- View Critical Materials June 2023 Performance Table

-

For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- Energy transition metals miners posted strong results in June, with uranium mining equities leading the group. Junior uranium miners gained 18.93% as measured by the Nasdaq Sprott Junior Uranium Miners™ Index7.

- The U.S. is entering the early stages of a manufacturing supercycle driven by massive investment in the energy transition. At the same time, China's two-decades-long commodities dominance has likely crested.

- Among other measures, U.S. industrial policy is promoting the build-out of a secure and resilient domestic EV battery supply chain using strategic investment, tax credits and policies designed to spur industry efforts.

- Considerable private sector investment has already flowed into the clean energy sector, but the U.S. needs to keep strengthening its domestic manufacturing capabilities and reducing its dependence on imported batteries. If not, the U.S. risks repeating past mistakes like its reliance on foreign oil.

- The physical metals markets posted mixed results in June. U308 uranium and copper were the top performers, while the rebound in lithium prices ran out of steam and nickel declined slightly. Copper and nickel inventories hit new lows.

June in Review

The Nasdaq Sprott Energy Transition Materials™ Index1 rose 9.73% in June. At the end of May, there was a mini-selloff across most commodities and commodity-related equities due to disappointing economic data from China and concerns about a possible U.S. recession. By June 30, the market began to price in a more optimistic outlook, including the likelihood of stimulus in China in response to its weak economic data and the fading probability (or delay) of a U.S. recession. The Index is up 3.31% year-to-date as of June 30, as the energy transition complex continues to trade sideways in a longer-term bullish consolidation pattern (Figure 1).

U.S. equity markets12 were surprisingly strong in the first half of 2023, gaining nearly 16% as of June 30. The triggers for this rally were an easing in inflation without a recession and a speculative frenzy around artificial intelligence (AI), with systematic fund flows amplifying all price movements. Expectations for the U.S. economy in the short term continue to surprise to the upside. Coming into this year, investors were bearish about high inflation, expected Federal Reserve (Fed) rate hikes, recession predictions and concerns about a U.S. debt default. However, events have turned out better than expected. Headline inflation now stands at 4% (though core inflation remains very sticky), the Fed has paused/skipped rate hikes, corporate profits have not collapsed, a debt ceiling deal was reached and the banking crisis in March was contained.

Figure 1. Energy Transition Materials Continue to Consolidate (2018-2023)

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index (2018-2023). Data as of 7/2/2023. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Beyond Industrial Policy: Bootstrapping the U.S. EV Industry

The U.S. electric vehicle (EV) industry is undergoing significant growth as the U.S. pushes to decrease its dependence on China and accelerate the transition to cleaner transportation. U.S. EV growth is benefiting from substantial government initiatives designed to promote domestic manufacturing and reduce reliance on China. To catalyze the U.S. domestic EV supply chain, the government has implemented tax credits incentivizing carmakers to expand domestic battery manufacturing. Some estimate that the savings to carmakers could surpass Congress's initial budget estimates by four times.

Various battery companies and startups are also investing substantially in energy transition technologies. Since last autumn, planned investments in large U.S. lithium-ion battery plants have climbed steeply from around $40 billion to more than $77 billion. While the U.S. still trails China in the EV battery race, a domestic supply chain is quickly taking shape, accelerating the industry's growth.

Tax Credits Support U.S. Battery Manufacturers

The Inflation Reduction Act of 2022 included several measures to boost EV sales. One particularly enticing incentive is a tax credit for battery manufacturers, which amounts to $35 per kilowatt-hour (kWh) for each U.S.-made battery cell, significantly reducing production costs. For example, a manufacturer producing 70-kWh batteries for 1 million vehicles could receive tax credits totaling $2.45 billion annually. It is estimated that the cost of battery rebates alone could reach approximately $130 billion over 10 years.

