Education

Copper Education Center

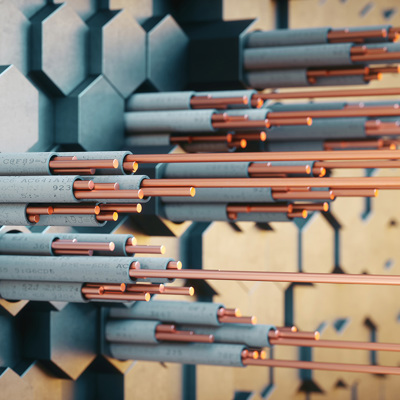

Copper is vital to addressing surging energy consumption from developing countries, artificial intelligence, data centers and the energy transition.

Featured

Copper: The Essential Power Player in the Energy Transition

Copper's story runs deep in human history, dating back over 10,000 years. It was one of the first metals humans mastered, shaping coins, jewelry, tools and weaponry that fueled societal advancement. Today, demand for copper is increasing as our electricity needs climb. Growing middle classes in the East, clean energy technologies, electric vehicles (EVs) and AI data centers are providing a new demand shock for copper markets.

Latest Resources

Podcast – The New Copper Story

Mining Analyst Stefan Ioannou joins host Ed Coyne for a timely update on the current supply-side dynamics of the copper industry.

Special Report - Copper: Wired for the Future

The demand for copper in energy grids, electric vehicles and clean energy technologies, combined with diminishing ore grades and limited inventories, underscores copper's growing importance. We believe copper prices and miners are likely to benefit from the growing supply-demand gap.

Infographic - The Copper Opportunity in One Chart

As the world embraces clean technologies, the search for and expansion of copper mines will be essential. Early investors who gain exposure to copper mines may benefit from the rapidly increasing demand.

White Paper - Copper: The Red Metal's Central Role in Powering Our Net-Zero Carbon Future

In the U.S. alone, copper is a crucial element in nearly 7 million miles of electrical transmission and distribution wires. This white paper introduces the trends that are driving copper markets and copper miners, and explains our positive outlook for growth.

More on Copper

-

Sprott Webcast Replay

Top 10 Dominant Drivers of Metals Markets in 2026

-

Sprott Copper Report

Copper’s Momentum: Key Catalysts to Watch in 2026

-

Special Report

Top 10 Themes for 2026

-

Special Report

Metals Post Strong Returns in 2025

-

Interview

Metals & Mining: Year in Review, Future in Focus

"Copper has been essential for thousands of years and remains critical to fields ranging from construction to electronics. Now it’s needed more than ever before, as increasing demand for electricity, the upgrading and expansion of power grids, and technological advancements such as artificial intelligence (AI) are underway."

John Ciampaglia, CFA, FCSI

Chief Executive Officer, Sprott Asset Management & Senior Managing Partner, Sprott Inc.

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like "store of value," "safe haven" and "safe asset." These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.