- View Critical Materials October 2023 Performance Table

-

For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- As the transition to clean energy advances, the U.S. is shifting the focus of its energy security efforts away from oil and toward critical minerals.

- This transition is expected to curb the country’s oil dependency and mitigate the impact of oil geopolitics and the influence of petrostates like Russia.

- Critical minerals are less of a fundamental risk to energy security than oil, but they have their challenges.

- The U.S. is moving to reshore and friendshore critical mineral supplies, speed up the development of mineral resources closer to home and bolster its domestic mining industry.

- The Nasdaq Sprott Energy Transition Materials Index declined sharply in October as it came under pressure from elevated bond yields, a strong U.S. dollar, weakness in China and the Israel-Hamas war.

October in Review

The Sprott Nasdaq Energy Transition Materials Index (NSETM) sharply declined in October, falling 11.21% to close the month at 873.22. Few resource commodity-related industries (excluding gold, a safe haven precious metal) performed well. The resource group has been under pressure for most of the year from the unrelenting rise in bond yields, a persistently strong U.S. dollar, weak economic data and credit stress from China. However, the Israel-Hamas war, with its threat of further regional conflagration, catalyzed a wave of risk-off selling in virtually all asset classes. Spot uranium was among the few non-precious metal commodities to post a positive month. Most equity groups in energy transition and natural resources declined.

Critical minerals are essential components in the transition to clean energy.

After its unrelenting climb into the summer, the equity market — as measured by the S&P 500 Index — declined three months in a row through the end of October, with an 8.61% drawdown from the July 31 peak. The rise in long-dated bond yields was a primary driver of the risk-off environment. Until early summer, these rising yields were attributed to increasing growth expectations. Since then, they have been attributed to a rising "term premium" — the additional yield needed to compensate for the risk of holding long-duration bonds. In addition to raising borrowing costs and slowing economic growth, a high term premium will likely tighten financial conditions and pressure asset prices.

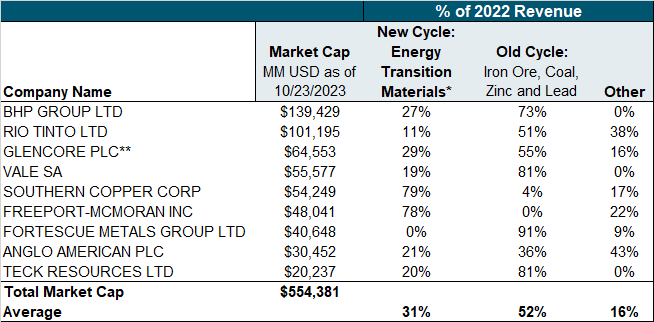

Figure 1. Nasdaq Sprott Energy Transition Materials Index Falls, Remains in Consolidation Phase (2018-2023)

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index (2018-2023). Data as of 10/31/2023. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Included for illustrative purposes only. Past performance is no guarantee of future results.

Energy Security: Focus Shifts from Oil to Critical Minerals

The U.S. transition to clean energy promises to curb its traditional reliance on oil and mitigate the impact of oil geopolitics and the influence of petrostates like Russia. However, as the U.S. shifts its focus toward clean energy, critical minerals and mining will present their own challenges.

Over the past three decades, U.S. dependence on imported minerals has grown.

Import dependence on critical minerals entails significant risks, but they fall far short of the risks of historical oil dependence. Minerals and batteries are inputs for manufactured goods, not energy flows that power the economy and our daily lives. Supply chain disruptions for minerals and batteries could cause bottlenecks and price spikes in solar panels and electric vehicles, but they would not halt the ability to drive cars or provide lighting and heating to homes. Nonetheless, as the U.S. progresses on its energy transition journey, critical mineral security is poised to be the new focal point of energy security.

Critical Minerals: Not So Rare but Widely Dispersed

Critical minerals are essential components in the transition to clean energy. As defined by the U.S. Energy Act of 2020, these minerals are crucial for the U.S. economy and national security. They are characterized by vulnerable supply chains and indispensable manufacturing roles. Despite often inaccurately being described as "rare," most critical minerals needed for the energy transition are relatively abundant. The deposits of many critical minerals are also far more geographically dispersed than oil deposits. For example, over 80% of the world's oil reserves are in OPEC countries, whereas roughly 80% of lithium reserves are in democratic states.

