Key Takeaways

- Uranium Price Recovery: The uranium spot price regained momentum, rising 3.78% in September 2024, and uranium miners posted significant gains in September, with junior miners gaining 15.96%.

- Nuclear Energy Support from Big Tech: Major tech companies, including Microsoft, Google and Amazon, are investing in nuclear energy, including Microsoft’s deal to restart the Three Mile Island reactor, to meet the rising energy demands for AI data centers.

- Small Modular Reactors (SMRs): Google and Amazon are advancing agreements for SMRs, which offer a promising future for uranium demand and clean energy generation.

- Supply Deficits and Demand Growth: Global uranium supply remains insufficient to meet current and projected reactor needs, with mine production falling short and Vladimir Putin threatening retaliatory actions that could suspend deliveries of enriched uranium.

Performance as of September 30, 2024

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

3.78% | -3.97% | -10.04% | 11.68% | 23.95% | 26.19% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

11.32% | -6.57% | -3.39% | 1.65% | 11.23% | 32.69% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 15.96% | -5.90% | -2.27% | -0.37% | 4.63% | 32.26% |

|

Broad Commodities (BCOM Index) 4 |

4.43% | -0.64% | 1.72% | -4.29% | -0.14% | 5.22% |

|

U.S. Equities (S&P 500 TR Index) 5 |

2.14% | 5.89% | 22.08% | 36.35% | 11.90% | 15.96% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 9/30/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium and Uranium Miners’ Rebound

The uranium spot price has regained momentum from its support around $79 per pound, ending September at $81.95 for a 3.78% gain.1 The gain starts to rectify the desynchronized nuclear fuel markets where the spot price is down 10.04% year-to-date, but the term price is at a 16-year high and conversion and enrichment are at all-time highs. Uranium miners rose significantly in September as the seasonal slowdown dissipated, Big Tech and Big Banks supported the nuclear energy thesis, and economic concerns faded into the background.

Emerging from the typical summer doldrums, the activity in the uranium market kicked off with the annual World Nuclear Association Symposium. The Symposium brought together participants from all nuclear energy-related sectors: fuel supply, mining, conversion, enrichment, government, research and more. With the theme of “Turning momentum into energy,” the industry members discussed how to deliver on last year’s pledge to triple nuclear generation by 2050. Though the market remained subdued immediately after the conference, it awakened after Microsoft and Constellation Energy announced a 20-year power purchase agreement to support reopening the Three Mile Island I nuclear power plant, which has been shuttered for five years. Microsoft is searching for clean, “firm” power6 for its electricity-hungry AI (artificial intelligence) data centers. Other large technology companies followed suit with their own nuclear energy announcements, which we believe represent another important inflection point for nuclear energy. First, it provides much-needed capital at a time when government energy policy is trying to “crowd in” private capital to revitalize the dormant nuclear power industry. Second, it raises awareness and helps validate nuclear energy's value across a broad range of investors.

These positive news developments reignited interest in the sector, helping uranium miners rebound with an 11.32% gain in September2 and junior uranium miners gain 15.96%.

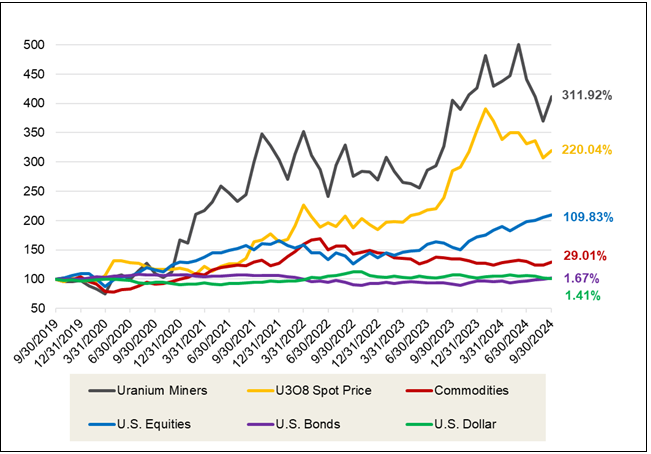

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended September 30, 2024, the U3O8 spot price has risen a cumulative 220.04% compared to 29.01% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (9/30/2019-9/30/2024)

Source: Bloomberg and Sprott Asset Management. Data as of 09/30/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

The Quest for Clean, Firm Electricity by Big Tech

Constellation Energy, the largest operator of nuclear power plants in the U.S., announced that it would restart a reactor at Three Mile Island, keeping it online for decades, and sell the power to Microsoft. The deal represents Constellation’s largest-ever power purchase agreement with Microsoft for 835 MW (megawatts) of carbon-free energy. Under the agreement, Microsoft will purchase electricity to match the energy its relevant data centers consume.

