August 8, 2024 | 25 mins 41 secs

Chief Investment Officer Maria Smirnova talks silver with Mark Bunting of Red Cloud Financial Services, RCTV LIVE. Maria takes a deep dive into what is providing support for silver in 2024, which is up 21.90% as of July 31, 2024.

Video Transcript

Mark Bunting: Hello and welcome to this live CORE Conversation brought to you by Red Cloud Financial. I'm your host, Mark Bunting, the host of RCTV. This is the third of five Live Core conversations we've been doing. This is where we talk to thought leaders in the mining sector about various aspects of commodities and mining, and we learn a lot. Today, we're going to be talking about silver. Let's bring our guest in straight away: Maria Smirnova. She is the Senior Portfolio Manager and Chief Investment Officer at Sprott Asset Management. Maria, thanks for joining us today.

Maria Smirnova: Hi, Mark. Hello, everyone. Thank you for having me on this platform.

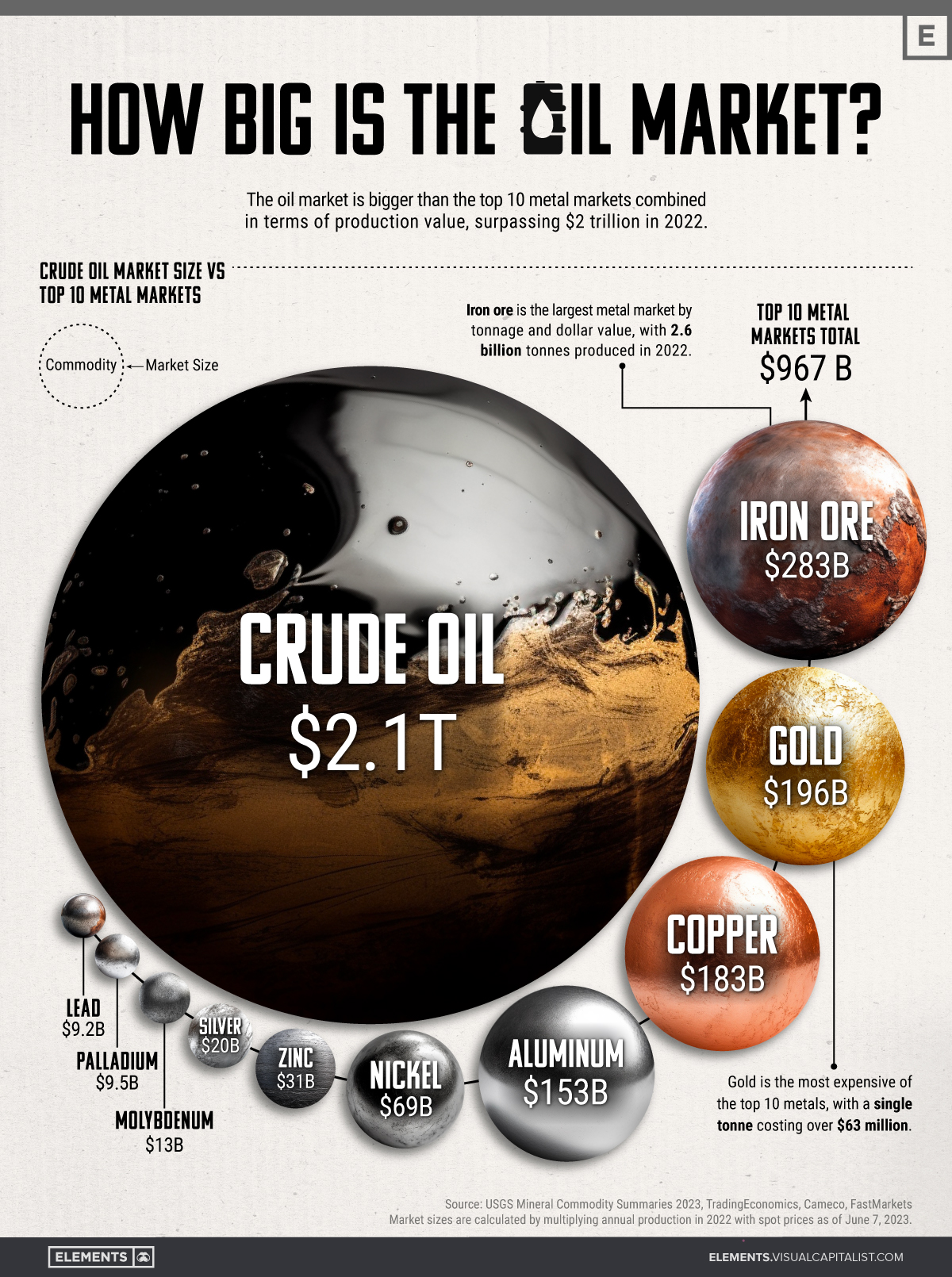

Mark Bunting: Absolutely, we're looking forward to this. As I ask my first question, we're going to bring up a graphic here. This is from Visual Capitalist. I think it came out about a year ago, but it shows you the relative size of the silver market.