These battery production tax credits are part of a broader set of U.S. policy initiatives designed to expedite the transition to electric vehicles and are undeniably among the most favorable incentives available anywhere in the world.

Over the past few years, the automotive industry has invested billions of dollars in establishing new EV and battery manufacturing facilities throughout North America. Now, automakers and battery suppliers can receive federal loans and tax credits worth billions of dollars to offset the associated costs and encourage further investment. This support will likely be instrumental in driving the industry forward. For example, depending on the specific battery cell or assembly pack, the tax credits could cover about 33% of current average production costs — a highly attractive proposition for manufacturers.

Benefits to U.S. Automakers and Consumers

With significant savings for automakers, the tax credits potentially drive down the cost of new electric cars and could stimulate sales. Prominent companies such as Tesla, GM, Ford and their Korean joint venture partners stand to benefit significantly. Tesla is expected to earn up to $1 billion in tax credits this year alone.

Despite the potential benefits, automakers are not entirely pleased with the new law due to its stringent supply chain requirements. This drawback limits the number of electric vehicles that qualify for substantial consumer tax credits today. However, as battery production is gradually reshored to the U.S., the credits are expected to lower the overall cost of electric vehicles and reduce dependence on China. These savings are expected to be passed on to consumers through more affordable electric cars.

Essentially, the new law shifts incentives for EV adoption from consumers to manufacturers. Instead of directly making electric vehicles cheaper for car buyers, the law rewards automakers for building EVs equipped with U.S.-made batteries. Lawmakers are not simply imposing new regulations and leaving automakers to figure things out independently. Rather, they are providing substantial financial support, offering tens of billions of dollars to help automakers meet the requirements.

As a result, automakers are racing to meet domestic content requirements and rapidly expanding manufacturing capacity for electric vehicles, batteries and the necessary components and materials. This development signifies a significant push towards a robust and self-sufficient EV industry in the U.S.

The U.S. Race to Establish a Domestic Battery Economy

Despite the surge in EV development, U.S. manufacturers are grappling with a shortage of battery minerals, including lithium, nickel, cobalt and graphite. These shortages put the U.S. at a disadvantage compared to China, the global leader in mining and processing battery minerals. To address this challenge, the U.S. has set a goal to establish a secure supply chain for battery materials and technology by 2030. The U.S. government recognizes the importance of strategic investments in collaboration with industry players to strengthen domestic manufacturing capabilities. Industry analysts are predicting the "balkanization"16 of the battery industry as governments and regions worldwide race to secure their supplies of battery manufacturing capacity and essential raw materials. We are already seeing this balkanization via resource nationalism as countries scramble to secure supplies of critical minerals.

EV batteries have emerged as the "new oil" (a reference to the U.S.'s vulnerability to the oil embargos of the 1970s). A resilient supply chain for critical minerals and EV components is needed to achieve energy independence (and national security). Recognizing this, the U.S. has initiated and invoked various measures and acts to promote domestic mining and processing of critical minerals. However, there are still significant gaps in the supply chain, particularly in producing EV battery cathodes and anodes.

Substantial private sector investment amounting to hundreds of billions of dollars has already flowed into the clean energy sector, including batteries, EVs and solar panels. However, without further action, the U.S. risks becoming as dependent on imported batteries as it once was on foreign oil, repeating past mistakes made with solar panels and smartphones primarily manufactured overseas. The goal and challenge lie in retaining future innovations and production within the U.S.

The U.S. and EU may likely replace China as the primary drivers of future metals demand.

This historic transition to EVs presents an opportunity for the U.S. to achieve energy independence and improve national security in a deglobalizing, multi-polar world. Higher EV adoption and self-sufficient domestic oil and gas energy production will give the U.S. more insulation from geopolitical risks than in prior decades. However, this requires strategic maneuvers and significant upfront capital investment with long-term paybacks. While the initial capital expenditures may be high, the future operating costs are low due to using renewable energy sources. The risks of supply disruption are also lower, given that renewable energy generation systems have longer lifespans and are much more sustainable than conventional hydrocarbon energy systems.

