.38 | $3.97 | 11.55% | 19.73% | (Same as above) |

| DXY US Dollar Index5 | 98.31 | 96.71 | 1.61 | 1.66% | 2.76% | Remains in elevated trade range |

| S&P 500 Index6 | 4,530.41 | 4,373.94 | 156.47 | 3.58% | (4.95)% | Late March market squeeze |

| U.S. Treasury Index | $2,360.57 | $2,436.43 | $(75.86) | (3.11)% | (5.58)% | Worst quarter ever, data back to 1973 |

| U.S. Treasury 10 YR Yield* | 2.34% | 1.83% | 0.51% | 51 BPS | 83 BPS | Largest monthly basis point increase since 2009 |

| U.S. Treasury 10 YR Real Yield* | (0.49)% | (0.80)% | 0.31% | 31 BPS | 61 BPS | Back to February high range |

| Silver ETFs (Total Known Holdings ETSITOTL Index Bloomberg) | 892.92 | 904.84 | (11.92) | (1.32)% | 0.77% | Positioning levels remain in consolidation |

| Gold ETFs (Total Known Holdings ETFGTOTL Index Bloomberg) | 105.73 | 100.41 | 5.32 | 5.30% | 8.01% | Largest monthly increase since Apr 2020 |

Source: Bloomberg and Sprott Asset Management LP.

*Mo % Chg and YTD % Chg for this Index is calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points.

March Recap

Spot gold rose by $28.45, or 1.49%, to close March at $1,937.44. Earlier in the month, gold's safe haven status helped it to peak at $2,070.44 on March 8, very close to its all-time intraday high of $2,075 (August 7, 2020; Figure 1). March proved to be an extremely volatile month for all asset classes, driven by the Russia-Ukraine War and increasingly hawkish Fed expectations. The War started on February 24, and market volatility peaked around March 8 as collateral funding stress from the extreme swings in commodity prices triggered margin calls across various commodities, especially crude oil, exemplified by the price of Brent crude oil touching $139 per barrel. The surge in commodity prices put the stagflation narrative into overdrive, weighing on bond and equity prices. For the quarter, gold posted its all-time highest quarterly close. By contrast, the U.S. Treasury Index returned its worst quarter ever (losing 5.58%) since the data series began in 1973, and the S&P 500 Index had its first negative quarterly return since Q1 of 2020. Silver continued to track gold's positive price movements year-to-date, while gold mining equities have soared since the end of January, playing catch up with the price advance in gold bullion.

Figure 1. Gold Bullion: Testing and Consolidating Just Shy of All-Time Highs (2017-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Investment Demand for Gold Resumes

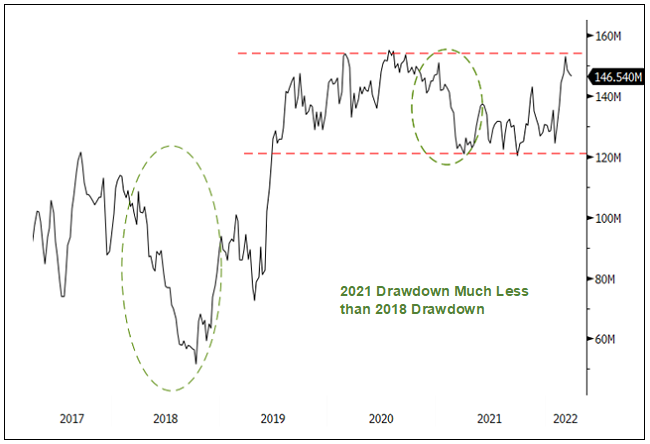

Gold positioning from investors is returning to the levels last seen during the peak in 2020. Figure 2 is our proxy for gold investment demand and is calculated by combining the total of CFTC net non-commercial gold contracts, managed futures contracts and known gold held in ETFs, expressed in millions of ounces. There are two points worth highlighting. First, the fear of central bank rate hikes peaked by Q1 2021, with investment demand dropping by ~32 million ounces or 20% from peak to trough. Though positioning remained choppy mainly due to CTA (commodity trading advisor) action, overall positioning had begun to recover well before the Russia-Ukraine conflict for reasons we have been highlighting for over a year now.