Look in the lower left of the image. You'll see that the silver market, by this measure, is bigger than the likes of lead, molybdenum, and palladium, but then on the upper right, you see it's much smaller than copper, and the gold market, nickel, and other metals as well. Maria, to kick things off here, can you remind us about the relative size of the silver market and how that can be advantageous and sometimes a disadvantage?

Source: Visual Capitalist. Data as of 12/31/2023.

Maria Smirnova: This is a great place to start, Mark. As you saw on the graphic, the silver market is relatively small. The physical market in silver annually is about a billion ounces. Demand has been exceeding supply. Depending on what side of the equation you look at, it's between one and 1.2 billion ounces. When silver trades at about $27, $28, you can do the math easily; it's about a $30 billion market. It's not a big market by any stretch of the imagination, especially when you look at other metals such as copper and gold, et cetera.

China has been increasingly active in the silver market because of the solar sector's industrial use, and it has been consuming more silver.

Like you said, Mark, there are pros and cons. Most importantly, I would say that it's easier to push the price around. That is why silver is more volatile than gold, for example. We'll get into the supply-demand fundamentals for silver. It also means silver is harder to find; therefore, it is a precious metal with gold, platinum and palladium. It does have its pros and cons, but here we are to talk about the cons of the metal going forward.

Mark Bunting: It's a precious metal with industrial uses. On a day-to-day basis, is it possible to gauge why the price is moving? How much is industrial demand? How much is speculation and investing in silver, just in and of itself?

Maria Smirnova: Unfortunately, getting day-to-day information on many metrics isn't easy, particularly on the industrial side. We get supply-demand numbers from Silver Institute several times a year. Outside of that, we must use other indicators to see what's happening. On the industrial side, we can look at things like PMIS,1 manufacturing activity, and any indicator that tells us about manufacturing activity worldwide, especially in China.

China has been increasingly active in the silver market because of the solar sector's industrial use, and it has been consuming more silver. One frequent indicator is trading activity in Shanghai for silver. We can see what's happening and what traders are doing in Shanghai.

On the investment side, we can also look at coin sales to gauge investor demand. We can look at ETF information, which is more readily available. However, things like jewelry consumption are a little more challenging to get data on. But there are some indicators we can look to for sure.

Mark Bunting: We’ll get back to some of the facts and figures you mentioned regarding supply and demand. I want to ask you: we know that part of the gold narrative is the U.S. debt and deficit and the U.S. dollar being devalued, so gold looks attractive as a store of value. Does the same pertain to silver? Can it be a hedge against inflation, as some people believe, or not necessarily?

Maria Smirnova: You bring up a great point. Gold is consumed in investment and investment-like uses, such as jewelry, bars and coins, ETFs, et cetera. Of course, silver and gold are some of the world's oldest currencies. I don't even like to call them commodities. These metals are currencies in my mind because that's their roots and history.

Gold is tied to anything you think about investing. Again, some of the recent drivers for gold, a big driver for gold demand, have been central banks and central banks buying physical gold, especially China, other developing countries, countries in the Middle East, et cetera. Silver is a metal of two heads, as we've touched on already. It has its dynamics.

However, I would argue that the investment side of silver also tends to correlate to gold. Again, we look at things like ETF sales and bar and coin sales, which are very important silver factors. I think our outlook right now from a macroeconomic point of view is that we believe the slowdown we're seeing in the US and other Western countries will continue.

We can argue about a soft or hard landing. We do think the Fed will finally pivot and start reducing rates. I think that brings a very positive view of silver and gold. I do believe that gold will benefit from the macro drivers.

Mark Bunting: Maria, you said that investors don't generally realize the impact of the fact that there is a lot of demand for silver now from the electric vehicle market, solar and wind, which you touched on. Can you give us a sense of the incremental demand from the greener economy? Do you think investors are starting to pick up on that now?

Maria Smirnova: I think that is coming finally. It's frustrating that silver doesn't seem to be on any of the country's critical minerals lists. For example, it's not on Canada's critical minerals lists. It's not on the U.S. critical minerals list. That is frustrating because, to me, silver is a critical mineral. After all, as you said, it is used in solar, electric vehicles, and anything else. Silver is used in anything electric because of its wonderful electricity conductivity properties. Some numbers for example, of course, the biggest one is solar, like we said.