The distinction between critical minerals lies mainly in their state of development and resource classification. There are three levels of resource classification: inferred (estimated with a low level of confidence), indicated (sampled and estimated with greater confidence) and measured (estimated with a high degree of confidence).

Decades of Underinvestment

Over the past three decades, U.S. dependence on imported minerals has grown. The country has glaringly underinvested in critical minerals while its need for greater quantities and a wider variety of minerals has grown. This underinvestment has several roots, including environmental concerns, escalating labor costs and diminishing economies of scale in domestic mineral production. In fact, since the 1950s, the U.S. has consistently scaled back its domestic capabilities in mineral extraction and related industries. Instead, it has turned to mineral-rich countries like China, Brazil, Mexico, Canada, South Africa, Indonesia and Australia. As a result, it is vulnerable to disruptions in the global supply chain.

China sits at the top of the critical minerals supply chain. Over the decades, China has firmly established its preeminence in the global mineral market. It has made substantial investments in mineral exploration, extraction and refining and has emerged as the leader in mineral processing. This overarching control is more than an economic interest; it has implications for geopolitics and global economic stability. China's dominance has the potential to create disruptions — particularly in critical sectors like green technologies — and pose a threat to U.S. national security.

The United States’ vulnerability becomes even more acute when considering future demand for critical minerals. The International Energy Agency estimates that achieving a net-zero emissions target by 2050 would require a staggering sixfold surge in the global supply of critical minerals. While technological innovation might reduce this need somewhat, this timeline poses a formidable challenge.

Building Resilience and Countering China

Without significant changes to the global supply chain, the U.S. would simply exchange its former oil insecurity for insecurity in energy transition minerals. There is a growing bipartisan consensus that the U.S. needs to build resilience and counter China's influence.

One example is the U.S. Minerals Security Partnership24, a collaboration between 13 countries and the European Union. Its goal is to identify and develop large-scale critical mineral projects along the value chain. The partnership has shortlisted 15 projects encompassing mining, processing and recycling critical minerals. The projects are geographically diverse, spanning Africa, Europe, Latin America and Asia.

However, the question remains: Can the U.S. and its allies secure enough critical minerals for their needs? One study by the Net Zero Industrial Policy Lab at Johns Hopkins University25 found that with significant technological and financial cooperation, democratic states could produce enough minerals to achieve global warming targets set by the Paris Agreement. The study identified potential shortfalls in key minerals like copper, lithium and nickel, and emphasized the need for a coordinated approach. The study also pointed out limitations, such as a focus on mineral reserves rather than broader resources. Despite this, it makes a strong case for a joint industrial strategy by the U.S. and its partners to mitigate challenges and risks.

Reshoring and Friendshoring

The supply of critical minerals can be increased and diversified more quickly than oil. Moreover, as deglobalization leads to a multipolar model, supply chains are becoming more region-centric, leading to reshoring or friendshoring rather than wide global dispersion. These closer arrangements are also better for sustainability because they make it easier to ensure adherence to ESG standards and create shorter supply chain routes that may reduce the environmental impact of transportation.

U.S. policymakers are championing reshoring efforts as they aim for self-reliance in critical minerals. They are backing these initiatives with various measures, including tax incentives, subsidies and simplified regulations to stimulate domestic mining activities.

At the same time, the U.S. permitting process remains a notable hurdle. It is more time-consuming than in many other countries and often results in lengthy litigation. Streamlining this process is key to accelerating the reshoring agenda and enhancing U.S. mineral security.

Environmental reviews have long been a bottleneck, according to the National Environmental Policy Act (NEPA), causing delays in mineral extraction and infrastructure projects. The U.S. Fiscal Responsibility Act of 2023 aims to tackle this issue by imposing deadlines on environmental reviews of two years for environmental impact statements and one year for environmental assessments. Previously, the U.S. took an average of 7-10 years to issue permits, while countries like Canada and Australia did the same in about two years. The protracted process has delayed projects and significantly eroded their economic value (via the number of years discounted in an NPV calculation). By expediting the permitting process, the Fiscal Responsibility Act lays a strong foundation for enhancing domestic mineral production and reducing import dependency.