Big tech's groundbreaking deals to power AI data centers with nuclear energy underscores the urgent need to secure stable, carbon-free electricity as energy demand surges.

Ambitious AI plans and their demanding energy needs have not been a new phenomenon. Google announced earlier this year that the company saw a 13% rise in greenhouse gas emissions for 2023, driven by energy-intensive artificial intelligence. As big tech companies, Amazon, Meta, Microsoft, Apple and Alphabet have various decarbonization goals and have all planned to be net-zero emitters by 2040, clean energy sources are required to power the future of AI. To that end, Microsoft and Brookfield signed a 10.5 GW (gigawatt) deal earlier this year to build more than $10 billion in renewable energy capacity.

While renewable energy is clean, its intermittent nature is not the ideal match for data centers’ consistent energy requirements. Therefore, the underpinning Constellation Energy deal with Microsoft to buy 100% of the electricity from the reactor to power data centers (and other infrastructure) stood out as significant proof of AI and nuclear power’s symbiotic relationship.

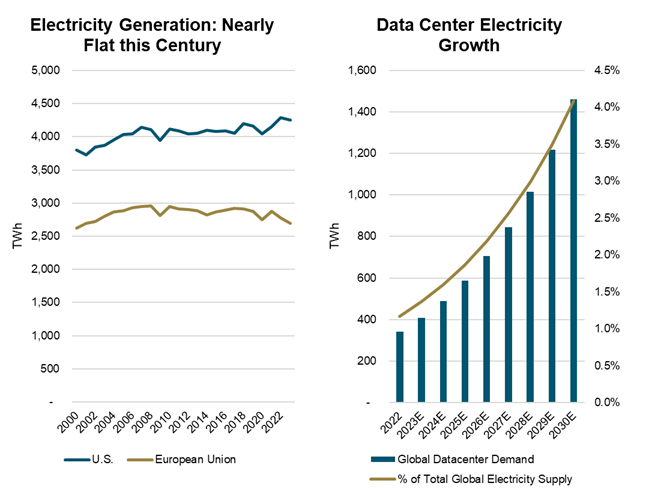

As AI capabilities expand, there is a growing need for stable power sources in data centers that manage large volumes of data and complex computations. The big tech firms are in a race to lead the development and deployment of artificial intelligence technologies. The rapid advancement of these technologies and their potential revolutionary future stands out for its potentially immense economic and geopolitical considerations. Big technology firms are at full speed in their developments, including building out their energy supplies. They will not likely wait for the notoriously slow electricity grid buildout. For context, for the last 23 years, electricity generation has grown by 0.5% in the U.S. and 0.1% in the European Union (annualized).7 This starkly contrasts the forecasted 258% electricity demand increase from 2023 to 2030 for global data centers, increasing from 1.2% of global electricity supply to 4.1% (Figure 2).

Figure 2. Western Historical Electricity Generation vs. Forecasted Data Center Electricity Growth

Source: Ember Global Electricity Review 2024 and International Energy Agency, World Energy Outlook 2023; https://www.iea.org/reports/world-energy-outlook-2023

Google and Amazon Embrace SMRs

In the artificial intelligence race, big tech firms have released multiple announcements recognizing the role of nuclear power. Google announced it is signing the world’s first corporate agreement to purchase nuclear energy from multiple small modular reactors (SMRs) to be developed by Kairos Power. Targeting to bring the first SMR online by 2030 and additional deployments through 2035, the deal encompasses 500 MW of carbon-free power to U.S. electricity grids.8

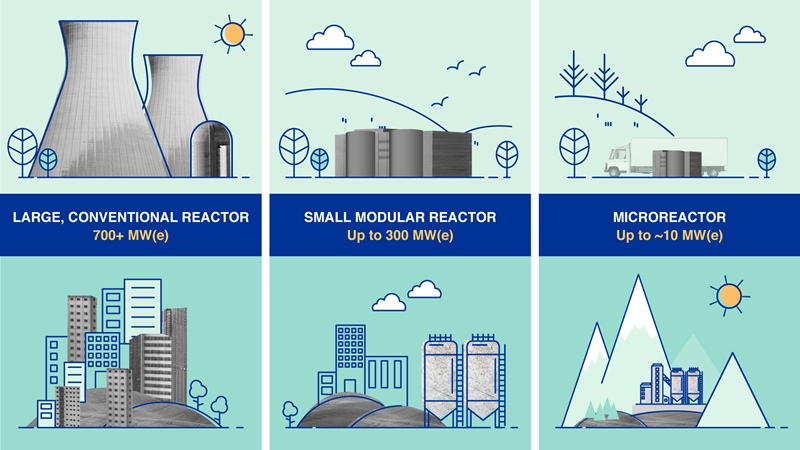

What are SMRs?