Not only are gold mining equities still undervalued relative to the broader equities market, we believe their valuation outlook will improve even further.

The other point is to compare the investment selling seen in 2018. The 2018 drawdown was over 55% or nearly 70 million ounces, an extreme overshoot driven mainly by short-selling, hoping for a replay of the 2013 Taper Tantrum. From the 2018 lows, gold investment then soared more than 95 million ounces into late 2019 (even before the COVID-19 peak). The market reacted by pricing in little hope that the Fed would be able to normalize interest rates and its balance sheet. Today, we see a similar situation developing, which we cover in the sections below. Short-term, safe haven flows have taken gold positioning back to its highs. While we continue to see these haven flows holding, other positive drivers are also now coming into play.

Figure 2. Gold Investment Demand is Rising (2017-2022)

Measured by CFTC Net Non-Commercial Gold Contracts, Managed Futures Contracts and Known Gold Held in ETFs (Millions of Ounces)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Gold Mining Equities are Bouncing Back

Gold mining equities had a solid first quarter returning 19.73% (as measured by GDX). Figure 3 highlights the GDX chart breaking out of a descending wedge and a double-bottom setup. A descending wedge pattern is a consolidation pattern that typically resolves higher with a sharp rise, such as the case here. Our 2022 Top 10 to Watch List highlighted the extreme relative valuation gap between the Gold Mining Equities Index (GDM) and the S&P 500 Index. The relative EV/EBITDA ratio expressed as a percentile going back 16-years showed the Gold Miners trading at the 6%-tile at year-end 2021. With the Gold Miners advancing and the S&P 500 falling, the relative EV/EBITDA has only increased to the 17%-tile at quarter-end, March 31, 2022.

Figure 3. Gold Mining Equities Testing Key Resistance (2018-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

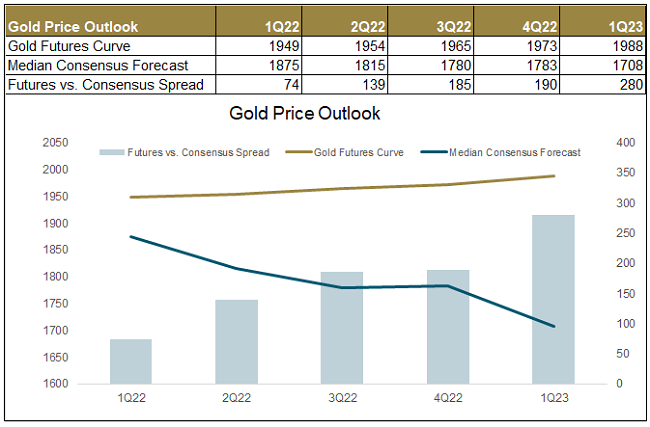

A Tale of Two Gold Bullion Price Outlooks

Not only are gold equities still undervalued relative to the broader equities market, we believe the valuation outlook will improve further for gold mining stocks. There are two familiar sources for the outlook for future gold price expectations: 1) the gold futures market and 2) the street consensus price deck forecast used for modeling gold equities. Figure 4 highlights the discrepancy between the futures market outlook (real money) and the consensus price deck (modeling purposes). From our experience, consensus price decks are almost always in steep backwardation (frontend prices are higher than backend), while the gold futures are almost always in contango (backend prices are higher than frontend). In fact, since 2000, using monthly data, the gold futures curve has traded in backwardation only 3% of the time (8 months out of 268), with an average price spread of only $11/ounce. Figure 4 shows that the consensus price deck is $300/ounce lower than the futures price for Q1 2023. We believe the consensus gold price decks will be marked to market reality higher as 2022 progresses. With it, positive EPS (earnings per share) revision momentum for gold equities will outpace the S&P 500, which currently has EPS revisions rolling over.