U.S. Miners’ Challenges

The U.S. mining sector also faces various critical obstacles to its long-term viability and competitiveness. The U.S. Geological Survey (USGS) highlights that the United States has insufficient reserves for nearly half of its 50 key minerals, even though it has ample supplies of specific resources like copper and rare earths. This shortfall highlights an urgent need to expand exploration and extraction activities for critical minerals.

Additionally, the industry is short of qualified workers and needs to invest in workforce development and training programs to fill the gap. It also faces challenges like declining ore quality and the requirement for social licenses for community approval of projects. Streamlining the permit process could lead to faster project execution and industry growth. Encouragingly, an uptick in investments and policy initiatives is already occurring as U.S. government agencies and private entities announce significant capital investments in the critical minerals sector.

Mineral Supercycle Moves Away from China

The mining industry is undergoing a transformative shift as it transitions from a China-led commodity supercycle focused on industrialization and urbanization to a new cycle driven by the global transition toward renewable energy sources.

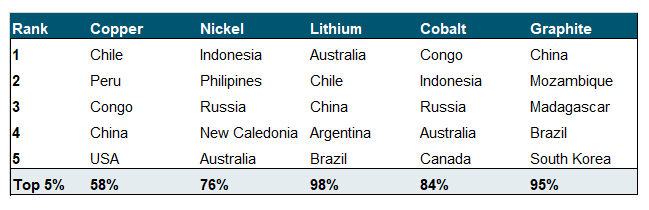

In Figure 6, we show the 2022 revenues of the top nine diversified mining companies by market capitalization and the proportion of their sales exposed to the new energy transition cycle versus the old China-led cycle. Approximately 31% of these companies’ 2022 revenues was derived from nine energy transition metals (uranium, lithium, nickel, cobalt, graphite, manganese, silver and rare earths) compared to about 52% from old cycle metals (iron ore, coal, lead and zinc). All these companies claim they are aiming for more exposure to energy transition minerals.

History suggests the mining industry will see an M&A cycle for energy transition metals in the years ahead. It will be difficult to scale up organically to meet the expected demand. Current prices are not high enough to incentivize new development. Mining companies are usually reactive rather than proactive in meeting industry demand because of the substantial lead times and capital required. Given the current urgency, large mining firms are more likely to acquire existing operations than start new mines.

Figure 6. China Losing Commodity Clout

Source: Bloomberg and company financial statements as of 10/31/2023.

*Includes copper, uranium, lithium, nickel, cobalt, graphite, manganese, rare earths and silver

**Excludes marketing revenues

Bringing Dependencies Closer to Home

For most critical minerals, production is dominated by a handful of key countries. In Figure 7, we show these concentrations. This make it clear why the U.S. is so determined to reshore or friendshore critical mineral production closer to North America. Even then, some countries have imposed roadblocks, such as Chile and Peru for copper and Chile for lithium. Additionally, some countries lack the necessary free trade agreements with the U.S. and the EU.

Figure 7. Global Top 5 Countries in Critical Minerals Production

Source: USGS, United States Geological Survey. Data available as of 10/31/2023.

Today, there is also a growing trend of resource nationalism fueled by deglobalization. Countries are increasingly focusing on their long-term strategic interests in critical minerals rather than seeking short-term profits. This shift could lead to more export restrictions. Acknowledging the national security implications, the U.S. and EU are streamlining environmental permitting processes and offering financial incentives to speed up development.

Based on stock price indications, investors seem to undervalue mines located in favorable jurisdictions despite their strategic importance. This trend was also evident in the early to mid-2000s, which saw a surge in big mining mergers and acquisitions, especially in 2006. (We discussed this in greater detail in our April 2023 Energy Transition Commentary.)