Most advanced batteries, including those used in EVs and energy storage, are currently sourced from Asia. The U.S. is establishing a secure and resilient supply chain for critical minerals and other components to control its energy destiny. This helps the U.S. lessen the risk of repeating its past practice of relying on the lowest-cost country (China), which created vulnerability within its domestic supply chains.

The U.S. aims for EVs to account for half of all cars sold by 2030. However, current manufacturing capacity in the U.S. is only about 5% to 10% of what is needed to meet this target. To bridge this gap, the U.S. government has incentivized foreign companies to build refining and manufacturing capacity within the U.S., marking a direct intervention into building a heavy industry from scratch. Cathodes and anodes, the most essential and expensive components of lithium-ion batteries, are predominantly produced in China. To achieve its ambitions in the EV sector, the U.S. is building a comprehensive supply chain connecting every link from the mining of critical minerals to the manufacturing of EV battery cells.

A Battery Belt in the U.S. Midwest Emerges

The U.S. focus on boosting battery production has domestic political and economic implications. Government efforts to support the production of batteries, components and raw materials through grants, loans and incentives to automakers and battery companies are gaining momentum. EV and battery-related manufacturing projects are increasing in Republican-leaning states, blurring partisan lines on clean energy. "The Battery Belt," a region spanning roughly from Michigan to Georgia, is witnessing the establishment of numerous EV-related factories and facilities and is expected to receive a significant economic boost.17

Birth of a U.S. Manufacturing Supercycle

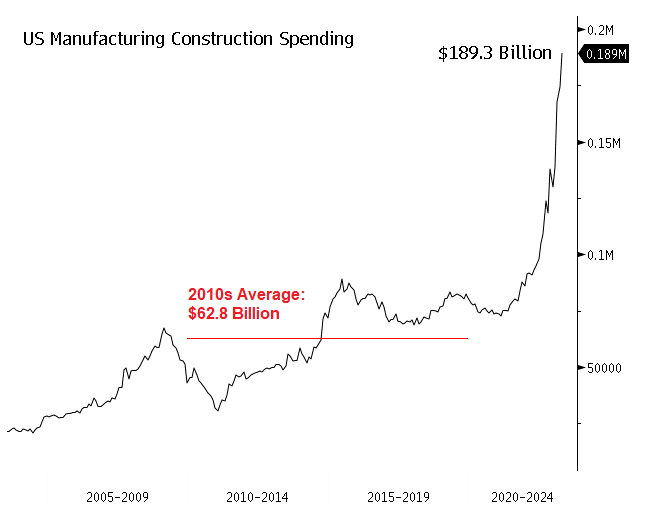

With substantial subsidies for high-tech EV plants and legislation to establish a domestic supply chain for batteries and critical materials, we are witnessing the early days of a U.S. manufacturing supercycle. Massive new investment is taking place in U.S. heavy industry (Figure 2), which is expected to significantly impact the economic landscape in the coming years. Both legislation (including the Inflation Reduction Act, Bipartisan Infrastructure Law, and CHIPS and Science Act) and pent-up demand are powering this investment surge. Foreign direct investment is also playing a role as global companies rush to establish a presence in the U.S. to secure future access.

The influx of capital into large-scale projects for manufacturing batteries, solar cells, semiconductors and more implies sustained demand for workers and raw materials, and reduces the likelihood of a recession. This trend is expected to continue well into the late 2020s. Manufacturing construction spending has tripled compared to the average rate of the 2010s, indicating the direct impact of U.S. industrial policy and its effect on the underlying strength of the U.S. economy.

The magnitude and duration of the new U.S. manufacturing boom is likely to significantly alter the macroeconomic landscape in the U.S.

