The Global Power Surge

Global electricity demand is expected to more than double between now and 2050.1 This skyrocketing demand is due to several factors across the globe. At the same time, energy security is vital to global electricity demand, ensuring stable access to power as countries scale grids and electrify industries.

From AI to electrification, surging power needs are fueling a $2.1 trillion energy revolution.

Increasing energy consumption in the East is driven by urbanization and industrialization in developing countries. The growth of emerging market countries has been substantial, and as they become wealthier, their need for electricity intensifies. In the West, the surge in demand is fueled by the growth of artificial intelligence (AI), data centers, electrification and industrial production.

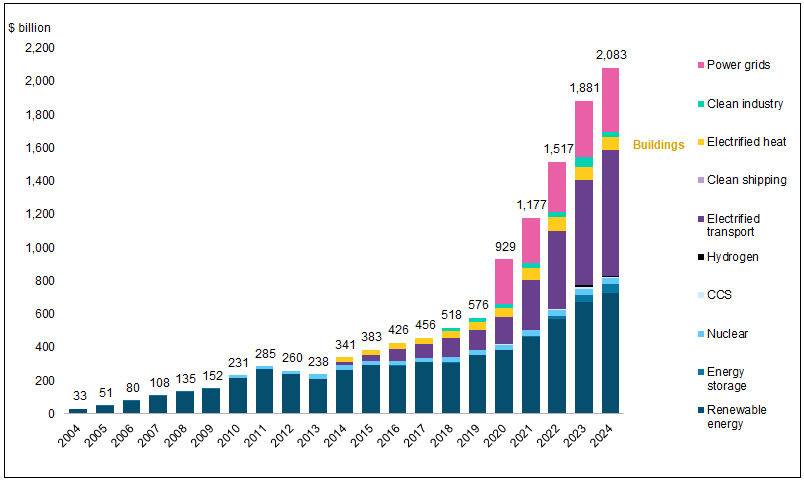

Soaring demand for electricity has triggered massive investment in critical materials and infrastructure, which is occurring alongside a global shift that embraces cleaner energy solutions. This shift has created a dynamic energy transition investment market that is growing significantly. Global investment in the energy transition has surged to $2.1 trillion in 2024 and now far exceeds investments made in fossil fuels.

Figure 1. Global Investment in Energy Transition

Source: BNEF Energy Transition Investment Trends 2025.

Energy Security

Governments are prioritizing energy security as global geopolitical tensions threaten vulnerable supply chains. The ongoing Russia-Ukraine war has also prompted a new era of energy security, as countries race to secure critical materials. Across Europe, governments are aggressively strategizing to end energy dependence on Russia. Countries are also looking to diversify energy sources to decrease reliance on single, potentially unreliable, providers.

Energy security has become a top geopolitical priority as nations scramble to control critical materials.

China’s grip on lithium, rare earths and other critical minerals has exposed the risks of concentrated supply chains. Past export restrictions triggered dramatic price spikes, underscoring the strategic importance of these materials, not just for energy, but also for defense and advanced technologies.

As energy independence is prioritized, nations are investing more aggressively and urgently in domestic systems. For example, the U.S. is treating critical materials as a national security priority. New federal initiatives are accelerating domestic production, streamlining permitting and building strategic stockpiles.