Updates on Critical Materials

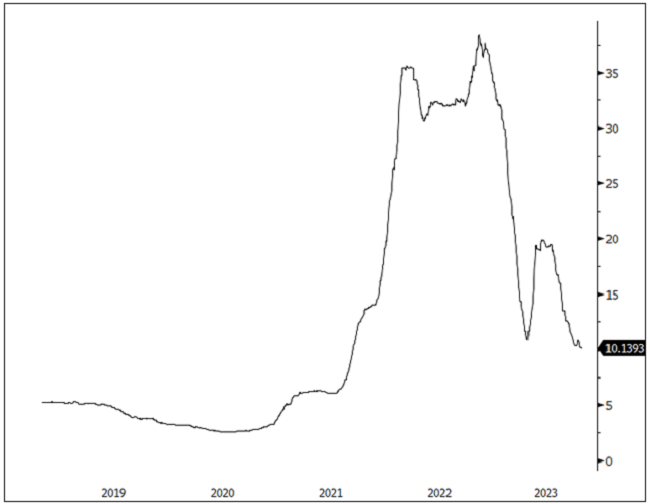

Lithium: Slowing EV Sales Weigh on Prices

The lithium carbonate spot price slowed its descent in October, falling 1.91% to $10.14 per pound (see Figure 2) — a small decline compared to its 17.79% drop in September. Electric vehicle (EV) sales are the main driving force in lithium markets, and recent activity has not met expectations. In October, Tesla released poor Q3 earnings, and commentaries by GM, Mercedes-Benz and other EV makers have shown a weaker-than-expected market. This slowdown in the downstream lithium sector coincided with the fourth quarter, which in the past has exhibited seasonally high demand and encouraged refiners to restock inventories, thereby increasing demand for lithium. However, this dynamic has been absent in 2023, pressuring the market.

We believe M&A may continue to provide a tailwind in the lithium mining space, especially given recent price weakness.

Notably, the weakness in demand is relative to expectations rather than absolute. EV sales in 2022 were over 10 million vehicles, a level five times that of 2019. Further, despite the recent weakness, EV sales for 2023 are forecast at 14 million vehicles.16 This level puts 23 countries at the 5% adoption rate for electric vehicles.17 This rate is considered a tipping point for a technology’s penetration of its overall market as it moves along an “S” curve from early adopters to early majority.

In October, stocks of lithium miners fell by 21.06% as the softer lithium price and negative EV sentiment weighed on the market. Continuing weakness in China (the world’s largest lithium consumer), high interest rates and other macroeconomic factors combined to pressure equities and capital-intensive sectors. Although the fall in the lithium spot price has reduced miners’ margins, they are still profitable at current prices. An S&P Global Market Intelligence analysis released in October showed that current margins are still high enough to incentivize lithium miners' pipeline projects.18 A lower-than-current spot price of $15,000 per tonne for lithium carbonate, or $6.80 per pound, results in a payback period of five years or less for 80% of the projects analyzed. This five-year payback period is considered typical in the mining industry and puts recent price decreases into context. The reality is, however, that prices are still much higher than historical levels.

Mergers and acquisitions (M&A) continued to be a driving force in lithium mining. Albemarle Corporation — the largest lithium producer in 2022 — abandoned its proposed $4.2 billion takeover of Australian lithium miner Liontown Resources.19 Australia’s richest woman, Gina Rinehart, built up a blocking minority, prompting Albemarle to walk away from the deal due to “the growing complexities associated with executing the transaction,” which tanked Liontown’s stock price. Another Australian miner of lithium and nickel, Azure Minerals, received a $1 billion takeover offer from Sociedad Quimica y Minera de Chile SA (SQM),20 representing a 44% premium to the stock price. SQM was 2022’s second-largest lithium producer. Azure agreed to the offer, but Gina Rinehart has also built an 18.3% stake in Azure, and there is speculation that she may also attempt to block this takeover. Azure’s stock price outperformed significantly in October.