SMRs represent a cutting-edge evolution in nuclear technology and have the potential to amplify nuclear energy's role and boost uranium demand. The International Atomic Energy Agency (IAEA) characterizes "small" reactors as those with a capacity of up to 300 MW(e) per unit — roughly a third of conventional nuclear reactors' size. The modular design of SMRs means components can be prefabricated in factories and transported for on-site assembly, reducing costs and construction time. This adaptability positions SMRs to deliver clean energy to areas previously out of reach for conventional nuclear plants and offers a promising approach to decarbonizing industrial processes.

SMRs represent a burgeoning technology, with various innovative designs in development worldwide. The heightened uranium demand from SMRs is anticipated to manifest toward the end of the decade and intensify into the 2030s. The World Nuclear Association (WNA) projected last year that SMRs might constitute up to 5% of the global nuclear capacity by 2040. However, given the infancy of the SMR industry, predictions differ. For instance, a forecast by BMO suggests a potential of 9%.

Source: IEA, International Energy Agency.

Amazon also announced that it had signed three new agreements to support the development of SMRs.9 The company signed a deal with Energy Northwest in Washington to develop four advanced SMRs with roughly 320 MW capacity to begin in the early 2030s. Amazon also invested in X-energy, which includes manufacturing capacity to develop the SMR equipment to support more than five gigawatts of new nuclear energy projects. The third agreement was with Dominion Energy to explore the development of an SMR near the existing North Anna nuclear power station for at least 300 MW. These deals mark a continuation of Amazon’s nuclear strategy, following its announcement earlier this year that it would buy a nuclear-powered data center from Talen Energy for $650 million.

Google’s “first-ever” agreement and Amazon’s agreements help the industry advance through the learning curve. Given that these agreements are positioned in the development phase, they are likely to support accelerated growth in the nuclear industry. Further strengthening this claim was Oracle’s (the third largest software company in the world by revenue) announcement in September that it is designing a data center that three SMRs would power. Notably, these SMRs have further government support, with the U.S. passing the Advanced Nuclear for Clean Energy Act (ADVANCE Act) in June, which allocated a $900 MM funding opportunity for SMRs and intends to relax legislation to accelerate the deployment of the technology.

Ubiquitous Nuclear and Uranium Demand

Next-generation nuclear and artificial intelligence-backed nuclear power plant restarts join an increasing overall nuclear build-out. In the U.S., the Three Mile Island restart is projected to be the second-ever restart, behind the Palisades nuclear plant in Michigan. On September 30, the U.S. Department of Energy (DOE) finalized a $1.52 billion loan for the first-ever U.S. nuclear plant decommissioning.10 Restarts like Three Mile Island and the Palisade Nuclear Plant provide additional, more immediate uranium demand as utilities generally contract for uranium in the term market years before the fuel is needed.

Global nuclear energy policies are shifting, with reactor restarts and new builds ramping up demand for uranium, while mine supply struggles to keep pace with future energy needs.

Additional announcements akin to this occurred more globally. A quintessential example is Japan, which has restarted 12 reactors since 2011. The country has another 13 reactors in the process of restart approval and is nearing the restart of the world’s largest nuclear power plant. Japan is one of many countries that have engaged in a U-turn in its nuclear energy policy, which was put on hold after Fukushima, and the country planned to reduce its reliance on nuclear energy. Japan’s current leadership, by contrast, says the government needs to maximize the use of existing nuclear power plants.11 South Korea and Belgium are other countries that have engaged in U-turns in their nuclear energy policy. More recently, Italy was reported in September to be moving towards reversing its nuclear energy ban.12