As of last year, solar energy represents about 200 million ounces of consumption. Again, remember that the supply of silver is one billion ounces, meaning 20% of the supply went directly into solar use. I would say that is very significant.

In the future, predictions are that solar panel installations will continue to grow. Some of the newer technologies in solar, by the way, the panels use more silver than the old technologies, which will contribute to the growth in the solar space. We would predict that the solar that 20% will only continue to grow.

Then, you add electric vehicles. That usage right now is not very big. I'd say it's about 5% of the market, but projections show it can grow. Interestingly, electric vehicles have higher silver loadings than internal combustion engines, and the reason is, again, anything electric, anything requiring conducting electricity and any automated components. Automation plays a big part in increasing silver loadings as well.

The third area, of course, is 5G networks. We've also written about this: your phones are going from 3G to 5G to 7G. Again, it will require more silver. Again, it's a smaller component, but it's just demonstrating that these kinds of uses will contribute to the growth of the silver demand.

Mark Bunting: All of those areas you mentioned are buttressing demand for silver, and there are new pillars for silver in terms of demand over the past several years. Overall, how would you characterize a silver demand equation right now?

Maria Smirnova: I think the industrial side is gaining ground for sure. In the past, I would say that industrial demand was the backbone of silver demand. Then, the investment side provides that torque because investment demand is much more volatile from year to year. Sometimes we have investors interested in the metal, and sometimes we don't. Those numbers swing up and down.

Recently, we've had outflows from ETFs, illustrating that Western investors have no interest in silver. We're still waiting for a turn in that, but I think, like I said, it is coming with a different economic outlook. I've mentioned that China has been playing a bigger and bigger part of the market. That dynamic is there, but I think as solar is growing, as this electric stuff is growing, industrial demand will contribute more, more than 50 and 60%.

That backbone will be increasingly important and stabilize the price of silver. If you want me to get into the supply of silver, that's a different conversation. What we've seen is a stagnation of supply. We've not increased the supply of silver annually in about ten years, which is why we're seeing deficits in the market. As demand continues to grow, the fundamental demand will have a bigger and bigger shortage of silver annually.

Mark Bunting: That's very interesting. Maria, regarding the price, one can argue that silver has kept pace with gold for the last five years or so. But when you look at the gold-silver ratio, and to backtrack here, we know that silver makes up about 16:1 in terms of how it's found in the Earth's crust, and yet the gold-silver ratio was in the high '80s last time we took a look. If you X out the pandemic, that's the highest level for that ratio going back to the early '90s and even the Second World War.

Are there any explanations for why the gold-silver ratio remains at that level? What will it take for it to come lower? Because it has been much lower over the years.

Maria Smirnova: Yeah. I'm not sure why it's not gone back to 16:1, but it has fluctuated to your point between about 40:1 and as high as 120:1, just before COVID. It hit 120:1. That's when everyone wrote silver off. I think one of the reasons is that until recently, we had a lot of silver inventories. It is now, though, that we're seeing silver inventories on the exchanges, such as the LBMA in London, dwindle. We've lost over 450, nearly 500 million ounces out of inventories in the last two or three years. That is very significant to me, and it's happening because we've been in deficit.

That's something that we need to continue to see for the price of silver to take off and catch up with gold. Again, if we're seeing some negative industrial news, not industrial but economic news, indicating a slowdown in industry, that will negatively impact silver, and that's what's happened very recently. But in the longer term, I think the fundamentals for silver, the demand-supply fundamentals, I should say, for silver, are solid. As we chew through the inventories, I think that that ratio will decline, and silver will gain ground versus gold.

Mark Bunting: Silver Bulls love to talk about the big run-up in '79, '80 when the Hunt Brothers tried to corner the market and the big run-up in 2011. Often, they'll say, "Oh, a big explosive run is coming soon." We hear about $300 silver. Let's start with $50 an ounce, and then we can talk about $300.

The CEO of Dolly Varden pointed this out to me: if you X out those big spikes going back to 1980, silver has just slowly but steadily risen. What should investors look for when investing in physical silver and/or silver companies? Is that slow and steady growth? If you get an explosive run, great, but don't expect that to be right around the corner all the time.

Maria Smirnova: I don't like anyone cornering the market. It's tough when the market and the price can be so volatile. People get excited, and then they get let down. If anything, that turns investors away because they don't like that volatility.

I also would say that silver right now, as we've discussed, is significantly undervalued compared to gold. I don't want silver to act just like an inflation hedge in the sense that it just protects your devaluation of the fiat currency that you have. I do like the silver to gain ground because it has great attributes and good fundamentals to do so somewhere, I guess, between those two.