In addition, Codelco — the world’s largest copper producer, which the Chilean state has chosen to lead the country’s lithium development — agreed to buy Lithium Power International Ltd. for $245 million, representing a 119% premium to the stock price.21 Finally, Tecpetrol Internacional S.L. acquired Alpha Lithium Corporation for C$241 million, a 13% premium.22

We believe M&A may continue to provide a tailwind in the lithium mining space, especially given recent price weakness. A continued deal flow will showcase the stronger long-term outlook for industry’s leaders.

Source: Bloomberg. Lithium carbonate spot price, $/lb, 2018-2023. Data as of 10/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper: Macro Fears Cause Market Headwinds

The copper spot price fell 2.23% to $3.64 per pound in September (see Figure 3), and shares of copper miners dropped 10.25%. Copper is the third-largest metals market behind iron ore and gold, with a very diverse demand segment profile that spans construction, electronics, electric vehicles, renewables and beyond. Given the large market and diverse demand profile, the copper spot price is a barometer of the global economy. The market dynamics we noted earlier — including an unrelenting rise in bond yields, a persistent strong U.S. dollar, weak economic data and credit stress from China — have also been headwinds for this market.

The copper spot price is a barometer of the global economy.

The copper price is still at a level that provides healthy profitability to most major producers. However, many copper miners say that profitability is not high enough to incentivize major new copper mines that require billions of dollars of investment. This is a problem because demand for copper is set to increase significantly due to its intensive use in the global energy transition (e.g., for electricity grids, EVs, solar panels and more).

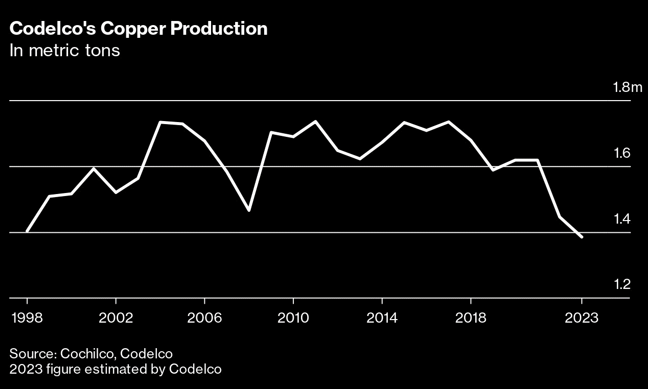

Disruptions in the current copper supply are exacerbating the situation. Production from Chilean state-owned copper miner Codelco is at a 25-year low (despite recently posting better-than-expected 2023 copper production numbers23 as shown in Figure 4). Panama’s Congress passed a bill to cancel a production agreement between Canada’s First Quantum Minerals and Panamanian copper mine Cobre Panama. Cobre Panama started production in 2019, cost $6.8 billion to build and accounts for around 1.5% of global copper production. Panama’s president also signed a moratorium on new mining projects. First Quantum’s contract remains at risk and is currently being reviewed by Panama’s Supreme Court.

At the same time, ore grades are declining industrywide, there is a dearth of major new copper discoveries and lead times from discovery to first production stretch out more than 16 years. All these factors highlight the vulnerability of the copper production supply chain and the likelihood that supply deficits may ultimately bolster the copper spot price.

Figure 3. Copper Slips on Economic Concerns (2018-2023)

Source: Bloomberg. Copper spot price, $/lb, 2018-2023. Data as of 10/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 4. Less Copper from World’s Biggest Producer

Source: Bloomberg. Codelco copper production in million metric tons. Data as of 10/26/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Nickel: Short-Term Factors Pressure Prices

The nickel spot price fell 2.91% in October (see Figure 5), and shares of nickel miners fell 10.86%. Currently, nickel’s demand comes mainly from stainless steel. However, lithium-ion batteries for EVs are the most significant demand growth driver because nickel is a critical mineral for NMC cathodes (nickel, manganese and cobalt oxides used in lithium-ion batteries). The demand for nickel from stainless steel producers lends cyclicality to its price. Like copper, nickel was negatively affected by macroeconomic developments. Further, like lithium, nickel was hurt in the short term by recent weakness in EVs.