Key Drivers of Electricity Demand

AI and Data Centers

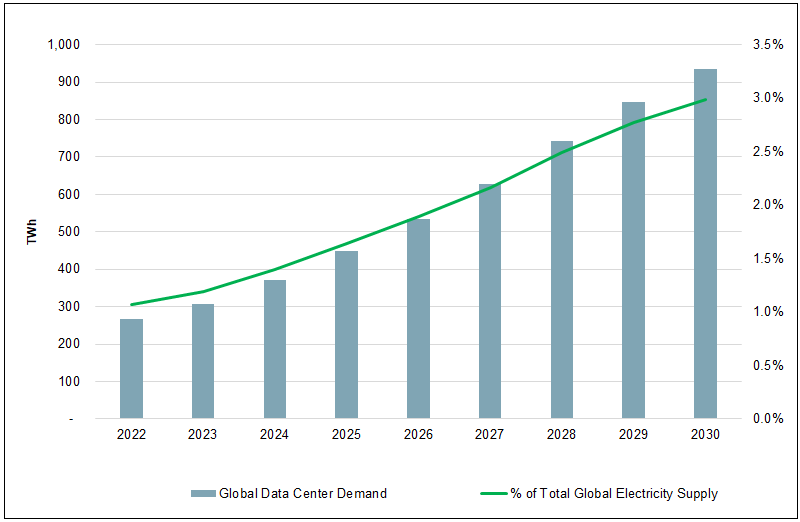

The growing adoption of AI and data centers is driving massive electricity demand and accelerating grid modernization. The construction, maintenance and powering of data centers incorporate critical materials, including uranium (via nuclear energy), silver and copper. With these materials expected to face long-term supply deficits and demand increasing in various markets, keeping up with this rapidly evolving sector will present challenges and opportunities.

Global data centers’ power demands may rise 2.5x by 2030, to a level approximating Japan’s total power use.2 AI will be the most significant driver of this increase, with AI data centers’ power usage set to increase more than 4x by 2030.3

Figure 2. Data Center Electricity Growth (2019-2025e)

Source: BloombergNEF, New Energy Outlook 2025.

Electrification

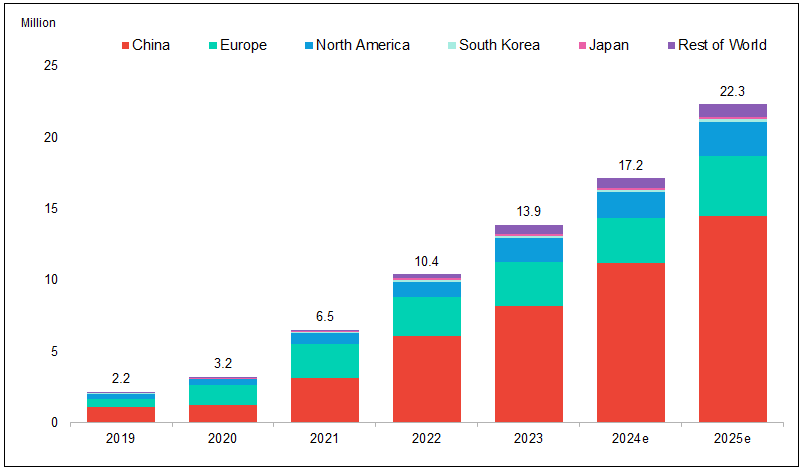

Transportation electrification—the shift from internal combustion engines to electric powertrains—is rapidly transforming global energy demand. As electric vehicles (EVs), electric buses and rail systems become more widespread, they are creating new and sustained demand for electricity across national grids. This transition requires significant upgrades to charging infrastructure, grid capacity and critical material supply chains. For example, EVs require a range of critical materials. Beyond rechargeable lithium-ion (Li-ion) batteries, an EV requires critical materials to power its motor and supply electrical power throughout the vehicle. EVs generally require 6x the critical materials of a conventional internal combustion engine (ICE) car.

Across the globe, approximately 17.2 million electric cars (EVs) are estimated to have been sold in 2024, more than five times the sales four years ago. Sales are estimated to reach 22.3 million in 2025.4

Figure 3. Strong Growth in Battery-Based Electric Vehicles Is Underway

Source: BloombergNEF, 1/13/2025. The total includes battery-electric vehicles (BEVs) and plug-in hybrid vehicles. 2024e and 2025e refer to estimated sales in 2024 and 2025, respectively.

Industrial Production

Industrial production is a major driver of rising global electricity demand. Sectors like manufacturing, mining and chemicals require large amounts of energy to power machinery, operate facilities and support continuous output. As economies grow, especially in developing regions, industrial activity expands, intensifying the need for reliable, high-capacity electricity sources.

Additionally, the reshoring of manufacturing and the growth of energy-intensive industries like semiconductors and electric vehicles, particularly in the U.S., further accelerate this demand.

Cooling Needs

Economic growth and rising global temperatures are driving a sharp increase in electricity demand for cooling, particularly from air conditioning. Cooling accounts for about 10% of global electricity use and could triple by 2050 (according to the International Energy Agency), with emerging economies like India seeing rapid adoption. Heatwaves are intensifying this trend, pushing power grids to their limits and increasing reliance on fossil fuels during peak demand.