Figure 4. Gold Futures Curve and Consensus Price Forecast Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Yield Curves Are Inverting, Signaling Recession Ahead

Historically, recessions have followed every U.S. 2s/10s Treasury yield curve inversion, but the timing varies from six months to a year and a half, with the average around 14 months. The immediate reaction of risk assets when the curves invert also varies but has reflected recession risk as time progressed. Of late, the Fed has been messaging a broader definition of what constitutes a soft landing in order to temper expectations. Aside from 1994, the track record of the Fed achieving a soft landing has not been good. Currently, the various yield curves are all in the process of inverting (see Figure 5).

Figure 5. Yield Curves Have Begun to Invert (2020-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

A recession is becoming near inevitable, as the forces appear overwhelming. Inflation is running at generational levels fueled by once-in-a-lifetime secular events. The across-the-board spike in commodity prices resulting from the Russia-Ukraine War is at levels that can only be brought down through demand destruction. This sudden increase in stagflation risk only adds to the monetary policy complexity. COVID-related stimuli have all expired while wage growth is lagging well behind the rising consumer price index (CPI). The Fed is not only tightening into an economic slowdown, it needs to front-load its hiking cycle given that it is so desperately behind the curve. If the Fed is not able to hike interest rates to reach restrictive levels to stop inflation before triggering a recession, it may be forced to stop or cut rates even given the generational high inflation. To help visualize this point, Figure 6 is the inflation-adjusted real shadow rate or the Federal Funds rate minus the year-over-year CPI change, which is at its most negative reading ever. This highlights how far the Fed is behind the curve currently and how potentially trapped has become. If the Fed hikes rates eight more times as expected and inflation stays at current levels, the shadow rate will only rise to about -5%, a historically low level.

Figure 6. Inflation-Adjusted Real Shadow Rate: Most Negative Ever (1975-2022)

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Fed Policy Mistakes and Reversal

While the market is signaling eight rate hikes for 2022, the Eurodollar futures spread (EDZ3-EDZ4 Index) is already pricing in rate cuts for 2024 (Figure 7). The market is pricing in Fed tightening into a recession with an aggressive but truncated tightening cycle. The EDZ3-EDZ4 Index chart also signals that the Fed will not be able to raise interest rates much beyond the neutral (currently ~2%) for any length of time without causing a recession. The U.S. Treasury 2s/10s yield curve closed at 3.4 basis points while various parts of the curve (3s/5s, 7s/10s, 3s/10s, 5s/30s, etc.) are already, or nearly, inverted. If further market stress/crisis events occur, Fed pivot expectations will accelerate and be pulled forward by the market, much like what happened in 2018 (The Powell Pivot). We believe that the next significant leg higher in gold will occur when that happens.

Figure 7. Eurodollar Futures Spread (EDZ3-EDZ4): Pricing Rate Cut Already

Source: Bloomberg and Sprott Asset Management LP. Data as of 4/01/2022. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

USD Monetary Reserve System

The seizure of Russia's FX (foreign currency) reserves will likely be a wake-up call for FX reserve managers at all central banks. Gold as "outside money" in the global central banking system will become more attractive to almost any central bank but especially for any country with an adversarial relationship with the U.S. or the EU. This tension is now starting to play out in the U.S. dollar (USD) reserve system. Though far from perfect, the USD-based international reserve system has proven to be a generally reliable, neutral, rules-based global system that has promoted prosperity for nearly 50 years. The system's premise is that U.S. dollars in the financial system are fungible and protected by property rights. Seizing assets undermines trust in the U.S. dollar system and will weaken the USD's long-term dominance.

Even if all parties desire to reduce USD dominance to some degree, the requirement of reserve managers to recycle current account surpluses in the capital account requires enormous amounts of liquidity. U.S. dollars account for just under 60% of the world's reserve currency, the Euro around 20%, the Yen at 6% and the Yuan approximately 3%. Changes in the world's reserve currency balance move at a glacial pace. Though the yuan is often viewed as a potential heir to the USD, we would note that it is not freely traded given its on-off soft peg to the USD. With only about a 3% representation of total global reserves, the yuan is not nearly liquid enough and would require wholesale changes to China's monetary and currency system. For that matter, how many countries would be willing to cede control of their financial future to China's Politburo? The desire for a "neutral currency" remains a strong issue.