In the long term, nickel demand is expected to grow significantly due to its use in NMC cathodes. Nickel-intensive cathodes are gaining traction because adding nickel to batteries provides greater energy density and increases an EV’s driving range. As global demand for EVs grows, nickel supply is unlikely to keep up with demand, even as additional supply comes online from Indonesia. A major factor in this supply-demand imbalance is that Russia is a significant nickel producer — including the Class 1 nickel needed for lithium-ion batteries — and is likely to remain under economic sanctions for quite some time.

Figure 5. Nickel Price Weakens Slightly (2018-2023)

Source: Bloomberg. Nickel spot price, $/lb. 2018-2023. Data as of 10/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Critical Materials: October 31, 2023 Performance

| Metric | 10/31/2023 | 9/30/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 873.22 | 983.45 | (110.23) | (11.21)% | (6.50)% |

Middle East tensions accelerated the risk-off environment further in Oct. A strong USD, scorching yields, a very weak China had the resource group under pressure, but the Israel-Hamas war has spiked equity and bond volatility measures, resulting in an across-the-board selling and liquidation. |

| Nasdaq Sprott Lithium Miners™ Index2 | 663.11 | 840.04 | (176.94) | (21.06)% | (28.10)% | |

| North Shore Global Uranium Mining Index3 | 3,515.70 | 3,655.66 | (139.96) | (3.83)% | 44.86% | |

| Solactive Global Copper Miners Index4 | 122.63 | 136.63 | (14.00) | (10.25)% | (5.88)% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 674.65 | 756.80 | (82.16) | (10.86)% | (25.87)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 815.81 | 888.26 | (72.45) | (8.16)% | (4.96)% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 1,362.74 | 1,426.96 | (64.22) | (4.50)% | 32.77% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 10.14 | 10.33 | (0.20) | (1.91)% | (70.33)% | See above. |

| U3O8 Uranium Spot Price $/lb9 | 74.48 | 73.38 | 1.11 | 1.51% | 54.16% | |

| LME Copper Spot Price $/lb10 | 3.64 | 3.73 | (0.08) | (2.23)% | (4.01)% | |

| LME Nickel Spot Price $/lb11 | 8.12 | 8.36 | (0.24) | (2.91)% | (40.10)% | |

| Benchmarks | ||||||

| S&P 500 TR Index12 | 4,193.80 | 4,288.05 | (94.25) | (2.20)% | 9.23% |

October was a continuation of rising USD and yields and increased concerns of debt issuance, deficits, fiscal policies, etc., but with now the added geopolitical risk brought on by the Israel-Hamas War and its potential to escalate. |

| 106.66 | 106.17 | 0.49 | 0.46% | 3.03% | ||

| BBG Commodity Index14 | 104.62 | 104.84 | (0.22) | (0.21)% | (7.26)% | |

| S&P Metals & Mining Select Industry TR Index15 | 2,532.85 | 2,687.99 | (155.14) | (5.77)% | (0.73)% | |

Source: Bloomberg and Sprott Asset Management LP. Data as of 10/31/2023.

Past performance is no guarantee of future results. Included for illustrative purposes only. You cannot invest directly in an index.

- For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | International Energy Agency. “World Energy Outlook 2023” |

| 17 | BNN Bloomberg. August 28, 2023. “Electric Cars Pass a Crucial Tipping Point in 23 Countries” |

| 18 | S&P Global Research. |

| 19 | BNN Bloomberg. October 15, 2023. “Lithium Giant Albemarle Abandons $4.2 Billion Liontown Deal” |

| 20 | Mining.com. |

| 21 | BNN Bloomberg. October 18, 2023. “Codelco Makes First Lithium Acquisition With Australian Deal” |

| 22 | Cision (Press Release). November 2, 2023. “TECPETROL AND ALPHA LITHIUM ANNOUNCE SUBSEQUENT ACQUISITION TRANSACTION AND COMPLETION OF OFFER” |

| 23 | BNN Bloomberg. July 28, 2023. Codelco Lowers Copper Output Guidance as Chile Mining Woes Worsen” |

| 24 | U.S. Department of State. “Mineral Security Partnership” |

| 25 | Carnegie Endowment. May 3, 2023. “Friendshoring Critical Minerals: What Could the U.S. and Its Partners Produce?” |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.