In hot regions, cooling can represent over 70% of summer electricity loads, requiring major investments in grid infrastructure and efficiency.

Where Do Critical Materials Fit In?

New technologies and power sources will require many critical materials, many of which are experiencing supply constraints that cannot keep up with demand. Here, we look at several key critical materials.

Uranium

Nuclear power depends on one fuel for which there is no substitute: uranium. According to the IEA World Energy Outlook, global electricity demand is expected to grow by 169% by 2050.5 Demand for uranium may likely outstrip supply, with a nearly 1.3-billion-pound deficit by 2045. Net Zero Nuclear, the pledge to triple global nuclear capacity by 2050, would result in nearly a 3.1-billion-pound deficit.

The global nuclear buildout is playing a critical role in meeting soaring electricity demand.

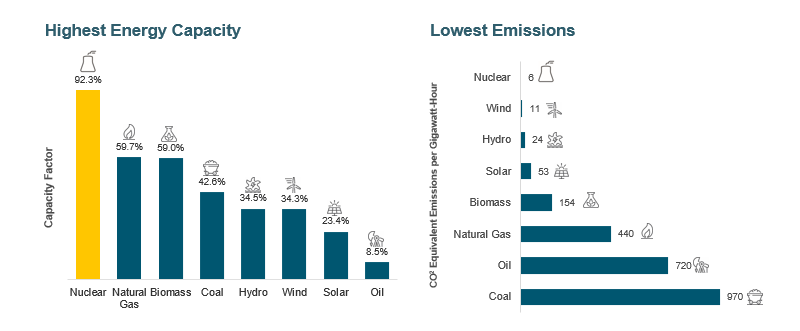

Nuclear power offers a unique combination of zero-carbon emissions and reliable, around-the-clock baseload energy, making it especially well-suited to support the high and constant loads required by AI data centers and industrial systems. As nations seek to strengthen energy security and reduce fossil fuel dependence, nuclear is emerging as a cornerstone of diversified, resilient energy strategies worldwide.

The global nuclear buildout is playing an essential role in meeting soaring electricity demand. Countries like China and India are leading the charge, accounting for over half of the world’s planned and under-construction reactors. Recent policy changes in the U.S. will likely further increase demand for uranium and focus on nuclear energy. President Trump recently signed executive orders related to the rapid deployment of next-generation nuclear technologies in the U.S. This plan to launch a “nuclear renaissance” will require significant amounts of uranium, affecting the global supply.

Figure 4. Growing Focus on Nuclear

Note: Capacity factor measures the total amount of energy produced during a period of time divided by the amount of energy the plant would have produced at full capacity.

Source: U.S. Energy Information Administration and energy.gov. Data as of 12/31/2024.

Source: https://ourworldindata.org/nuclear-energy as of April 2024; measured in emissions of CO2-equivalent per gigawatt-hour of electricity over the life cycle of the power plant. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper

Copper is another key player in growing energy demand, as all systems that produce and store electricity depend on copper for transmission. For example, air conditioners are a high-growth segment for the copper market. India is expected to have significant growth in this regard, as 97% of Indian households are electrified, but only 8% own air conditioners. Additionally, the swift rise of data centers fueling AI requires vast amounts of copper. Microsoft's recently built $500 million data center in Chicago used 2,177 metric tons of copper.

Copper is essential to growing energy demand, powering every system that generates, stores or transmits electricity.