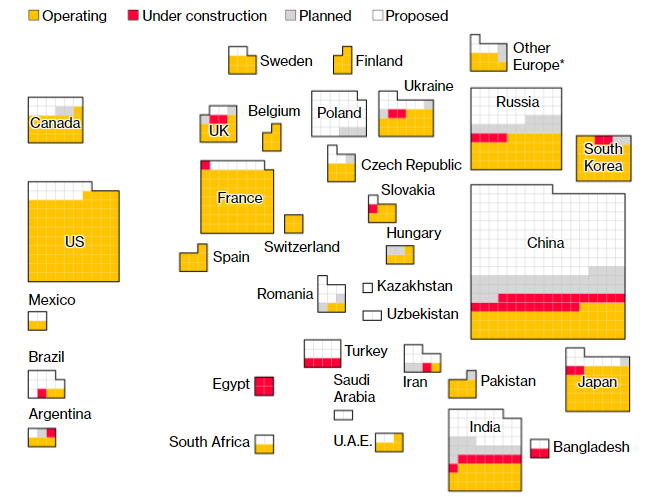

Electricity demand is increasing due to artificial intelligence and the reshoring of energy-intensive industries (given increasing geopolitical tensions), the energy transition and the urbanization and industrialization of developing countries. Uranium demand remains ever-present, with nuclear reactor buildouts in full force. For example, South Korea approved the construction of two nuclear reactors in September, reviving a project that was scrapped under its previous anti-nuclear regime.13 China is also a standout in this regard. Recently, they made a $31 billion nuclear push by approving 11 reactors.14 China leads the world in reactors that are under construction and planned. Globally, there are 439 nuclear reactors in operation, 67 under construction, 87 planned and 344 proposed (Figure 3).

There is currently not enough mined uranium for the world’s nuclear reactors' requirements, and further reactor restarts will increase this disparity. Mine supply, with 2024 forecasted production of 157 million pounds, is still well short of the world’s uranium reactor requirements, with 176 million pounds forecasted for 2024, and forces the industry to rely on secondary sources of supply, predominantly existing commercial inventories. Further, given the increasing global recognition of the importance of nuclear energy to energy security and decarbonization, the demand for uranium is forecasted at 338 million pounds in 2040.

To meet these 2040 projections, the uranium mine supply needs to more than double by then, but the supply response thus far has proven to be more challenging to ramp up than anticipated. Western uranium enrichment capacity is already under strain, given that Russia controls 44% of global enrichment capacity and that Russia is contemplating a retaliatory uranium export ban. Orano USA has announced that it will build a multi-billion-dollar enrichment facility in Tennessee, which also follows Western enricher's announcements of capacity expansions. Still, this additional capacity will likely not come online for 2-3 years. As such, the Western enrichment industry's lack of excess capacity may need to be accounted for with a shift from underfeeding to overfeeding (using more UF6 as feedstock to produce more enriched uranium). The scale of this shift is not insignificant, given that underfeeding had created the largest equivalent uranium mine in the world.

Figure 3. World Nuclear Power Reactors

Source: Bloomberg and World Nuclear Association; Deadly and Wildly Profitable, Uranium Fever Breaks Out and World Nuclear Power Reactors & Uranium Requirements.

Potentially Attractive Entry Point

We believe the current price movement is a step in the right direction, and given that the spot price is still negative year-to-date and off the highs earlier this year, this may represent an attractive entry point in the ongoing bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and failed to adapt their procurement strategies to the new market realities.

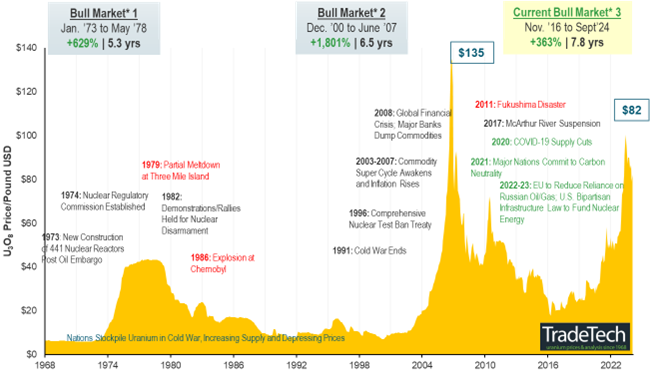

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 4).

Figure 4. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 09/30/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | “Firm” electricity, refers to power or power-producing capacity, intended to be available at all times during the period covered by a guaranteed commitment to deliver, even under adverse conditions. |

| 7 | Ember Global Electricity Review 2024. |

| 8 | Google Blog, New nuclear clean energy agreement with Kairos Power. |

| 9 | Amazon, Amazon signs agreements for innovative nuclear energy projects to address growing energy demands. |

| 10 | Pwermag.com, DOE Finalizes $1.52B Palisades Loan for First-Ever U.S. Nuclear Plant Recommissioning. |

| 11 | BNN Bloomberg, Japan’s New Economy Minister Seeks to Maximize Nuclear Restarts. |

| 12 | Reuters, Italy inches towards reversing a nuclear energy ban. |

| 13 | Bloomberg, South Korea Approves Two New Reactors in Nuclear Power Push. |

| 14 | Bloomberg, China Makes $31 Billion Nuclear Push With Record Approvals. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.