The current boom in investment involves more significant capital outlays and has the potential to keep interest rates higher than pre-COVID pandemic levels. The new industrial facilities also tend to create high-wage jobs, which may contribute to upward pressure on wages across the economy but could also impact inflation. The magnitude and duration of this manufacturing boom will significantly alter the macroeconomic landscape in the U.S. in the coming years.

Figure 2. Taking Manufacturing Investment to a New Level (2005-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

China's Commodity Dominance Set to Decline

The 20-year era of China driving demand for metals such as copper, aluminum and iron ore has likely reached its peak. The U.S. and its partners will almost certainly dominate the future of metals demand as China grapples with challenges including deglobalization pressures, a declining population and escalating geopolitical issues. The China commodity supercycle, fueled by urbanization and industrialization, appears to be ending and a new commodity supercycle centered around energy transition and decarbonization is rising in the West.

Through extensive infrastructure development, China has been crucial in determining the shape of metals markets for the past two decades. However, China's sluggish economic recovery from the COVID pandemic suggests that it may lack the impetus to buoy global demand as it runs up against the limits of its highly leveraged system and transitions to a more service-oriented economy. In the coming decade, China may no longer provide the same tailwind intensity for metals demand. Instead, the U.S. and the European Union (EU) are likely to become the primary drivers of future metals demand. Evidence of this changing dynamic has already shown itself in the markets, with most metals experiencing price declines despite Beijing's abandonment of its Zero-COVID policy.

Updates on Critical Materials

Lithium: Price Rebound Slows in June

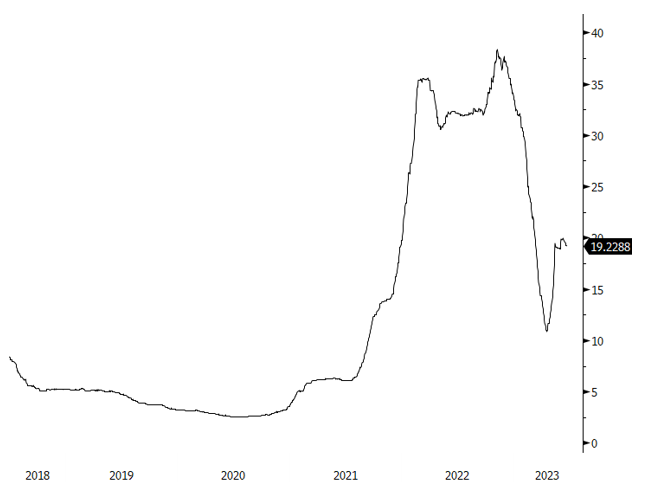

The lithium carbonate spot price8 rose 1.35% in June to $19.23 per pound, while lithium mining stocks jumped 8.22%. Lithium’s performance in June marked a slowdown in its recent rebound (Figure 3). The lithium carbonate spot price has been extremely volatile and is now ~78% above its April 25, 2023, low but ~50% below its November 14, 2022, high. Over a longer horizon, however, the lithium price is still many times higher than its historical levels.

At the start of the year, when the lithium spot price declined from its all-time high, EV sales were weak as China ended its decade-long EV subsidy at the end of 2022. This past month, China released a 520-billion-yuan (US$72.3 billion) package of tax breaks over four years for electric vehicles.18 These tax breaks, as much as ~$4,000 per EV, have helped improve market sentiment and inventory restocking.

China has been a dominant player in lithium markets, leading both the historical ramp-up in demand for lithium for EVs and, from the supply side, lithium processing. However, China is not the world leader in lithium extraction; at 15% of world mine production in 2022, it lags behind Australia (47%) and Chile (30%).19 Strategic partnerships are also becoming critical as the U.S. and EU move to reshore lithium supplies. For example, in June the EU began negotiations on a lithium deal with Chile, which boasts the world’s largest lithium reserves.20

China has also been making strategic investments to secure lithium supplies. For its own lithium extraction, China is counting on a different source of lithium production growth than the rest of the world: lepidolite, an abundant lithium-bearing mineral. At 4% of the 2022 lithium mine supply, lepidolite is a much smaller source of lithium than brine and spodumene, which each account for about half of the remaining lithium production. Lithium brines are underground accumulations of saline groundwater rich in dissolved lithium. Spodumene, like lepidolite, is lithium found in hard rock. Of the two, lepidolite has the lower lithium concentration.