Mark Bunting: Regarding silver companies, you said Sprott's sweet spot is in the small to mid-size silver companies. Is there something about larger producers, developers or explorers that aren't as appealing as the small to mid-cap type companies?

Maria Smirnova: I think when you say explorer and developer, by definition, these are the smaller companies. I'm on board with Mark Bristol on what excites me, and I've said this for a long time. Exploration is the bloodline of this industry. For mining, we need to explore this to not only maintain production but also increase production. I'm a big believer in exploration, and that's where the small companies come in, right? They raise money to drill, explore, and find ounces. There have been some success stories recently in the silver space with discoveries, coming up with good-size resources and putting mines into production. I love seeing those success stories in mining, and I just hope that that continues.

As I said earlier, the interesting part about the silver mine supply is it's been flat to down in the last ten years. The Silver Institute projects a decline of about 1% in supply this year. We're coming out of a COVID low when mines were shutting down. We are expecting an increase in supply, and yet we're just not seeing it a reaction that we were, I guess, hoping for.

Now, the flip side of that goes back to the deficits I've discussed and a continuation of those deficits. It should be good for the price of silver in the longer term.

Mark Bunting: In terms of portfolio construction, if an investor is looking to either augment what they have already in terms of silver assets or maybe start to nibble away and create a portfolio for themselves. I'm sure you're familiar with Peter Krauth, who wrote The Great Silver Bull. We've talked to him a few times. He recommends that investors have a diversified portfolio of about 10% physical and 50% ETFs, royalty and streaming companies, large producers, 20% growing producers and developers, and 20% explorers. Does that sound like a reasonable mix? Would you be more concentrated in other areas?

Maria Smirnova: I read Peter's book and found it an excellent summary of the silver market. I am not an investment advisor, and I'm not allowed to make recommendations regarding portfolio allocation. Every investor has their objectives, different age groups, etc.

As an investor, you must be comfortable with volatility and pick your point of view, which will be less volatile, and stocks will be more volatile. Stocks have operational and financial leverage on the price of silver and other metals. You have to be choosing your comfort point in that regard. I know that's a roundabout answer, but I think it's very individual, and there's not one approach that you can take with portfolio allocation.

Mark Bunting: Right. That makes sense. Now, I will ask you to summarize your thoughts, but is there anything we haven't touched on here? Is there anything you want to expand on about the silver market or mining?

Maria Smirnova: Yes, I would. I want to comment on general valuations in the mining space, both gold and silver. We're seeing companies since COVID are trying to do a better job of capital allocation, making sure that they're not doing silly acquisitions, so more discipline is shown. There's more emphasis on governance. What I'm saying is we're seeing a lot of positive things in the mining space.

Unfortunately, generalist investors are just not paying attention quite yet. We have not seen generalist investors move in a big way and allocate to gold and silver equities. That is quite frustrating because we see these positive signs in the industry.

I'm just hoping that the generalist investors will come once we have more positive results and companies delivering on their promises. Of course, as we discussed, the silver market is relatively small, so it won't take much money to move this. If you think the physical market is small, the equity market in silver is even smaller. These stocks can move when there is good news, contributing to that spikiness. We're pretty positively inclined on the equities right now, as well as the physical silver market.

Mark Bunting: Many of your comments speak to the struggles and the frustration about sentiment over the past few years in precious metals and mining. To wrap things up, could you just expand and summarize your thoughts on why silver and silver companies should be strongly considered as investments by most people?

Maria Smirnova: It's easy to summarize. Just one word: rare. These things are rare. Gold and silver-producing companies, in general, are rare. We're very comfortable with the thesis on silver, both from that macroeconomic perspective of monetary and fiscal policies we're seeing. Nothing's changing on the fiscal side, and we are convinced that interest rates cannot stay here. Interest rates have to come down, which should be positive both for gold and silver.

We see these trends picking up steam over time on the physical and industrial demand side. I think the train has left the station on solar and electric components, and the world is not turning back around. That is very positive for the fundamentals and supply demand.

Of course, I've spoken about going back to rare. Unless we have more discoveries, unless we have more mines coming into production, the supply will not increase drastically. Mines will run out, and grades will come down, further pressuring the supply. From that perspective, I think the outlook on silver is positive.

Mark Bunting: You make a compelling case, Maria. We appreciate your insights today and your time. So, thanks a lot. We'll see you again.

Maria Smirnova: Thank you, Mark. Have a great day.

Mark Bunting: You too. Maria Smirnova, Senior Portfolio Manager and Chief Investment Officer at Sprott Asset Management. Our thanks to her. Thanks to you for watching. We have another live CORE Conversation coming next Thursday. Check that one out as well. We'll see you then. Take care for now.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.