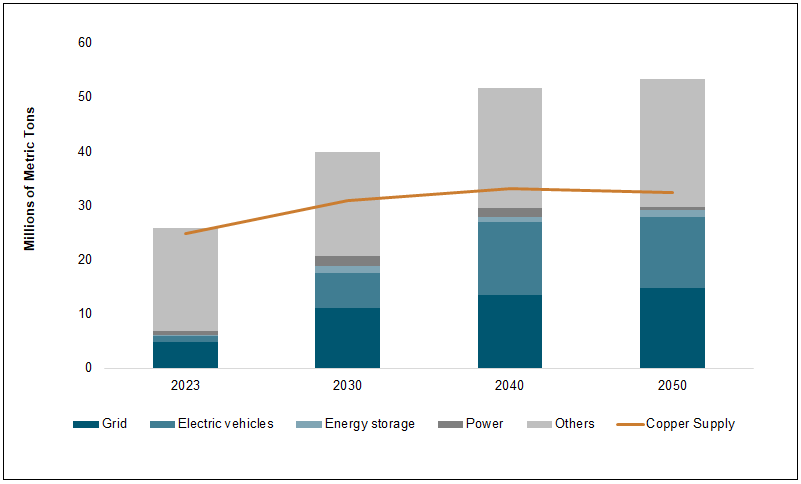

As the global electricity grid expands and modernizes to accommodate rising energy demands, copper emerges as a vital material for enhancing power lines, substations and other essential components and connecting to upgraded transportation and manufacturing systems. Overall, demand for copper is likely to outstrip supply going forward.

Figure 5. Copper Supply and Demand Imbalance Likely to Grow (2023-2050e)

Source: BloombergNEF Transition Metals Outlook 2024.

Silver

Silver is unique as a critical material because it plays multiple roles in the economy, ranging from industrial uses to its history as an investment or store of monetary value to its use in decorative jewelry and housewares. For the energy transition, silver is essential because of its superior electrical conductivity profile—silver ranks as the most conductive metal on earth.

Silver stands at the crossroads of industry and investment—essential to innnovation and trusted as a store of value.

Silver plays an important role in the solar energy sector, and as the use of solar panels grows over time, industrial demand for silver is expected to expand significantly. By 2050, approximately 332 million ounces of silver will be needed to support 1.33 terawatt/year of new installations, per the Silver Institute. Silver also plays a key role in auto manufacturing for both EVs and internal combustion engine vehicles. Thanks to its conductivity, silver is used extensively in autos, from electric power steering to automatic braking and control units that manage some engine functionalities.

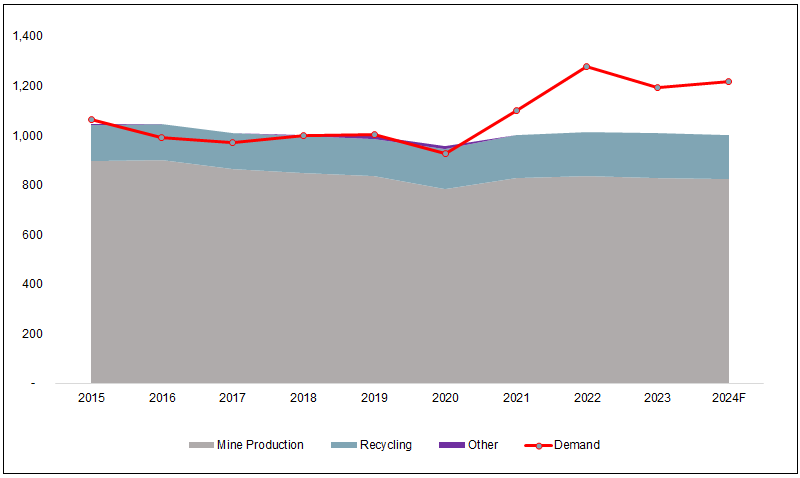

Silver supply has faced challenges over the past decade, remaining largely stagnant even as demand has steadily risen. The global silver supply has not significantly increased since 2014, leading to a supply deficit, and silver inventories have been falling.

Figure 6. Silver Demand Is Outpacing Supply (2016-2025F)

Source: The Silver Institute 2025.