The Chinese province of Yichun aims to quadruple its annual output to 350,000 metric tons of lithium carbonate equivalent by 2025, matching the total 2022 output from Australia, the world’s largest lithium producer.21 We believe this goal may be overly optimistic. In a piece titled “China’s Lithium Lepidolite Rush: Hype or Reality?” BloombergNEF notes that “the capital expenditure and production cost of lithium extraction from lepidolite ore are 50% higher than spodumene.” Given the potential technical challenges, we believe China’s lithium supply from lepidolite may fall short of its target.

Figure 3. Lithium Prices Take a Break (2018-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper: Inventories Tighten

The copper spot price rose 3.12% in June to $3.77 per pound, while stocks of copper miners jumped 10.15%. Copper has traded in line with swings in sentiment in the global macroeconomic environment.

Prior to June, the copper price had been hurt by weaker-than-expected data from China, disappointing those who expected China’s post-COVID reopening to boost copper demand. In June, investors started pricing in Chinese fiscal stimulus to combat this weak recovery and monetary stimulus when the People’s Bank of China reduced the rate on its one-year loan. These moves created a short-term tailwind for copper.

In the U.S., the copper price gained on the release of May’s inflation data, which measured 4.0% year-over-year based on the consumer price index, the smallest increase in two years. Copper prices benefited from the Fed's decision at its June meeting to leave interest rates unchanged, the Fed's first pause since it began raising rates in March 2022. However, Fed Chair Jerome Powell’s comments that additional rate hikes in 2023 could not be ruled out, weighed on the market.

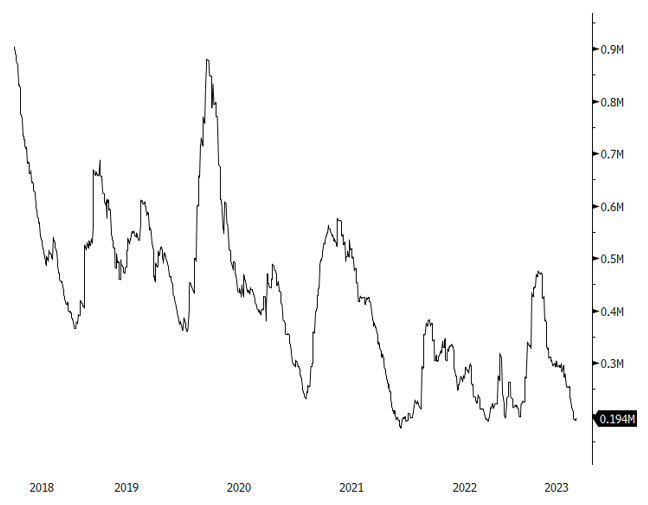

The recent weakness in the copper price has tightened the copper market. Copper inventories on exchanges (Figure 5) are at historic lows as downstream industries restock. Currently, these inventories cover less than three days of global demand. Limited inventories raise the risk of a sudden price increase if buyers make large drawdowns to secure supplies.

Figure 4. Copper Prices Track Macro Sentiment (2018-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 5. Copper Inventories Hit a Historic Low (2018-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Nickel: Selloff on Fed Fears

The nickel spot price fell 0.43% in June to $9.23 per pound, while stocks of nickel miners jumped 7.12%. Nickel followed a similar path as copper, appreciating in the first half of June due to China’s EV tax breaks and improved market and macro sentiment. That said, nickel sold off more vigorously than copper in the latter half of the month as investor sentiment turned negative on continued hawkish comments from the Fed.