Sanctions Impacting Commodities and Adding to Funding Stress

Removing $500 billion in FX reserves from the global financial system, sanctioning Russia, the 11th largest economy and restricting access to the world's largest commodity producer will continue to cause economic and market stress. In today's modern markets, commodities are highly financialized and leveraged and are a primary source of collateral for funding markets. The wild swings in commodity prices are due to margin calls impacting global commodities trading. As margin calls increase, commodity trading houses will require access to more credit. Extreme, elevated volatility in commodities is a sign of ongoing funding stress.

Global energy markets had been tight well before the Russia-Ukraine War, primarily due to a nearly decade-long period of underinvestment for many reasons. We believe significant energy sector volatility, not just with intermittent wild price swings, but in a perpetual state of turbulence. This commodity volatility storm will continue to reverberate as there are no short-term solutions to the energy markets' tightness. This tightness in crude oil and distillates existed well before the War. Depending on China's oil demand, a recession may not dampen overall global oil demand. Russian oil production is on a lower long-term trend. Russia's oil production growth is in the country's remote north, and its development and extraction are dependent on western technology, which is leaving due to the War. We see no replacement for these lost Russian barrels for years to come.

President Biden's release of oil from U.S. Strategic Petroleum Reserves (SPR) will help oil markets short term, but it will delay demand destruction. Since there is so little oil inventory and zero spare capacity, demand destruction is the only effective means to rebalance oil markets. The structural supply deficit, made far worse by the War, will not be helped by the release from the SPR as lower prices will delay the supply response. The SPR will also need to be refilled as it is not a new supply source; the SPR release will only postpone some of the pain.

Russia-Ukraine War has Accelerated Deglobalization and Inflation

Since the end of the Cold War (1991), globalization of cross-border movement of goods and services, technology and capital has increased economic growth while providing a disinflationary tailwind. Before COVID, the pendulum had begun to swing away from globalization with budding trade wars and rising protectionism. In stark terms, COVID exposed the complexity and vulnerabilities of the global supply chain to disruptions. The Russia-Ukraine War is likely to close this three-decade-long globalization chapter as nations shift focus to the security of supply chains and protecting access to raw materials. Onshoring will likely usher in inflationary pressures as access to low-cost labor in developing markets will reverse. Furthermore, the disruption to the energy markets will put energy security near term ahead of the energy transition for now.

Though it is still early, the world economy appears to be morphing into blocs, with each bloc trying to insulate itself from the potential negative influence of the others. The result will be lower trend growth globally and previous disinflationary forces turning inflationary. Instead of focusing on minimum cost, the focus will shift to security and certainty as the primary goals. Thirty years ago, the end of the Cold War brought a peace dividend and a positive supply shock leading to disinflationary outcomes. Today, a new cold war variant is brewing. It will bring an opposite effect – a taxation effect from higher defense spending and a negative supply shock (energy security), leading to more inflationary outcomes. The Russia-Ukraine War has accelerated the deglobalization and inflation forces that were already well in place.

Long-Term Structural Shifts are Bullish for Gold

It has been a little over a month since the Russia-Ukraine War started. Several long-term structural shifts have been put into motion that will likely have significant positive long-term implications for gold's role in well-diversified multi-asset portfolios. The inflationary effects of deglobalization (onshoring, more economic self-sufficiency, etc.) are meeting head-on with commodity scarcity, volatility and fears of security of supply. Adding to this mix is are concerns over the USD reserve system and the safety and validity of FX reserves. While many of these items may take years to play out entirely, changes are coming, impacting all asset class pricing. Volatility and risk profiles are the most likely to diverge higher from what has been an unusually low volatility period since the end of the global financial crisis (GFC; 2008-2010). Gold as a safe-haven asset will trend higher on this one point alone. Deglobalization and changes to the USD reserve system will have more significant and long-lasting effects not yet anticipated.

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Spot Price. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT) aims to track the performance of larger-sized gold mining companies whose stocks are listed on Canadian and major U.S. exchanges. |

| 4 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management LP (“SAM LP”) and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. SAM LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. SAM LP and/or its affiliates may hold a short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, SAM LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not residents of Canada or the United States should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, or considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2024 Sprott Inc. All rights reserved.