Lithium

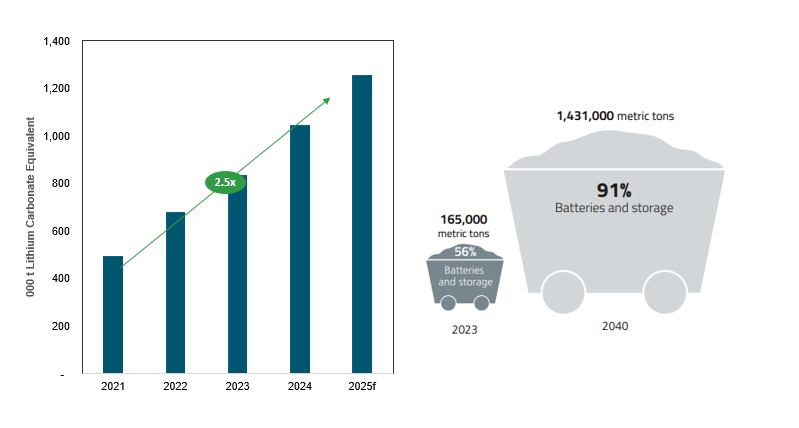

Lithium plays a pivotal part in battery construction and is an area of pressing interest for a world looking to replace up to 1.4 billion ICE vehicles with EVs in the decades to come. Lithium also plays a significant role in other parts of the energy sector, where it excels due to high energy density, long cycle life and efficiency, making it ideal for grid balancing, renewable energy integration and backup power applications.

Limited reserves make lithium a key front in global resource competition.

According to the U.S. Geological Survey, the earth’s lithium resources are estimated at 115 million metric tons, but only around a quarter of that is in reserves and is considered economically viable to mine. Lithium demand is expected to rise substantially, with the demand from EVs and grid battery storage expected to account for 91% of lithium demand by 2030.6 Demand is forecast to outpace supply in 2028 and onward.

Figure 7. Lithium Demand Has and May Continue to Soar

Sources: "Global Critical Minerals Outlook 2024," International Energy Agency (IEA), May 2024. S&P Global Market Intelligence. January 2025.

Nickel

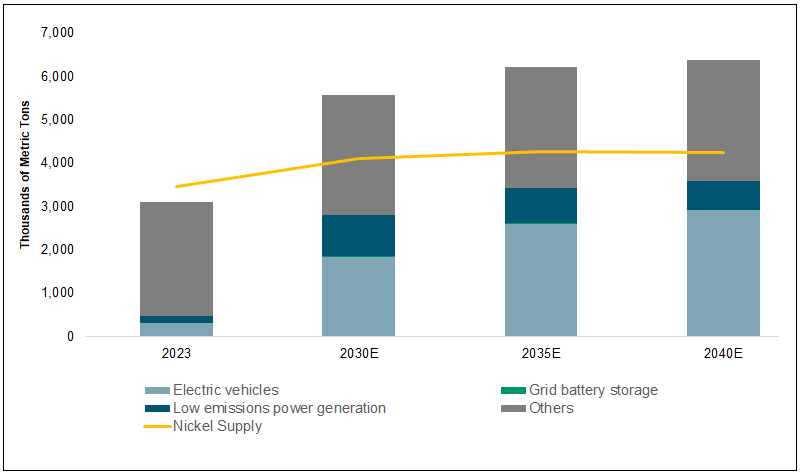

Nickel is another metal crucial to rechargeable battery design. It is the most important metal by mass in the lithium-ion battery cathodes used by EV manufacturers for long-range vehicles. Nickel may account for up to 80% of the weight in a cathode, such as in nickel cobalt aluminum (NCA) cathodes or in some nickel manganese cobalt (NMC) cathodes.

High-performance batteries run on nickel, making it essential to the electrified future.

Nickel is already used widely in stainless steel and other industrial applications, and it plays a prominent role in other energy-transition technologies. In nuclear power plants, nickel is mixed into alloy materials used in the heat transfer and cooling systems and inside the reactor vessel. Thermal solar or concentrated solar plants also depend on nickel alloys for heat-transfer purposes, while hydro and wind energy generation depend on turbines containing nickel.

Figure 8. Nickel Supply Unlikely to Keep Up with Demand (2023-2040E)

Source: BloombergNEF Transition Metals Outlook 2024.

Fueling the Electricity Transformation

The world is profoundly transforming how energy is generated, consumed and secured. As global electricity demand surges, driven by AI, data centers, electrification and industrial expansion, the strategic role of critical materials has never been more important. Meeting this demand will require continued advancements in nuclear power, data center efficiency, electric vehicle production and energy security strategies.

The growing reliance on these resources presents challenges in supply and infrastructure, but also potential opportunities for innovation and investment. The world is speeding toward an even more electrified future, and the ability to navigate this transition will determine success in the decades ahead.

Footnotes

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.