As with copper, nickel inventories on exchanges are historically low (Figure 7), and currently, can cover just over five days of global demand.22 Nickel price volatility and low exchange inventories continue to be affected by the fallout from the nickel scandal last year on the London Metal Exchange.

Figure 6. Nickel Prices Rise then Fall (2018-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 7. Nickel Inventories Test the Bottom (2018-2023)

Source: Bloomberg. Data as of 6/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Critical Materials: June 30, 2023 Performance

| Metric | 6/30/2023 | 5/31/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 964.81 | 879.27 | 85.53 | 9.73% | 3.31% | June was a recovery month as 1) the weak China data in May has now led to speculation of future stimulus, and 2) U.S. data continues to strengthen, pushing out fears of recession later in the cycle. Overall, energy transition equities remain in a long-term bullish consolidation pattern. |

| Nasdaq Sprott Lithium Miners™ Index2 | 1,084.64 |

1,002.23 | 82.41 | 8.22% | 17.60% | |

| North Shore Global Uranium Mining Index3 | 2,578.76 | 2,307.58 | 271.18 | 11.75% | 6.26% | |

| Solactive Global Copper Miners Index4 | 139.49 | 126.64 | 12.85 | 10.15% | 7.06% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 848.34 | 791.96 | 56.38 | 7.12% | (6.78)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 949.30 | 872.95 | 76.35 | 8.75% | 10.59% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 1,021.54 | 858.96 | 162.58 | 18.93% | (0.47)% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 19.23 | 18.97 | 0.26 | 1.35% | (43.71)% | Price rebounding, but decelerating |

| U3O8 Uranium Spot Price $/lb9 | 56.02 | 54.59 | 1.43 | 2.61% | 15.95% | Continues to outperform other metals |

| LME Copper Spot Price $/lb10 | 3.77 | 3.66 | 0.11 | 3.12% | (0.51)% | Modest appreciation; inventories very low |

| LME Nickel Spot Price $/lb11 | 9.23 | 9.27 | (0.04) | (0.43)% | (31.92)% | Volatile month; inventories very low |

| Benchmarks | ||||||

| S&P 500 TR Index12 | 4,450.38 | 4,179.83 | 270.55 | 6.47% | 15.91% | U.S. equities markets continued to rise as FOMO has taken over. Covering of hedges and right tail option purchases has resulted in a remarkable squeeze up, lifting sentiment. |

| DXY US Dollar Index13 | 102.91 | 104.33 | (1.41) | (1.36)% | (0.59)% | |

| Bloomberg Commodity Index14 | 101.48 | 97.96 | 3.51 | 3.59% | (10.04)% | |

| S&P Metals & Mining Select Industry TR Index15 | 2,602.45 | 2,273.29 | 329.16 | 14.48% | 1.99% | |

Source: Bloomberg and Sprott Asset Management LP. Data as of June 30, 2023.

Past performance is no guarantee of future results. You cannot invest directly in an index.

- For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | "Balkanization" was first used in the nineteenth century to refer to Russia's approach to the division of larger states into smaller ones. Today, it is used to refer to the fragmentation of a larger region or state into smaller regions or states, which may be hostile or uncooperative with one another. |

| 17 | Bloomberg, “US Battery Belt Grows With $1 Billion Kentucky Cathode Deal”, June 7, 2023. |

| 18 | Reuters, “China unveils $72 billion tax break for EVs, other green cars to spur demand”, June 21, 2023. |

| 19 | U.S. Geological Survey, Mineral Commodity Summaries on Lithium, January 2023. |

| 20 | Reuters, “EU and Chile to develop lithium and green hydrogen projects”, June 14, 2023. |

| 21 | Mining.com, “In China’s lithium hub, mining boom comes at a cost”, June 15, 2023 |

| 22 | Source: Nornickel 31 May 2023 Press Release. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.